China’s Q3 Growth Holds Steady at 4.8%, but Structural Imbalances Deepen

Headline Performance and Interpretation

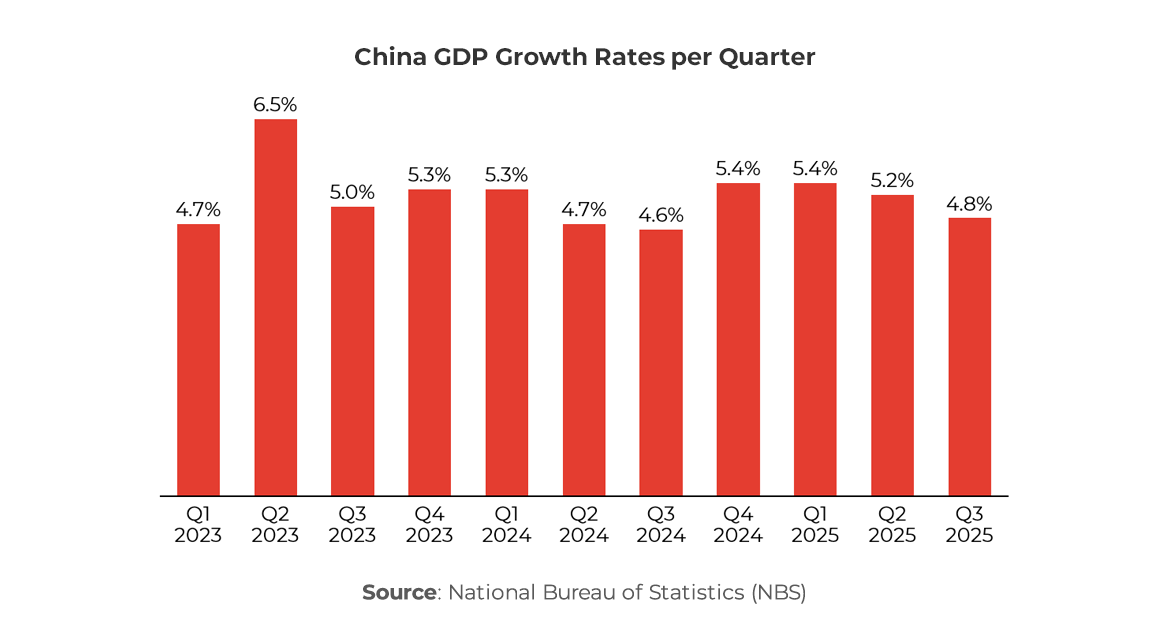

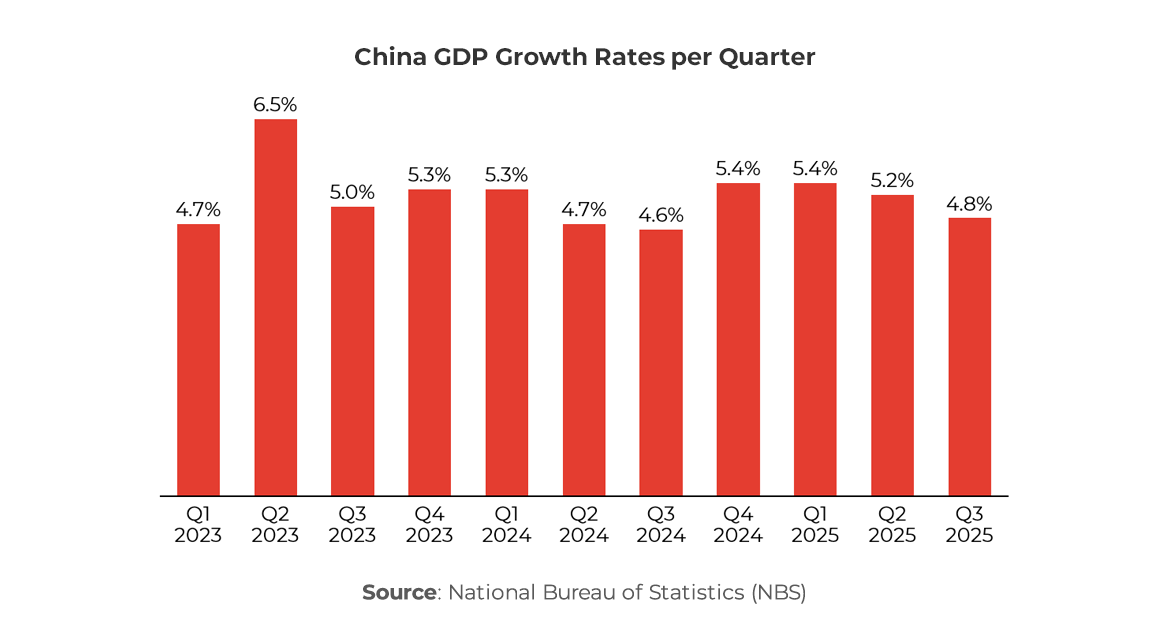

In the third quarter of 2025, China economy expanded by 4.8% year-on-year, matching market expectations and down from 5.2% in Q2. On a quarter-on-quarter basis, growth was around 1.1%, signaling a moderation in momentum as the year progresses. For the first nine months of the year, cumulative GDP growth stood at roughly 5.2% year-on-year, keeping China broadly on track to meet its full-year target of around 5%, as outlined in the government guidance.

The data suggest that while China remains on target to achieve its 2025 growth goal, the underlying drivers are shifting toward export-led manufacturing, as domestic demand shows increasing signs of weakness.

Context and Growth Drivers

While headline growth remains respectable relative to global peers, underlying data highlight structural pressures. After a relatively strong start to the year (~5.3% year-on-year in H1 2025), the slowdown in Q3 reflects the mounting drag from weak domestic consumption, ongoing property market stress, and external headwinds such as slower global demand and geopolitical uncertainties. Household demand, in particular, shows signs of fatigue, with retail sales in September growing only ~3.0% year-on-year, the slowest pace since late 2024.

Policy Landscape

The People’s Bank of China (PBoC) and the central government maintain the capacity to deploy monetary and fiscal tools to support growth. At the late-July Politburo meeting, policymakers signaled continued monetary support and faster local bond issuance to boost infrastructure, while emphasizing consumption, innovation, and structural reform as growth drivers. H2 policy will remain sector-focused, channeling funding toward tech innovation, industrial upgrading, and RMB internationalization. Broad stimulus is unlikely; instead, targeted measures will support high-tech manufacturing, green transport, and small urban businesses. Stricter oversight of EVs, batteries, and solar projects reflects efforts to curb overcapacity, while housing policy shifts toward “high-quality urban renewal” and redevelopment of aging infrastructure rather than speculative expansion. The 15th Five-Year Plan discussions in late September Politburo meeting reaffirmed that the upcoming 2026-2030 period is pivotal for consolidating foundations and advancing socialist modernization. It commits to high-quality development, innovation-driven growth, deeper reform, and higher-level opening-up, signaling that China will deepen structural reforms while prioritizing technological self-reliance, green transition, and domestic demand, implying stronger policy support for strategic industries such as semiconductors, AI, new energy, and advanced manufacturing.

Sectoral Performance

- Industrial output and manufacturing remain relatively robust, particularly in high-tech and strategic industries. Segments such as equipment manufacturing, new energy vehicles, industrial robots, and other advanced manufacturing lines continue to post double-digit growth, reflecting both domestic policy support and strong export demand.

- The services sector shows more modest growth, with value-added services for Q1–Q3 expanding ~5.4% year-on-year. While stable, this is below the pre-pandemic trend, indicating a cautious recovery in consumer-facing and service-oriented activities.

- Investment remains a weak spot. Fixed-asset investment (excluding rural households) fell about 5% year-on-year over the first nine months, while property development investment plunged nearly 13.9%, highlighting the ongoing struggles in real estate and infrastructure projects.

Consumption is under pressure, constrained by rising household caution, tighter credit conditions, and subdued wage growth in certain sectors.Outlook and Implications

While China continues to deliver steady headline growth, the composition of expansion shows widening imbalances. Strong export-oriented manufacturing is masking underlying softness in domestic demand, creating structural risks. The divergence between industrial growth and household consumption underscores the challenge of transitioning toward a consumption-led growth model. Policymakers face the task of balancing support for strategic sectors with measures to revive consumer confidence and investment, without exacerbating financial or property market vulnerabilities.

In conclusion, Q3 2025 highlights both resilience and fragility: China remains a key driver of global growth, yet the structural pressures and uneven sectoral performance signal that sustaining long-term, balanced growth will require careful policy calibration and continued reform of the domestic economy.

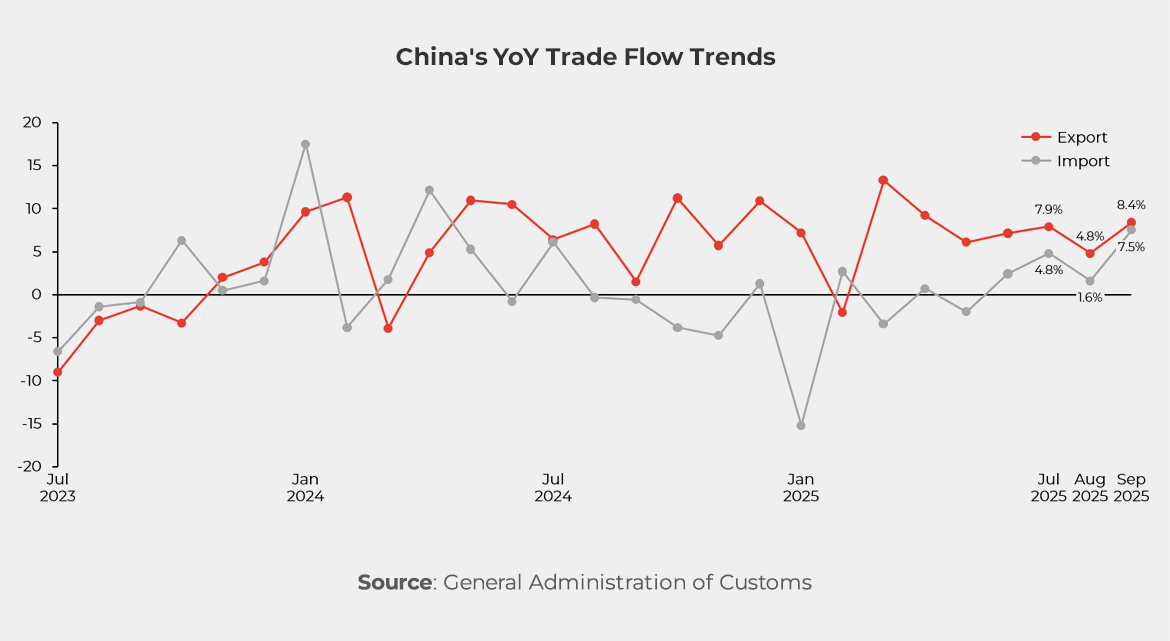

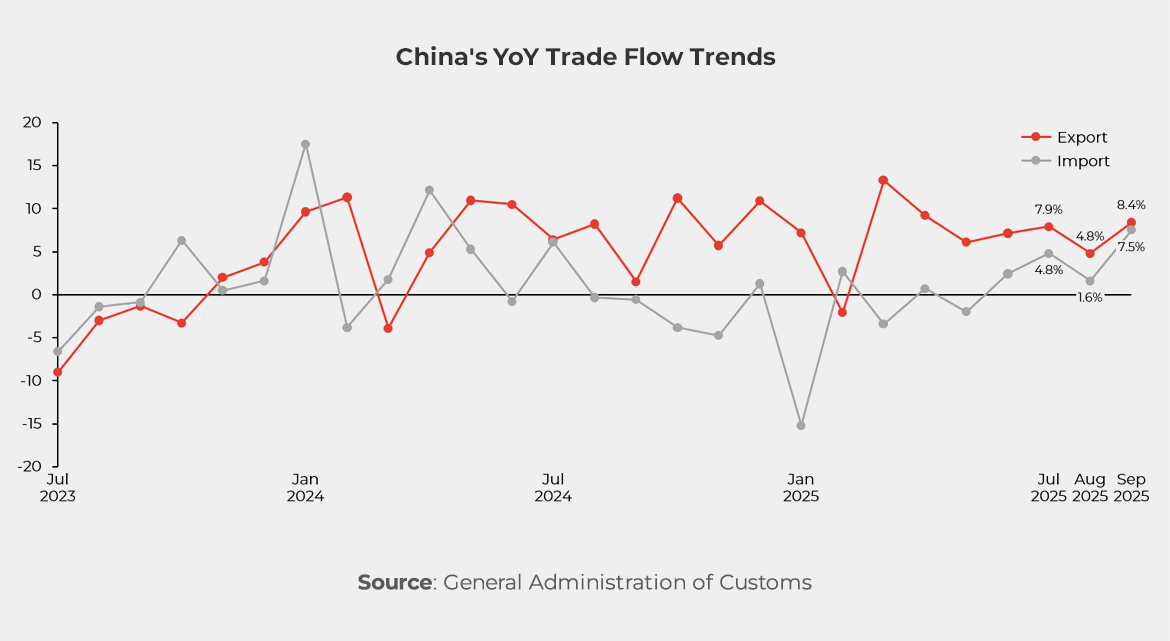

China’s Q3 Trade Remains a Bright Spot Amid Domestic Weakness

During Q3 2025, China’s trade continued to demonstrate resilience, providing a relative bright spot in an otherwise uneven economic landscape. According to the General Administration of Customs of China, the total value of imports and exports from January to September reached RMB 33.61 trillion (~US$4.60 trillion), representing an increase of roughly 4.0% year-on-year (year-on-year). Exports rose ~7.1% year-on-year to RMB 19.95 trillion (~US$2.73 trillion), while imports slightly declined by ~0.2% year-on-year, reflecting weak domestic demand.

September alone saw trade activity pick up, with total trade increasing ~8.0% YoY, exports rising ~8.4%, and imports growing ~7.5%, signaling some short-term momentum in international commerce. Several key dynamics underpin China’s trade performance:

- Manufacturing exports remain resilient, especially in high-tech and equipment goods. For the first nine months, mechanical and electrical exports rose ~9.97% YOY, accounting for over 50% of total exports, underscoring China’s continued strength as a global manufacturing hub.

- While the U.S. export markets are under pressure (exports to the U.S. reportedly fell ~16.2% YoY in September) China has shifted toward other markets such as the EU, Southeast Asia and Africa where growth rates are higher (9.2 %, 15.8 % and 29.4% respectively), highlighting a strategic pivot toward emerging and regional markets.

- Import growth remains shallow, constrained by weak domestic consumption, a struggling property sector and cautious investment. This trend reinforces earlier signs of consumer caution and limited investment appetite, highlighting the internal-external growth imbalance. .

For foreign business interests, this trade backdrop presents mixed implications. China continues to serve as a critical export platform, offering opportunities for firms that can compete on quality and cost. At the same time, the slower import growth signals that domestic sourcing expansion may remain limited, requiring careful strategic planning. The ongoing diversification of export markets provides new avenues, but navigating price competition and margin pressures will be increasingly important for companies engaging with China’s global trade ecosystem.

China’s Export-Led Stability vs. Domestic Demand Weakness – A Strategic Crossroads for Foreign Investors

In Q3 2025, China displays a familiar yet increasingly delicate dynamic: resilient external demand buttresses growth, even as the domestic engine sputters.

With the headline Q3 GDP growth rate of 4.8% YoY (down from 5.2% in Q2) Beijing appears to be keeping the “around 5%” full-year target in view, but the underlying structure of the economy is increasingly imbalanced.

The export underpinning

China’s manufacturing sector remains a relative strong point. According to recent data, high-tech manufacturing and equipment goods are posting robust growth: e.g., in the first nine months, equipment manufacturing was up ~9.7%, high-tech manufacturing ~9.6%. Export markets beyond the U.S. are also playing a larger role. For instance, shipments to the EU, Southeast Asia and Africa are growing strongly (9.2 %, 15.8 % and 29.4% respectively) even as exports to the U.S. collapse (~-16.2% year-on-year in September). For businesses in international supply chains, this signals that China still plays a strong role as an export-platform, but the market dynamics are shifting: firms are diversifying destination markets, and competition is intensifying (both from Chinese peers and global rivals).

This export strength has important implications. First, it cushions the drag from weak domestic demand. But second, it means that China’s growth is increasingly reliant on global demand and external markets, making it vulnerable to trade policy shifts, exchange-rate moves, and global demand slowdowns. As one analyst noted: “China’s growth is becoming increasingly dependent on exports, which are offsetting a slowdown in domestic demand.”

Domestic demand and investment: the weak link

While exports look largely healthy, the domestic economy tells a different story. Private consumption remains soft: retail sales in September grew only around 3.0% year-on-year, the slowest pace since late 2024. Household consumption remains cautious, weighed down by falling home prices, weak wealth effects and job/income uncertainty. Meanwhile, investment is under strain: fixed-asset investment (excluding rural households) through the first nine months contracted ~0.5% YoY, while property development investment plunged ~13.9%. For foreign suppliers and global sourcing partners, this means that domestic Chinese demand for imported goods, whether capital goods, consumer durables or inputs, may be weaker than headline GDP suggests. A business model depending primarily on Chinese domestic demand may need recalibrating.

Structural challenge and business implications

What does this mean for foreign firms considering China engagements?

1. Export-platform strength remains: China is still a cost-competitive manufacturing hub with deep upstream supply chain capabilities. For firms targeting non-Chinese markets, leveraging China as a production base remains viable, especially given China’s ability to shift export destinations.

2. Domestic market growth is uneven: Opportunities in China’s domestic market are more selective. High-tech, new energy vehicles, premium consumer goods or digital/online channels are outperforming, while mass consumer spending and traditional categories are under pressure. Firms should align their projections with market realities, deciding whether to double down through major investments or to pivot through exit or relocation.

3. Policy risk and margin pressure rising: As China leans on exports, price competition intensifies and margins shrink. Foreign suppliers may face stronger local competition and need to manage cost, quality and differentiation carefully. Moreover, external risks (tariffs, supply chain shifts, geopolitical tensions) remain elevated.

4. Investment / sourcing strategy needs nuance: With investment flows constrained domestically and property weak, Chinese firms may continue to outsource or offshore low value work while upgrading domestic production. Suggesting opportunities for foreign firms in joint ventures, higher value manufacturing, equipment supply and adjacent services.

5. Diversification remains key: Supply chain diversification beyond China remains important for risk mitigation. Even as China’s export engine props up near-term growth, the structural shift toward “dual circulation” (domestic + international) means foreign firms cannot rely solely on China for growth.

For the remainder of 2025 and into 2026, Beijing faces the balancing act of meeting its growth target (around 5%) while rebalancing toward consumption and services. Analysts expect limited broad stimulus near-term, with more likely targeted fiscal support, infrastructure bond issuance and selective monetary easing. For foreign businesses, this suggests moderate tailwinds but not a regime of aggressive stimulus. It also underscores the importance of watching policy signals, five-year plan developments (especially linked to industrial upgrading) and trade-policy shifts.

China in Q3 2025 is at a strategic crossroads: it continues to privilege export-led manufacturing as the main growth driver, even as domestic demand and investment lose steam. For foreign business interests, the key message is that China remains a meaningful manufacturing base and export platform, but the growth model is evolving. Success will require higher value added positioning, diversified markets, and sensitivity to both domestic demand constraints and external trade risks.

China’s Innovation-Driven Manufacturing: From Factory Floor to Global Tech Powerhouse

In 2025, China’s manufacturing landscape is rapidly evolving from cost-based competitiveness to innovation-driven leadership. Once known primarily as the “world’s factory,” China is now asserting itself as a global hub for advanced manufacturing and technological innovation, underpinned by strong policy support, accelerated digital transformation, and continuous industrial upgrading. According to the Global Innovation Index 2025 (GII 2025), China entered the world’s top 10 most innovative economies for the first time, ranking 10th globally. The same report also identified the Shenzhen-Hong Kong-Guangzhou innovation cluster as the world’s leading innovation hub among the top 100 clusters, highlighting the region’s growing global influence in research, technology, and high-value manufacturing.

From “Made in China” to “Created in China”

The government’s industrial strategy—through initiatives such as Made in China 2025 and the 14th Five-Year Plan—has accelerated the transition toward high-value manufacturing. Sectors such as new energy vehicles (NEVs), robotics, semiconductors, and advanced materials are seeing double-digit growth. In the first nine months of 2025, output from high-tech manufacturing expanded by nearly 9.6% year-on-year, far outpacing traditional industries. This structural shift reflects a deliberate effort to reduce reliance on low-cost production and move toward technology intensive manufacturing.

Digital and Green Transformation

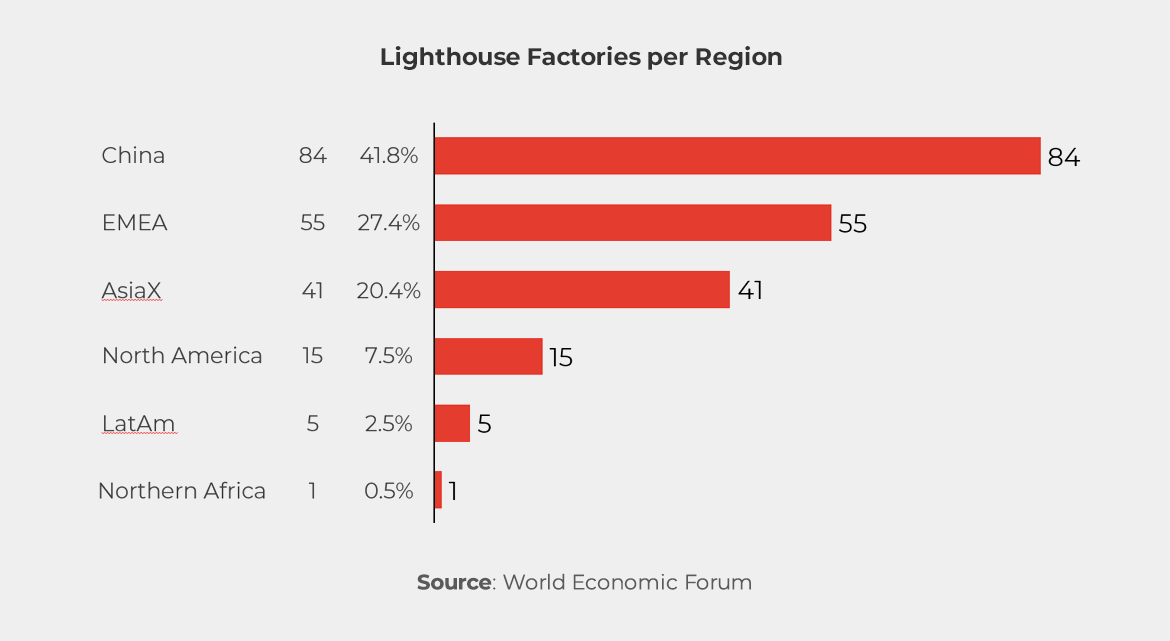

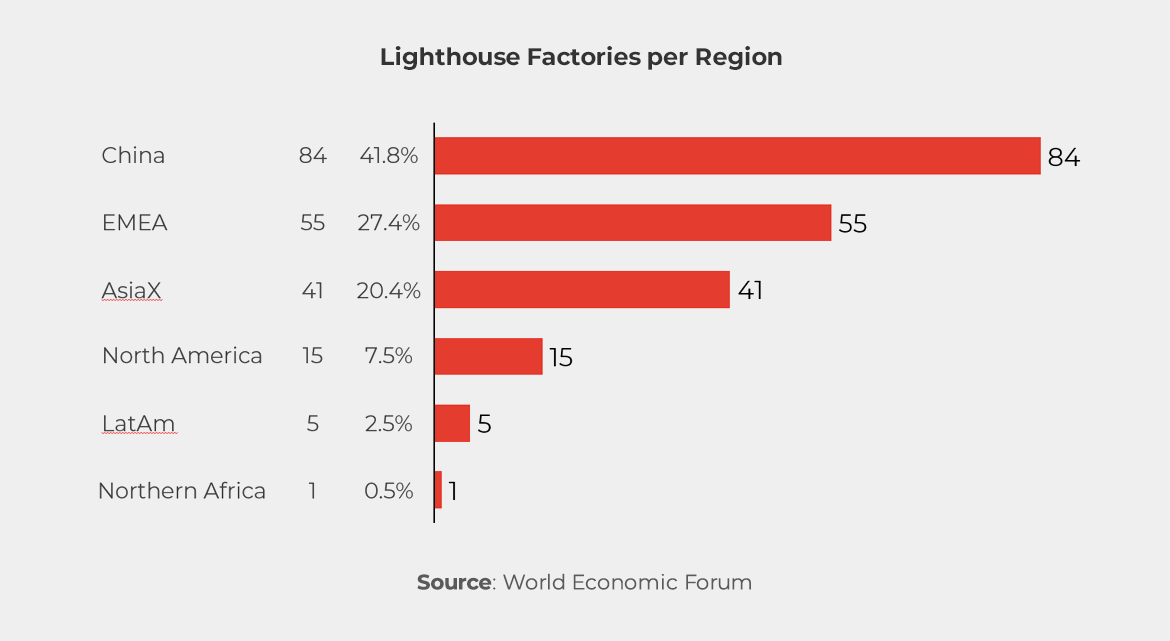

Digitalization is redefining manufacturing productivity. Smart factories integrating AI, IoT, and 5G technologies are proliferating across industrial clusters in provinces like Jiangsu, Zhejiang, and Guangdong. These “lighthouse factories” are capable of self-optimizing operations, cutting waste, and improving efficiency by 20–30%. Meanwhile, the green transition is accelerating: renewable energy inputs, electrification of production lines, and circular-economy practices are becoming mainstream. China’s investment in green tech manufacturing, particularly in EV batteries, solar panels, and wind turbines, has also cemented its dominance in global clean-tech supply chains.

Private and Regional Innovation Hubs

While national champions like CATL, Huawei, and BYD lead the charge, regional ecosystems are increasingly dynamic. Shenzhen and Suzhou are emerging as “innovation belts,” where private manufacturers integrate R&D with flexible production. In 2025, over 40% of industrial enterprises above a certain scale reported R&D spending exceeding 3% of revenue which is a historic high. This signals that innovation is no longer confined to top-tier firms but is diffusing throughout the manufacturing base.

Global Implications

China’s innovation surge reshapes global value chains. Foreign firms operating in China face both opportunities and competitive pressures: joint innovation, co-manufacturing, and tech collaboration are rising, but so are local competitors’ capabilities. For international businesses, success now depends less on cost arbitrage and more on co-innovation, supply chain agility, and alignment with China’s technological priorities.

About this report

Author:

Catherine Guo

Associate

This report was compiled with contributions from the team of business experts across ARC Group’s global offices.

ARC Group is an advisory firm specialised in supporting western companies operating in Asia and beyond. Our mission is to bridge the gap between global business ecosystems and key markets worldwide. Through our Management Consulting division, we provide services within corporate strategy, business transformation, operations, sustainability, growth, sales & marketing, and digital & AI solutions. We work across a wide range of industries, including automotive & mobility, energy & environment, consumer goods & retail, food & beverage, technology, media & telecom, advanced industry & materials, financial services, and healthcare, medtech & biotech.

If you are interested in exploring how we can support your business, reach out through our contact page, or leave your email below for a representative to get in touch directly: