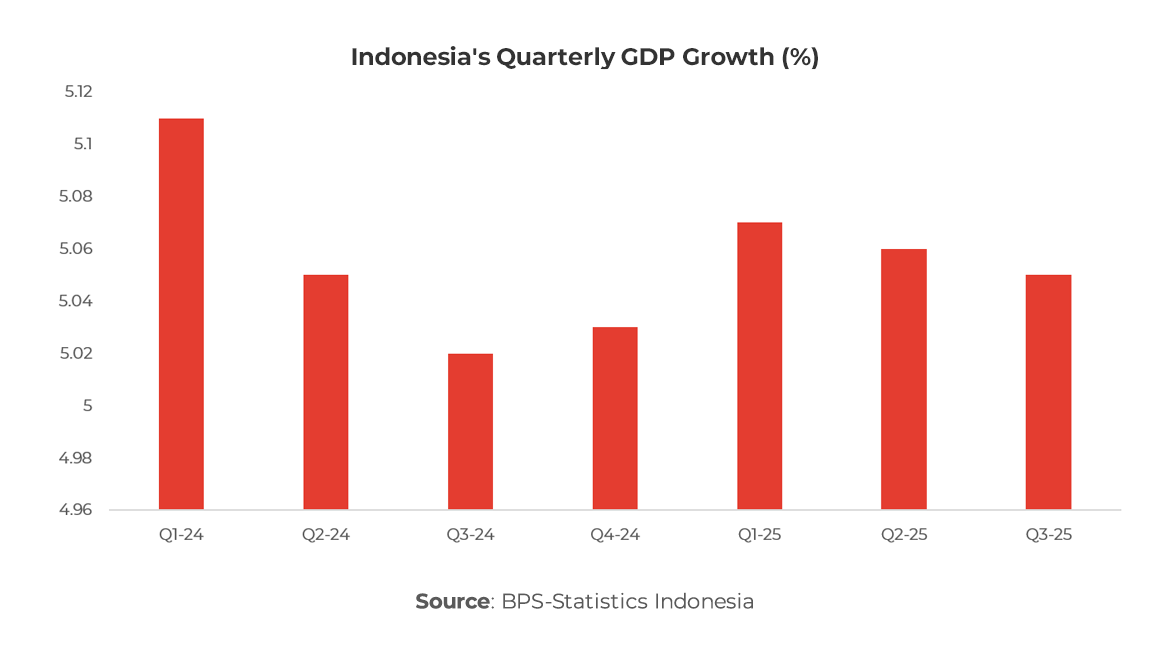

Indonesia’s Economy Grew 5.04% in Q3 2025, Supported by Household Consumption and Strong Export Recovery

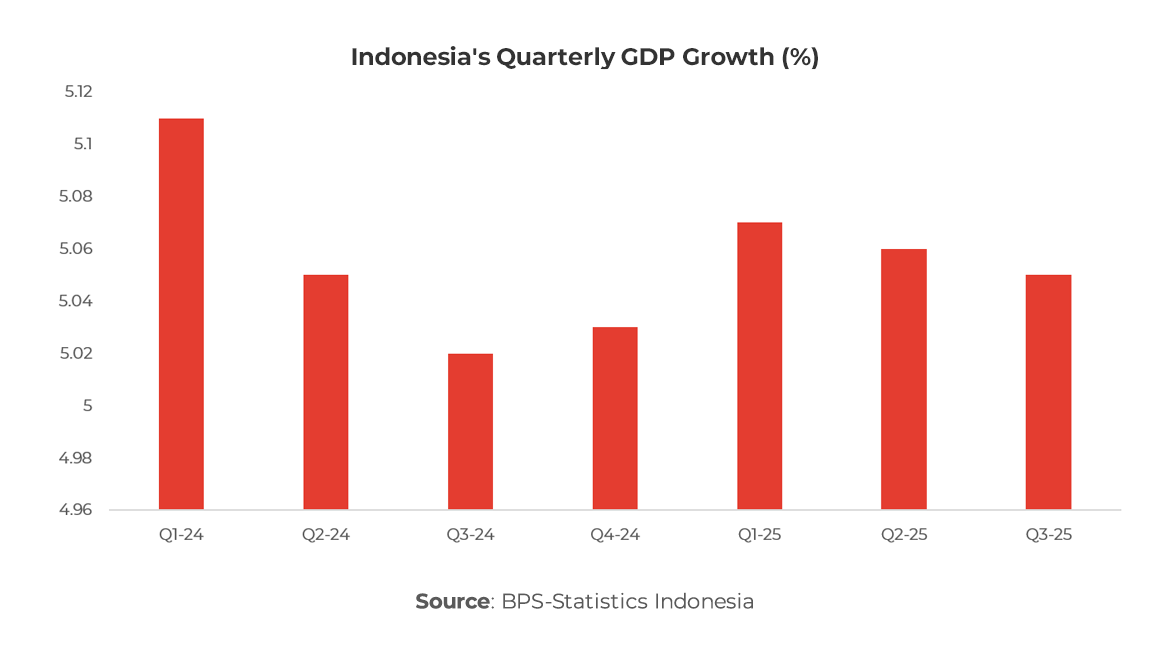

Indonesia’s economy expanded by 5.04% year-on-year (YoY) in Q3 2025, driven by household consumption, export recovery, and improved government spending execution.

This growth was broadly consistent with the previous quarter’s 5.09% and slightly higher than 4.94% in Q3 2024, indicating a stable trajectory amid a challenging global environment. On a quarter-on-quarter (QoQ) basis, GDP grew 1.43%, reflecting continued domestic demand momentum and a recovery in external trade.

In nominal terms, Indonesia’s GDP reached IDR 6,060.0 trillion at current prices, while GDP at constant 2010 prices stood at IDR 3,444.8 trillion, according to BPS. Cumulatively, the economy expanded 5.01% (C-to-C) in the first nine months of 2025, keeping the government’s full-year growth target of around 5% within reach.

Sectoral Performance: Services and Industry Lead Expansion

From the production side, Transportation and Storage continued to be the fastest-growing sector, surging 9.15% YoY, supported by rising logistics activity, holiday travel, and increased goods movement across major islands. The Information and Communication sector followed with 7.42% growth, underpinned by digital services and mobile data demand. Financial Services also rose 6.21%, reflecting resilient banking activity and steady credit growth.

Among key contributors, Manufacturing grew 4.86% YoY, maintaining its dominant share of GDP at 18.8%, while Wholesale and Retail Trade expanded 4.78%, driven by private consumption and improved consumer confidence. In contrast, Agriculture, Forestry, and Fisheries slowed to 1.05%, reflecting seasonal factors and commodity price normalization.

On a quarter-to-quarter basis, the Electricity and Gas Supply sector recorded the highest growth (+5.42% QoQ), followed by Transportation and Storage (+3.12%), Trade (+2.01%), and Construction (+1.85%), signaling a rebound in industrial and infrastructure activity.

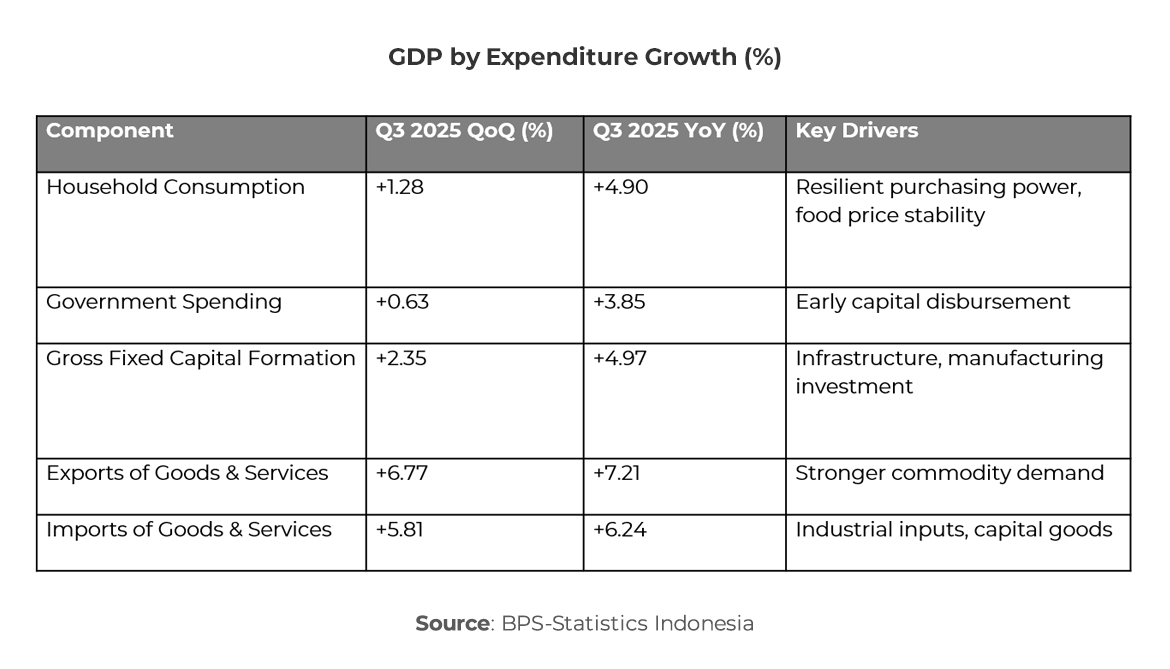

Expenditure Side: Consumption and Exports Drive Growth

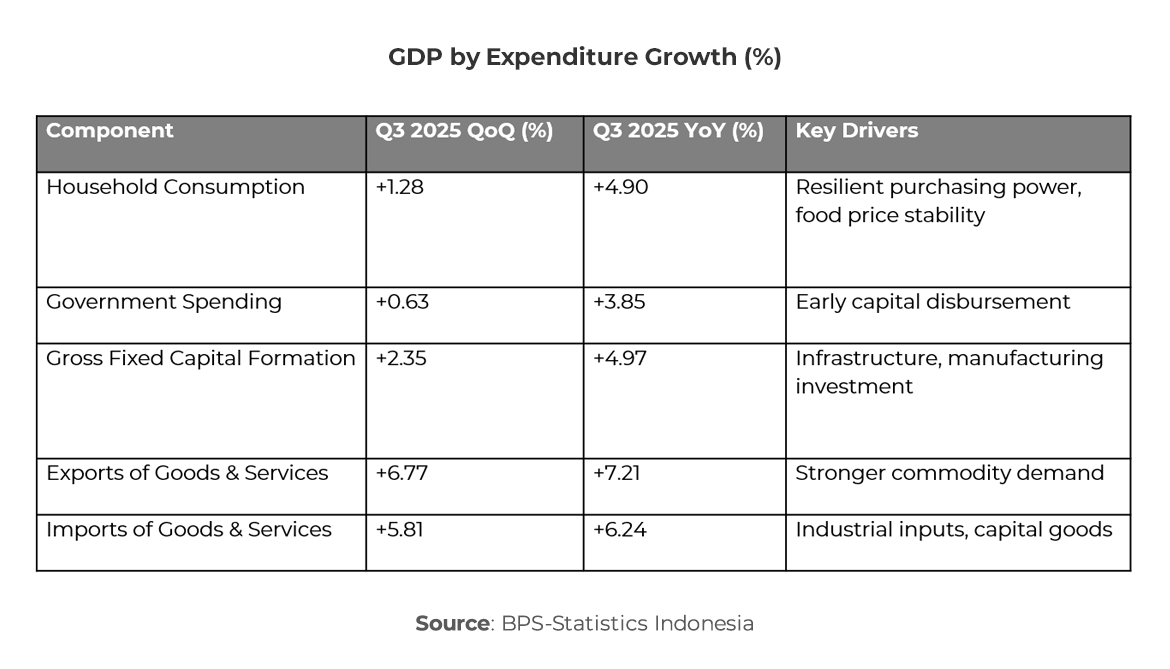

From the expenditure perspective, Household Consumption, which accounts for more than half of Indonesia’s GDP, grew 4.90% YoY, reflecting sustained purchasing power, stable inflation, and government efforts to manage energy and food prices. Gross Fixed Capital Formation (GFCF) rose 4.97% YoY, driven by public infrastructure projects and manufacturing investment.

The most notable boost came from Exports of Goods and Services, which jumped 7.21% YoY, supported by stronger demand for coal, palm oil, and metal commodities amid a recovery in China and India. Imports also increased 6.24% YoY, largely reflecting higher input demand for industrial and capital goods, signaling ongoing production expansion rather than consumption-led imbalances.

On a quarterly basis, exports surged 6.77%, while investment rose 2.35% and household spending grew 1.28%, supported by Eid al-Adha and mid-year holiday consumption. Government spending expanded 0.63%, reflecting the early disbursement of priority infrastructure programs under the 2025 state budget.

Macroeconomic Stability Remains Intact

Macroeconomic fundamentals stayed solid through Q3 2025. Headline inflation averaged 2.4%, comfortably within Bank Indonesia’s target range of 1.5–3.5%. Fiscal metrics remained prudent, with the budget deficit maintained below 2.5% of GDP and the public debt ratio below 40%, reflecting continued commitment to fiscal discipline.

The stability of the Rupiah, supported by Bank Indonesia’s targeted FX interventions and steady foreign reserves above USD 138 billion, helped anchor investor confidence despite global market volatility. Domestic credit growth remained moderate, led by investment lending and consumption financing.

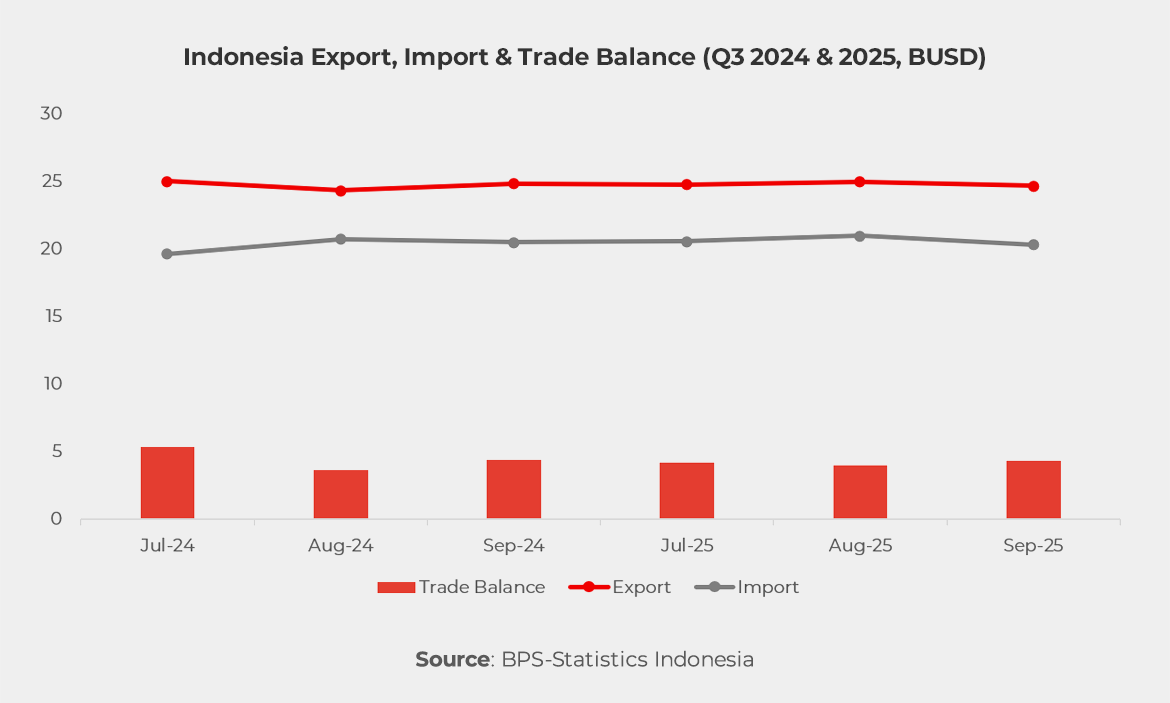

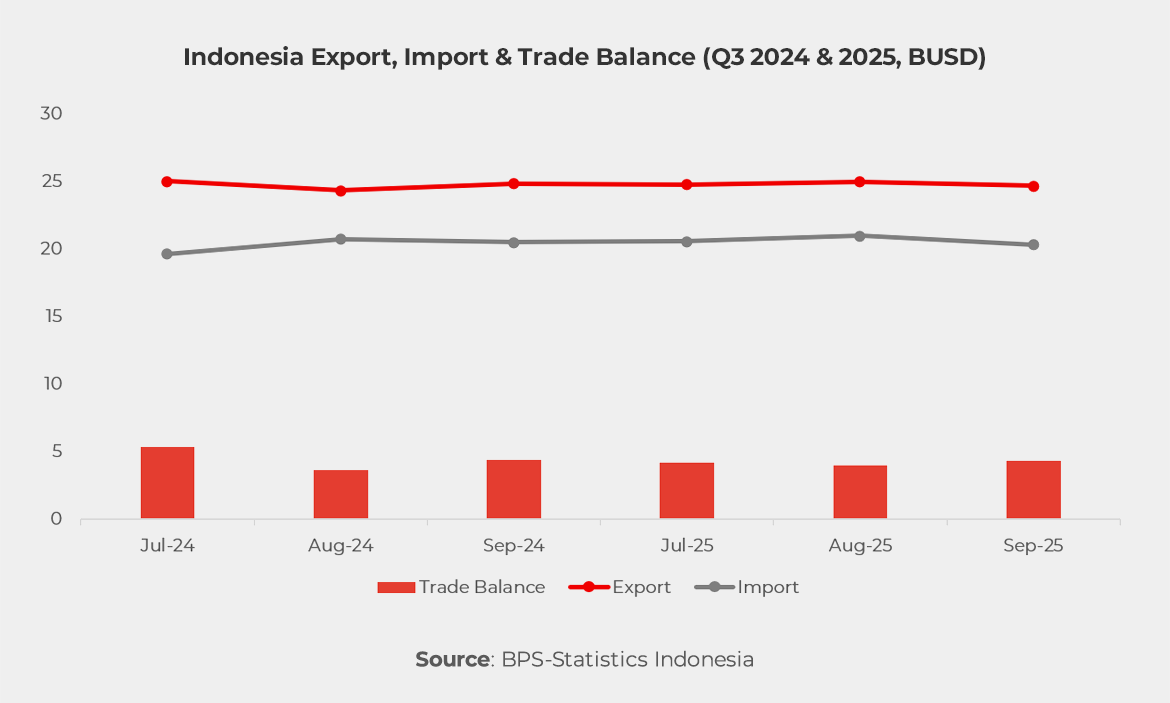

Indonesia’s Trade Surplus Strengthened in Q3 2025 Amid Firm Export Growth and Rising Imports

Indonesia’s external sector remained a pillar of stability in Q3 2025, despite moderated exports eased amid weaker commodity prices while imports remained steady, reflecting resilient domestic investment and production activity. Total trade in goods for the quarter reached US $136.3 billion, down 1.1 % YoY. Exports totaled US $74.4 billion (-3.1 % YoY), while imports rose slightly to US $61.9 billion (+2.9 % YoY).

Despite the softer external demand, Indonesia recorded a quarterly trade surplus of US $12.5 billion, marking its 65th consecutive monthly surplus since May 2020.

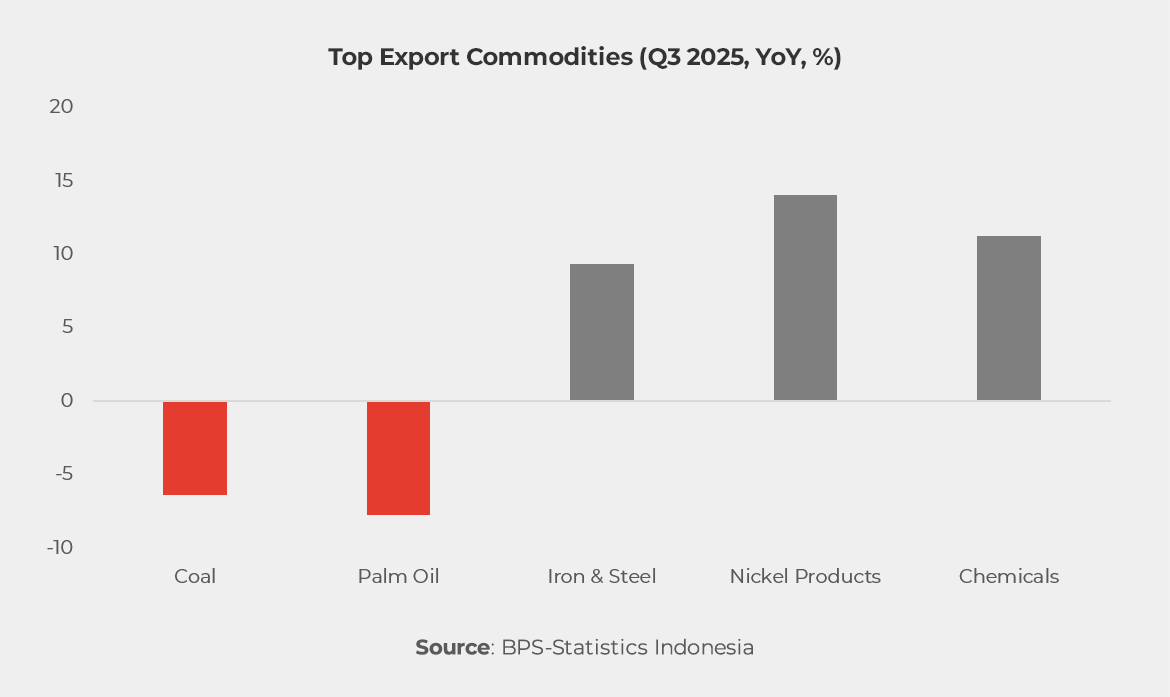

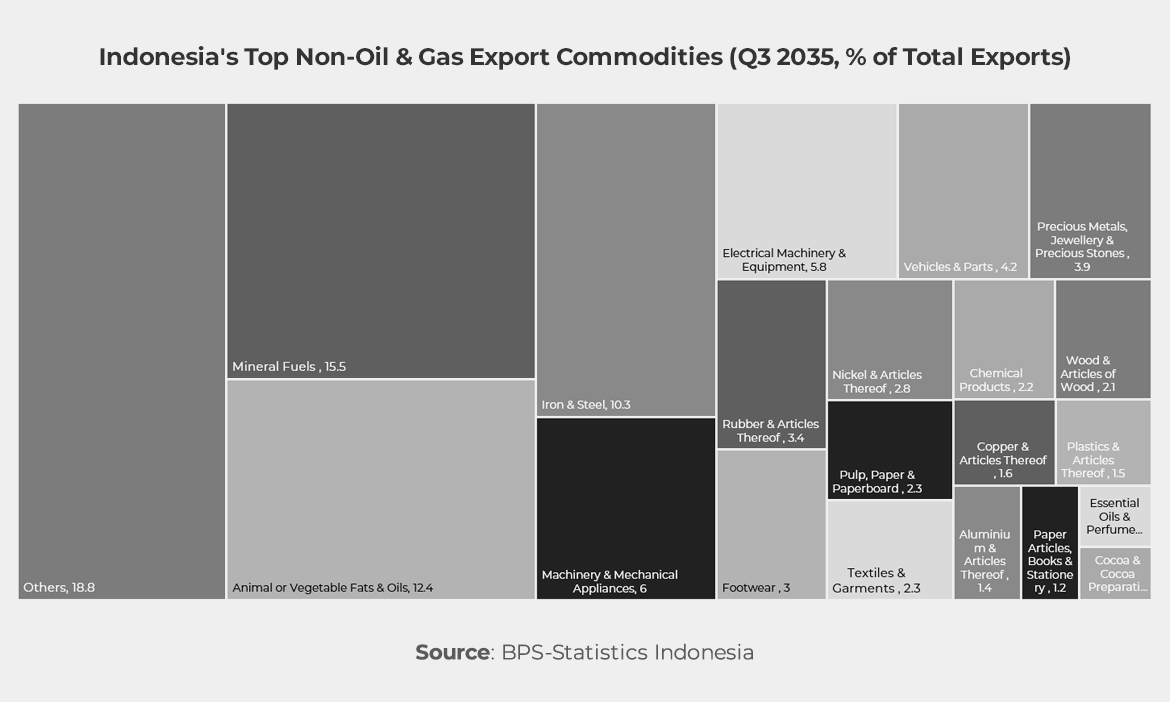

Exports: Manufacturing Cushions Commodity Weakness

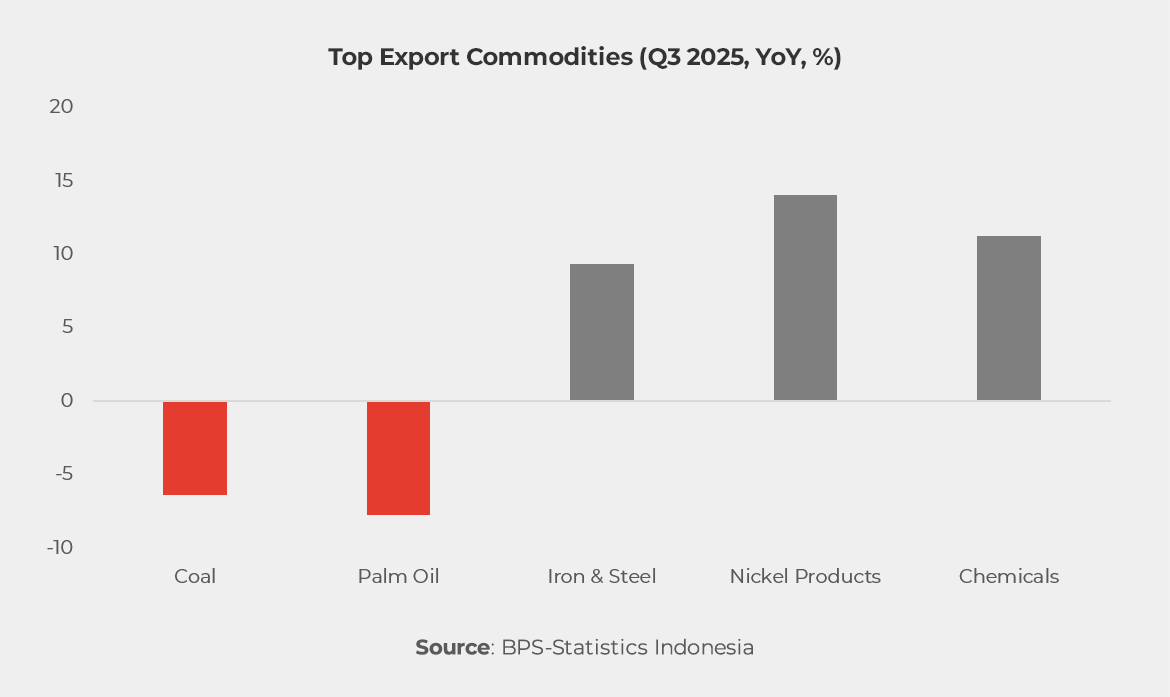

Export performance in Q3 2025 reflected both moderating commodity prices and continued strength in processed goods shipments.

- Coal exports fell 6.4 % YoY to US $8.9 billion, driven by weaker benchmark prices.

- Palm oil and derivatives declined 7.8 % YoY to US $7.8 billion, amid softer demand from India and China.

- Iron and steel exports increased 9.3 % YoY to US $6.4 billion, supported by rising orders from ASEAN partners and the Middle East.

- Nickel-based and chemical products posted double-digit growth as new smelter capacity came online.

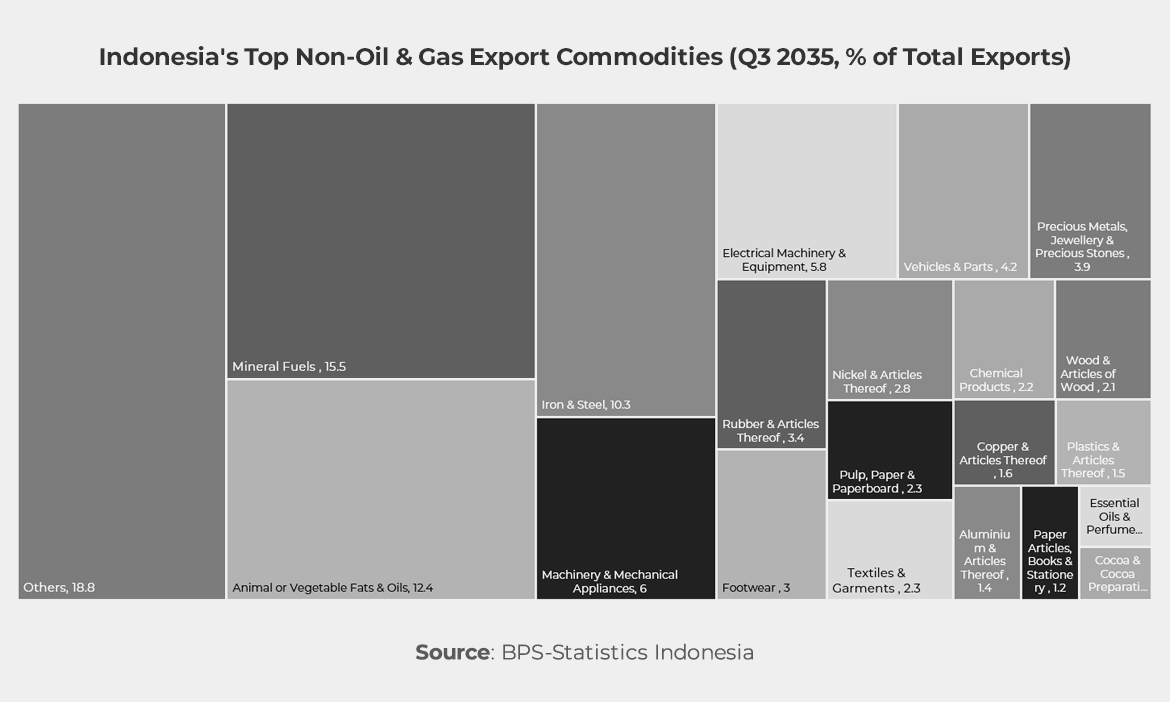

Manufacturing exports now make up over 74 % of total shipments, underscoring Indonesia’s gradual shift toward higher-value production.

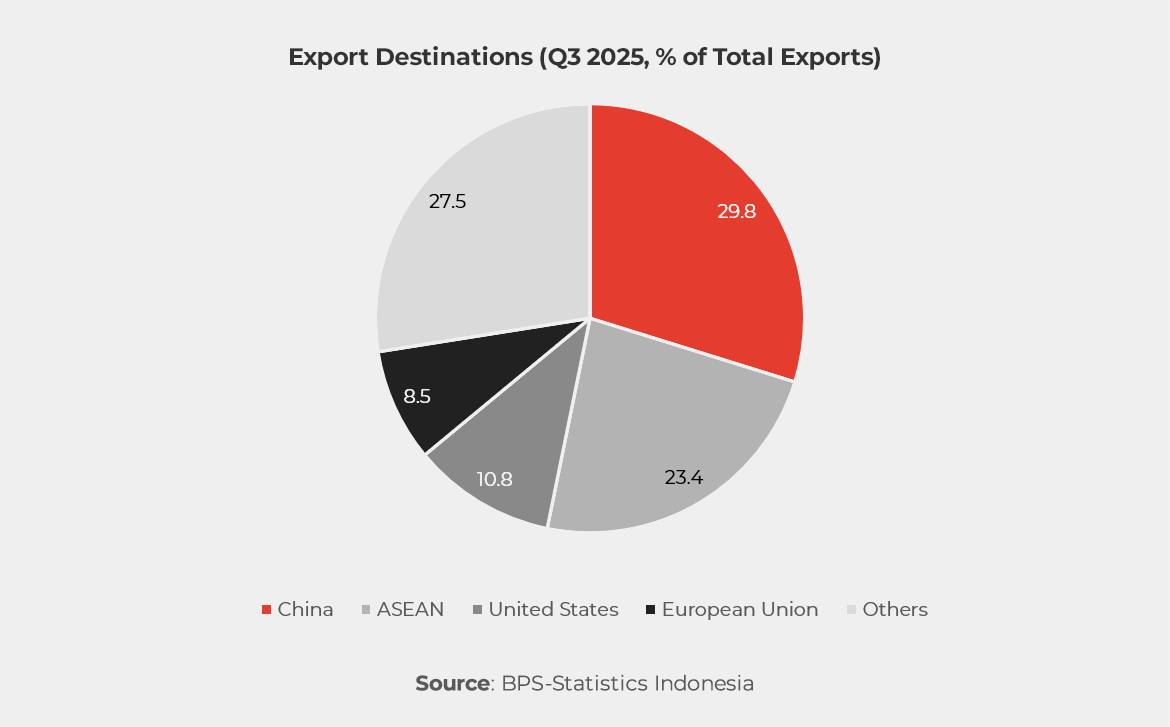

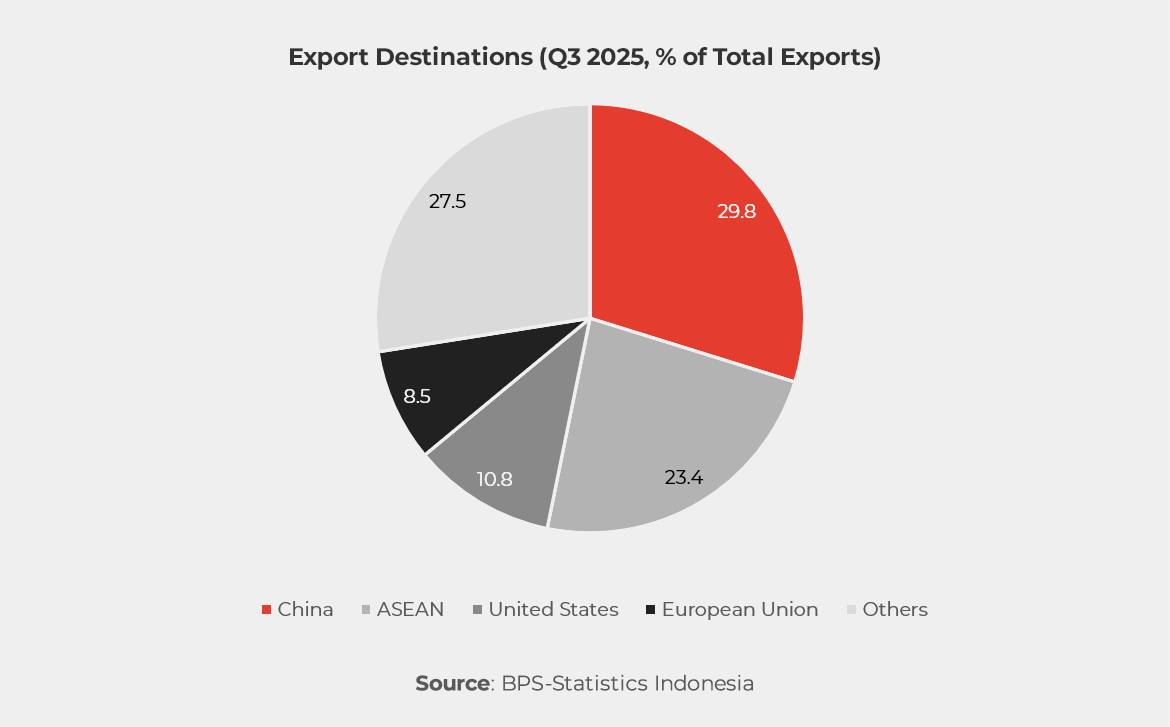

By destination, China remained the largest export market (29.8 %), followed by ASEAN (23.4 %), the United States (10.8 %), and the European Union (8.5 %).

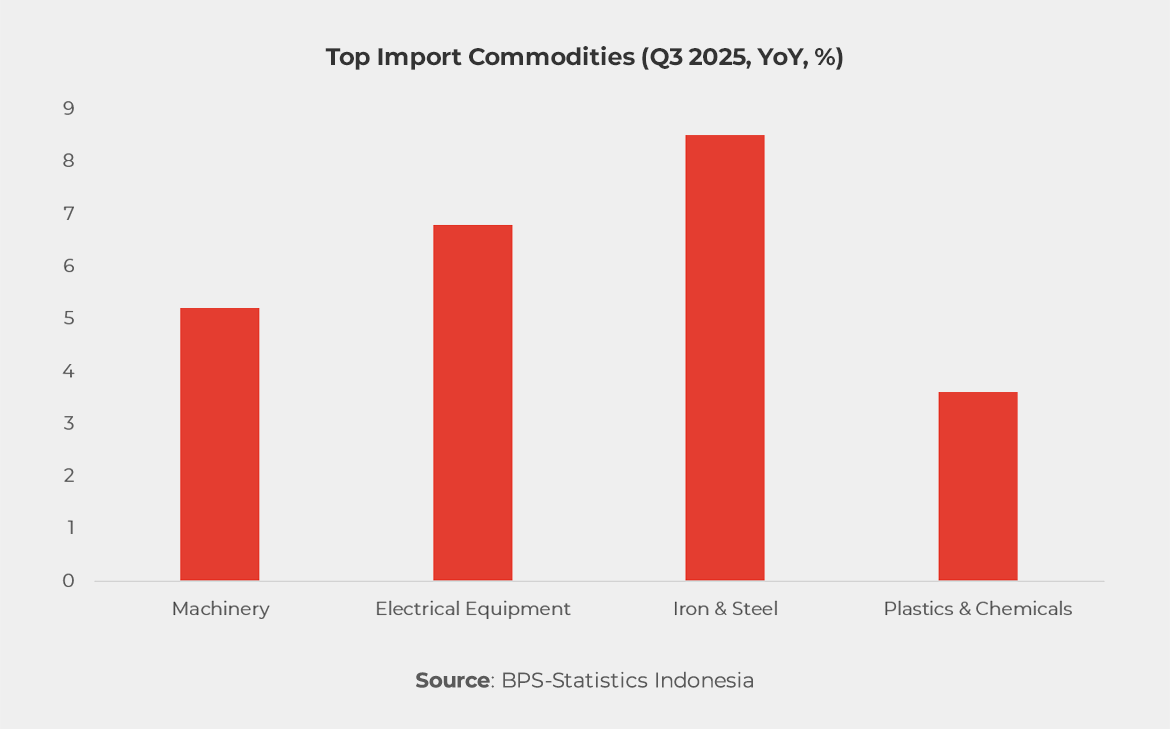

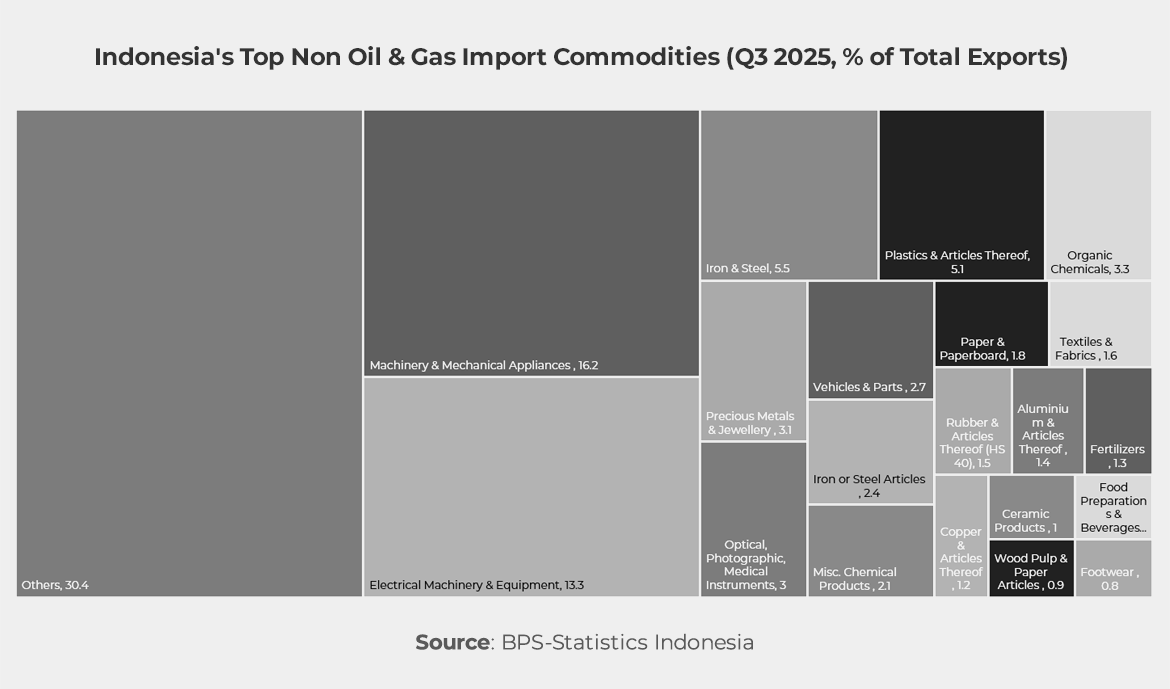

Imports: Capital Goods and Industrial Inputs Drive Demand

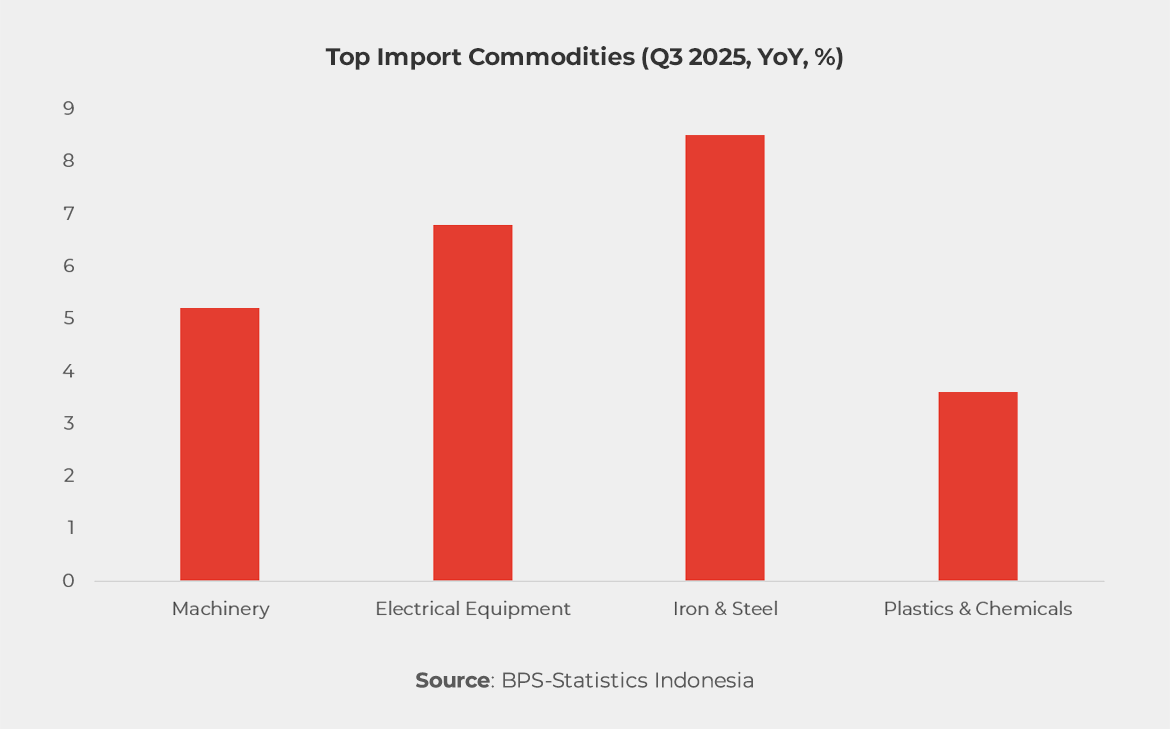

Imports expanded modestly to US $61.9 billion, supported by sustained infrastructure spending and industrial production. Non-oil-and-gas imports reached US $53.7 billion, while oil-and-gas imports amounted to US $8.2 billion.

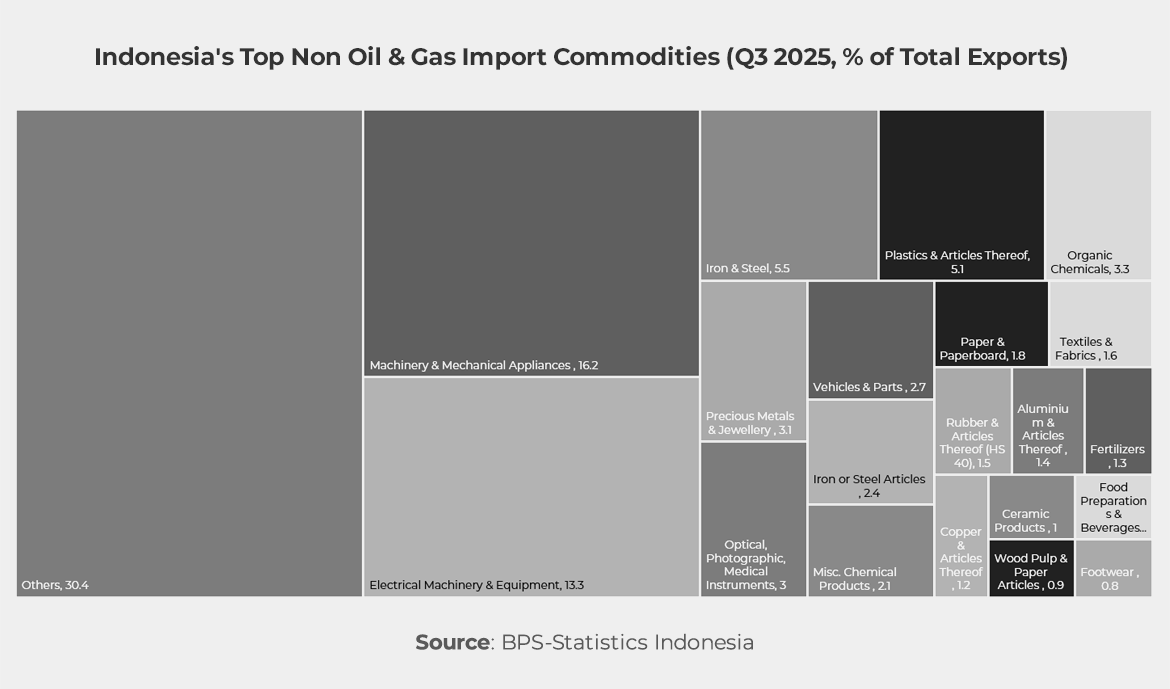

Breakdown by commodity group shows continued investment-related demand.

Capital goods, intermediate goods, and raw materials together accounted for over 90 % of total imports, confirming that import growth was driven primarily by production needs rather than consumption.

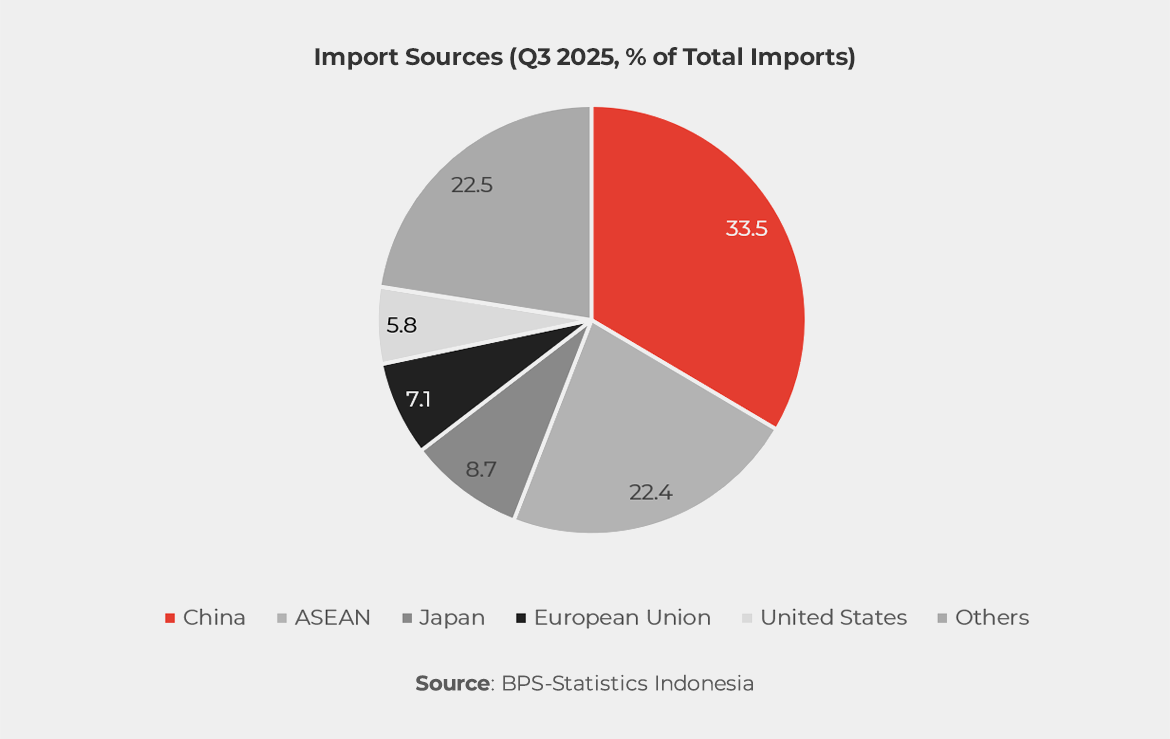

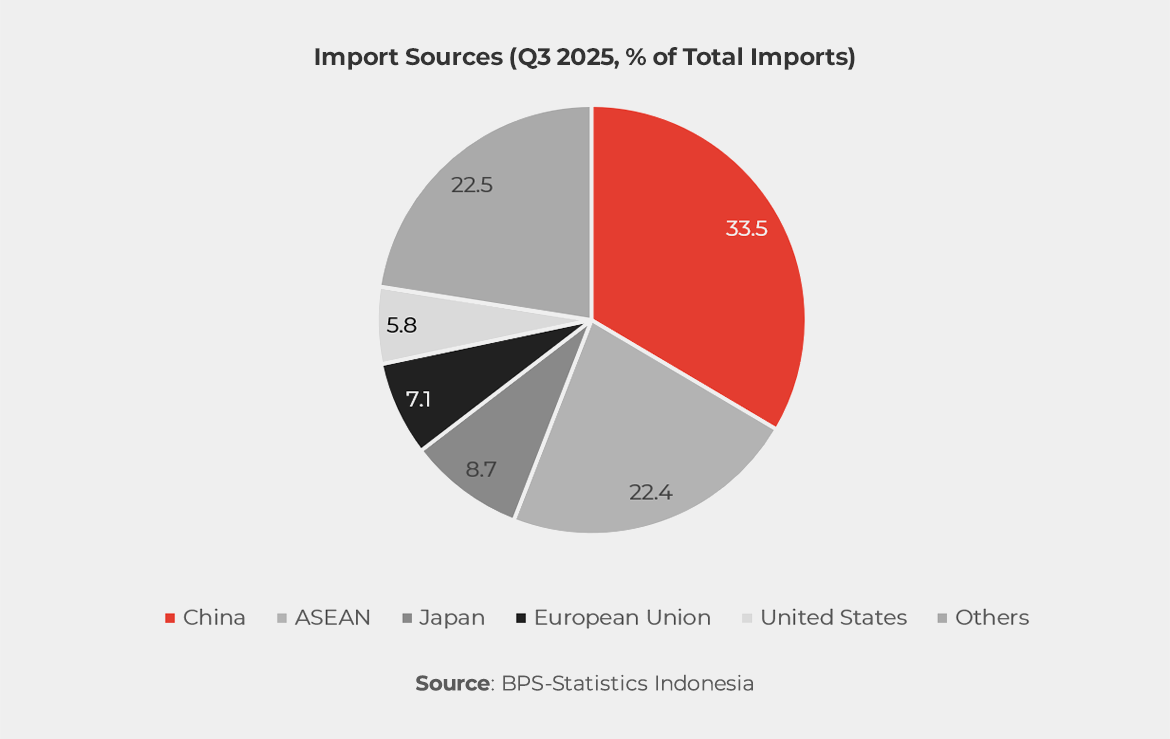

By origin, China remained Indonesia’s top import partner (33.5 %), followed by ASEAN (22.4 %), Japan (8.7 %), the EU (7.1 %), and the United States (5.8 %).

Cumulatively, Indonesia booked a US $40.1 billion trade surplus for January – September 2025, narrowing from US $47.9 billion in the same period of 2024.The moderation mainly reflected lower commodity export prices and firm domestic demand lifting import growth.

Nevertheless, Indonesia’s trade position remains strong by regional standards, underpinned by diversified export products, stable non-oil-and-gas performance, and disciplined import management. While the global environment in late 2025 points to softer commodity demand, a resilient manufacturing base and continued infrastructure spending are expected to sustain Indonesia’s external stability into Q4 2025.

Indonesia’s Fiscal Discipline in Action: Prabowo’s “Soldier Economics” Takes Shape After September Cabinet Reshuffle

Indonesia’s economic trajectory took a more decisive turn in Q3 2025, as President Prabowo Subianto began putting his “soldier economics” philosophy into practice.

The quarter was defined by an assertive cabinet reshuffle in early September, which brought key ministries under closer presidential oversight, with fiscal authorities tightened control over spending and accelerated capital disbursement across infrastructure and defense projects, along with stronger central coordination between ministries. Steps widely viewed as the first concrete implementation of his command-and-control approach to governance. Together, these actions signaled a clear shift toward stronger central coordination and faster execution, marking the first period in which Prabowo’s leadership style had a tangible impact on economic management and fiscal governance.

The 2025 state budget continues to target a conservative deficit of about 2.3% of GDP, but Q3’s developments changed how that budget was administered. Ministries received clearer directives on priority projects and were asked to report monthly to the Presidential Office and the National Development Planning Agency (Bappenas). This stronger line of oversight aimed to reduce chronic underspending and speed up procurement and tendering processes for major projects.

Fiscal Execution and Institutional Shifts

Following the reshuffle, the Ministry of Finance tightened spending controls and prioritized capital expenditure execution. Authorities front-loaded funds for a set of strategic programs, transport and logistics upgrades, selected energy and defense projects, and critical food-security initiatives, seeking visible delivery on campaign commitments. State-owned enterprises were also instructed to play a more active role, with clearer mandates to support national projects and align investment plans with government priorities.

These changes were operational; procurement cycles were compressed in several ministries, and a number of tenders for infrastructure projects moved faster than they had earlier in the year. At the same time, the administration increased scrutiny over certain subsidy and social-assistance lines to ensure budget alignment with strategic objectives.

Markets and the Private Sector’s Reception

Financial markets remained broadly stable throughout the quarter. Key indicators, including bond yields and the Rupiah exchange rate, showed limited volatility, suggesting that investors viewed recent policy changes as measured rather than disruptive. Fiscal conditions stayed within official targets, and government bond demand remained healthy.

From the private sector, responses were measured, with many domestic business associations, such as KADIN, generally welcoming the government’s focus on execution and spending discipline, seeing it as a step toward reducing project delays. There remains an emphasis on the need for transparency and consistency in how new directives are implemented, particularly as stronger central oversight reshapes coordination with regional administrations and state-owned enterprises.

Implementation Gaps Remain

Despite stronger central oversight, implementation challenges persisted across several ministries and regions during Q3 2025. While capital expenditure accelerated in infrastructure and defense, disbursement for social assistance and regional transfers lagged behind schedule. This uneven execution reflects ongoing capacity gaps in project preparation and inter-agency coordination, particularly at the subnational level.

The Ministry of Finance and Bappenas have responded by tightening monitoring mechanisms and standardizing reporting procedures, aiming to improve spending consistency in the final quarter of the year. These measures signal a continued effort to translate Prabowo’s emphasis on discipline and control into more uniform results across government programs.

Takeaway: Discipline With Trade-offs

Q3 2025 provided a clear snapshot of the administration shifting from policy design to operational execution. The cabinet reshuffle and tighter fiscal oversight translated into faster action on a set of national priorities and showed the government was prepared to use centralized levers to drive delivery. That discipline preserved macroprudential credibility in the quarter, yet it also sharpened a core trade-off, stronger central control can boost execution but risks reducing flexibility and private-sector confidence if not balanced with transparency and institutional safeguards.

In short, Q3 2025 marked the moment when “soldier economics” moved from concept to practice, demonstrating the administration’s ability to marshal state resources quickly, while highlighting that sustaining investment momentum will require managing the trade-off between command and collaboration.

Tightening the Purse Strings: Central Lending to Regions Marks a New Fiscal Era

Indonesia’s fiscal landscape is shifting, as the government introduces a new mechanism allowing direct lending from the central government to regional administrations and state-owned enterprises (SOEs). The regulation, issued in October 2025, enables the Ministry of Finance to channel state funds directly to local governments for infrastructure, housing, and industrial projects deemed nationally strategic, a move that underscores President Prabowo Subianto’s drive for tighter fiscal control and execution discipline.

For over two decades, Indonesia has operated one of the most decentralized fiscal systems in Asia, a product of post-President Suharto reforms designed to empower local governments. The new lending framework marks a recalibration of that model. Officials describe it as a way to accelerate project execution, reduce idle regional balances, and improve spending efficiency, aligning closely with Prabowo’s emerging approach that prioritizes command, coordination, and measurable outcomes.

Under the new system, the Ministry of Finance and Ministry of Home Affairs will jointly evaluate regional borrowing proposals to ensure alignment with national priorities. This replaces a fragmented structure in which regions relied heavily on transfers and limited borrowing capacity, often leading to underspending and project delays. As of mid-2025, unspent regional funds were estimated to exceed IDR 180 trillion, highlighting the scale of inefficiency the government seeks to address.

This move is interpreted as both strategic and symbolic, signaling a return of fiscal influence to the center. While proponents view it as a necessary correction to chronic underspending and weak project delivery, others caution that excessive central control could dampen local initiative. Business stakeholders, meanwhile, expect the mechanism to improve budget realization for contractors and infrastructure players.

In effect, the new lending framework extends Prabowo’s “soldier economics” into Indonesia’s fiscal management. By consolidating budgetary power, the administration aims to push faster execution of strategic investments, strengthen intergovernmental coordination, and reassert the state’s role as both financier and driver of growth. For now, Indonesia’s fiscal pendulum is clearly swinging back toward the center, a defining feature of its evolving economic playbook.

About this report

Author:

Albert Halim

Associate

This report was compiled with contributions from the team of business experts across ARC Group’s global offices.

ARC Group is an advisory firm specialised in supporting western companies operating in Asia and beyond. Our mission is to bridge the gap between global business ecosystems and key markets worldwide. Through our Management Consulting division, we provide services within corporate strategy, business transformation, operations, sustainability, growth, sales & marketing, and digital & AI solutions. We work across a wide range of industries, including automotive & mobility, energy & environment, consumer goods & retail, food & beverage, technology, media & telecom, advanced industry & materials, financial services, and healthcare, medtech & biotech.

If you are interested in exploring how we can support your business, reach out through our contact page, or leave your email below for a representative to get in touch directly: