Popular search

Recently visited pages

Vietnam Economic Update Report, Q3 2025

Vietnam’s growth engine shifts into a higher gear in Q3 2025

GDP rose 8.23% YoY, the fastest quarterly pace since 2011, led by manufacturing and services.

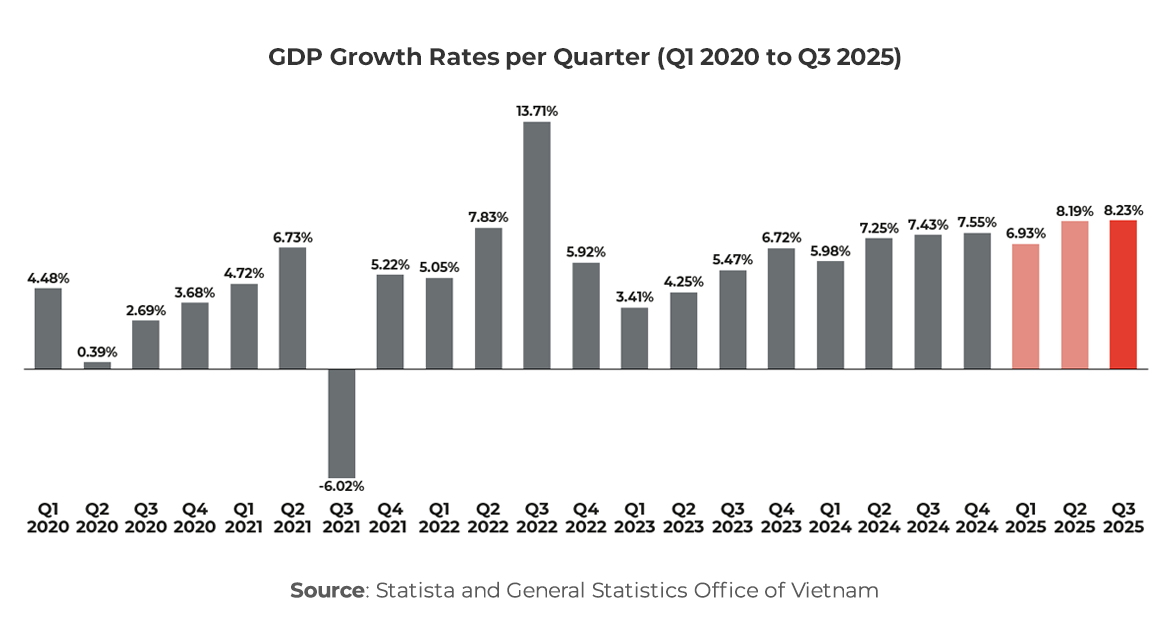

Vietnam’s economy demonstrated robust growth in Q3 2025, with GDP expanding 8.23% year on year (YoY), the fastest quarterly pace since 2011 (excluding the post-pandemic surge in 2022). This marked an acceleration from Q2’s 7.96% growth and kept the economy on track toward the government’s full-year target of 8.3 to 8.5%, notably above multilateral forecasts earlier in the year. Cumulatively, GDP in the first nine months (9M) of 2025 grew 7.85% YoY, the second-highest 9M rate in over a decade (only behind 2022’s 9.44%). The step-up in momentum came despite the 20% U.S. tariff on Vietnamese goods that took effect on August 7, which raised uncertainty for some export-oriented sectors. Growth was underpinned by stronger industrial output, vibrant services, resilient domestic demand, and steady FDI disbursement, while inflation stayed contained.

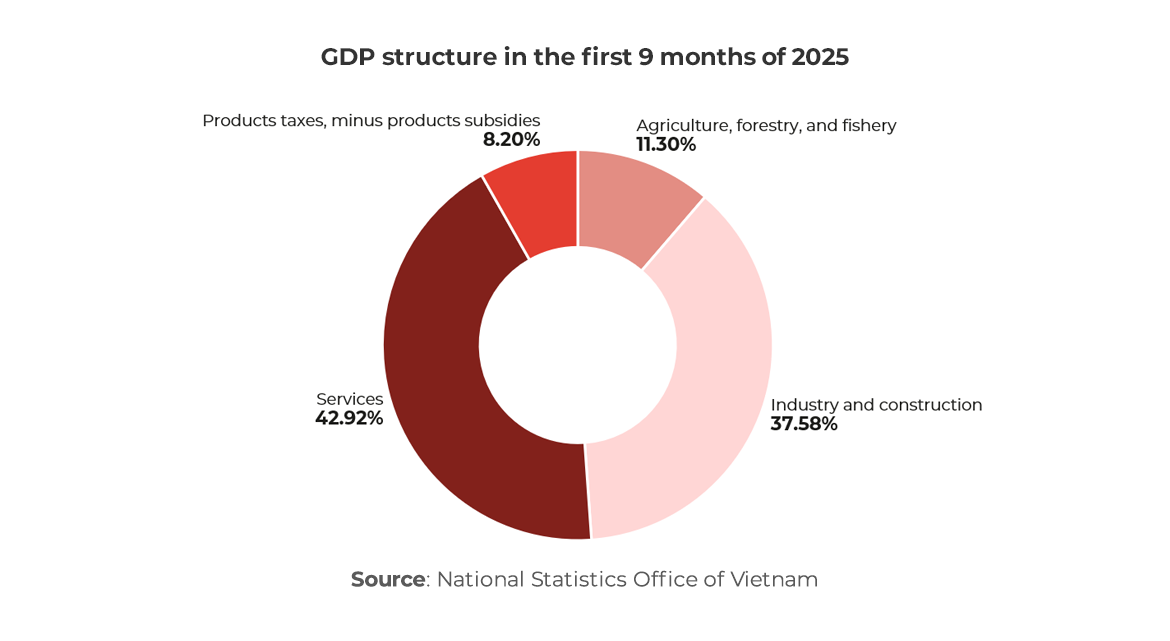

The structure of GDP remained balanced across the three main pillars. In 9M 2025, services accounted for about 42.9% of GDP, industry and construction for 37.6%, and agriculture–forestry–fishery for 11.3% (the remainder from taxes/subsidies on products). All three sectors expanded in Q3 and over 9M, with different speeds but broadly supportive contributions to headline growth.

The structure of GDP remained balanced across the three main pillars. In 9M 2025, services accounted for about 42.9% of GDP, industry and construction for 37.6%, and agriculture–forestry–fishery for 11.3% (the remainder from taxes/subsidies on products). All three sectors expanded in Q3 and over 9M, with different speeds but broadly supportive contributions to headline growth.

- The agriculture–forestry–fishery sector grew 3.74% YoY in Q3 and 3.83% YoY in 9M, providing a stable base for food supply and rural incomes despite adverse weather.

- The industry and construction sector, Vietnam’s traditional growth engine, expanded 9.46% YoY in Q3 and 8.69% YoY in 9M 2025, contributing materially to the overall outturn given its roughly 37.58% share of GDP.

- The service sector maintained strong momentum and remained the largest contributor to growth, expanding 8.54% YoY in Q3 and about 8.48% YoY in 9M 2025.

Inflation dynamics remained supportive of growth. CPI in September increased 0.42% month-on-moth (MoM), 2.61% versus December 2024, and 3.38% YoY. Average CPI in Q3 2025 rose 3.27% YoY. Average CPI in 9M 2025 also rose 3.27% YoY, while core inflation increased by 3.19%. These readings indicate that underlying price pressures stayed moderate and broad within the policy comfort zone, helping preserve real incomes and consumption. Against this backdrop, the State Bank of Vietnam (SBV) kept policy supportive, ensured ample liquidity, and guided lending rates lower to foster production and household demand. While the dong faced some depreciation pressure amid a stronger U.S. dollar, SBV operations helped smooth FX volatility and preserve investor confidence. Credit growth remained robust, roughly high teens to about 20% on an annualized basis, channeling funds toward manufacturing, construction, and consumer sectors.

Overall, Vietnam’s third-quarter performance reaffirmed its position as one of Asia’s most dynamic economies. Strong industrial production, a vibrant service sector, and stable macro fundamentals combined to deliver the fastest growth rate in over a decade. As of September, cumulative GDP gains, steady inflation, and supportive monetary conditions positioned the economy to meet its full-year goals, provided domestic demand remains firm and global conditions do not deteriorate sharply. The balance between growth and stability achieved in Q3 2025 illustrates Vietnam’s resilience and its continued evolution toward a diversified, service-oriented, and high-value industrial economy.

Trade powers ahead despite new headwinds

9M turnover reached USD 680.6 billion (+17.3% YoY), Q3 exports grew 18.4% YoY, and the surplus stood at USD 16.8 billion.

Foreign trade remained one of the most dynamic components of Vietnam’s economy in Q3 2025, highlighting continued export resilience and robust import demand tied to manufacturing recovery. Total trade turnover in the first nine months reached USD 680.6 billion, up 17.3% YoY, marking one of the strongest trade expansions in recent years. Despite global headwinds and the 20% U.S. tariff implemented in August, Vietnam’s external sector continued to grow faster than most regional peers, supported by diversified export markets, steady FDI inflows, and strong industrial production.

Exports in Q3 2025 reached USD 128.57 billion, increasing by 18.4% YoY and 9.6% compared with Q2. For the 9M period, export turnover stood at USD 348.74 billion, up 16.0% YoY, already surpassing the government’s full-year growth target of 12%.

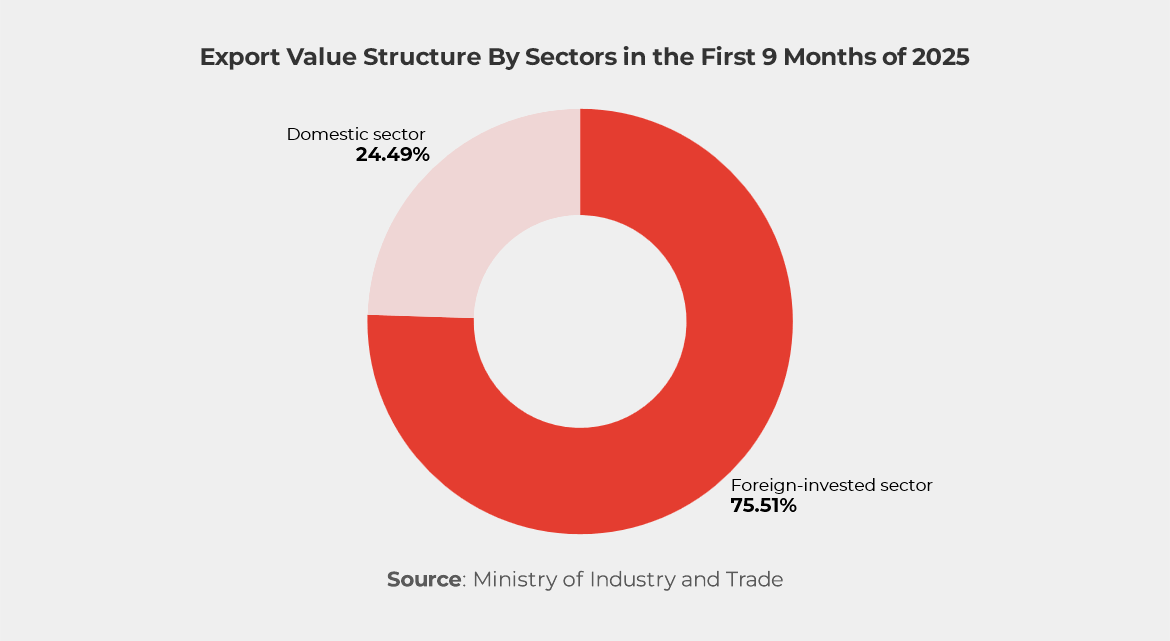

The foreign-invested sector, including crude oil, contributed USD 263.33 billion (+21.4%), accounting for 75.5% of total exports, while the domestic sector reached USD 85.41 billion (+2.0%), or 24.5% of the total.

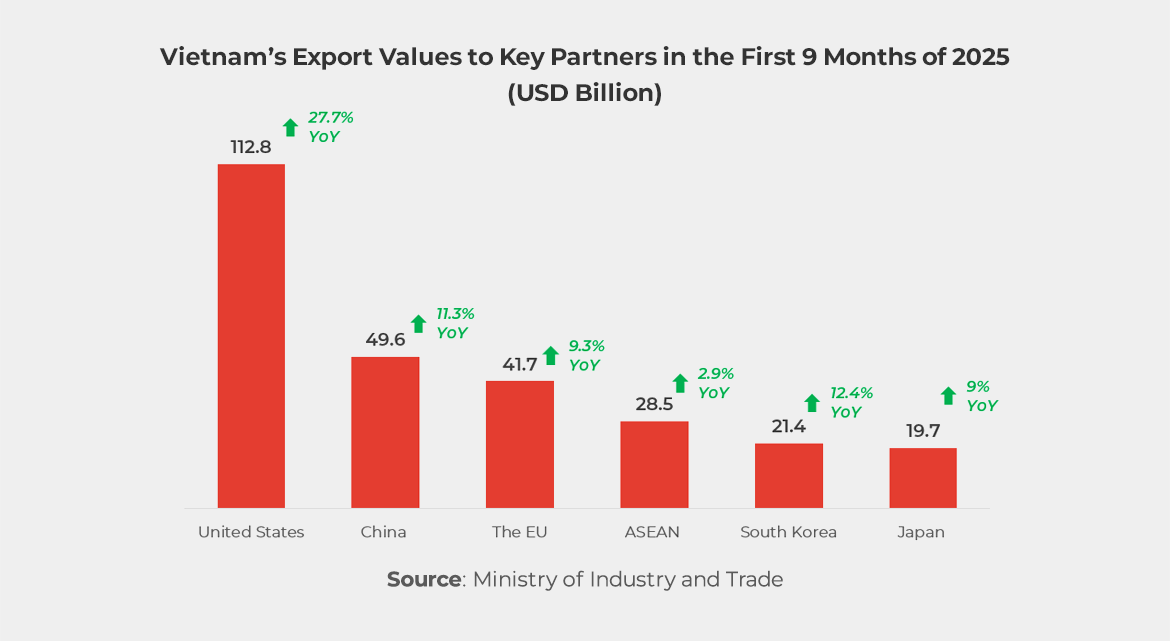

By market, the United States remained the largest destination at USD 112.8 billion (+27.7% YoY). Exports to key partners like China, the EU, ASEAN, South Korea, and Japan are all witnessed an increase during the period.

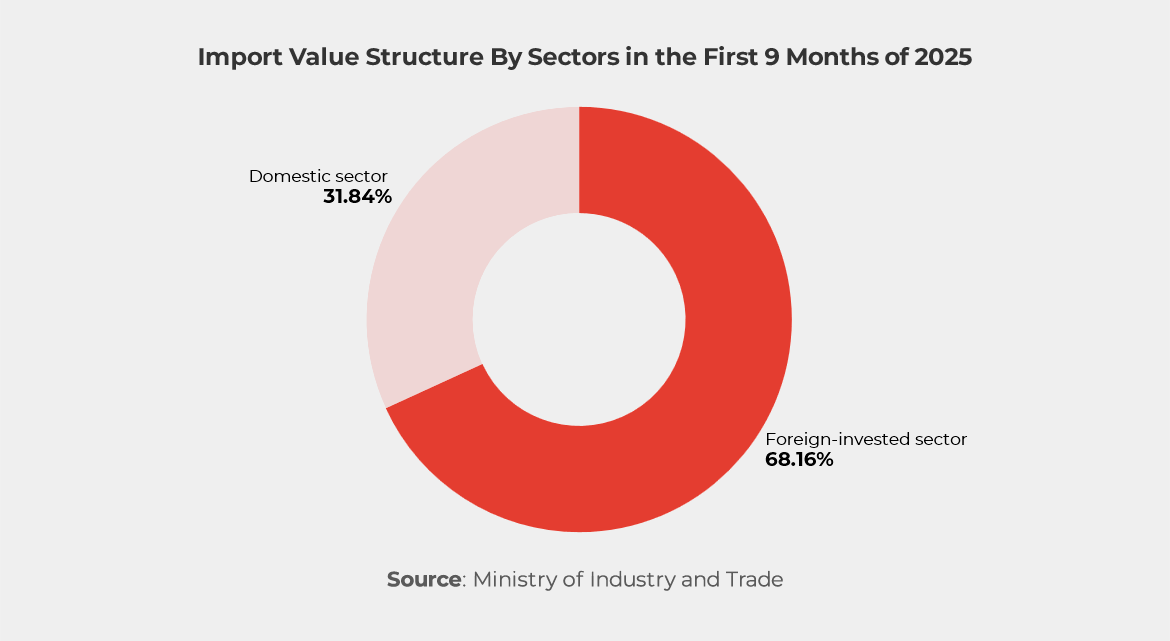

On the import side, Vietnam posted USD 119.66 billion in Q3 2025 (+20.2% YoY and +6.3% versus Q2). Total imports in 9M reached USD 331.92 billion (+18.8% YoY).

The foreign-invested sector imported USD 226.25 billion (+26.8%), while the domestic sector imported USD 105.67 billion (+4.6%).

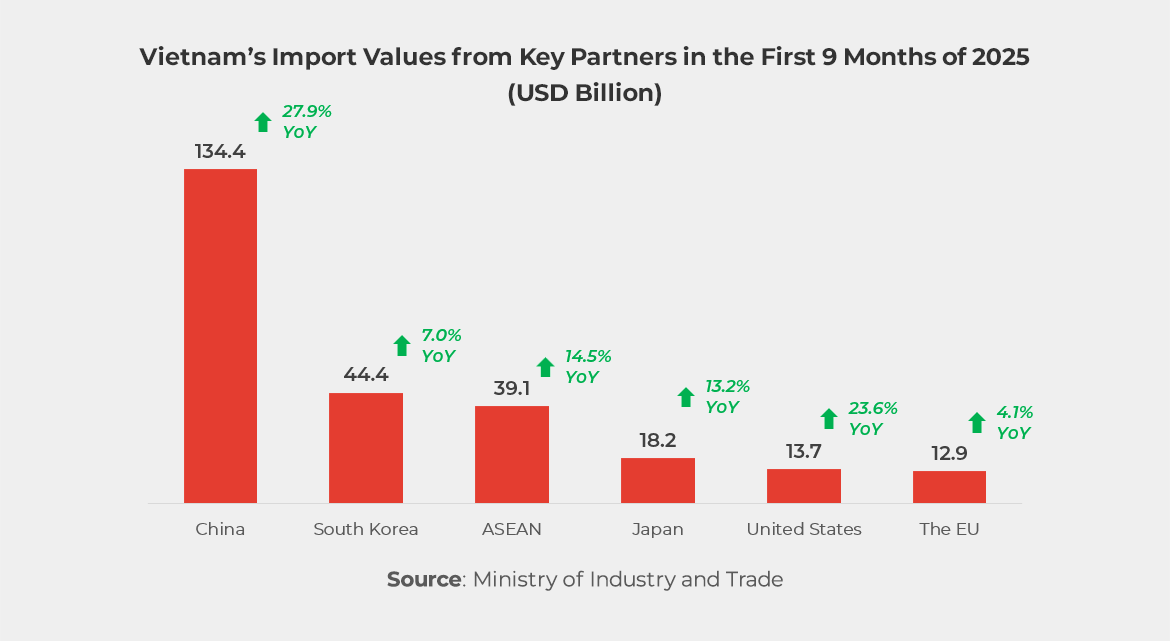

By partner, China continued to be Vietnam’s largest supplier with USD 134.4 billion (+27.9%), followed by the South Korea USD 44.4 billion (+7.0%), ASEAN USD 39.1 billion (+14.5%), Japan USD 18.2 billion (+13.2%), the United States USD 13.7 billion (+23.6%), and the EU USD 12.9 billion (up 4.1%).

Although import growth (+18.8% YoY) outpaced exports (+16.0% YoY), Vietnam still recorded a trade surplus of USD 16.8 billion in 9M, supporting macroeconomic stability and foreign reserves. The foreign-invested sector posted a USD 37.08 billion surplus that offset a USD 20.26 billion deficit in the domestic sector. Assuming stable external conditions and continued production expansion, authorities expect total trade turnover to approach ~USD 900 billion by year-end 2025, with Vietnam remaining one of Asia’s most dynamic trading economies. The diversified product mix, strong manufacturing base, and expanding high-tech exports provide resilience amid shifting global trade conditions, while ongoing efforts to boost domestic industry and trade facilitation will be critical to sustaining momentum into 2026.

U.S.–Vietnam trade: from tariff shock to framework détente

A new framework keeps 20% tariffs for now but opens zero-tariff windows on selected goods and anchors cooperation with major deals.

The third quarter of 2025 marked a turning point in Vietnam’s trade relations with the United States. The period began with uncertainty after Washington imposed a 20% tariff on Vietnamese goods effective August 7, with a 40% rate on goods suspected of transshipment through Vietnam. Many observers feared a sharp disruption to one of Vietnam’s most critical export markets, since the U.S. accounts for nearly a third of the country’s total export revenue. By the end of the quarter, Vietnam had not only weathered the tariff shock but also reached a preliminary framework with the U.S. that signaled a path toward renewed stability and cooperation.

The new U.S.–Vietnam Trade Framework, announced on October 26, aims to create a “reciprocal, fair, and balanced” trading relationship. While the 20% tariff remains in place for now, the agreement opens the door for zero-tariff treatment on selected Vietnamese goods pending further negotiations. In return, Vietnam committed to widening market access for U.S. products, adopting international standards in key sectors, and enhancing enforcement against transshipment and duty evasion. These commitments include greater alignment with U.S. vehicle regulations, streamlined approval for American medical devices and pharmaceuticals, and stronger customs cooperation. The framework shifts the tone of the bilateral relationship from confrontation to structured engagement, creating the conditions for more predictable trade rules that businesses can plan around.

Major commercial deals helped anchor this policy shift. Vietnam Airlines finalized an order to purchase 50 Boeing aircraft worth over USD 8 billion, one of the largest aviation contracts in the country’s history. Additional memoranda of understanding were signed for U.S. agricultural exports, including soybeans, corn, and meat products, collectively valued at several billion dollars. These transactions reduce the bilateral trade imbalance and demonstrate tangible economic cooperation. For both sides, they provide political and commercial ballast at a time when global trade tensions remain high.

For companies operating in Vietnam, the framework carries several practical implications. First, firms should prepare for a prolonged period of elevated tariffs, since the 20% rate will likely remain through at least early 2026. Exporters to the U.S. should assess which product categories might qualify for future tariff exemptions under the framework and adjust pricing and sourcing strategies accordingly. Second, the U.S. has indicated it will intensify origin verification and anti-transshipment checks, especially for electronics, textiles, and furniture. Robust documentation and supplier audits to prove genuine Vietnamese origin are essential. Third, Vietnamese manufacturers should diversify export portfolios toward the EU, Japan, and ASEAN, which continue to expand under existing free-trade agreements, reducing reliance on the U.S. market during the transition.

Despite short-term headwinds, the framework is an opportunity for Vietnam to move up the value chain and strengthen institutional trade practices. The government has accelerated customs modernization and digitalization to comply with international standards. Domestic enterprises are investing in compliance systems, traceability tools, and sustainability standards to maintain market access. These changes, although demanding at first, will improve Vietnam’s long-term competitiveness and integration into global supply networks.

Macroeconomic impacts appear manageable so far. Export growth to the U.S. slowed modestly late in Q3 but remained positive, contributing to an overall export increase of 18.4% YoY during the quarter. Electronics, agricultural goods, and machinery shipments performed well and partially offset declines in footwear and textiles. The trade surplus of USD 16.8 billion in the first nine months helped stabilize foreign reserves and the exchange rate. The government’s diplomatic and policy response also reassured investors and supported high-tech FDI inflows during the same period.

Q3 2025 was a quarter of adjustment and recalibration rather than retreat. Vietnam showed resilience under tariff pressure and agility in turning a potential trade crisis into an opportunity for strategic realignment. The emerging trade framework with the U.S. points to a more balanced, transparent, and cooperative phase in bilateral relations, one that could redefine Vietnam’s role in global supply chains over the coming years.

High-tech FDI deepens as Vietnam climbs the semiconductor and AI stack

Semiconductor ATP capacity and AI investments accelerated, with 9M registered FDI up 15.2% YoY and record disbursements.

Vietnam’s third quarter of 2025 underscored a clear shift toward higher-value investment. Registered foreign direct investment reached about USD 28.54 billion in the first nine months, up 15.2% YoY, while disbursements were the highest in five years, signaling that projects are moving from commitment to execution. Manufacturing continued to attract the largest shares, with processing and electronics leading the pipeline.

Semiconductors were a focal point. Vietnam’s role in assembly, testing, and packaging continued to expand as global firms diversified footprints. Amkor Technology advanced its USD 1.6 billion project in Bắc Ninh, one of the country’s largest semiconductor facilities, while Hana Micron reiterated plans to lift total investment in Việt Nam toward USD 1 billion by 2025. The build-out strengthens upstream and downstream supplier ecosystems and shortens regional supply chains for electronics customers.

The AI layer is scaling alongside chips. FPT formalized a USD 200 million partnership with Nvidia to build an AI factory and has broken ground on a complementary ~USD 174 million AI center in Bình Định. Nvidia has previously flagged more than USD 250 million invested in Việt Nam and is deepening cooperation with leading local firms to support cloud, healthcare, and automotive AI applications. These moves point to a maturing digital infrastructure base and a pathway from manufacturing into AI research, model training, and enterprise adoption.

The investment momentum sits within a broader reconfiguration of regional supply chains. Reuters has noted a steady relocation of chip packaging from China to Việt Nam, with expectations that the country’s share of global ATP could rise meaningfully over the next decade as more capacity comes online and local champions’ scale. The combination of electronics depth, pro-investment policies, and talent development initiatives is positioning Việt Nam as a credible Southeast Asian hub for semiconductors and AI-enabled manufacturing.

For foreign investors, three implications stand out. First, the project mix is shifting toward technology-intensive activities, which supports higher productivity and stickier capex. Second, complementary AI infrastructure can accelerate adoption across sectors such as electronics, autos, healthcare, and public services, improving returns on manufacturing investments. Third, localization opportunities are widening for equipment makers, materials suppliers, and design-adjacent services, especially in northern clusters where semiconductor and electronics ecosystems are densest. Continued progress on workforce skills, grid reliability, and customs efficiency will be important to convert the current pipeline into sustained value creation.

Overall, Q3 2025 reinforced a durable upgrade in Việt Nam’s FDI profile. With semiconductor ATP capacity expanding and AI infrastructure moving from plans to deployment, the country is building the foundations for a technology-led growth cycle that complements its established manufacturing strengths.

About this report

This report was compiled with contributions from the team of business experts across ARC Group’s global offices.

ARC Group is an advisory firm specialised in supporting western companies operating in Asia and beyond. Our mission is to bridge the gap between global business ecosystems and key markets worldwide. Through our Management Consulting division, we provide services within corporate strategy, business transformation, operations, sustainability, growth, sales & marketing, and digital & AI solutions. We work across a wide range of industries, including automotive & mobility, energy & environment, consumer goods & retail, food & beverage, technology, media & telecom, advanced industry & materials, financial services, and healthcare, medtech & biotech.

If you are interested in exploring how we can support your business, reach out through our contact page, or leave your email below for a representative to get in touch directly:

Ready to talk to our experts?

References

- https://www.nso.gov.vn/en/data-and-statistics/2025/10/consumer-price-index-gold-price-index-and-usd-price-index-for-september-third-quarter-and-9-months-of-2025/

- https://www.nso.gov.vn/en/data-and-statistics/2025/10/infographic-on-the-socio-economic-situation-in-the-third-quarter-and-the-9-months-of-2025/

- https://wtocenter.vn/tin-tuc/28786-vietnams-gdp-grows-785-in-nine-months-near-growth-target

- https://en.vietnamplus.vn/vietnams-total-trade-turnover-reaches-68066-billion-usd-in-nine-months-post329870.vnp

- https://www.reuters.com/world/asia-pacific/vietnam-q3-gdp-grows-823-yy-statistics-office-2025-10-06/

- https://www.reuters.com/world/asia-pacific/vietnam-says-q3-gdp-growth-accelerates-822-2025-10-05/

- https://moit.gov.vn/en/news/latest-news/ministry-of-industry-and-trade-holds-regular-press-conference-for-q3-2025.html

- https://vietnamnews.vn/economy/1726701/foreign-investment-disbursement-reaches-five-year-high-in-first-nine-months.html

- https://www.idnfinancials.com/news/57713/vietnams-economy-grew-8-22-in-3q-2025-highest-since-2011

- https://www.reuters.com/world/asia-pacific/vietnam-says-q3-gdp-growth-accelerates-822-2025-10-05/

- https://www.whitehouse.gov/briefings-statements/2025/10/joint-statement-on-united-states-vietnam-framework-for-an-agreement-on-reciprocal-fair-and-balanced-trade/

- https://tradingeconomics.com/vietnam/gdp-growth-annual/news/490492

- https://en.qdnd.vn/economy/news/vietnam-s-economy-grows-7-85-in-nine-months-583319

- https://theinvestor.vn/vietnams-economy-expands-785-in-9-months-industrial-sector-855-d17265.html

- https://www.reuters.com/technology/nvidia-ceo-plans-expand-partnership-with-vietnam-support-vietnam-ai-development-2023-12-11/

- https://www.reuters.com/technology/artificial-intelligence/fpt-consortium-commences-work-173-mln-ai-centre-southern-vietnam-2024-08-21/

- https://www.reuters.com/technology/vietnam-expands-chip-packaging-footprint-investors-reduce-china-links-2024-11-12/

- https://www.reuters.com/world/asia-pacific/qualcomm-launches-ai-rd-centre-vietnam-2025-06-11/

- https://www.reuters.com/world/asia-pacific/vietnam-approve-key-infrastructure-projects-revised-gdp-target-2025-02-19/

- https://www.reuters.com/world/asia-pacific/us-vietnam-agree-framework-trade-deal-2025-10-26/

- https://www.reuters.com/technology/vietnam-expands-chip-packaging-footprint-investors-reduce-china-links-2024-11-12/

- https://www.reuters.com/world/china/vietnam-exports-us-imports-china-fall-august-after-tariffs-take-effect-2025-09-09/

- https://www.reuters.com/world/asia-pacific/us-vietnam-agree-framework-trade-deal-2025-10-26/

- https://www.reuters.com/business/aerospace-defense/vietnam-airlines-signs-funding-deal-with-vietcombank-50-narrow-body-planes-2025-04-24/

- https://en.vneconomy.vn/vietnams-fdi-inflows-hit-2854-bln-in-9m.htm

Subscribe to New Articles and ARC Group Updates

Receive our latest market insights, news and reports, and business bulletins.