Introduction

The first half of 2025 has set the tone for a pivotal year in technology M&A. Following a volatile 2023 and cautious recovery in 2024, dealmakers enter this year with renewed optimism, driven by a surge in generative AI applications, strategic semiconductor consolidation, and the integration of hardware and AI into the very core of modern business. While challenges such as macroeconomic uncertainty, regulatory scrutiny, and geopolitical shifts remain, the hunger for capability-driven innovation and digital infrastructure investments is palpable across the landscape.

Big Tech’s $320B AI Bet: 2025’s Infrastructure Arms Race

The AI race is being fueled by unprecedented capital deployment. In 2025, technology giants including Meta, Amazon, Alphabet, and Microsoft are collectively planning to invest more than $320 billion in AI technologies and data center expansion, based on executive comments and earnings calls in Q1 and Q2.

This spending surge reflects a strategic push to dominate the next phase of AI infrastructure from cloud compute to custom chips and AI-native devices. Amazon alone expects to spend $100 billion, marking the most ambitious plan among its peers.

These investments are not just about scale, they’re reshaping the M&A landscape, as firms race to acquire the hardware, energy, and IP needed to support their AI buildouts.

AMD’s Acquisition Spree: A Direct Challenge to Nvidia

AMD made a series of bold acquisitions in 2024 and 2025 to strengthen its AI and data center ecosystem. These moves position AMD as a full-stack rival to Nvidia. These moves target gaps in infrastructure, software, and chip-level innovation. Each acquisition addresses a critical gap:

- ZT Systems brings hyperscale infrastructure capabilities, enabling AMD to deliver end-to-end AI systems at cloud scale.

- Silo AI enhances AMD’s in-house AI model development and domain-specific LLM capabilities, especially for enterprise use cases.

- Brium strengthens AMD’s AI software stack, reducing reliance on Nvidia’s CUDA ecosystem and optimizing inference across diverse hardware.

- Untether AI adds energy-efficient AI inference chips IP and engineering talent for edge and enterprise acceleration.

- Enosemi introduces cutting-edge co-packaged optics and photonics to improve data throughput and energy efficiency in large-scale AI systems.

Together, these moves reflect AMD’s shift from a chip supplier to a vertically integrated AI platform company. The company is now combining CPUs, GPUs, interconnects, software, and system-level as well as model-level integration. The strategy is clear: compete not just on hardware, but across the entire AI compute stack.

Key Drivers Behind 2025 Tech M&A

The AI Supercycle

The adoption of AI has shifted from hype to operational necessity. Companies are no longer investing solely in software; there is a race for integrated AI hardware, cloud infrastructure, and vertical solutions.

- Big Tech Spending: The US$320B+ in planned 2025 AI investments by tech giants like Microsoft, Meta, and Google are deploying hundreds of billions annually into AI infrastructure, catalyzing large-scale acquisitions across data centers, chip designers, and specialist AI hardware companies.

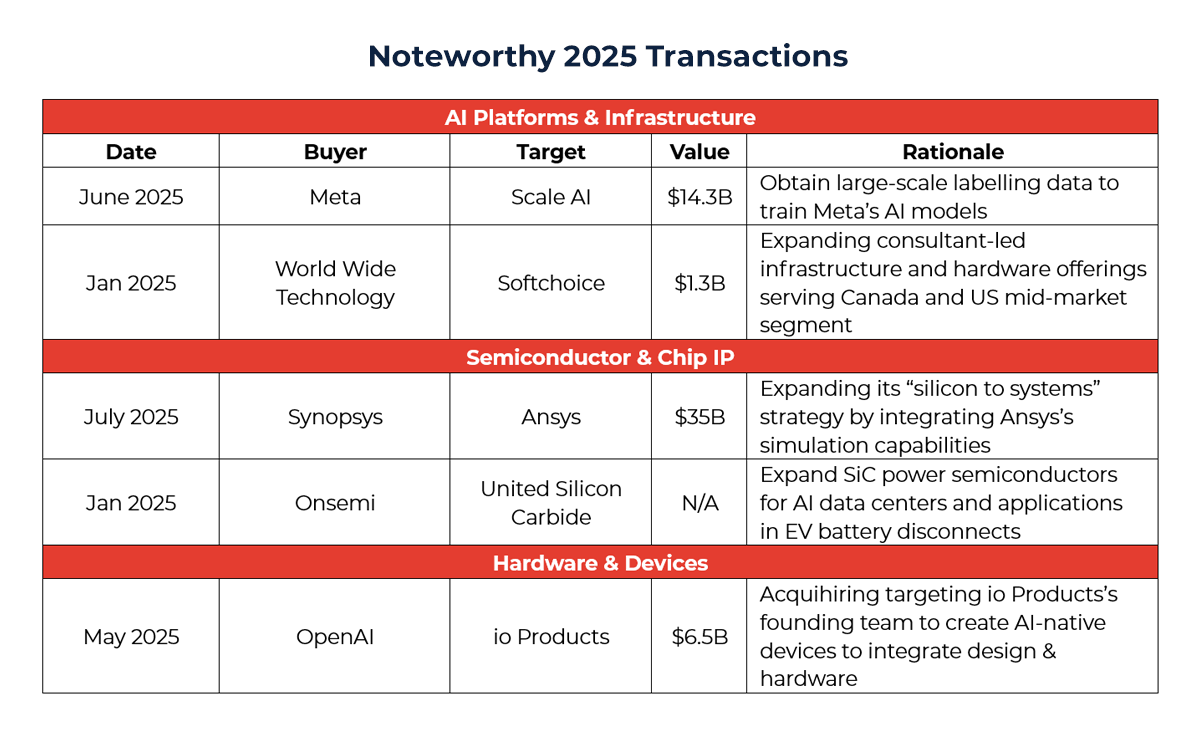

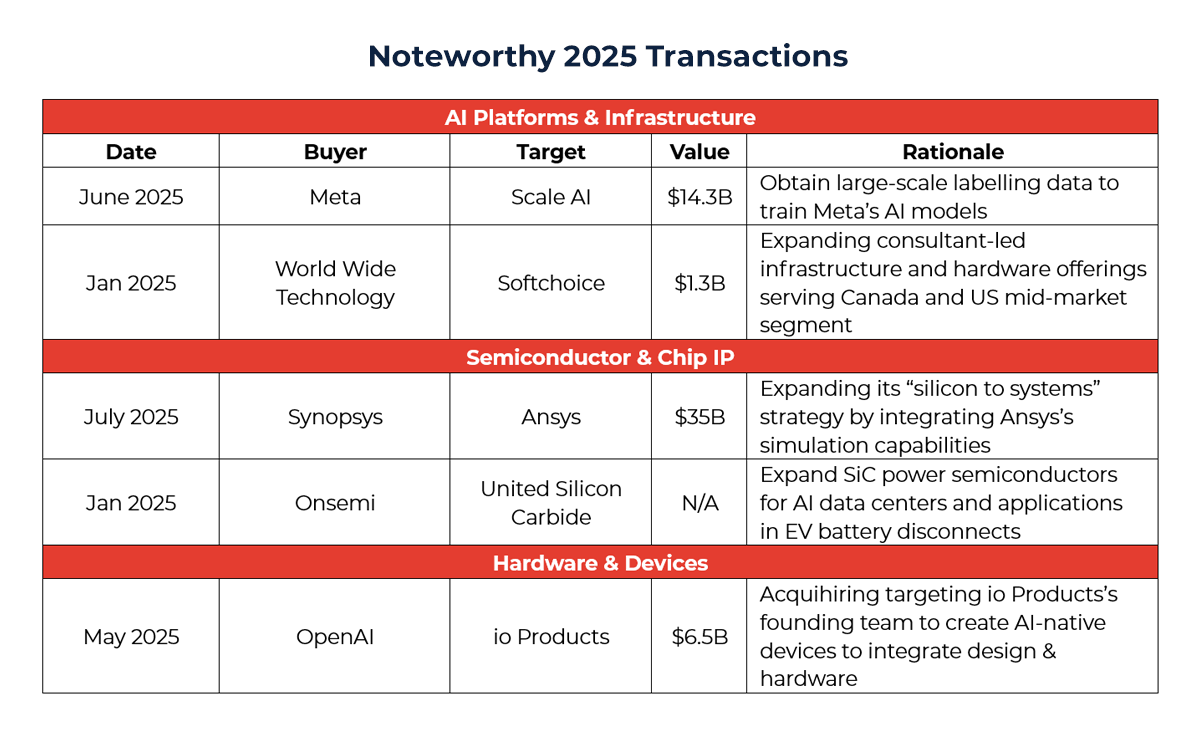

- AI-First Hardware: OpenAI’s $6.5B acquisition of io Products, an AI-driven hardware startup co-founded by legendary Apple designer Jony Ive, exemplifies the emerging intersection of design, hardware, and generative AI. This deal signals a push towards dedicated AI-native devices and greater integration of conversational AI into daily life.

- Energy Infrastructure: The ascent of AI has even prompted major M&A moves in power generation and supply, as companies anticipate an ongoing “supercycle” in energy demand. Deals such as Constellation Energy’s $26.6B acquisition of Calpine and NRG Energy’s $12B purchase of gas power plants are directly linked to AI data center expansion.

- Acquihiring for AI Talent: Large tech firms often acquire AI startups primarily to secure top talent. This strategy, known as acquihiring, accelerates innovation and helps companies maintain a competitive edge in AI development.

Semiconductor Consolidation

In 2025, the semiconductor industry is experiencing a significant wave of consolidation, driven largely by explosive demand for AI capabilities. Several major M&A have taken place as semiconductor manufacturers strive to enhance their technological edge in artificial intelligence, expand product lines, and secure their positions in the global market.

- AI as a Catalyst: Artificial intelligence continues to be the most significant driver for both innovation and consolidation in semiconductors. Companies are merging to combine complementary technologies, expand access to advanced manufacturing nodes, and accelerate the development of AI-optimized chips. The demand for chips specialized for generative AI, high-performance computing, and edge AI has led to a surge in investments and partnerships.

- Deal Activity: 2025 witnessed Onsemi’s acquisition of United Silicon Carbide (Qorvo subsidiary) to boost its power semiconductors for AI data centers and electric vehicles. NXP, meanwhile, bought Kinara.ai for $307M to access deeptech AI processors, expanding global foothold and underscoring India’s rising role in the semi sector.

- Global Investments: World Semiconductor Trade Statistics expects 11.2% growth vs 2024, reaching $697.2B in sales, boosted by logic and memory segments that cater directly to AI workloads. US and Europe are ramping domestic capacity with government incentives, while China, Taiwan, and South Korea pour billions into chip manufacturing.

Hardware as Differentiator

- AI-Optimized Devices: The next frontier involves not just chips but physical products engineered for seamless AI integration. These include smartphones, wearables, edge devices, and robotics.

- Recent Deals: Sanmina’s $3B purchase of ZT Group’s Data Center Infrastructure Manufacturing business reflects the growing demand for scale in cloud and server manufacturing. Hyperscalers and cloud providers are rapidly investing in data center capacity to meet AI’s computing requirements.

- Design Synergy: M&A activity is increasingly targeting companies with design and engineering excellence, rather than just commodity production. This shift places a premium on intellectual property, patent portfolios, and specialized talent pools.

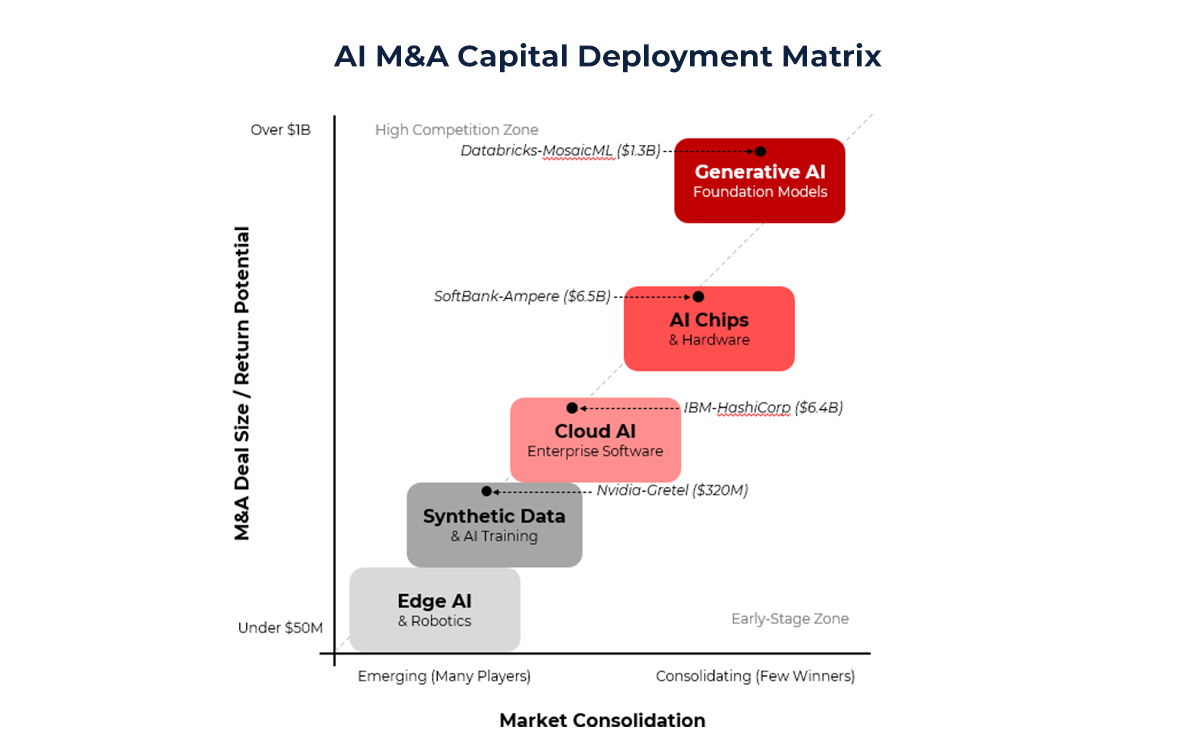

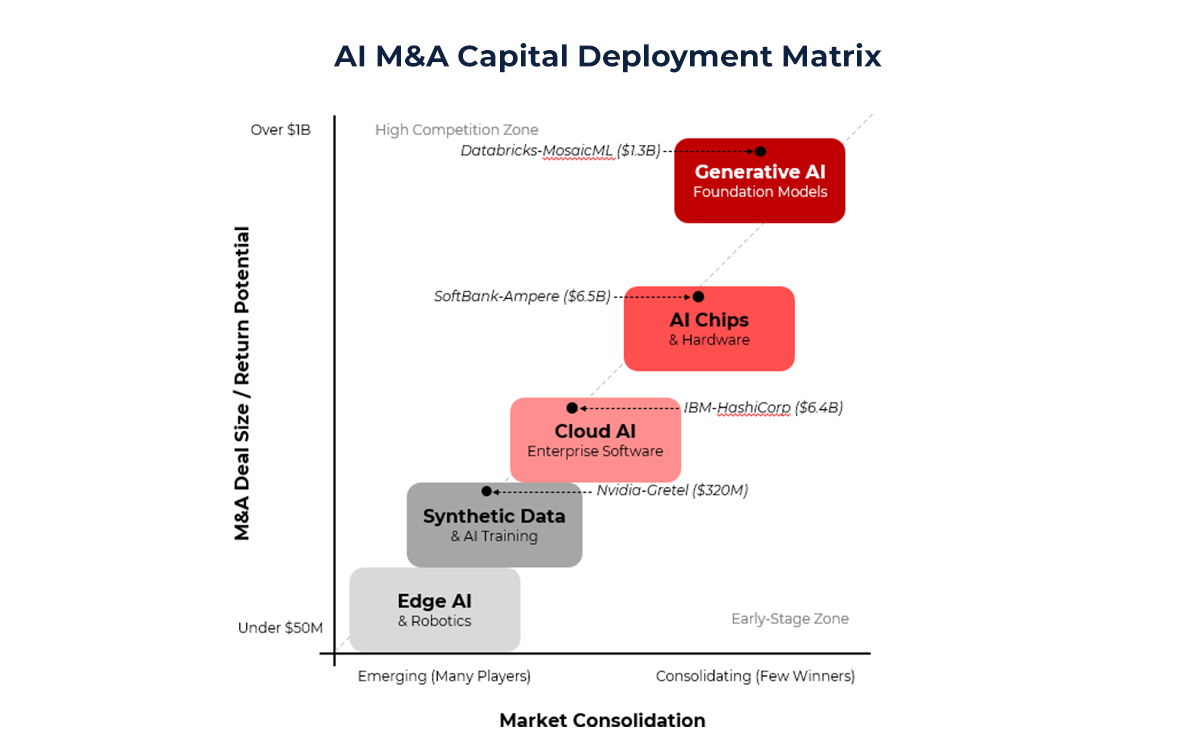

Generative AI and AI Chips lead the high competition zone with major M&A deals like SoftBank’s $6.5B purchase of Ampere and Databricks’ $1.3B acquisition of MosaicML, highlighting strong investor demand and high return potential. In Generative AI, companies are acquiring foundational model builders to gain proprietary models, talent, and infrastructure. In the chip space, M&A reflects a push for vertical integration and control over AI computing as demand for custom hardware grows.

Cloud AI and Synthetic Data sit in the mid-tier range. IBM’s $6.4B acquisition of HashiCorp shows how enterprise players are consolidating cloud-native AI tools, while Nvidia’s $320M+ deal with Gretel.ai signals rising interest in synthetic data for model training and privacy. These sectors are maturing, with increasing consolidation and larger deal sizes.

Edge AI remains early-stage, with smaller deals and many players. It’s still fragmented, with strategic interest focused on robotics and on-device AI. Overall, the trend moves from fragmented, low-value markets toward high-value, consolidated sectors, showing where capital is flowing most aggressively in the AI space.

Case Studies: Notable Ongoing Transactions

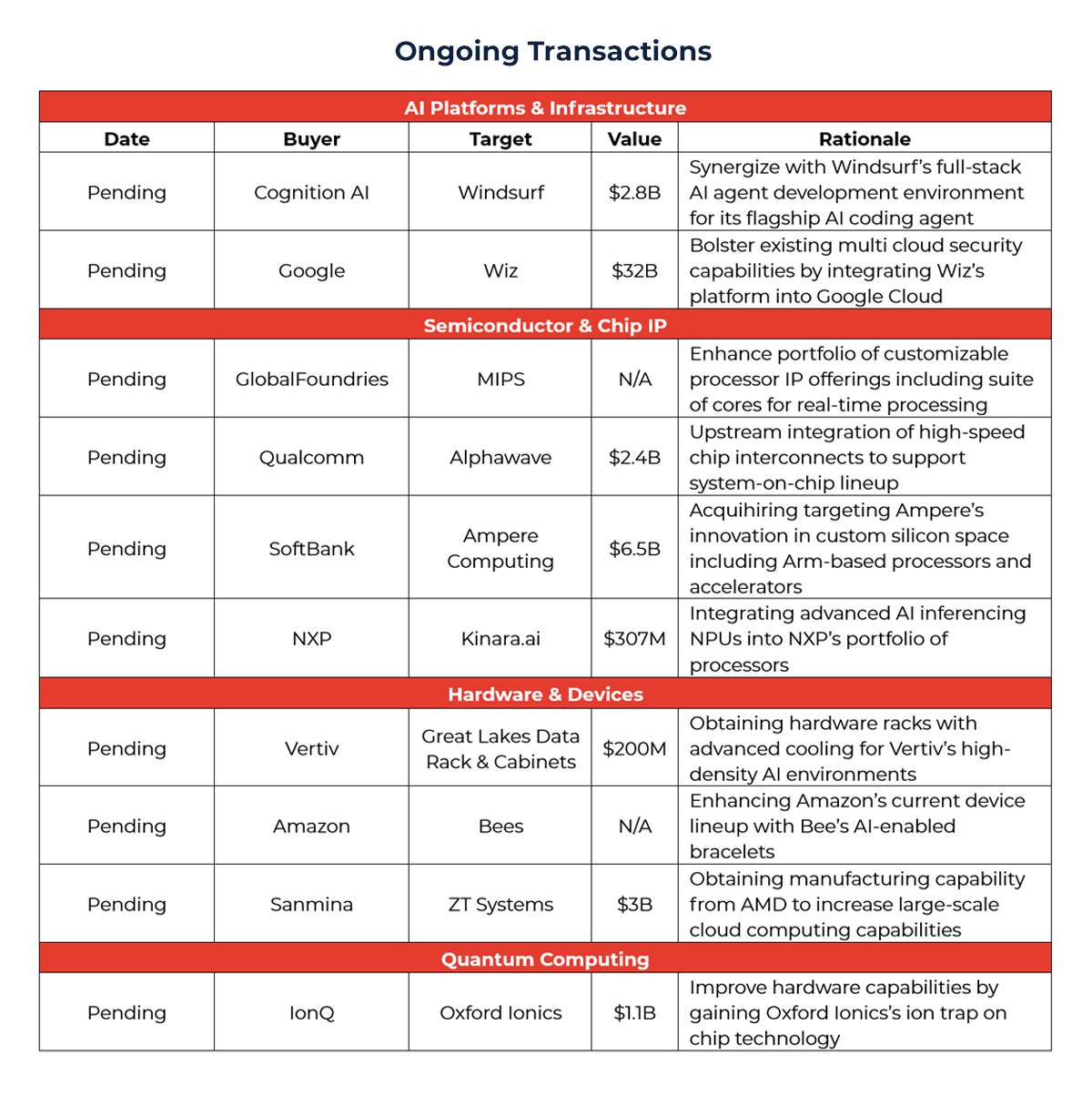

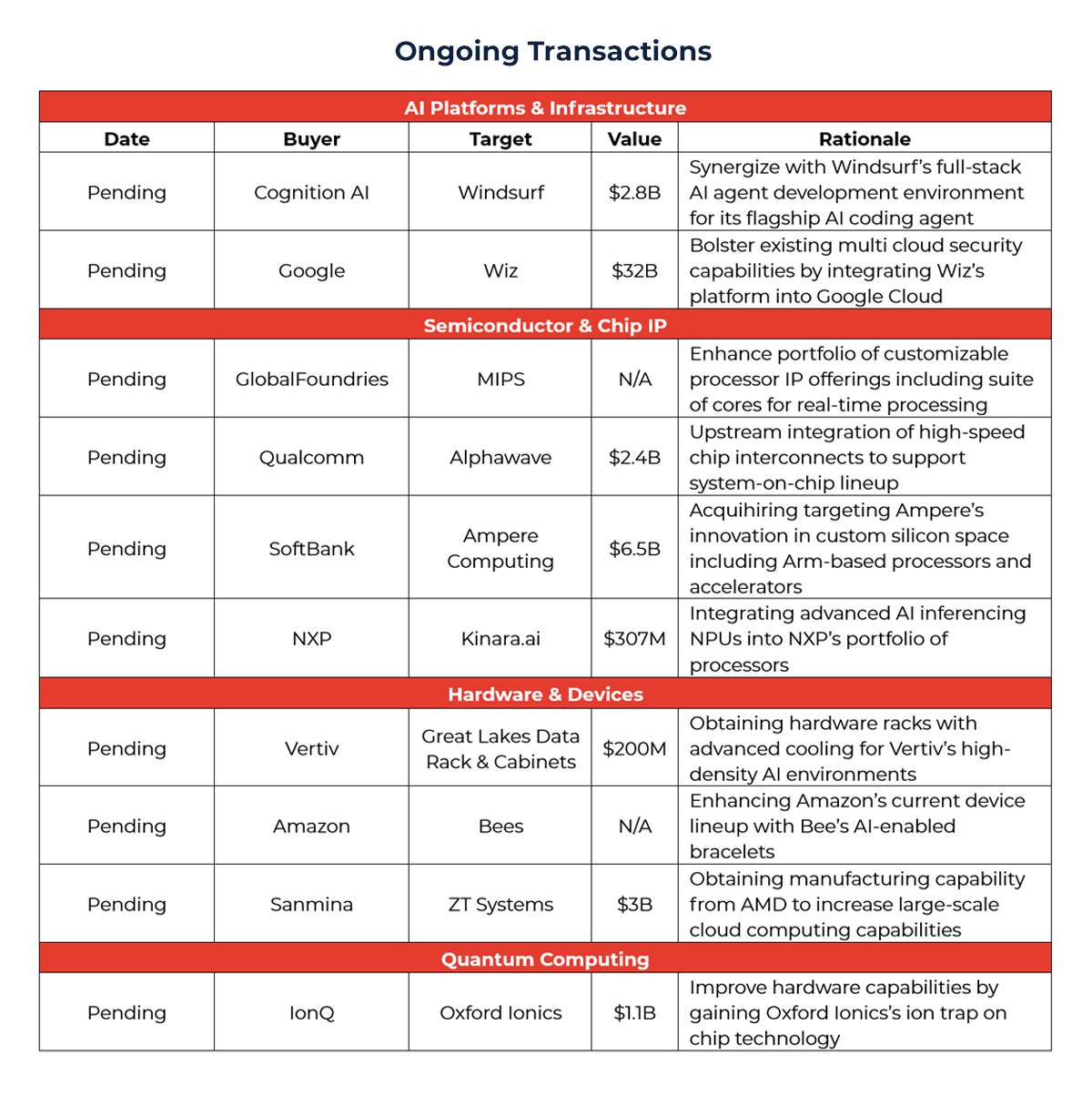

- Cognition’s acquisition of Windsurf

In July 2025, Cognition AI announced its acquisition of Windsurf, a US startup on developer-focused AI integrated development environment (IDE), in a transaction that followed a dramatic week of competing bids from OpenAI and Google. The deal gives Cognition ownership of Windsurf’s agentic IDE, designed to automate end-to-end software engineering tasks. Although the acquisition price was not disclosed, Windsurf was last valued at US$2.8B in OpenAI’s previously failed bid. Windsurf generated US$82M ARR, with the figure doubling quarter-over-quarter (Q1 to Q2 2025).

Rationale

Through this acquisition, Cognition allows its flagship agent, Devin, to operate in Windsurf’s integrated environment built specifically for autonomous development workflows. In simpler terms, this creates a coding environment with tools for the AI agent to execute tasks, providing feedback data to fine tune the agent’s behavior and reliability. This gives Cognition unique control over both the agent and the environment, a competitive moat that enables faster reinforcement learning.

Transaction Aftermath

The transaction followed OpenAI’s abandoned acquisition attempt, which collapsed amid internal pushbacks from Microsoft. In parallel, Google moved quickly to license Windsurf’s core IP and hired founder Varun Mohan along with the R&D team in a US$2.4B side deal. This left the remaining corporate entity, including the Windsurf brand, IDE codebase, and customer relationships for Cognition. With over 350 enterprise customers, Windsurf’s existing clients will soon have access to a broader platform integrated with Devin as part of Cognition’s offering.

- Qualcomm’s acquisition of Alphawave Semi

In June 2025, Qualcomm announced a definitive agreement to acquire Alphawave, a UK based high speed chip interconnect IP, for approximately US$2.4B.

Rationale

Qualcomm is acquiring Alphawave Semi to support its expansion into the data center segment and meet growing demand for energy-efficient, high-performance AI compute. Alphawave’s high-speed connectivity and compute technologies complement Qualcomm’s Oryon™ CPU and Hexagon™ NPU, enabling faster, lower-power data transfer essential for AI, networking, and storage. The acquisition strengthens Qualcomm’s product offerings and technological capabilities.

Transaction Details

The transaction is expected to close in Q4 2025. Qualcomm’s all cash offer of 183 pence per share represents a 96% premium to Alphawave’s closing price on March 31 and was accepted by a majority of institutional shareholders by mid-June. This move is part of a broader trend where chip companies are racing to buy specialized technology, such as Synopsys’s acquisition of Ansys, and Nvidia’s sweep of chiplet startups, each fighting to get ahead in the AI hardware race.

- HP’s acquisition of Humane

In Feb 2025, HP announced a definitive agreement to acquire key AI capabilities from Humane, including their operating platform Cosmos, which orchestrates AI-driven interactions across devices; along with over 300 patents and patent applications related to AI. Humane’s founding team and employees will also join HP’s AI innovation lab, bringing in expertise in-house.

Rationale

Humane’s Cosmos operating system gives HP a ready-made platform to embed AI across its existing product ecosystem, from PCs to printers. Unlike most PC makers who rely on Microsoft or Google for AI services, this deal gives HP first-party ownership of the AI experience. Humane’s patents cover gesture-based UI, multimodal interaction, and AI agent frameworks, which are defensive assets for HP’s future AI-native devices.

Transaction Details

This deal costs HP US$116M in cash, significantly lower than Humane’s previously reported US$230M+ fundraising and ~US$1B implied valuation in earlier discussions. A critical consideration is that HP selectively acquired only the valuable assets (software, IP, and talent), not Humane’s loss-making AI Pin hardware, effectively taking the brains without the body.

- Elon Musk’s xAI raises US$10B in debt and equity to challenge OpenAI

As of July 2025, Elon Musk’s AI startup has raised funding towards building AI infrastructure and developing its Grok AI chatbot. Currently, xAI has already installed 200,000 GPUs, and is continually buying chips from Nvidia and AMD, targeting a facility size of 1 million. Musk is planning to boost the use of Grok by integrating the AI model within X’s social media platform.

Transaction Details

The US$10B figure is split into US$5B of secured notes and term loans, while the remaining was secured through strategic equity investments from financial sponsors.

Competitive Landscape

xAI’s closest competitor OpenAI has closed a US$40B fundraising round that now values the platform at US$300B. Similarly, Anthropic has also closed a funding round of US$3.5B, followed by a US$2.5B revolving credit line.

Emerging Trends and Themes

- Capability-Driven and Strategic Focus

- AI, Security, and Data: The largest deals are dominated by companies acquiring missing capabilities in areas such as AI, cloud security, and next-generation semiconductors. These acquisitions are driven by strategic needs rather than a pure focus on revenue or market share.

- Antitrust Scrutiny Intensifies Around AI M&A

- Early-Stage Deals Under the Microscope: Antitrust regulators are increasingly scrutinizing AI-related M&A, especially as Big Tech firms acquire or partner with startups that could evolve into future competitors. Even small deals, including those below traditional reporting thresholds, are attracting attention due to concerns about early consolidation in a strategically critical sector.

- Acquihires and “Backdoor” Deals: To avoid full acquisitions, some companies have pursued acquihires by hiring key talent and licensing intellectual property. However, these approaches are now under regulatory scrutiny as well. The FTC’s ongoing investigation into Microsoft’s acquihire of Inflection AI may set new precedents, following similar inquiries by the UK’s CMA and Germany’s FCO.

- Strategic Partnerships Under Review: Partnerships that involve minority stakes, board representation, or exclusive access to AI models are being examined as potential backdoor acquisitions. Regulators such as the FTC and CMA are closely reviewing high-profile AI collaborations, including Microsoft’s relationship with OpenAI and partnerships between cloud providers and generative AI developers.

- National Security Reframes Cross-Border M&A

- AI as a Strategic Asset: National security concerns are reshaping AI M&A, particularly for cross-border transactions. Policymakers are focused on preventing the transfer of sensitive AI technologies and data to adversaries, leading to new restrictions on both inbound and outbound investments.

- Reverse CFIUS in Effect: A key development is the “reverse CFIUS” regime, effective January 2, 2025, which screens U.S. investments in Chinese AI companies. It imposes due diligence, recordkeeping, and prohibits certain transactions involving AI and other sensitive technologies.

Conclusion

2025 is shaping up to be a transformational year for tech M&A. As AI moves beyond software and becomes central to every industry, chips and hardware are gaining new strategic importance. In this rapidly evolving landscape, dealmakers must navigate continuous innovation and shifting capital flows.

The winners will be those who deploy capital creatively and decisively, focusing on technological capabilities, supply chain resilience, and the development of next-generation platforms.

For investment bankers, advisors, and entrepreneurs, the message is clear: stay agile, pay close attention to the intersection of AI and hardware, and prepare for a dealmaking environment that is accelerating in pace and complexity.

How Can ARC Help?

As deals increasingly center around AI, semiconductors, and advanced hardware, M&A activity in the tech sector is becoming more complex and competitive. ARC Group plays a crucial role in helping clients understand market shifts, identify high-value opportunities, and execute successful transactions. Alongside deep experience in IT and technology and strong investor relationships, here are a few ways ARC Group adds value to clients navigating today’s dynamic environment:

- Comprehensive Transaction Execution Support

ARC Group supports both buyers and sellers across the full deal lifecycle, including target identification, synergy analysis, due diligence, marketing materials, investor outreach, and negotiation. With extensive cross-border experience, we also navigate legal, tax, and cultural complexities to ensure seamless execution in international transactions.

- Strategic Storytelling and Positioning

They craft compelling narratives that highlight a company’s unique technology, talent, and growth potential to attract premium offers.

- Tailored Investor Outreach

ARC Group maintains strong relationships with global PEs, VCs, and corporate acquirers. Using our network, we connect clients with capital partners aligned to specific technology verticals such as AI, chips, cloud, and advanced hardware.

- Long-Term Strategic Vision

Our role extends beyond transaction execution. ARC Group works with clients to shape long-term growth strategies, evaluate capital allocation between organic initiatives and M&A, and position them for sustained market leadership.

References