Market Comeback: U.S. IPO Activity Accelerates in 2025

The U.S. IPO market has entered 2025 with renewed momentum, reversing the cautious sentiment that defined much of 2023 and 2024. According to S&P Global Market Intelligence, second quarter IPO issuance increased more than 80% compared with the same period last year, delivering the strongest first half since 2021. Total equity issuance in the first six months exceeded $26.3B, supported by a significant increase in both operating company IPOs and SPAC offerings.(1)

The second quarter alone recorded 59 IPOs that raised $15B, compared with 45 IPOs raising $11.2B in the first quarter.(1) Data from Nasdaq shows that 108 operating company IPOs were launched in the first half of the year, which is the third highest half-year total in the past decade, with proceeds up 40% compared with the same period in 2024.(2)

High profile transactions such as Figma’s first day price increase of 250% have further lifted sentiment.(3) Blackstone reported that its IPO opportunity pipeline is 50% larger than in 2024, representing the most active environment since 2021.(4) Morgan Stanley projects continued strength in the second half as sponsor exits, secondary offerings, and improving macroeconomic conditions, including easing inflation, lower interest rates, and reduced trade policy uncertainty, support sustained deal flow.(5)

Southeast Asia’s Rising Role: Singapore and Malaysia Contribute Nearly One Third of U.S. IPOs in 2025

Amid this market resurgence, Southeast Asia has emerged as a leading contributor to the U.S. IPO landscape. Based on ARC’s research, Singapore and Malaysia together accounted for almost 30% of all Asian U.S. IPOs in 2025 year to date. This marks a significant increase in participation compared with prior years and positions the region among the top sources of foreign issuers accessing U.S. capital markets.

Several structural and market driven factors explain why U.S. investors are actively seeking more opportunities from Southeast Asia:

- Strong Economic Growth: Southeast Asian economies have consistently delivered higher GDP growth rates than most developed markets, driven by expanding consumer bases, rapid digital transformation, and increasing infrastructure investment.

- Sector Diversity: Issuers from the region operate across a wide range of industries including energy, consumer products, financial services, technology, and industrial manufacturing, providing diversification beyond U.S. domestic sectors.

- Diversification for U.S. Portfolios: For U.S. investors, investing in Southeast Asian companies listed on U.S. exchanges provides exposure to high growth emerging markets while benefiting from U.S. market transparency, disclosure standards, and trading infrastructure.

This combination of regional growth potential and U.S. market advantages creates a mutually beneficial dynamic for both issuers and investors.

Malaysia & Singapore in Focus

In 2025, Malaysia and Singapore have moved from being secondary participants to leading contributors in the Asian U.S. IPO landscape. Year to date, the two markets have produced a combined 22 IPOs on Nasdaq and NYSE, surpassing China’s 20 and closing in on Hong Kong’s 27. Singapore’s position as a regional financial hub gives its issuers an execution advantage, with faster readiness to meet SEC, PCAOB, and exchange requirements. Malaysia brings high growth stories in consumer, industrial, and emerging technology sectors that appeal to U.S. investors seeking differentiated exposure beyond North Asia.

What sets them apart is not just the quantity of listings but the quality. Offerings from these markets are disciplined in profitability, sector positioning, and market readiness, reflecting an understanding of U.S. investor expectations and an ability to deliver clear growth narratives. This has positioned Malaysia and Singapore as credible alternatives to the traditional dominance of North Asian issuers.

Sectoral and Strategic Implications

The Malaysia and Singapore cohort in 2025 spans digital platforms, industrial manufacturing, consumer products, and specialized services. Singapore’s technology and platform companies are leveraging U.S. listings to scale internationally, offering high margin, asset light models that target fast growing user bases. Industrial and manufacturing players from both markets are securing capital to modernize operations and integrate into global supply chains. Consumer product issuers are positioning themselves in niche segments with strong brand identity, meeting demand from both regional and global markets. Professional and specialized service firms are using the U.S. market to validate their business models and reach new client channels.

For issuers, the U.S. market offers not only deep liquidity, robust analyst coverage, and valuation benchmarks against global leaders, but also a crucial capital access advantage. Many Southeast Asian companies face relatively limited funding capacity in their domestic markets, and a U.S. listing allows them to tap into broader institutional participation and more substantial investor pools. For investors, this set of listings delivers balanced exposure to growth-oriented consumer and technology names alongside stable, cash-generating industrial and service businesses, all supported by the long-term growth profile of Southeast Asia.

Case Study: Delixy Holdings Limited (Nasdaq: DLXY)

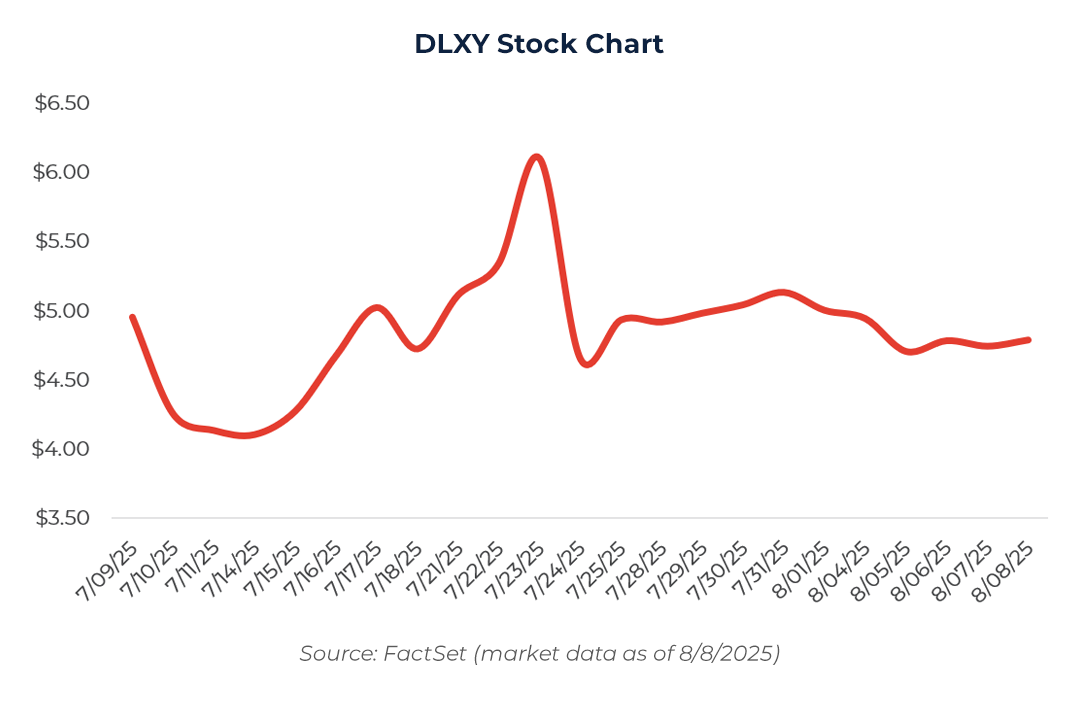

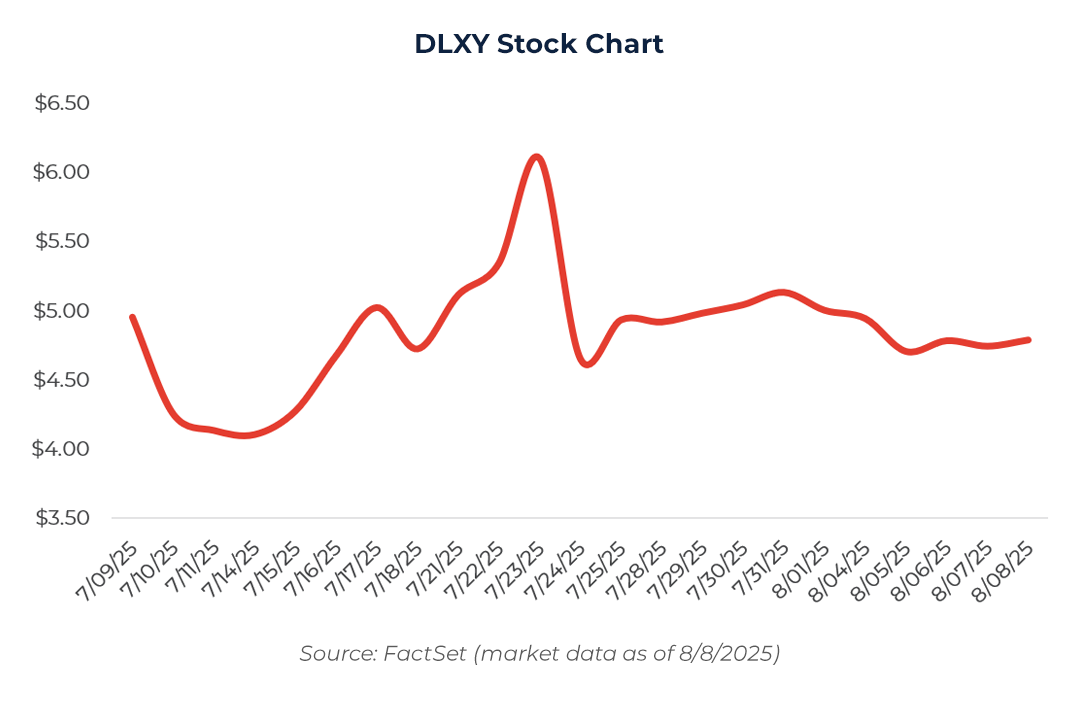

Delixy Holdings Limited, a Singapore based trader of oil related products, completed its IPO on July 9, 2025. The company sold two million ordinary shares at $4.00 per share, raising $8M in gross proceeds, of which approximately $5.4M was allocated for corporate use.(6)

Delixy entered the market with FY 2024 revenues of $315M, and financial profile that resonated with investors seeking cash-generative yet scalable businesses. The IPO also included the registration of 3 million shares for resale by insiders, creating immediate liquidity for current shareholders. On its first day, DLXY closed at $4.95, up 23.8%, underscoring strong initial demand. Proceeds will be used to expand product offerings, enhance market positioning, pursue strategic acquisitions, and bolster working capital.

Case Study: Empro Group Inc. (Nasdaq: EMPG)

Empro Group Inc., a Malaysian beauty and personal care company, became the first Malaysian beauty brand to list on a U.S. exchange when it debuted on Nasdaq on July 2, 2025. The offering of 1,375,000 ordinary shares at $4.00 per share raised approximately $5.5M in gross proceeds, with an additional $825K secured from the exercise of the over-allotment option.

ARC Group served as Empro’s exclusive financial advisor, leading a two-year transformation from a domestic beauty brand into a Nasdaq-ready issuer. This included establishing a Cayman Islands holding structure to align with cross-border listing norms, preparing PCAOBaudited financials, and guiding the company to meet Nasdaq’s Net Income Standard following a return to profitability. ARC coordinated diligence, regulatory filings, and investor marketing to position the IPO for optimal valuation and reception.(7)

Empro’s successful debut underscores a broader playbook for Southeast Asian issuers: rigorous financial preparation, adherence to U.S. listing standards, and strategic structuring are essential to capturing U.S. investor interest. The transaction demonstrates how ARC’s end-to-end execution capabilities can help regional companies navigate the complexities of multi-jurisdictional listings and compete effectively on the global stage.

Looking Ahead: The Southeast Asia Pipeline

The rebound in U.S. IPO activity in 2025, along with the growing share of Malaysia and Singapore in the issuer mix, creates a favorable window for Southeast Asian companies to access the world’s deepest capital markets. Recent deals show that smaller, well-prepared offerings can succeed in a selective investor environment, provided issuers meet U.S. regulatory standards, present scalable business models, and maintain strong governance.

For Malaysian and Singaporean companies, disciplined preparation is key. This means engaging PCAOB registered auditors, aligning governance and disclosure with SEC and exchange requirements, and adopting optimal corporate structures to facilitate cross border listings. With the right advisors, a compelling equity story, and timely market entry, regional issuers can capitalize on current momentum and strengthen Southeast Asia’s position as a significant force in U.S. IPO markets through 2025 and beyond.

ARC Group: Enabling Southeast Asian Success in U.S. IPOs

ARC Group is the partner of choice for Southeast Asian companies aiming to list in U.S. markets, combining proven cross-border expertise, deep capital markets capabilities, and a track record of successful multi-jurisdictional transactions. From initial strategy and corporate structuring to PCAOB-audited financial preparation, SEC and exchange compliance, and investor marketing, ARC provides end-to-end advisory that ensures issuers are market-ready and positioned for maximum valuation. Our execution model integrates regulatory navigation with tailored equity storytelling, connecting clients to a global network of institutional investors through targeted roadshows and strategic outreach. Recent successes, such as guiding Empro Group from a domestic Malaysian brand to a Nasdaq-listed company, demonstrate our ability to manage complex, high-stakes listings that meet the expectations of U.S. investors. With ARC’s guidance, Southeast Asian issuers can confidently navigate the complexities of the U.S. IPO process and compete on the global stage.

References

(1) S&P Global (2025): US IPOs rebound in Q2 2025 amid mixed global activity | S&P Global

(2) Nasdaq (2025): IPO Market Resilient Despite Dip in IPOs | Nasdaq

(3) CNBC (2025): Figma (FIG) starts trading on NYSE after IPO

(4) Business Insider (2025): https://www.businessinsider.com/blackstone-ipo-activity-pipeline-second-quarterearnings-steve-schwarzman-2025-7

(5) Morgan Stanley (2025): IPO Outlook 2025: Rebound in Activity & Equity Financings | Morgan Stanley

(6) Delixy Energy (2025): News & Event

(7) ARC Group (2025): Foreign IPO Case Study – Empro Group Inc. – ARC Group