Executive Summary: Global Consolidation Meets Cultural Innovation

The global fragrance industry is no longer just about luxury—it’s about identity, emotion, and investment. What began as ritual and royalty in ancient Egypt and Renaissance Europe has evolved into a deeply personal and commercially potent category that blends art, science, and storytelling.

Today, as consumers embrace scent as a form of self-expression, wellness, and cultural identity, fragrance has become a high-growth, high-margin sector attracting strong interest from global luxury houses, private equity, and strategic investors alike.

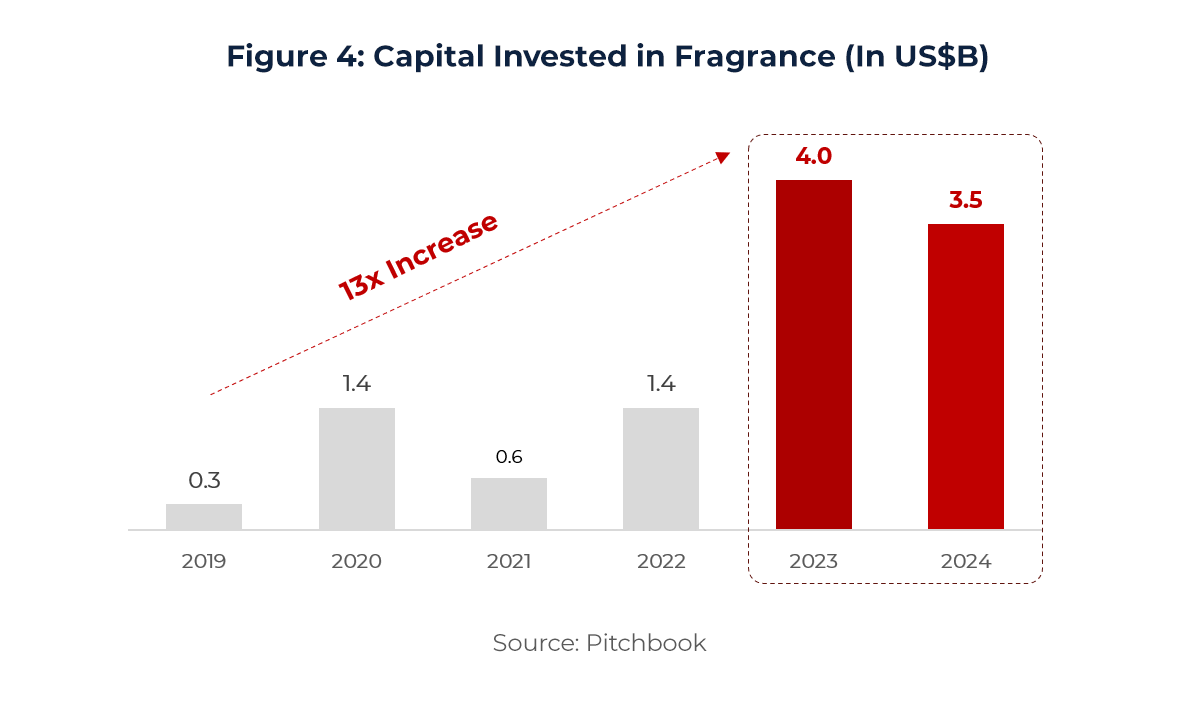

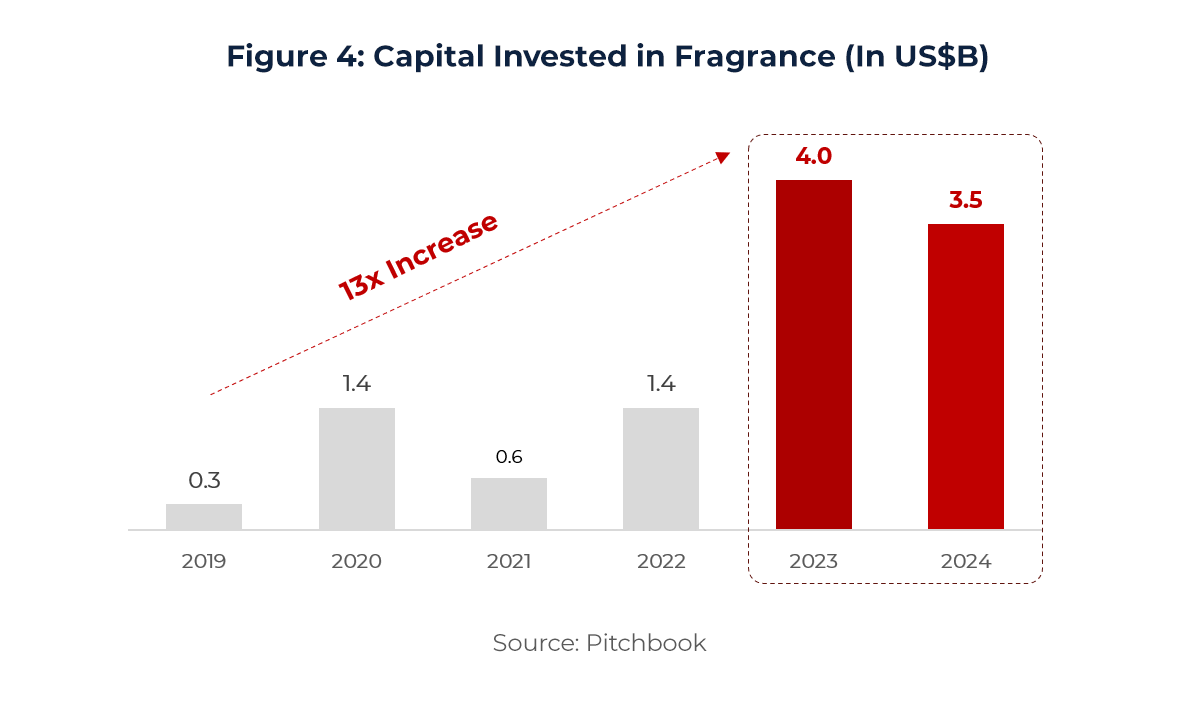

With the market projected to exceed US$100 billion by 2034 and capital investment having multiplied 13x in just five years, fragrance is now a focal point for M&A activity. This article explores the strategic forces behind the industry’s transformation—premiumization, digital disruption, and cultural relevance—and why the business of scent is emerging as one of the most compelling growth stories in the global consumer space.

1. Introduction: The Business of Scent

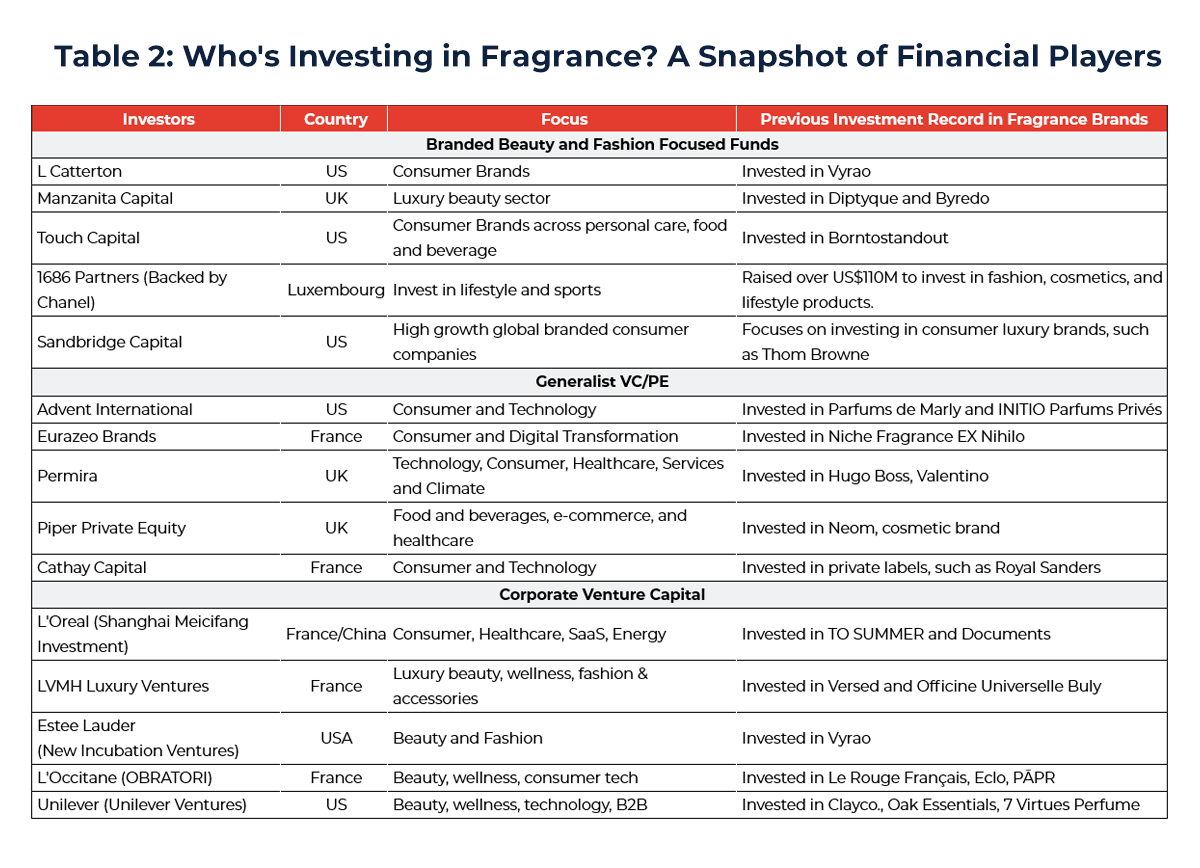

Fragrance, in the context of this article, refers specifically to perfume—a product that holds a unique place in both personal expression and global culture. At its core, perfume is a sophisticated blend of fragrance oils, alcohol, and water, designed to create scents that resonate on an emotional level. More than just a pleasant aroma, perfume can evoke memories, shape identity, influence mood, and reflect aspiration. Unlike many consumer products, perfume sits at the crossroads of science, art, and emotion, making it one of the most intimate and compelling categories in the beauty and lifestyle industries.

What Is Perfume?

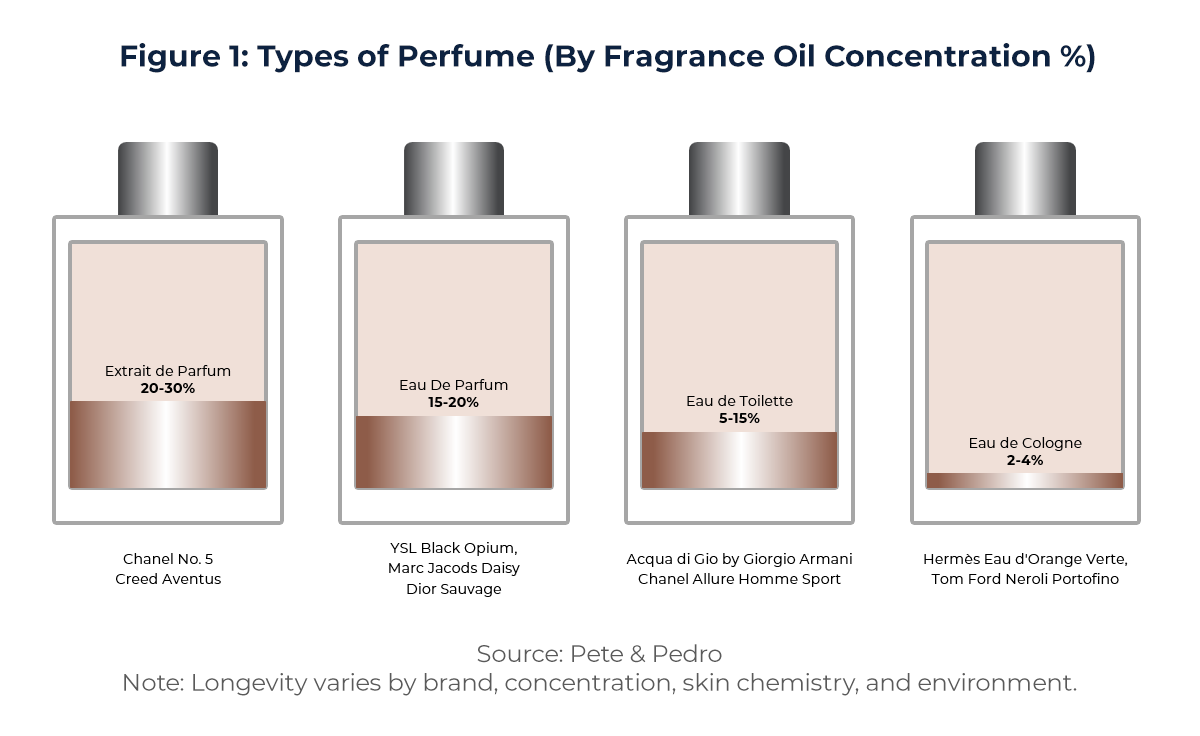

From a technical standpoint, perfumes are categorized by the concentration of fragrance oil in their formulation, which determines their intensity, longevity, and price point:

A Brief History of Perfume

A Brief History of Perfume

The use of fragrance dates back thousands of years, with roots in ancient Egypt, India, and Mesopotamia, where scent was used in spiritual rituals, medicine, and personal grooming. In Renaissance Europe, perfume became an aristocratic luxury, with cities like Grasse, France emerging as major production centers.

The modern perfume industry took shape in the late 19th and early 20th centuries, led by visionary French houses such as Chanel, Guerlain, and Coty, who transformed perfume into a commercial lifestyle product. Since then, fragrance has evolved from a niche indulgence into a US$57 billion global industry in 2024, projected to surpass US$100 billion by 2034, spanning personal scent, home fragrance, and functional wellness products.

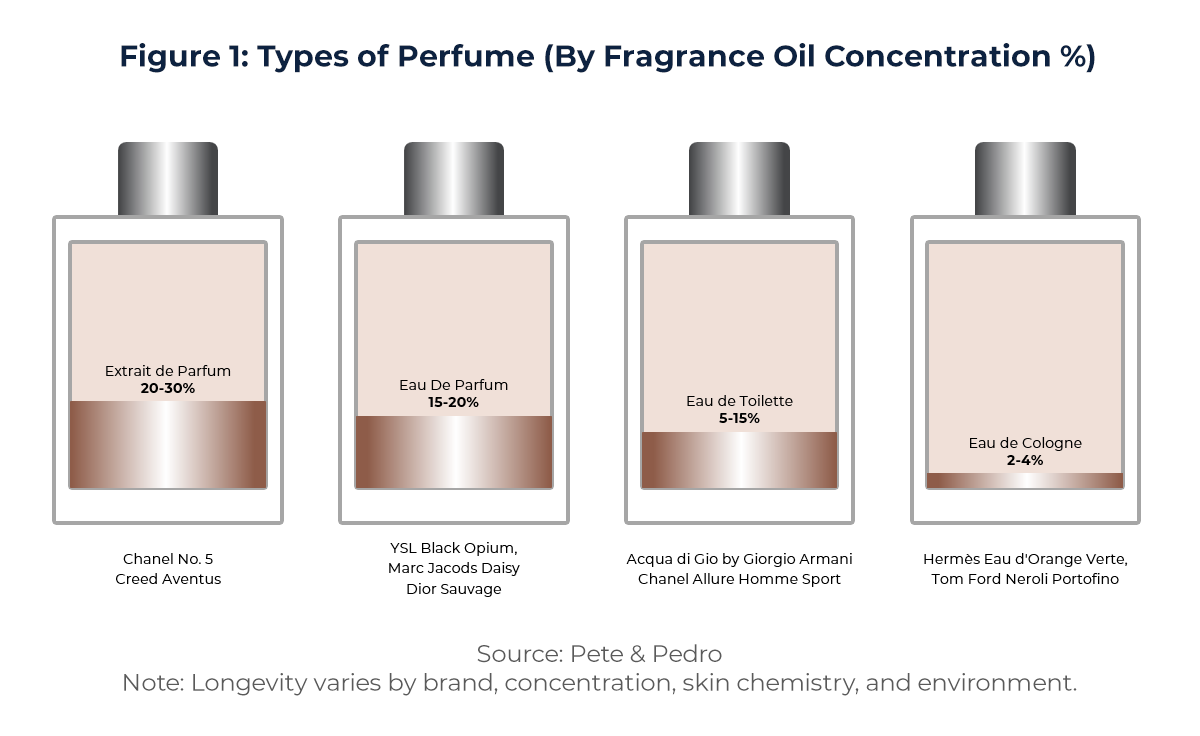

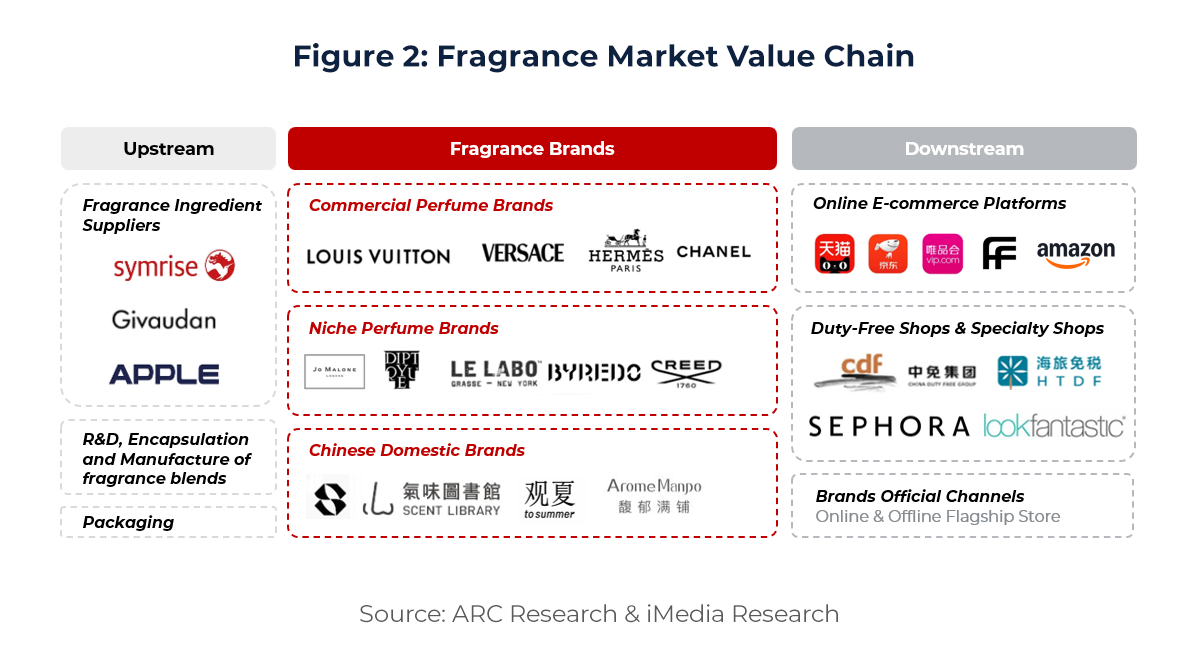

The key players within the fragrance market value chain are shown below:

This value chain is not only the foundation of product creation and delivery, but also where strategic opportunities for investment, innovation, and M&A reside. However, for the purpose of this article, we will focus on fragrance brands.

This value chain is not only the foundation of product creation and delivery, but also where strategic opportunities for investment, innovation, and M&A reside. However, for the purpose of this article, we will focus on fragrance brands.

2. Industry Trends – A Dynamic Sector with Significant Consolidation

The fragrance sector is undergoing a major shift, with consumers increasingly viewing scent as a form of personal identity and emotional expression. Fragrances are now lifestyle statements, elevating the role of brand storytelling, aesthetic appeal, and experiential marketing, especially among younger consumers.

This evolution has made the industry a prime target for M&A, attracting global luxury groups, private equity, and strategics. From acquiring cult-favorite niche brands to expanding regional portfolios, investors see fragrance as a high-margin, scalable, and brand-loyal category with strong global growth potential.

Key Growth Drivers:

- Global Premiumization & Aspirational Demand: Consumers are trading up to higher-end scents, including niche, heritage, and artisanal fragrances. This trend is driven by growing interest in exclusivity, long-lasting formats, and storytelling—especially among the rising upper middle class in emerging markets.

- Fragrance as Emotional Self-Care & Personal Expression: Post-pandemic, fragrance has become a tool for self-confidence, mood enhancement, and emotional well-being. Consumers are now building fragrance wardrobes, purchasing multiple scents for different occasions, moods, and gifting purposes.

- Fragrance as an Affordable Luxury: The “Lipstick Effect” continues to support fragrance sales during economic slowdowns. As an accessible indulgence, perfume provides comfort and prestige without the cost of big-ticket luxury goods.

- Digital Transformation and E-commerce Growth: Online sales now account for 63% of non-luxury fragrance revenue, propelled by rising digital adoption, including AI tools like Sephora’s Fragrance Finder, and the dominance of social media platforms such as TikTok. Digital channels like Tmall and Nykaa further amplify this shift, enabling fragrance brands to execute targeted product launches and connect with tech-driven consumers.

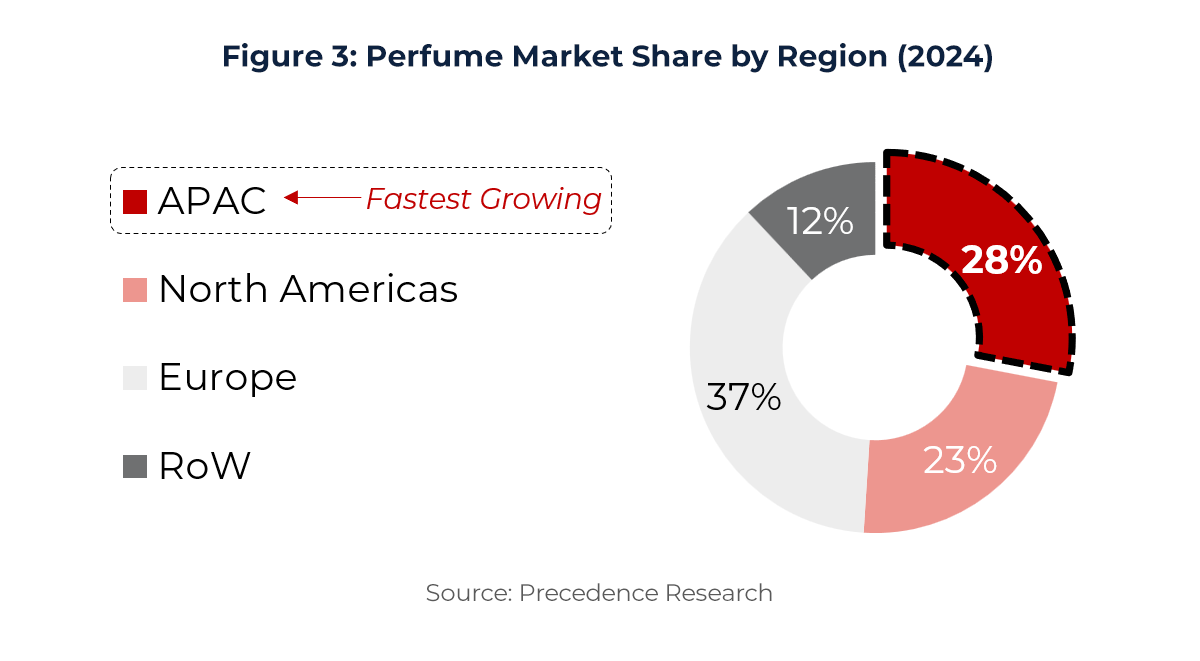

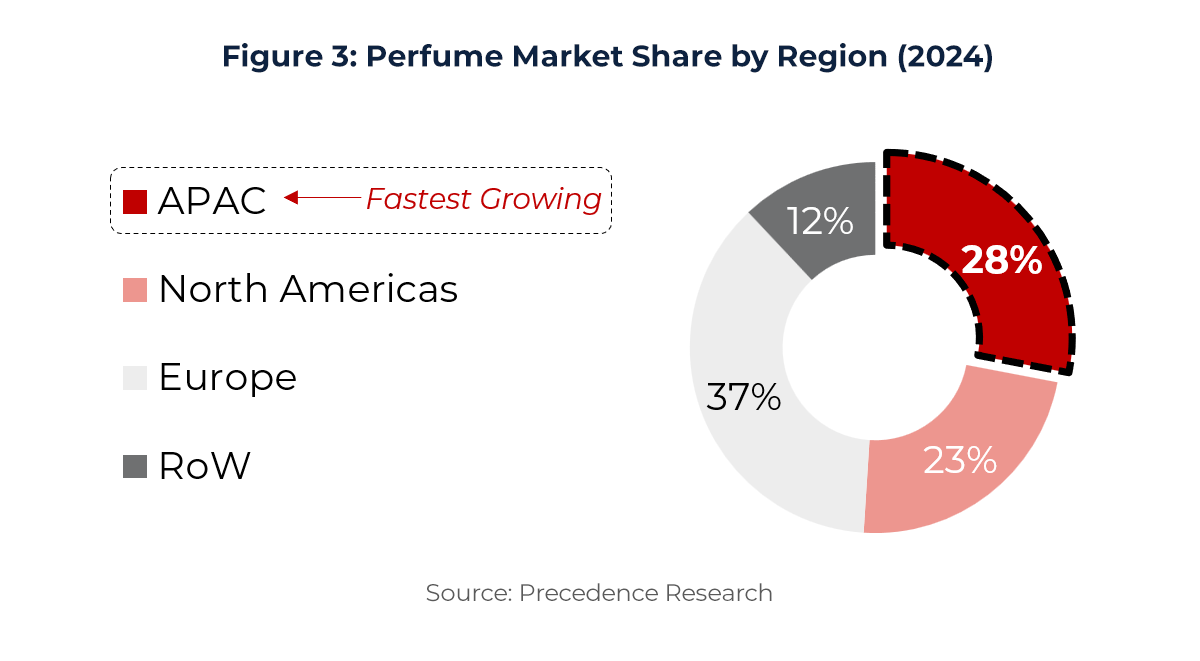

APAC: The Rising Powerhouse of Fragrance

APAC region is now the fastest-growing fragrance market globally, driven by evolving lifestyles that emphasize self-care, grooming, and personal expression. Perfume is increasingly seen as a daily essential rather than a luxury reserved for special occasions.

Within APAC region, China is the largest and most rapidly evolving fragrance market, attracting significant investment. While international fashion houses like L’Oréal and LVMH maintain a strong presence, the market is becoming increasingly fragmented, with a surge of local and niche brands.

Within APAC region, China is the largest and most rapidly evolving fragrance market, attracting significant investment. While international fashion houses like L’Oréal and LVMH maintain a strong presence, the market is becoming increasingly fragmented, with a surge of local and niche brands.

As a result, overseas investors are turning to niche and premium Chinese fragrance brands that blend cultural storytelling with strategic positioning —aligning with rising demand for quality, personalization, and scalable, high-margin opportunities. Key examples include L’Oréal’s 2024 minority stake in To Summer, and Cathay Capital’s investments in DOCUMENTS and AromeManpo.

At the same time, a countertrend is emerging: Chinese fragrance brands holding companies are expanding abroad or moving into higher-value retail segments. Ushopal’s investment in French niche perfumer Juliette Has a Gun reflects this outward momentum, underscoring a dynamic, two-way shift reshaping both domestic and global markets.

3. Growing M&A Interest in the Fragrance Industry

In line with the fragrance market’s rapid expansion, both the fragrance and broader beauty and personal care industries have seen a surge in transaction activity in recent years. 2023 and 2024 were record-breaking years. As shown above, capital invested in fragrance brands rose from $0.3B in 2019 to $4.0B in 2023 and $3.5B in 2024, marking a 13x increase over five years.

In line with the fragrance market’s rapid expansion, both the fragrance and broader beauty and personal care industries have seen a surge in transaction activity in recent years. 2023 and 2024 were record-breaking years. As shown above, capital invested in fragrance brands rose from $0.3B in 2019 to $4.0B in 2023 and $3.5B in 2024, marking a 13x increase over five years.

Moreover, the broader the global beauty and personal care sector has also gained significant traction in deal activity, reaching approximately 350 transactions in 2024—a 40% increase over the previous year.

What’s Driving Fragrance M&A Momentum

Several key trends are fuelling continued M&A activity in the fragrance industry:

- Evolving Consumer Preferences & Innovation: As competition intensifies, brands must stand out through innovation and storytelling. Gen Z is reshaping the market with a desire for personalized, experience-driven scents—prompting larger players to acquire agile, niche brands that resonate with younger consumers and fill portfolio gaps.

- Attractive Margins & Resilient Business Models: The fragrance industry is characterized by high attractive margins which make them stand out for both strategic and financial acquirors. More specifically, fragrance brands’ business model allows for loyal customers, repeat purchases, and premium pricing which contributes to many brands exhibiting high EBITDA margins of 15-25%.

- Surging Demand for Niche Brands: The success of premium players like Le Labo and Byredo has inspired a wave of independent fragrance startups. Investors are actively backing these brands to tap into rising consumer demand for exclusivity and craftsmanship.

- New Digital Channels Fuelling Growth: New digital channels have also enabled a greater influencer and celebrity presence in launching and promoting new brands. This minimizes barriers of entry and gives rise to new digitally savvy brands, further driving M&A activity as leading brands seek capture new channels.

- Global Expansion & Localization: Preferences vary widely by region, making product localization essential for global fashion and fragrance brands. Western fragrance brands often adopt local scent profiles—like floral or tea notes—to appeal to Asian markets. With rising demand for local brands in countries like China, foreign brands are also motivated to acquire local companies to leverage their cultural insights.

Attractive Buy for both Strategic and Financial Investors

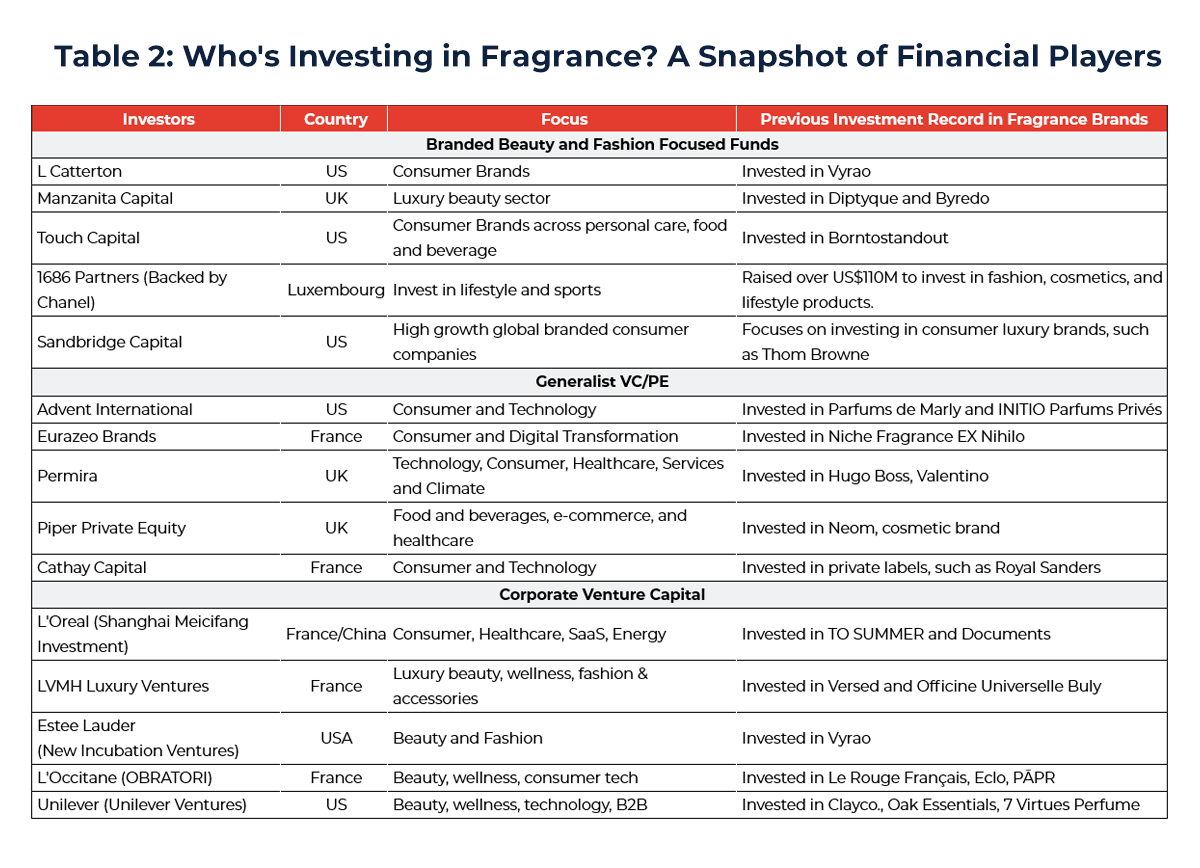

Given current market dynamics and M&A trends, there is significant activity from strategic investors within the fragrance industry. As shown in the table below, the sector is becoming increasingly consolidated, with leading beauty and fragrance companies actively acquiring innovative niche brands to enhance their portfolios and stay aligned with rapidly evolving consumer preferences.

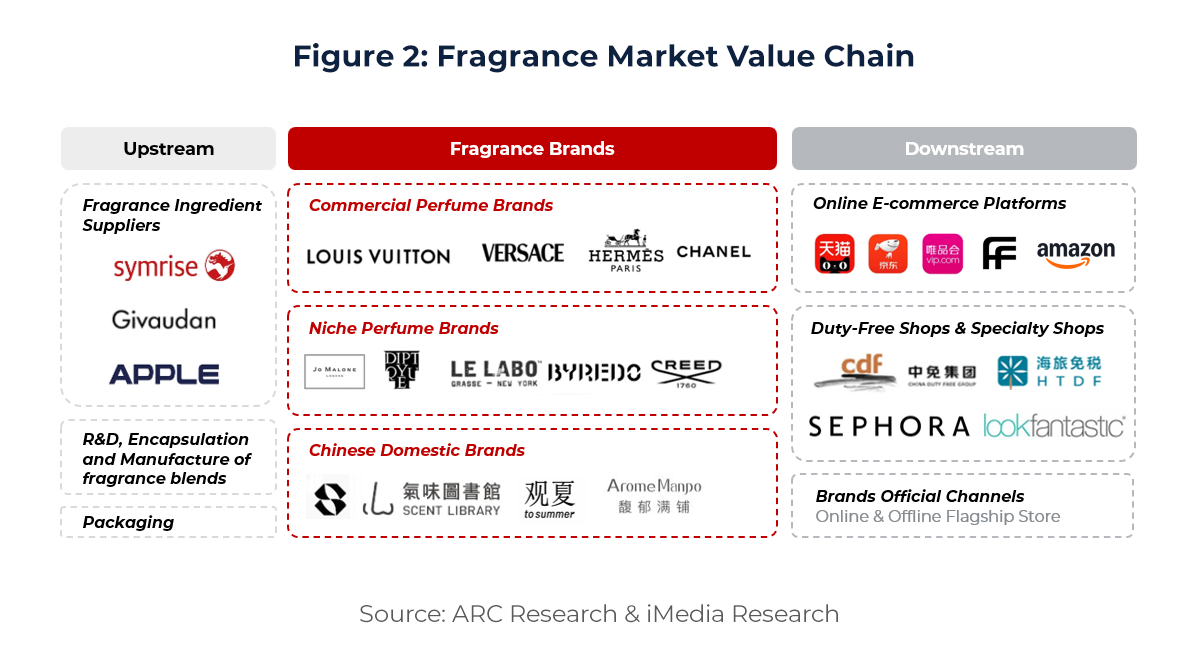

There is also significant traction among financial investors within the fragrances industry. High profit margins, strong growth potential and industry tailwinds make fragrance brands stand out as attractive investment targets for financial investors. Financial investors can be broken down into three main types:

- Luxury and Fashion industry focused funds that are specialized in investing in fragrances and related sectors.

- Generalist VC/PE Funds that cover consumer goods and are seeking to gain exposure to the rapidly growing fragrances sector.

- Corporate venture capital and investment arms of leading fashion and luxury players aiming to invest in early-stage fragrances with high growth and synergy potential.

The table below includes sample investors who have previously invested in fragrance brands.

4. Notable Transaction Case Studies

Given the rapid growth and the multiple drivers for M&A activity within the fragrance industry, ARC observes an accelerating trend of global consolidation within the sector. Consolidation within fragrances primarily manifests in three ways – through brand acquisitions, minority investments, and strategic partnerships. We highlight four notable case studies to showcase the nature and rationale of each form of consolidation.

PUIG x Byredo – Standout Niche Fragrance Acquisition

In 2022, Spanish beauty and fashion group Puig acquired majority stake in Byredo, the Swedish brand known for its crisp, minimalistic branding and premium, gender-neutral perfumes. Founded in 2006, Byredo has since expanded significantly as a niche fragrance player and sold their products in over 55 countries.

Notably, French beauty conglomerate, L’Oréal also attempted to acquire Byredo and was willing to pay 1 billion euros but was ultimately outbid by Puig. The exact deal size and acquired stake were undisclosed but market sources indicate the acquisition size was over EUR 1B with >10x revenue multiple. Manzanita Capital was a previous investor in Byredo and retains their position as shareholder, remaining committed to the long-term growth of Byredo.

The acquisition, in many ways, acted as a key driver for M&A within the fragrance industry as it came at a time of uncertainty and diminished deal volume. The significant size of the deal acted as a success story for a growing number of new niche fragrance players while paving the way for increased investment in the fragrance industry.

Rationale:

- Deepen emotional brand engagement: Leverage Byredo’s strong focus on authenticity & personalization to enhance consumer connection & brand loyalty.

- Elevate luxury positioning: Strengthen Puig’s presence in the high-end segment with a modern, inclusive brand that redefines luxury through purpose and design.

- Drive innovation and creative synergy: Integrate Byredo’s product development expertise and creative vision to fuel innovation across Puig’s fragrance portfolio.

L’Oréal Group x To Summer – Cross-Border Investment in Local Brands

French cosmetics giant L’Oréal Group has invested in Chinese home fragrance brand To Summer, reinforcing its “acquire to grow” strategy amid increasing competition from rising C-beauty brands. This marks L’Oréal’s second investment in a Chinese cosmetics start-up, following its minority stake in Documents in 2022.

To Summer is a niche home fragrance brand which focuses on products that feature a distinctly Eastern identity, using notes native to the region. The investment amount remains undisclosed but was executed through Shanghai Meicifang Investment, L’Oréal’s China investment arm, with support from its venture capital fund, BOLD.

China has been a key strategic market for L’Oréal, driving strong growth, particularly between 2017 and 2021 which saw double-digit year-over-year growth %. However, growth has slowed recently due to rising competition and shifting consumer preferences. To adapt, L’Oréal is accelerating its “acquire to grow” strategy to retain market share across both mass-market and premium segments. Similarly, its key competitor in the luxury segment, Estée Lauder, has invested in Chinese brands Codemint and Melt Season to cater to the growing demand for products tailored to Asian consumers’ preferences in the global beauty market.

Prior to L’Oréal’s investment, multiple Chinese domestic VCs have also invested in To Summer, including IDG Capital, Hongshan Capital, Being Capital, and several others.

Rationale

- Early-stage opportunity: Gain exposure to a high-growth domestic fragrance brand aligned with emerging consumer trends.

- Market competitiveness: Strengthen position in China through a local brand that meets demand for premium, culturally inspired products.

- Portfolio expansion: Broaden L’Oréal’s fragrance offerings with niche scents rooted in Chinese heritage.

Shiseido x MaxMara – Cross Border Licensing Partnership

Japanese beauty brand Shiseido and Italian luxury fashion house Max Mara have announced plans to establish a long-term fragrance partnership. Under this agreement, Shiseido will hold the exclusive global license to develop, produce, market, and distribute fragrances under the Max Mara brand. The key terms of the partnership will be formalized in a licensing agreement, which will be managed by Shiseido EMEA, a consolidated subsidiary of Shiseido.

Max Mara is an Italian luxury fashion house known for its sophisticated collections and timeless designs; they had previously entered the fragrance industry through partnerships with P&G in the early 2000s but have since discontinued their fragrance business. Shiseido is a leading Japanese beauty company specialized in skincare, fragrances, and makeup.

Fragrances are a key driver of Shiseido’s business expansion in Europe, where the company has a strong focus on the fragrance sector. The addition of Max Mara’s fragrances is expected to further boost Shiseido’s global fragrance business. Shiseido and Max Mara have reached a preliminary agreement to move forward with the new licensing arrangement.

The strategic partnership and licensing structure offers a low risk means for brands to enter the fragrance industry, while the creating a unique and attractive brand story.

Rationale

- Combine Brand Strengths: Leverage Max Mara’s luxury fashion heritage and Shiseido’s global beauty expertise to create a compelling fragrance line.

- Enable Market Reentry: Provide Max Mara with a low-risk path back into the fragrance sector via Shiseido’s established capabilities.

- Support Strategic Growth: Strengthen Shiseido’s fragrance portfolio, particularly in Europe, a key growth region.

- Enhance Operational Synergies: Share R&D, supply chain, and marketing resources for greater efficiency and impact.

Ushopal x Juliette has a gun – Multiple Cross-Border Investments

Ushopal, a Chinese luxury brand management group and omnichannel retailer has invested in, and partnered with Juliette Has a Gun, a French niche fragrance brand. The investment enabled strategic partnership between Ushopal and Juliette Has a Gun, enabling Ushopal to expand their portfolio to include foreign brands.

Following the initial investment in 2019, Juliette Has a Gun debuted in Chinese markets and was highly successful, rapidly establishing a loyal customer group within the first 12 months. Most notably, the investment and subsequent partnership enabled the French brand to effectively leverage Chinese online channels and promotion through live streaming and local KOLs.

Following the success of Juliette Has a Gun, Ushopal’s parent company Cathay Capital underwent a follow-on investment in 2023. Juliette Has a Gun also secured funding from Weinberg Capital Partners.

Ushopal’s investment also marked the first instance of Chinese fragrance investing abroad, paving the way for future cross-border opportunities.

Rationale:

- Strategic brand partnership: Establish a long-term collaboration with a high-potential niche fragrance brand to strengthen market positioning.

- Portfolio expansion: Broaden Ushopal’s luxury portfolio with differentiated, globally recognized offerings.

- International growth: Enter new markets and elevate Ushopal’s profile as a cross-border brand builder and investor.

5. How Can ARC Help?

At ARC Group, we understand the fragrance market sits at the crossroads of creativity, science, and emotion. As the industry evolves—driven by premiumization, and personalization—fragrance houses face key decisions around consolidation, global expansion, and innovation. Our deep expertise in mid-market M&A, particularly in luxury and lifestyle sectors, makes us a trusted partner in navigating this dynamic space.

- Deep Industry Insight

Our team possesses a nuanced understanding of the fragrance industry’s complexities, from raw material sourcing and fragrance innovation to brand storytelling and regulatory compliance. Our expertise enables us to identify strategic opportunities in emerging trends—such as clean beauty, biotech-inspired scents, and direct-to-consumer (DTC) models—to align M&A with long-term growth objectives.

- Global Reach and Cross-Border Expertise

With offices in 12 countries and a dedicated M&A team, ARC bridges cultural and operational divides. We connect brands with international partners, advise on market entry, and ensure deals succeed across markets including Europe, Asia, and the Americas.

- Award-Winning & Globally Recognized

ARC Group is a multi-award-winning Investment Bank, including the 2024 Frost & Sullivan Company of the Year and M&A Worldwide Deal of the Year. These accolades reflect our ability to deliver superior outcomes in high-stakes transactions. For fragrance brands, this means working with an advisor who is trusted, respected, and proven at the highest level.

- Full-Service Advisory Across M&A, Capital Raising, and Market Entry

Fragrance brands often need more than M&A support—they need a strategic growth partner. ARC Group offers a comprehensive advisory platform covering buy- and sell-side M&A, post-merger integration, and operational consulting such as strategic planning and market entry, positioning us as a long-term partner, not just a deal advisor.

- Tailored Strategy for Consumer & Luxury Brands

Fragrance is more than business—it’s brand heritage, consumer connection, and creative vision. We craft M&A strategies that preserve brand equity, empower founders, and enhance positioning in the luxury space. ARC ensures your brand’s story and value are front and center in every transaction.

6. Let’s Shape the Future of Fragrance

As consumer tastes evolve and global dynamics shift, the fragrance industry is entering a new era of opportunity. Whether you’re a heritage house pursuing innovation, a regional brand eyeing global expansion, or an investor seeking high-potential assets, ARC Group is your strategic partner for growth.

With deep industry expertise, cross-border capabilities, and a track record of delivering results, we help you turn your vision into value.

Connect with us today to discover how ARC can help you unlock new markets, scale with purpose, and craft deals that preserve the soul of your brand—because in fragrance, every note matters, and every deal defines what’s next.

References

![[M&A] Smell of Opportunity: Bottled Desires and M&A in the $100B Fragrance Market](jpg/fragrance-investment-1200.jpg)

A Brief History of Perfume

A Brief History of Perfume This value chain is not only the foundation of product creation and delivery, but also where strategic opportunities for investment, innovation, and M&A reside. However, for the purpose of this article, we will focus on fragrance brands.

This value chain is not only the foundation of product creation and delivery, but also where strategic opportunities for investment, innovation, and M&A reside. However, for the purpose of this article, we will focus on fragrance brands. Within APAC region, China is the largest and most rapidly evolving fragrance market, attracting significant investment. While international fashion houses like L’Oréal and LVMH maintain a strong presence, the market is becoming increasingly fragmented, with a surge of local and niche brands.

Within APAC region, China is the largest and most rapidly evolving fragrance market, attracting significant investment. While international fashion houses like L’Oréal and LVMH maintain a strong presence, the market is becoming increasingly fragmented, with a surge of local and niche brands. In line with the fragrance market’s rapid expansion, both the fragrance and broader beauty and personal care industries have seen a surge in transaction activity in recent years. 2023 and 2024 were record-breaking years. As shown above, capital invested in fragrance brands rose from $0.3B in 2019 to $4.0B in 2023 and $3.5B in 2024, marking a 13x increase over five years.

In line with the fragrance market’s rapid expansion, both the fragrance and broader beauty and personal care industries have seen a surge in transaction activity in recent years. 2023 and 2024 were record-breaking years. As shown above, capital invested in fragrance brands rose from $0.3B in 2019 to $4.0B in 2023 and $3.5B in 2024, marking a 13x increase over five years.