During this year’s Jackson Hole Economic Policy Symposium, Chair Jerome Powell described a U.S. economy that remains resilient, with inflation slightly elevated but notably below its post‑pandemic peak. The Fed reviewed its policy framework, scaling back parts of the 2020 consensus statement and reaffirming a straightforward 2% inflation target within a more flexible policy approach. Powell’s message indicates a near‑term tendency toward easing, conditional on incoming economic data, while highlighting that the new neutral rate may be higher than pre-pandemic norms.

Current U.S. Economic Conditions

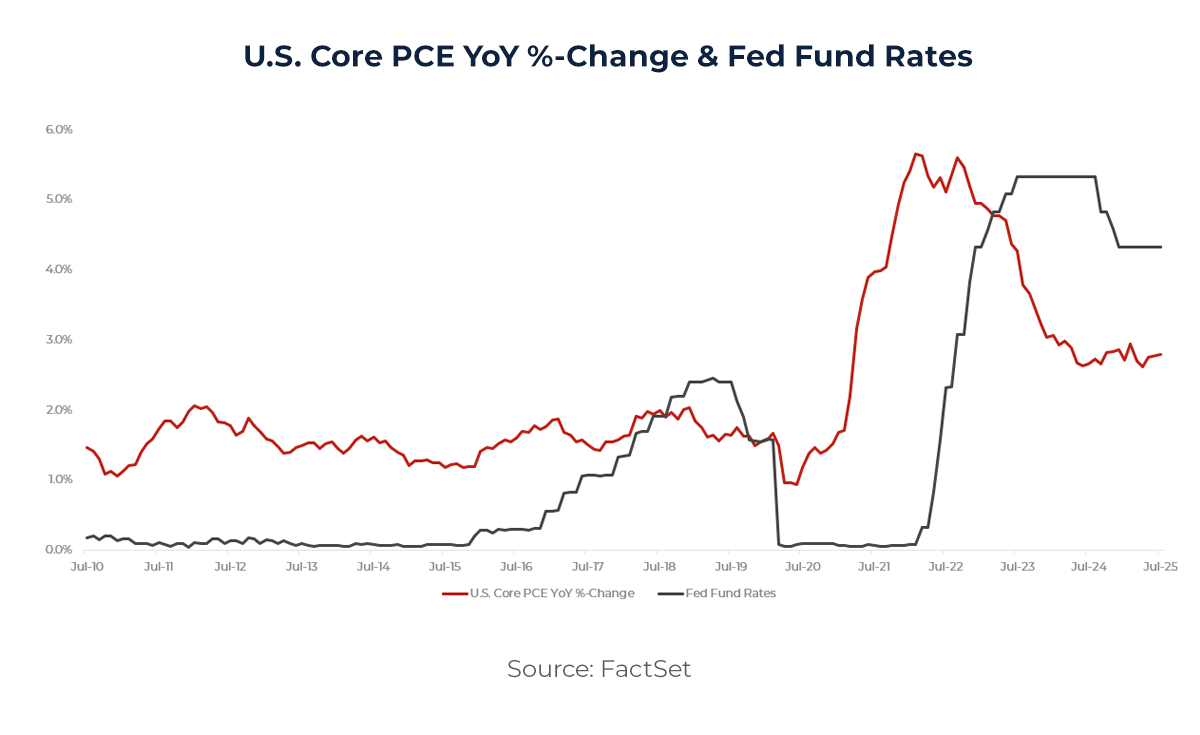

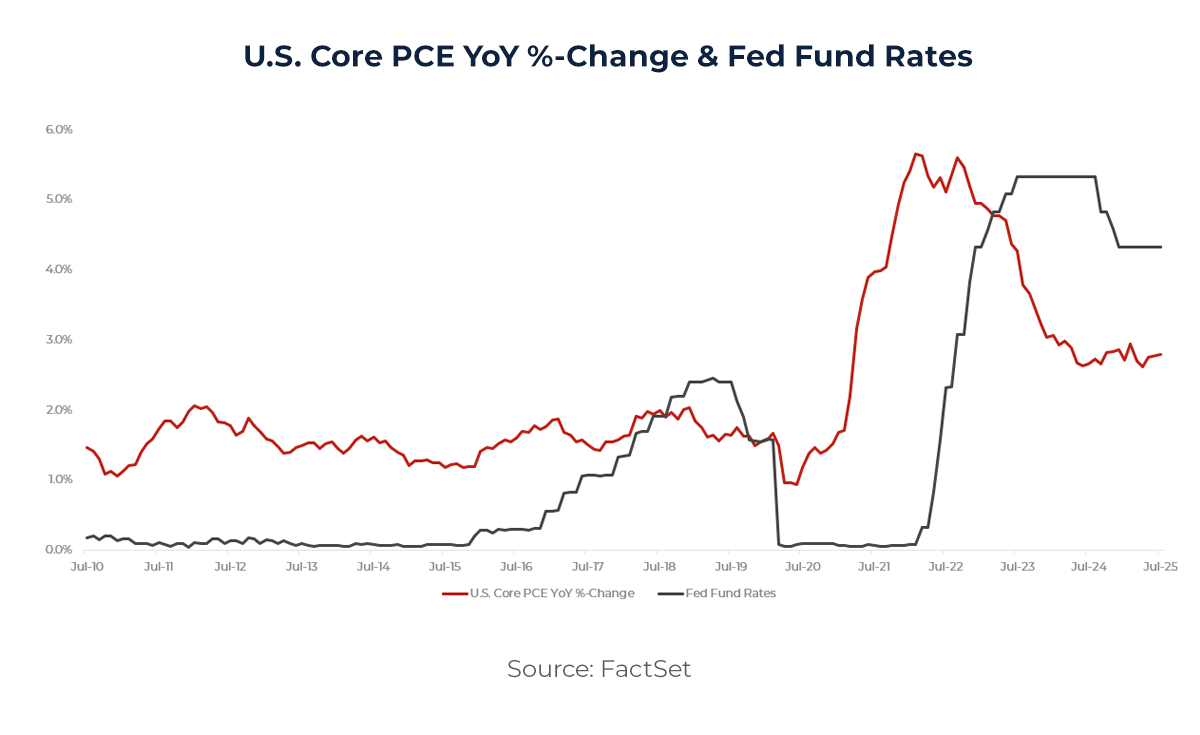

The U.S. economy currently shows moderate growth, easing but still elevated inflation, and a labor market that remains strong while gradually cooling. Powell noted that U.S. GDP growth has slowed notably in the first half of this year to a pace of 1.2%, roughly half the 2.5% pace in 2024. The decline in growth has largely reflected a slowdown in consumer spending. Inflation has eased significantly from its peak but continues to exceed the Fed’s 2% target. Higher tariffs have begun to push up prices in some categories of goods. The labor market continues to adjust gradually, with payroll gains slowing and wage pressures easing, though overall employment remains historically strong. Powell emphasized that the combination of current economic conditions creates a more balanced risk environment.

Powell’s Remarks and Key Policy Adjustments

On the near-term outlook, Powell emphasized that policy is still restrictive and that with inflation risks tilted to the upside and employment risks to the downside, the Committee must balance both sides of its mandate. Crucially, he added that because the balance of risks is shifting, the Fed may need to adjust its policy approach. Decisions are not predetermined and will instead be based on incoming economic data as the September meeting approaches. Market participants interpreted these remarks as keeping the possibility of a September rate cut open without signaling a firm commitment.

The Jackson Hole Symposium also highlighted the evolution of the Fed’s monetary policy framework. The revised version remains adaptable across various economic conditions while maintaining its core dual mandate. The changes build on the 2012 consensus statement

The 2020 framework introduced flexible average inflation targeting to address prolonged periods of low inflation and growth. However, the pandemic led to the highest inflation in four decades, prompting rapid rate hikes to bring inflation closer to target without significant job losses. The 2025 reviewed framework emphasizes anchored inflation expectations as central to achieving both mandates and stresses the need for balance when employment and inflation goals diverge. It reaffirms the commitment to periodic reviews to adapt to structural changes in the economy. The 2025 review reflected shifting economic conditions, with higher rates and inflation’s potential for rapid increases. The Fed removed emphasis on the effective lower bound, reaffirmed the 2% inflation target, and clarified that employment can exceed sustainable levels temporarily without triggering tightening, though the Committee retains discretion to act when necessary. Overall, the change in the framework reflects lessons from both the post-GFC stagnation and the post-pandemic inflation surge, restoring clarity and flexibility in the Fed’s reaction function.

Easing in a Higher Neutral-Rate Environment

The signal from the Jackson Hole meeting is not an “all clear” for a 2019-style lower-for-longer regime. The Fed’s revised framework and Powell’s remarks suggest three working assumptions for the near future.

First, Fed policy is restrictive but not constrained by the effective lower bound. The Fed has the flexibility to ease policy if needed to address labor market risks, without causing inflation expectations to become unanchored. This supports the possibility of a modest front-end rally and a gradual steepening of the yield curve if growth slows and the Fed adjusts rates toward, but not below, neutral levels.

Second, the neutral rate may be higher than last decade’s norms. Productivity dynamics, fiscal settings, and demographics all argue against a rapid return to pre-2020 funding costs. Regarding rates, this limits the potential for a long-duration rally and suggests a strategy of actively positioning along the yield curve instead of making broad bets on longer-term duration. For equities, this implies that the minimum level for discount rates is likely higher than it was in the 2010s, which keeps stock valuations more sensitive to changes in real interest rates.

Third, the Fed’s reaction function is more straightforward. The Fed has regained flexibility in its approach, allowing it to take proactive action on either side of its dual mandate as needed. As a result, markets can expect fewer unexpected changes in policy and more consistent decisions based on data related to employment and inflation.

How Markets Reacted

Price action following Chair Powell’s speech underscored market sensitivity to a potential policy shift. U.S. equities rallied broadly, with cyclical sectors and small‑capitalization stocks outperforming on expectations of lower discount rates and improved financing conditions. In fixed income, the yield curve steepened as front‑end yields fell more sharply than the long end. On the day of the speech, benchmark 10‑year Treasury yields declined by ~7 basis points to 4.26%, while two‑year yields dropped ~10 basis points to 3.68%, reflecting a modest repricing of the near‑term policy path. Fed funds futures shifted meaningfully, with market‑implied probabilities placing a quarter‑point cut in September in the 85%–90% range.

Beyond equities and rates, credit spreads narrowed as expectations of policy easing reduced refinancing risk, while the dollar softened modestly against major peers before stabilizing. Oil prices slightly increased due to expectations of higher demand, whereas gold gained modestly on lower real yield prospects. Trading volumes across asset classes were elevated relative to recent averages, reflecting heightened investor attention to the Fed’s revised framework.

Treasury Yield Outlook

Entering September, modest additional front-end rally is possible in Treasury yields if payroll and core PCE data continue to soften, though term premium may limit gains at the long end. Gradual steepening is possible with front-end cuts priced, while the long end remains firm given a higher neutral rate and sustained Treasury supply. The symmetry in the revised framework also increases sensitivity to upcoming data. Any upside inflation surprise could flatten the curve as the Fed counters it.

Big banks also adjusted their baseline forecasts. Barclays and BNP Paribas revised their outlooks to include a 25-basis point cut in September, followed by another move later in the year. Both institutions described the first cut as precautionary, intended to manage downside labor‑market risks and to respond to recent payroll revisions. Such revisions in consensus are material for asset pricing, shaping investor positioning into the final quarter of the year. (Singh, 2025).

Implications on Various Asset Classes

Credit: A conditional easing bias supports investment-grade spreads through reduced refinancing risk and benefits high-yield issuers by sustained growth. However, a sharper labor-market slowdown could elevate default risk in weaker issuers. Continued primary market demand for high-quality borrowers is likely in the September–October window, with cyclical sectors potentially issuing at lower overall coupons if a September cut occurs.

Equities: Lower discount-rate expectations provide support to cyclical sectors, small-cap equities, and housing-linked industries. Nonetheless, a higher neutral rate and persistent above-target inflation reduce the scope for valuation multiple expansion compared with prior cycles. Sector leadership will depend on whether the slowdown remains controlled. For large-cap growth, resilient earnings combined with lower rates are favorable, though sensitivity to real yields remains significant.

FX and Commodities: Under typical conditions, a more accommodative policy would weaken the dollar, but the effect is moderated by a higher neutral rate and uneven global growth dynamics. In commodities, monetary policy interacts with tariff-related price movements. Powell noted that these tariff effects are expected to be temporary, which reduces the likelihood of renewed inflation that could otherwise delay policy easing. Commodity prices will remain sensitive to shifts in demand expectations and supply disruptions, underscoring their volatility in the current environment.

Conclusion

Overall, Jackson Hole signaled a cautious policy adjustment. The Fed remains committed to a 2% inflation target but has regained flexibility to respond to labor‑market risks without the complications of the flexible average inflation targeting framework. In the near term, a September rate cut is possible depending on incoming data. Over the medium term, a higher neutral rate reduces the likelihood of an extended easing cycle. For markets, this implies support for modest front‑end duration, selective credit exposure, and equity positioning tilted toward cyclicals and quality growth, while maintaining awareness of sensitivity to real yields. The principal risk is renewed inflation that delays easing, while the opposite risk is a sharper deterioration in labor demand that accelerates rate reductions. Powell’s message underscored the critical importance of maintaining flexibility in monetary policy, allowing the Federal Reserve to make timely adjustments based on evolving economic conditions. By keeping policy options open, the Fed aims to effectively navigate future challenges, ensuring that it can respond swiftly to shifts in inflation, employment, and overall economic stability, while continuing to support long-term growth and price stability.

Author:

Patrik Kohary

Analyst

References: