In U.S. capital markets, the greenshoe option, or over-allotment option, is a pivotal tool in initial public offerings (IPOs) that leverages short selling to manage stock price volatility, particularly during the critical first trading day. Originating with the Green Shoe Manufacturing Company in 1919, this mechanism helps new issuers manage initial market volatility post-pricing. It permits underwriters to sell up to 15% more shares than the initial offering, creating a controlled short position without immediate share ownership. Governed by SEC Regulation M (Rule 104), this practice allows “naked” short selling (selling without first borrowing shares or ensuring their availability) during the offering, exempt from standard restrictions, to ensure a smooth transition to market-driven pricing(1).

The greenshoe functions by enabling underwriters to sell additional shares they do not yet hold, anticipating coverage based on market dynamics. For instance, in an IPO of 10 million shares priced at $20 / share, underwriters may sell 11.5 million shares, establishing a 1.5 million share short position. Should robust demand elevate the price to $25 / share, underwriters exercise the greenshoe to acquire these shares from the issuer at the original $20 / share price, covering the short position(2). This mechanism significantly raises more institutional capital for the issuer by enabling the sale of extra shares at the offering price. In this case, the issuer gains an additional $30 million (1.5 million shares at $20 / share) beyond the initial $200 million, totaling $230 million. This extra capital provides issuers with greater financial flexibility for expansion, innovation, debt repayment, and other strategic capital deployment initiatives. If after the IPO, the price drops to $18 / share due to weak demand or external factors, underwriters repurchase shares in the open market at the lower price, adding buy-side volume and bolstering liquidity to stabilize the stock(3).

As Jesus Emilio Hoyos, Managing Partner at ARC Group, emphasizes,

“The greenshoe option plays an instrumental role within IPOs in today’s market. It provides value and protection for all parties. A true win-win initiative for all involved.”

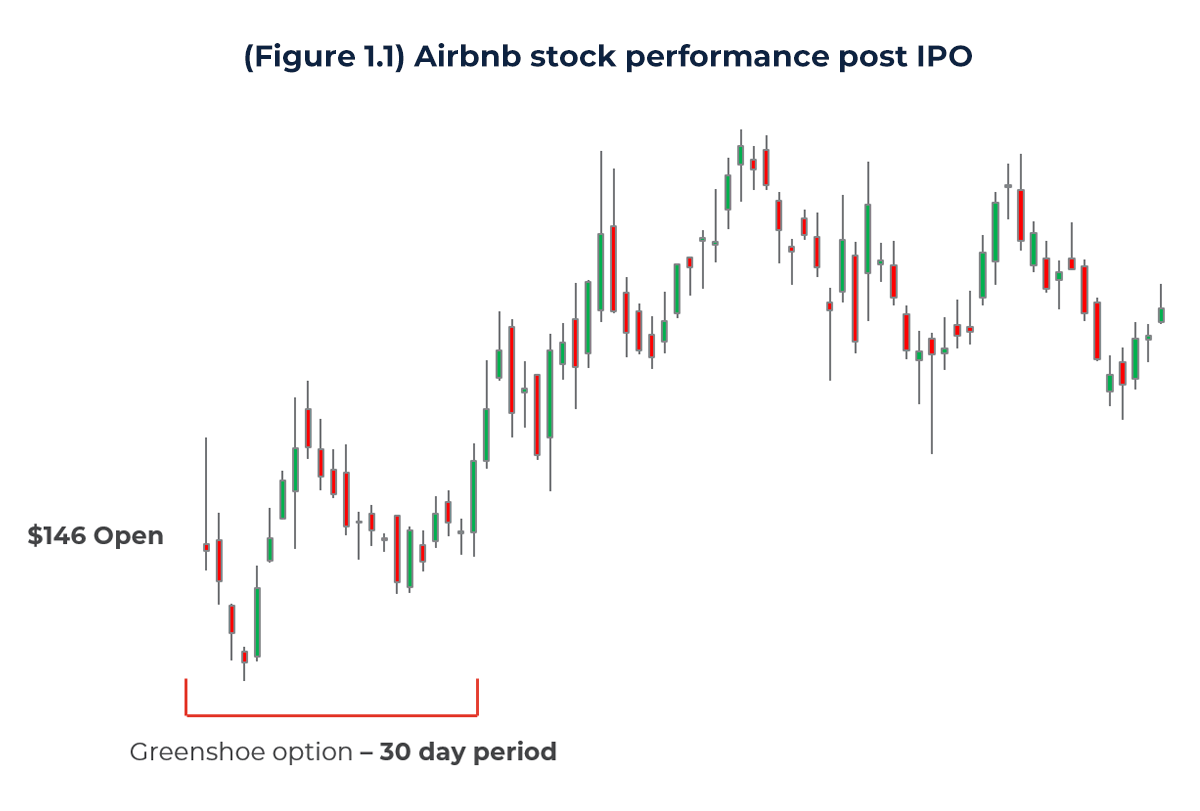

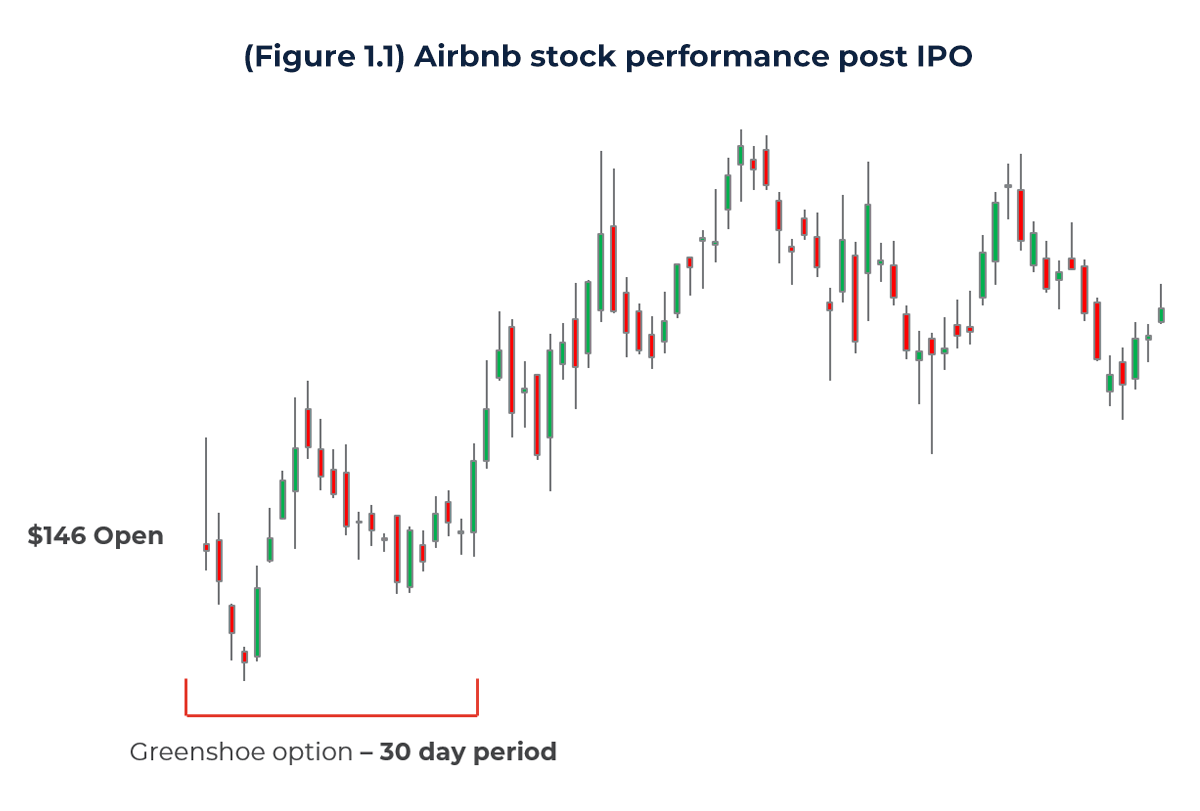

A prime example is Airbnb’s December 2020 IPO, priced at $68 / share for approximately 51.3 million shares. Fueled by post-COVID travel optimism, the stock opened at $146 / share, achieving a 113% first-day gain and a valuation exceeding $100 billion(4). Underwriters, led by Morgan Stanley, used a greenshoe for up to 7.7 million additional shares, purchasing them at $68 / share to cover the short as prices surged, curbing volatility and enabling Airbnb to raise an additional $524 million(4) .This illustrates the greenshoe’s efficacy in high-demand scenarios.

The greenshoe option is the cornerstone of IPO stabilization, empowering underwriters to assist issuers in navigating market volatility, enhancing liquidity, and safeguarding their reputation through strategic short selling and over-allotment.

Please reach out to ARC Group for additional information regarding IPOs and other capital markets services.

Author:

Callum Cox

Analyst

References:

(1) SEC, n.d.

(2) Investopedia, 2023

(3) Cbonds, n.d.

(4) Reuters, 2020; Airbnb Investors, 2020.