On September 8th 2025, Nasdaq announced that it had submitted a filing to the SEC to enable trading of tokenized securities on its markets.

Nasdaq’s proposal aims to provide market participants with the flexibility to choose between clearing and settling trades in the conventional manner or through tokenized, blockchain-based processes. Under the new system, any trade can be executed as usual, but if a participant opts for tokenized settlement, the Depository Trust Company (DTC) will handle back-end processing using distributed ledger technology. This ensures that whether shares are held in traditional or tokenized form, they retain identical rights, value, and market identification, safeguarding continuity and investor protection.

Why Now:

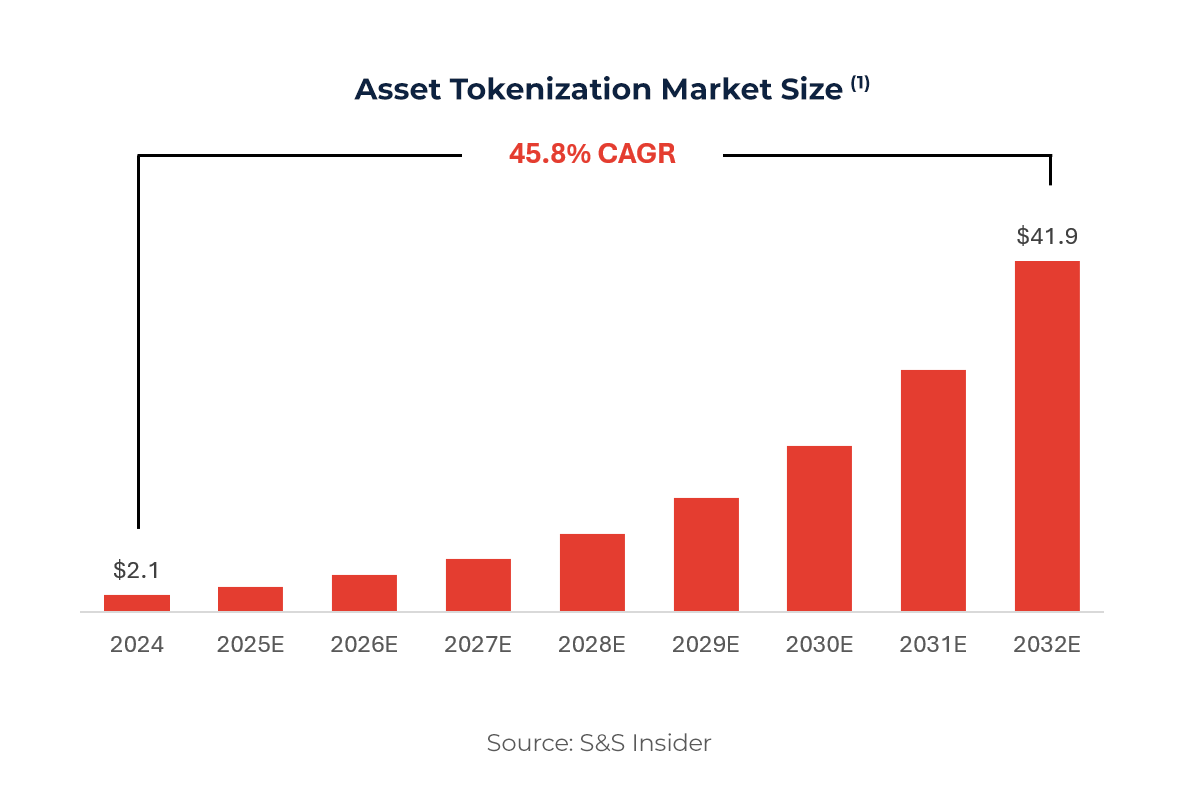

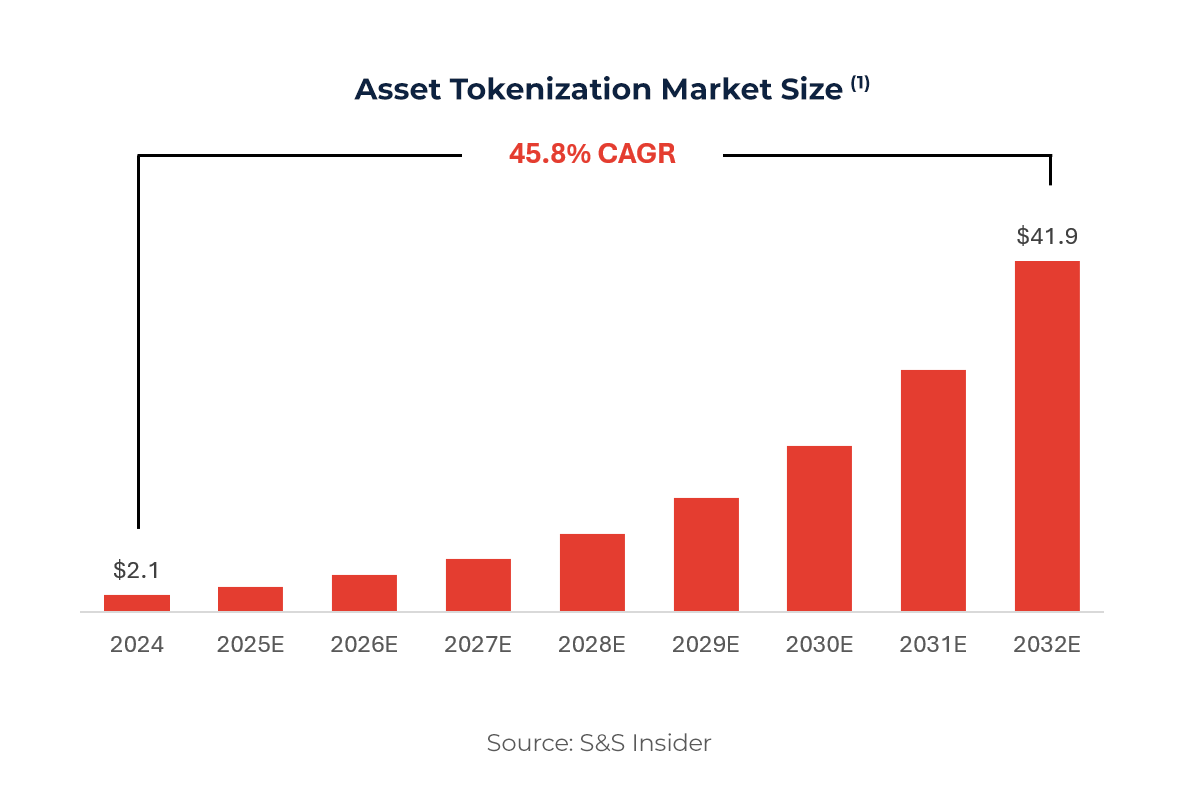

The timing of this proposal aligns with the substantial growth projected in the asset tokenization market, which is anticipated to rise from $2.1 trillion in 2024 to $41.9 trillion by 2032(1), representing a remarkable CAGR of 45.8%. This momentum is further reinforced by accelerating institutional interest in blockchain technology and a clearer, maturing regulatory environment underpinning digital asset adoption.

Nasdaq’s Reasoning:

Chuck Mack, Senior Vice President of North American Markets at Nasdaq, highlights that the primary objective is to seamlessly integrate digital assets into existing Nasdaq systems. In a recent Q&A, he discussed how the proposal for tokenized securities is rooted in Nasdaq’s long-standing “goal of advancing financial innovation while maintaining stability, fairness, and investor protections.”

Key Benefits:

- Settlement Speed: Blockchain and distributed ledger technology allow for near-instant settlement speeds compared to the traditional T+2.

- Cost Reduction: Tokenization offers substantial cost reductions in reconciliation and custodial operations.

- Market Accessibility: By enabling fractional ownership, tokenization could democratize trading and liquidity for a broader spectrum of investors, including those previously excluded from conventional markets due to high capital thresholds or geographic barriers.

- Risk Mitigation: The shift to blockchain also promises reduced operational risk by minimizing manual errors and mismatches inherent in legacy clearing systems.