Introduction

The Securities and Exchange Commission (SEC) oversees the trading of securities to ensure transparency and investor protection. Rule 144, under the Securities Act of 1933, sets the rules for selling restricted and insider-owned shares to the public without going through full SEC registration. This article offers a comprehensive examination of Rule 144, detailing its requirements, distinctions between affiliate and non-affiliate sellers, recent amendments, and its significance in capital markets.

Overview of Rule 144

Rule 144 was created to make it easier to resell securities that are not registered with the SEC. Normally, the Securities Act of 1933 requires registration for public sales, and without exemption, holders of restricted or insider shares could be treated as underwriters, forcing them to register. Rule 144 solves this by setting specific conditions for resale, giving holders a path to liquidity while still protecting market integrity.

Rule 144 applies to two categories of securities:

- Restricted Securities: Securities acquired through unregistered transactions, such as private placements under Regulation D, employee stock plans, or compensation agreements. These securities typically bear a restrictive legend prohibiting public sale.

- Control Securities: Securities held by affiliates, defined as individuals or entities with significant influence over the issuer (e.g., directors, executive officers, or shareholders owning 10% or more of voting stock). These securities, even if unrestricted, are subject to resale limitations due to the affiliate’s access to material nonpublic information.

Compliance with Rule 144 allows sellers to remove restrictive legends through coordination with the issuer’s transfer agent, enabling trading on public exchanges or over-the-counter markets.

Conditions for Compliance with Rule 144

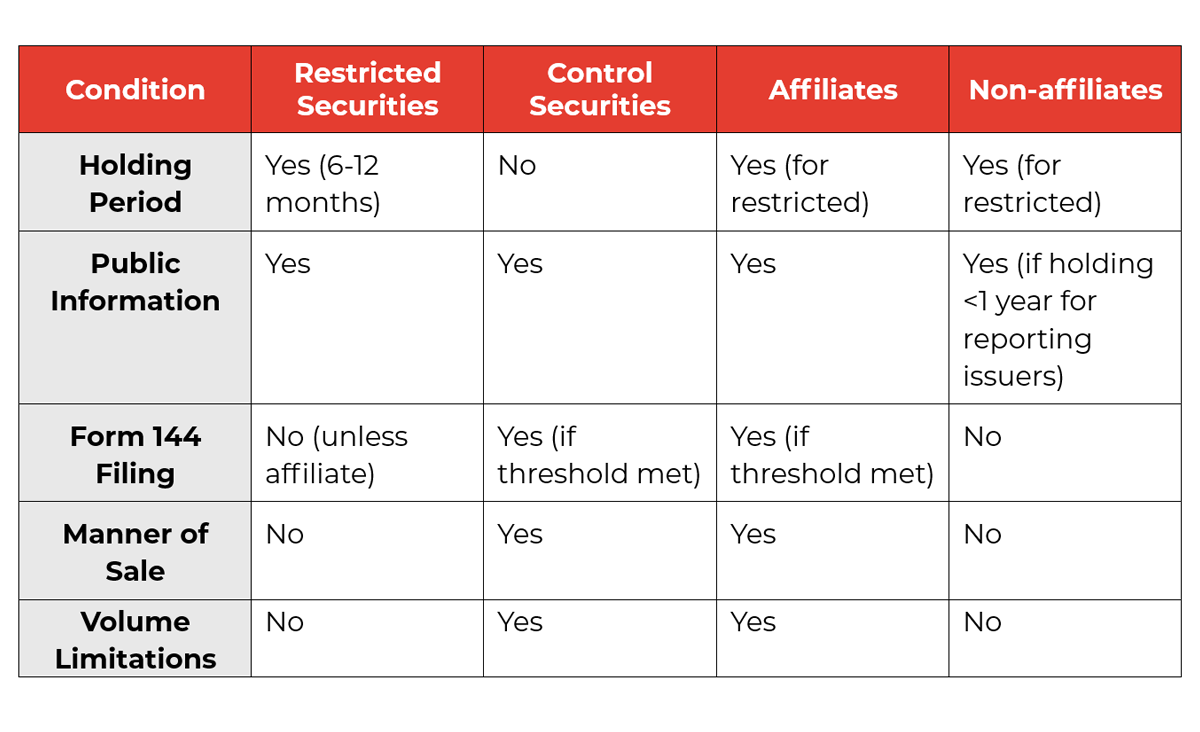

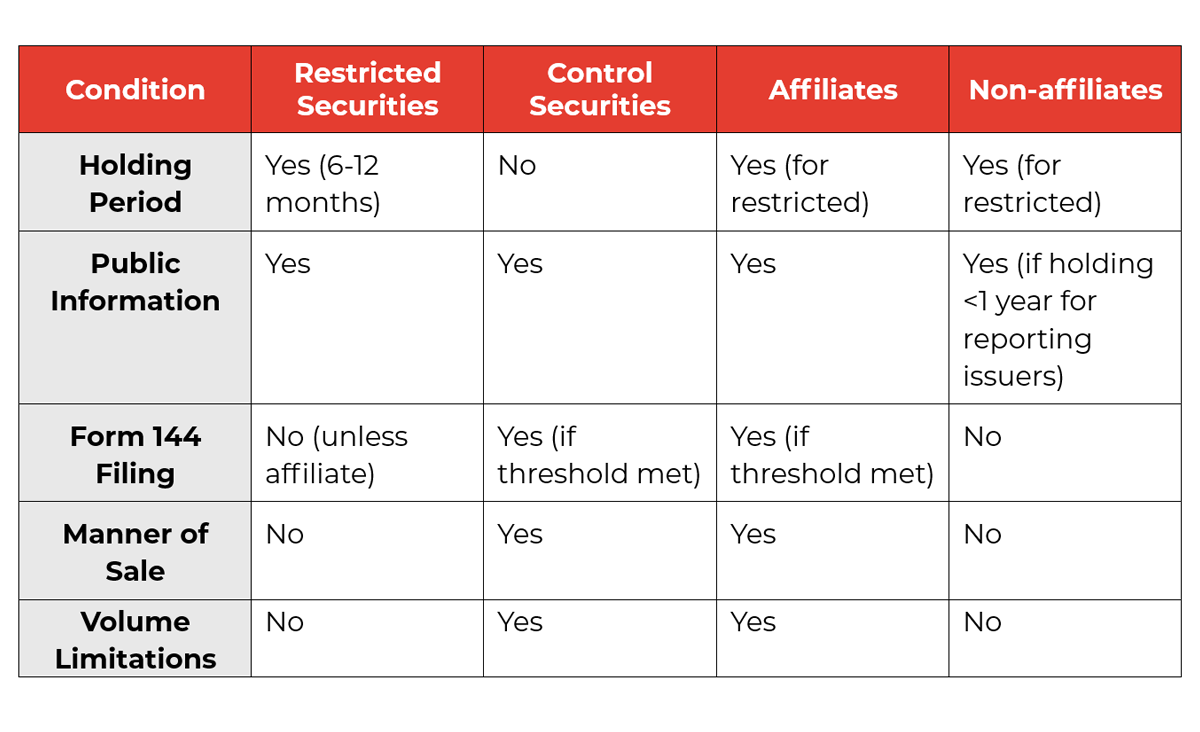

To qualify for the safe harbor exemption, sellers must meet up to five conditions, depending on their affiliate status and the nature of the securities. These requirements ensure that resales do not constitute unregistered public distributions.

- Holding Period: Restricted securities must be held for a minimum period to demonstrate investment intent. For issuers filing periodic reports under the Securities Exchange Act of 1934 (reporting companies), the holding period is six months. For non-reporting issuers, the holding period is one year.

- Current Public Information: The issuer must provide adequate public information. For reporting companies, this means compliance with SEC filing obligations (e.g., Forms 10-K, 10-Q). As for non-reporting issuers, they must disclose essential details, including the nature of their business, officers, directors, and financial statements.

- Notice of Proposed Sale (Form 144): Affiliates selling more than 5,000 shares or securities valued over $50,000 within a three-month period must file a Form 144 with the SEC while non-affiliates are exempt from this requirement.

- Manner of Sale: Affiliate sales must be conducted through routine brokerage transactions without special commissions or active solicitation of buyers, ensuring market-based transactions.

- Volume Limitations: Affiliates are restricted to selling, within any three-month period, the greater of:

- 1% of the company’s outstanding shares, or

- The average weekly trading volume over the prior four weeks.

The following table summarizes the applicability of these conditions:

Non-compliance with Rule 144 may result in SEC enforcement actions, including penalties or rescission of sales.

Affiliate vs. Non-Affiliate Requirements

The obligations under Rule 144 vary significantly based on whether the seller is an affiliate. An affiliate is defined by their control over or relationship with the issuer (e.g., ownership of 10% or more of voting securities or board membership).

- Affiliates: Must comply with all applicable conditions when selling either restricted or control securities. Even after satisfying the holding period for restricted securities, affiliates remain subject to volume limitations, manner-of-sale requirements, and Form 144 filings to prevent market manipulation stemming from their access to insider information.

- Non-Affiliates: Face fewer restrictions. After holding restricted securities for one year, non-affiliates may resell unlimited quantities without adhering to any Rule 144 conditions. For securities of reporting companies held between six months and one year, only the current public information requirement applies.

Case Study: Apple Inc. (AAPL) – Arthur D. Levinson Form 144 Filing

On August 28, 2025, Arthur D. Levinson, the chairman and director of Apple Inc. (AAPL), filed a Form 144 indicating the proposed sale of 90,000 shares of Apple common stock through his trust. These shares were acquired via an open market purchase on February 27, 2001, more than two decades earlier.

Because Levinson is an affiliate of Apple due to his board position, the shares are considered control securities. As such, while there was no holding period requirement (the shares were not restricted because of open market purchase), the proposed sale was subject to Rule 144 conditions:

- Notice of filing: Form 144 filing was required because the proposed sale exceeded the reporting thresholds, which is more than 5,000 shares or securities valued over $50,000.

- Volume Limitations: Restricting the number of shares that could be sold within a three-month period.

- Manner of Sale: Transaction will be conducted through ordinary brokerage methods.

This case provides a clear illustration of how affiliates selling control securities, without restricted share issues, must still comply with Rule 144 to ensure transparency and market integrity.

Significance in Capital Markets

Rule 144 plays a pivotal role in capital markets by enabling liquidity for securities acquired in private transactions or held by affiliates. It supports venture capital and private equity ecosystems by allowing early investors to monetize their holdings through public markets. For affiliates, the rule permits diversification of personal portfolios while having volume limitations prevent market disruptions. As private market activity grows, Rule 144 remains essential for bridging private and public capital markets.

Conclusion

SEC Rule 144 provides a structured framework for the public resale of restricted and control securities, balancing liquidity with regulatory oversight. By setting out clear conditions, it enables investors and affiliates to participate in capital markets while upholding transparency and fairness.

At ARC Group, we regularly advise clients on Rule 144 considerations in the context of PIPE financing, SPACs, IPOs, and reverse takeovers. Ensuring compliance not only avoids regulatory pitfalls but also protects long-term liquidity opportunities for issuers and investors alike. As private and public markets continue to converge, Rule 144 remains a cornerstone of efficient and equitable capital markets, and ARC is committed to guiding clients through its application with precision and expertise.

References: