In line with the outlook we outlined in our late August publication, “Jackson Hole 2025: Powell Hinting at Rate Cuts?”, the Federal Reserve delivered its first interest rate cut of 2025 on September 17, reducing the federal funds target range by 25 basis points to 4.00%–4.25%. The move, widely anticipated by markets, marks a notable policy shift after months of holding rates steady to assess the balance between persistent inflationary pressures and signs of labor market cooling.

In its official statement, the Federal Open Market Committee (FOMC) highlighted that job gains have slowed, and unemployment has edged higher, even though labor market conditions remain solid by historical standards. Inflation, meanwhile, has moved up and remains somewhat elevated, underscoring the Fed’s ongoing challenge of balancing its dual mandate. The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. Uncertainty about the economic outlook remains elevated.

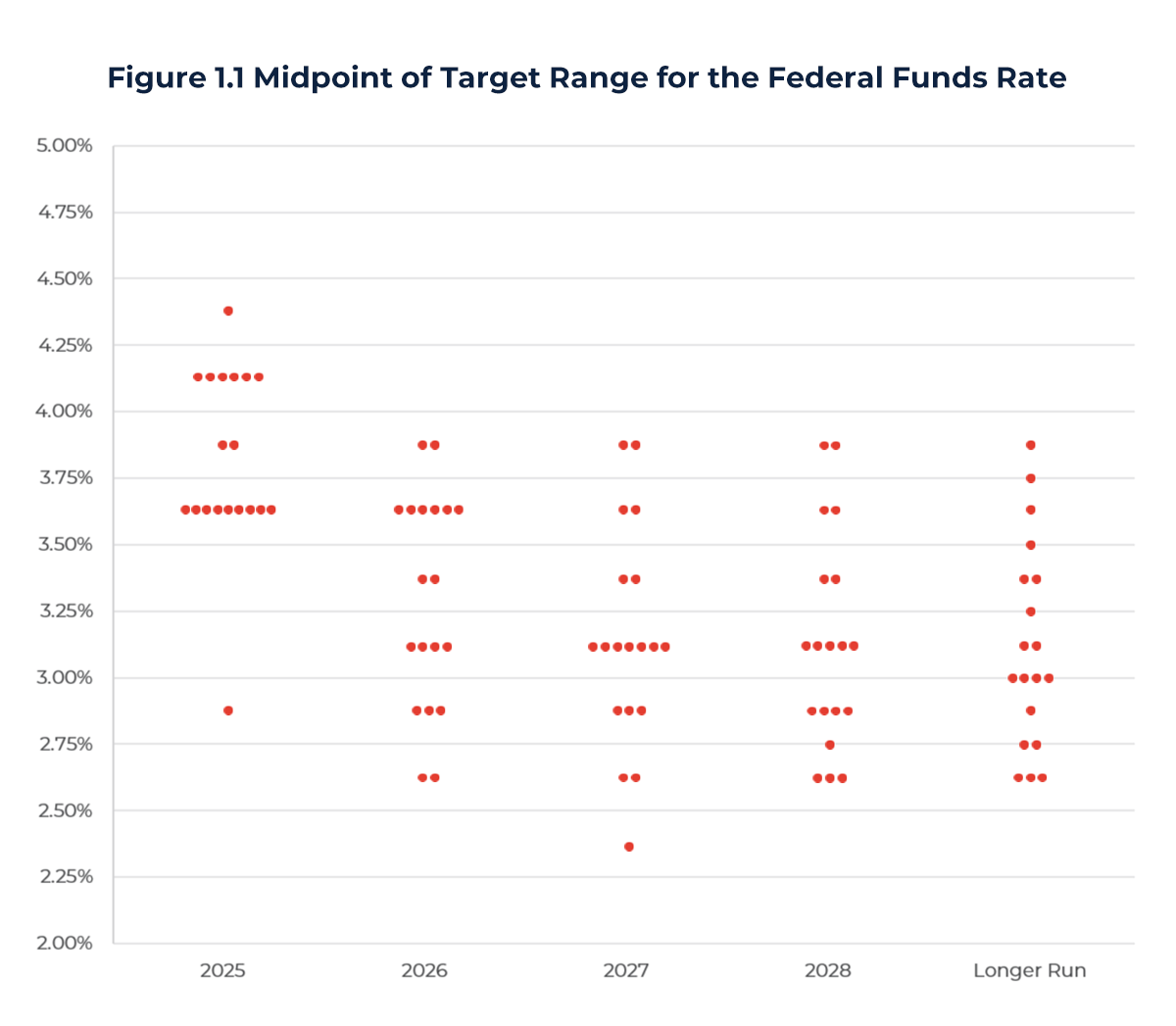

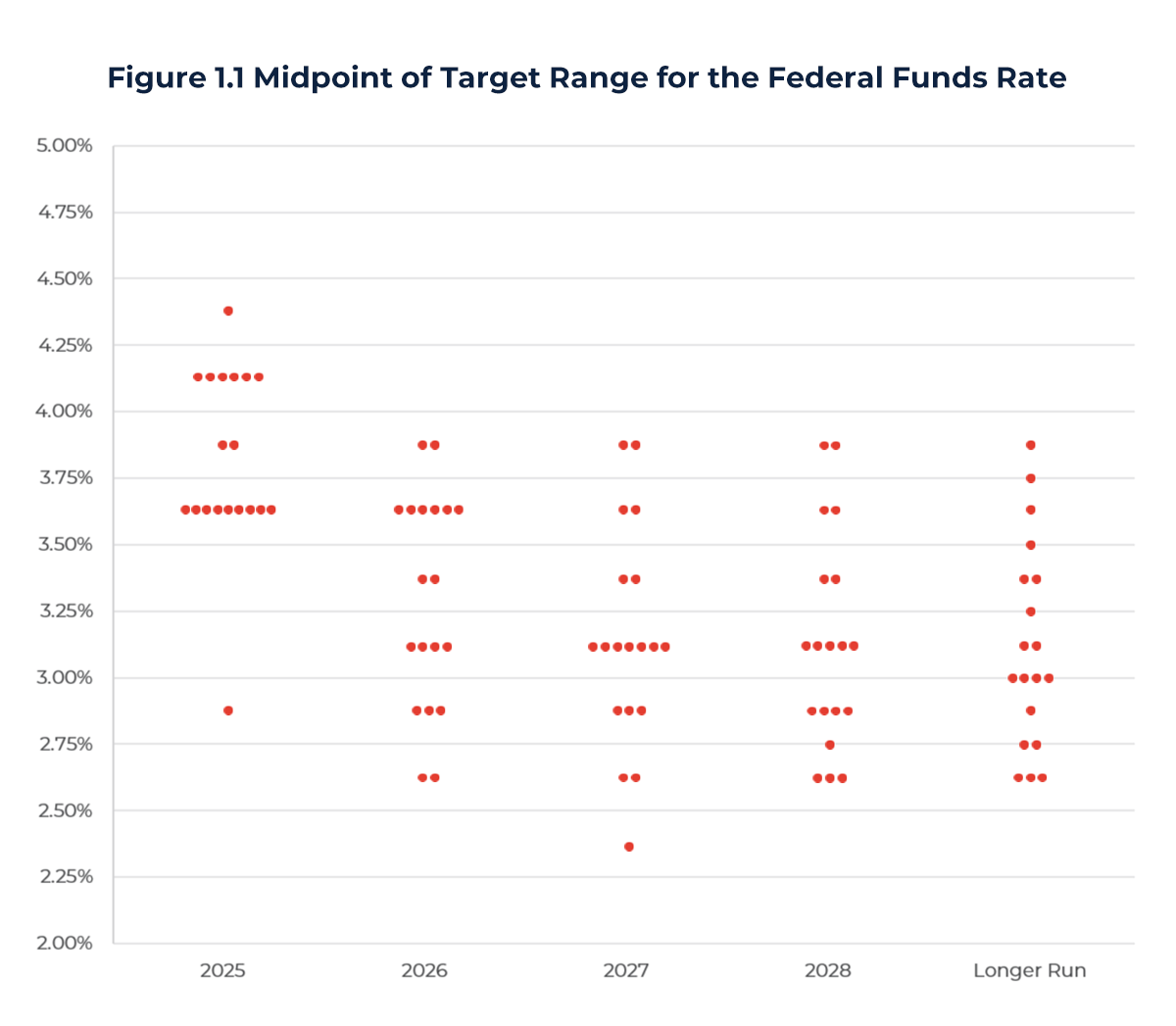

Alongside the rate decision, the Fed released its quarterly Summary of Economic Projections in which FOMC participants project the midpoint of target range for the federal funds rate. As shown in Figure 1.1, most policymakers expect two additional quarter-point cuts before year-end, which would bring the policy rate to 3.50%–3.75% by December.

Importantly, Chair Jerome Powell emphasized during his press conference that these projections are not commitments, highlighting the Committee’s data-dependent approach. The decision was not unanimous: Governor Stephen Miran favored an even more aggressive 50-basis-point reduction, reflecting concerns about downside risks to growth.

Equity markets were volatile following the announcement, with major indices mixed as Chair Powell framed the rate cut as a “risk management” measure rather than a response to underlying economic weakness. Treasury yields adjusted lower at the front end of the curve, while futures markets began pricing in a clearer trajectory of multiple cuts into 2026. The U.S. dollar softened slightly against major currencies, reflecting narrower interest-rate differentials.

From an economic perspective, the cut aims to ease financing conditions for households and businesses amid slowing momentum in consumer spending and investment. Lower borrowing costs could provide near-term support to housing and credit markets, though the Fed remains cautious about reigniting price pressures. Growth projections released alongside the decision showed modest real GDP expansion expected over the next several quarters, with inflation projected to move gradually toward the 2% target.

The policy shift suggests that the Fed is increasingly focused on supporting the labor market as risks shift toward weaker employment and softer growth. At the same time, the central bank faces the delicate task of maintaining credibility on inflation, which has not yet fully converged to target. This balance points to a gradual easing path rather than a rapid reversal of the tightening cycle seen in 2022–2023.

With the 2026 midterm election cycle approaching, monetary policy has become a focal point in Washington. Lawmakers from both parties are watching closely, with some criticizing the Fed for being too slow to ease amid labor market weakness, while others caution that premature cuts could entrench inflation. Although the Fed maintains its independence, policy moves at this juncture inevitably carry political implications, influencing not only economic sentiment but also the broader policy debate over fiscal priorities and financial stability.

Looking ahead, the trajectory of monetary policy will be strongly dependent on incoming data. Employment reports, inflation prints, and indicators of consumer demand will guide whether the Fed delivers the additional cuts projected for later this year. For investors and corporates, the environment remains one of cautious optimism: policy is becoming more accommodative, but economic uncertainty continues to demand careful monitoring.

Author:

Patrik Kohary

Capital Markets Analyst

References: