After nine years of negotiation, the EU and Indonesia have struck a landmark trade deal that will reshape how Europe engages with Southeast Asia’s largest economy. The Indonesia–EU Comprehensive Economic Partnership Agreement (IEU-CEPA), signed on 23 September 2025 in Bali, removes the bulk of tariffs, eases non-tariff barriers, and expands market access across goods, services, and investment.

For European businesses, this shouldn’t just be another trade pact. The region’s fourth-most populous nation and fastest-growing consumer base is opening its doors on such a scale. With implementation expected as early as 1 January 2027, companies that prepare now stand to capture significant first-mover advantage; those that delay may find themselves squeezed by rivals who acted earlier.

What the IEU-CEPA Deal Covers

Here are some of the most important terms and provisions:

Tariff removal /reduction

- 80-90% of Indonesian goods entering the EU will enjoy zero tariffs.

- On the flip side, a very large share (around 98%) of EU products will benefit from lower or zero tariffs entering Indonesia.

Non-tariff barriers (NTBs) addressed

- Includes simplification of customs, technical barriers, sanitary & phytosanitary (SPS) standards, rules of origin, intellectual property, and regulatory transparency.

Sensitive goods & sustainability concerns

- Covers palm oil, a long a contentious issue, and other sensitive commodities, with distinctions by end-use (e.g., palm oil in food vs. biofuels) and requirements to comply with EU deforestation and sustainability rules.

Rules of Origin & sectoral provisions

- Defines eligibility for tariff benefits, with specific measures on critical minerals, EV supply chains, local content, and streamlined customs processes.

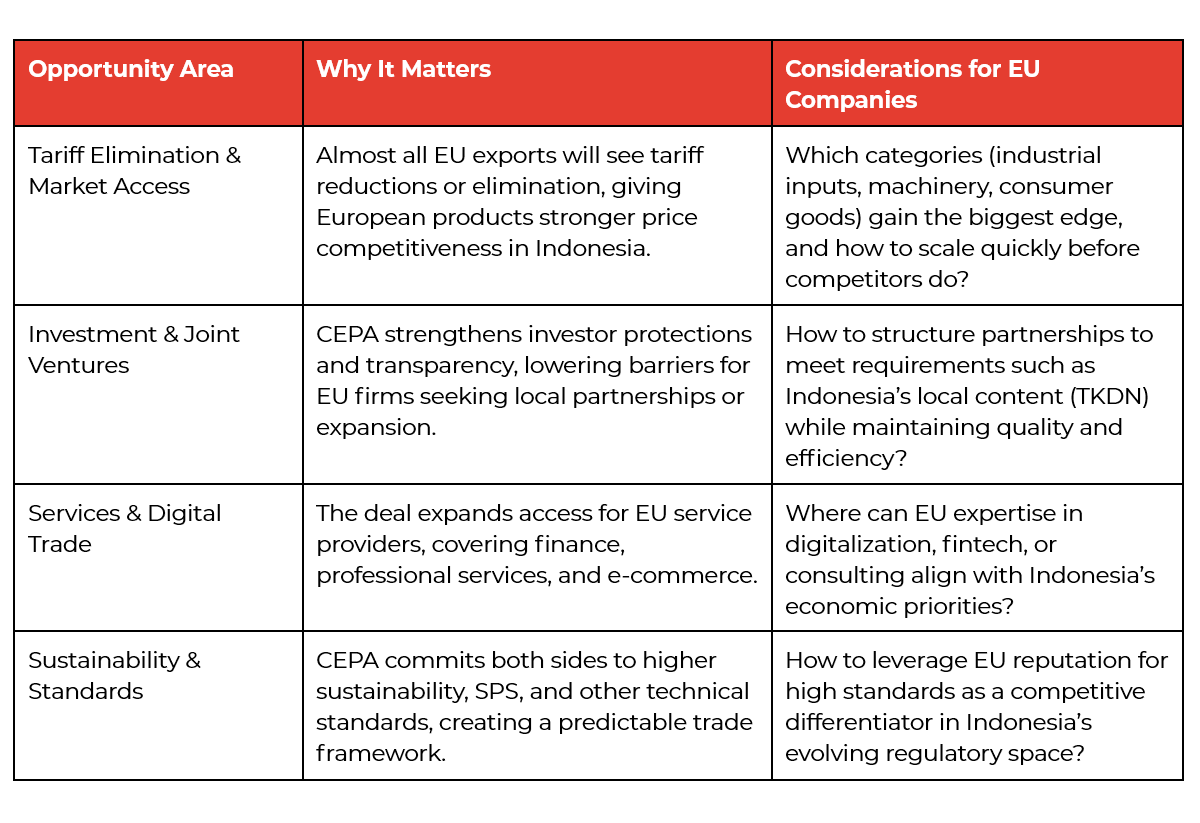

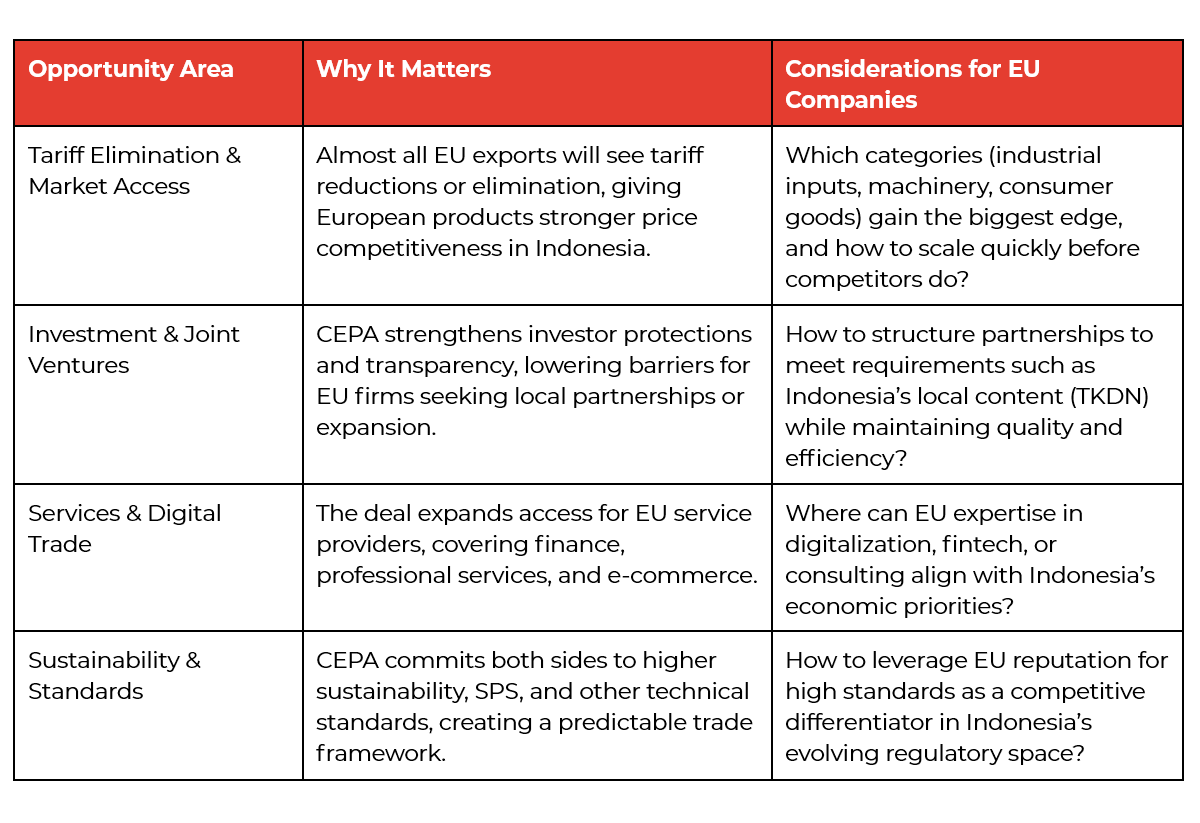

Opportunities for EU Companies under IEU-CEPA

Risks, Challenges & What to Look Out For

No agreement is without caveats. For EU companies to succeed, they’ll need to manage or mitigate some potential challenges:

- Regulatory compliance & sustainability requirements Compliance requirements in Indonesia can be complex, from local content rules (TKDN) to product standards, labelling, and certification (such as Halal). While CEPA eases many barriers, companies must still navigate evolving regulations and ensure alignment with both EU and Indonesian requirements.

- Ratification delays & implementation challenges

The deal must be ratified by all 27 EU member states, legal scrubbing, translations. The expected start (January 2027) is contingent on smooth ratification.

- Competition & local content

Indonesia will compete aggressively for foreign investment. Local firms will also adapt. EU firms must be ready for competitive pressure, ensuring cost competitiveness, adapting to local market & supply chain norms.

- Logistics, supply chain issues, non-tariff barriers

Even with tariff reductions, transport costs, infrastructure quality, bureaucratic delays, and standards alignment may pose challenges. EU firms will need local legal, procurement, tariff & regulation expertise.

Strategic Imperatives for EU Companies

For EU companies to fully leverage IEU-CEPA:

1. Due Diligence on Market Entry – Identify which products/services fall under low/zero tariffs, understand Indonesian regulatory landscape, including labelling or local content requirements.

2. Local & Joint Venture Partnerships – Local partners can help navigate distribution, regulation, logistics, cultural business practices.

3. Supply Chain Optimization – With improved access, consider moving more of the supply chain upstream/downstream in Indonesia (e.g., component manufacturing, assembly) to reduce costs and better serve ASEAN/Asia markets.

4. Sustainability & ESG Compliance – Environmental, social, traceability standards will be a key part of whether access is granted, especially for commodities.

5. Leverage ARC Group Expertise

- Advisory on navigating regulatory and certification requirements

- Strategy for market entry & partnership structuring

- Risk assessment & mitigation (trade law, environmental compliance)

- Identifying investment opportunities (e.g., in EVs, critical minerals, agrifood processing)

IEU-CEPA marks a pivotal moment in Indonesia-EU relations. For European companies, it presents both significant opportunity and serious responsibilities. Those who move early will master the regulatory landscape, form strong local partnerships, align with sustainability expectations, and can gain first-mover advantages in supply chains, in fast-growing consumer segments, in green tech and EV value chains, as well as in infrastructure and services.

Author:

Albert Halim

Associate