From Pandemic Spike to Structural Shift

The role of retail investors in U.S. equities has undergone a fundamental transformation over the past five years. Initially, the sharp increase in individual trading activity during the pandemic was regarded as a temporary phenomenon. Stimulus checks, remote work, and commission-free trading platforms brought millions of new participants into the market.

What followed, however, was not a reversion to pre-pandemic norms but rather a sustained elevation in retail activity. Prior to 2020, retail order flow rarely exceeded 10% of daily U.S. equity trading. In contrast, J.P. Morgan reports that retail activity reached 36% of total order flow on April 29, 2025, an all-time high and a clear indication that retail participation has reached levels that fundamentally reshape market dynamics[1]. This shift is anchored by lasting changes in technology access, commission-free trading, and investor education, suggesting it will endure beyond cyclical market phases.

Evidence of Elevated Participation

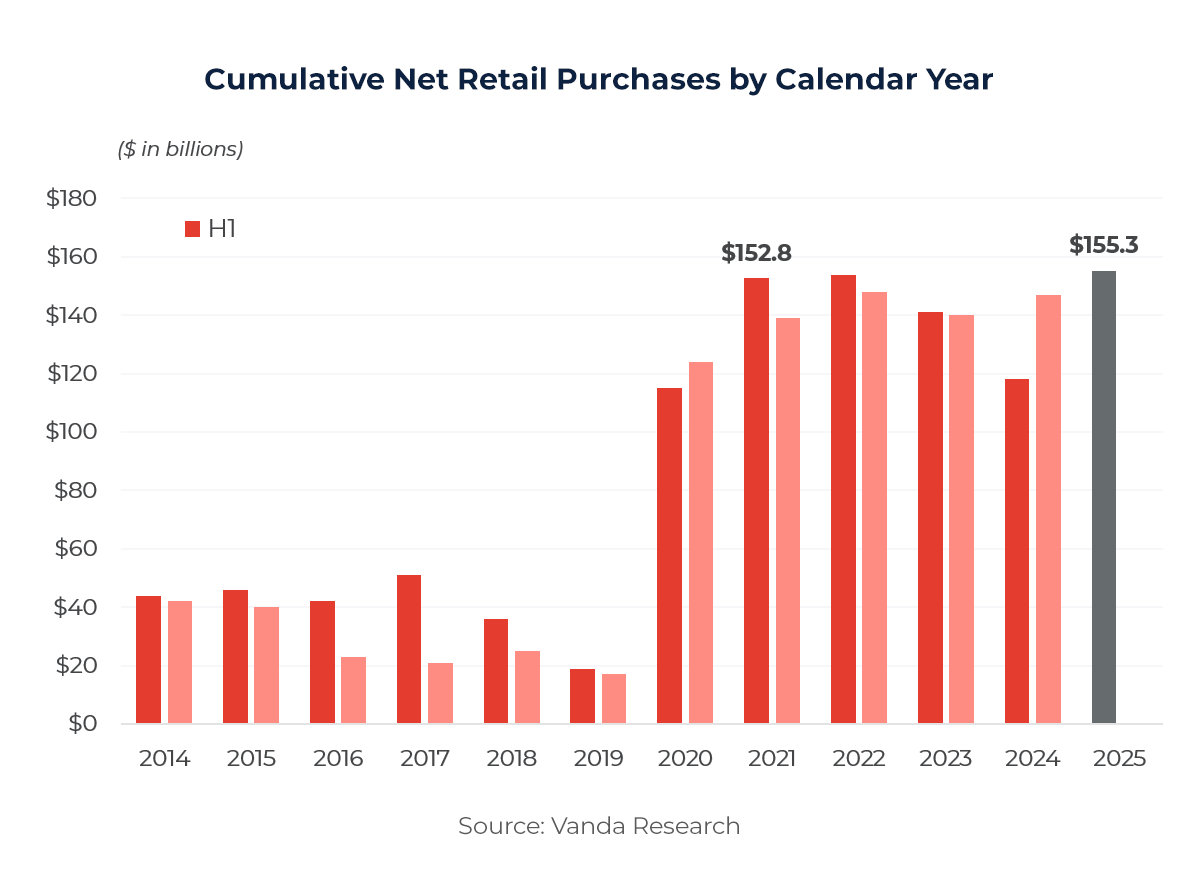

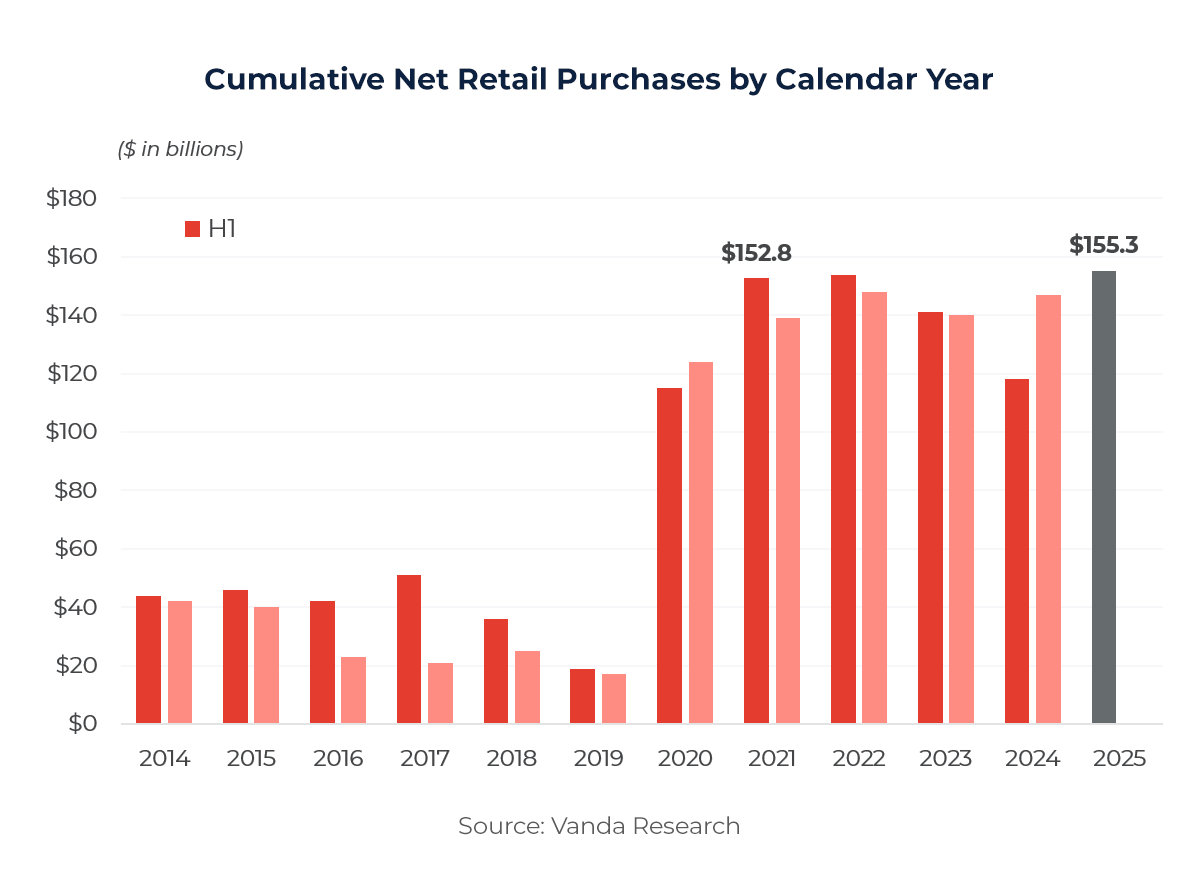

Vanda Research reported that retail investors purchased a net $155.3B worth of single stocks and ETFs in the first half of 2025. This was the largest net inflow of retail investor cash since Vanda began tracking the data in 2014, surpassing the previous high of $152.8B recorded in the first half of 2021 during the height of the meme-stock mania and pandemic stimulus trading wave[2]. In addition, Vanda estimated that retail investors added an average of $1.3B to the market each day in the first half of 2025, a 21.6% increase relative to the daily averages in the same period of 2024[2].

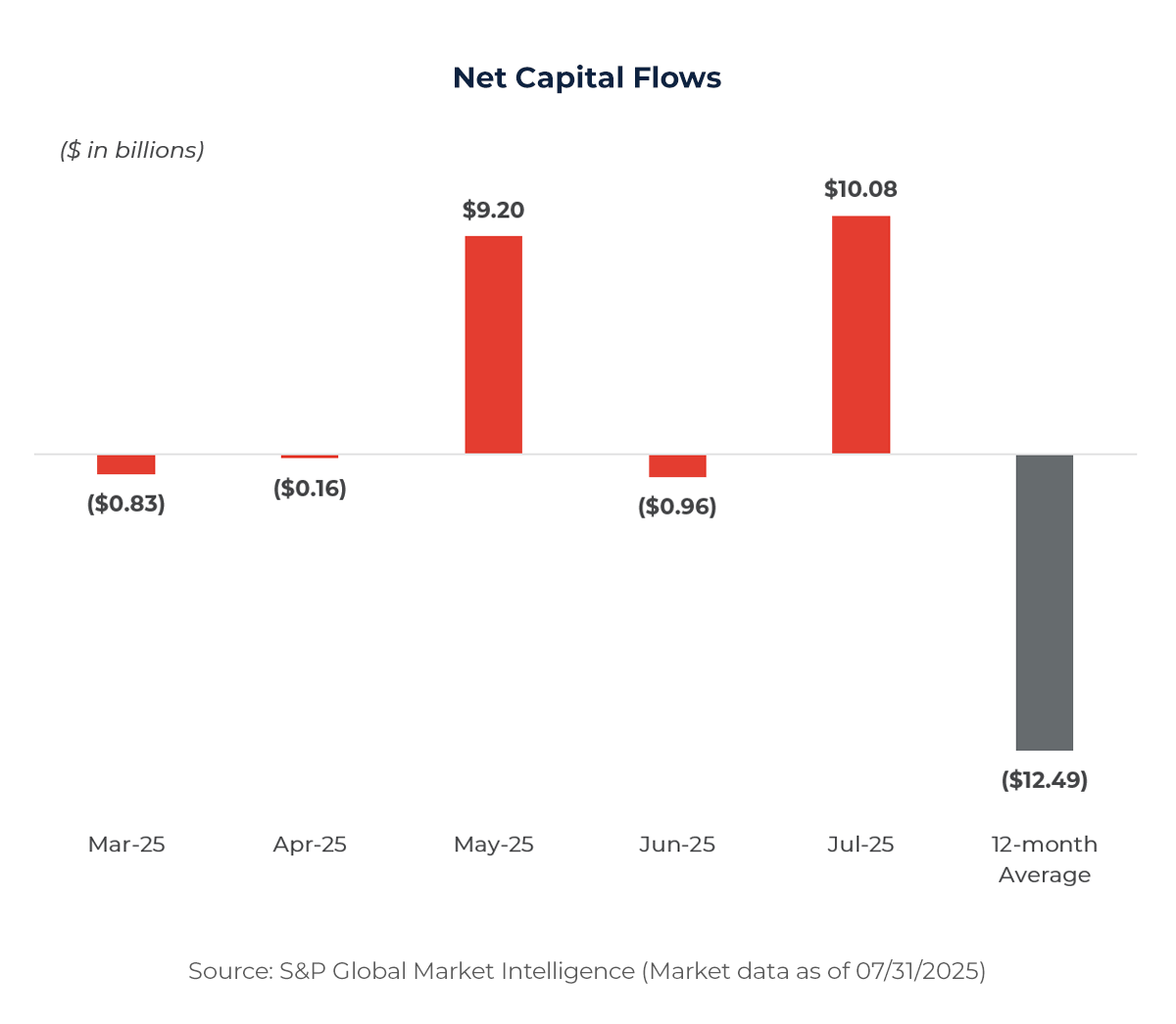

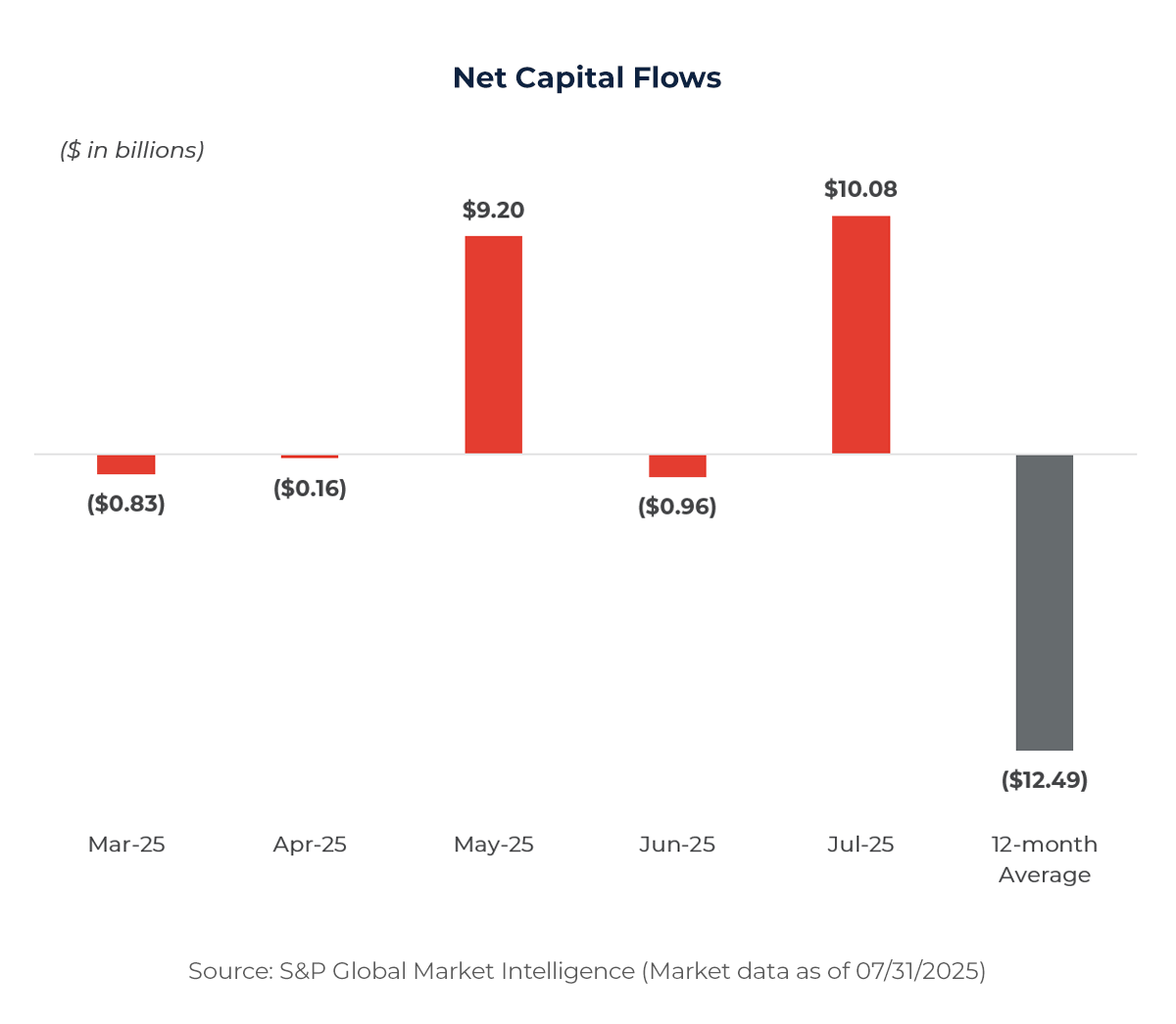

S&P Global Market Intelligence highlighted the variability of monthly flows. Retail investors recorded modest outflows of $0.83B in March and $0.16B in April[3], followed by a sharp rebound to a $9.20B inflow in May[4], a small outflow of $0.96B in June, and a renewed surge of $10.08B in July. While the 12-month average in July remains negative at –$12.49B, reflecting the cumulative effect of earlier sustained outflows[5], the strong inflows in May and July suggest that sentiment has turned. This reversal suggests that retail investors are re-entering the market with conviction, supported by easing macro uncertainties, particularly the resolution of tariff concerns that had previously weighed on sentiment.

In a separate note, J.P. Morgan estimated that retail investors purchased a net $270B in U.S. equities during H1 2025, with potential for an additional $360B over the second half of the year[6]. Separately, other market estimates suggest that retail now accounts for approximately 20.5% of daily equity trading volume, a sharp increase from pre-pandemic levels[7].

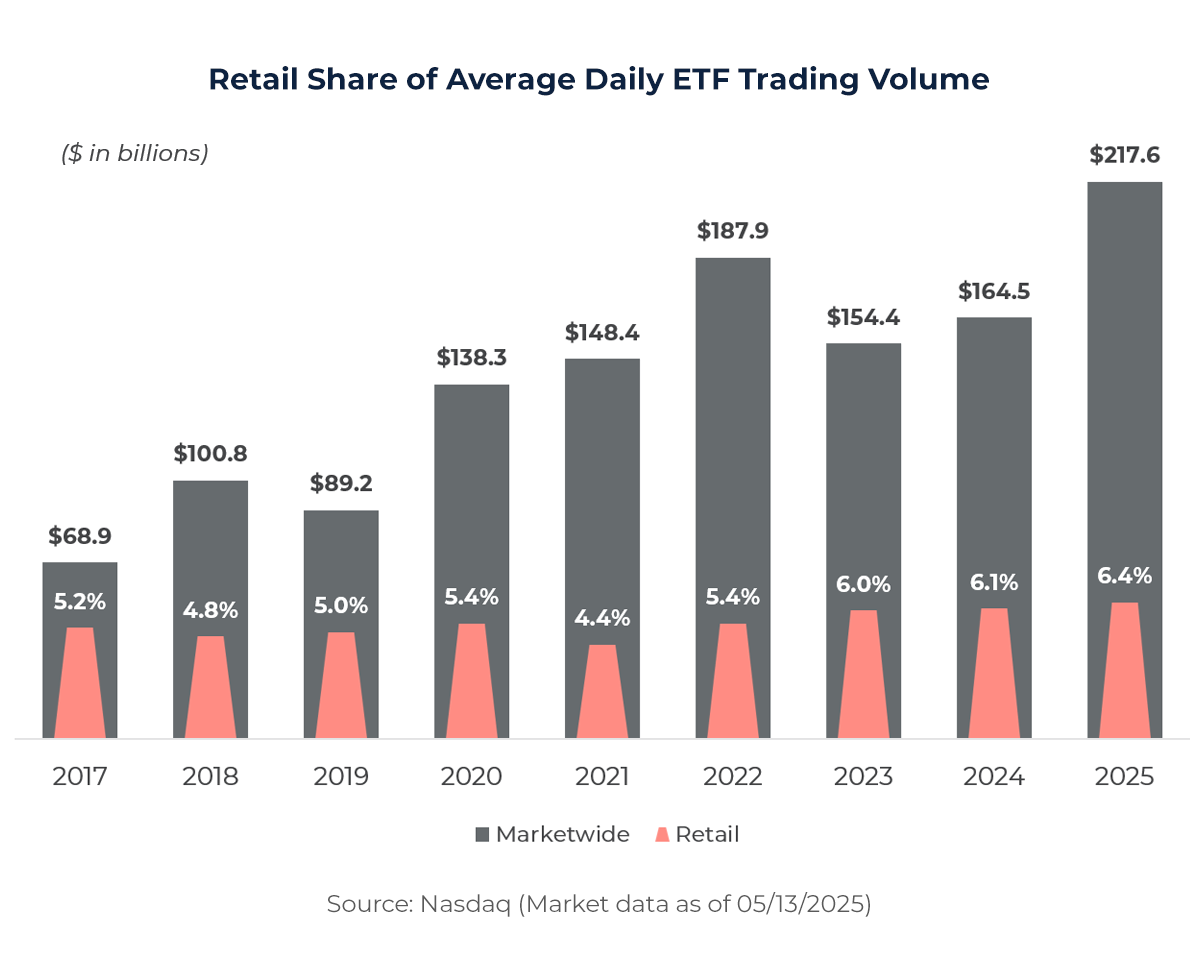

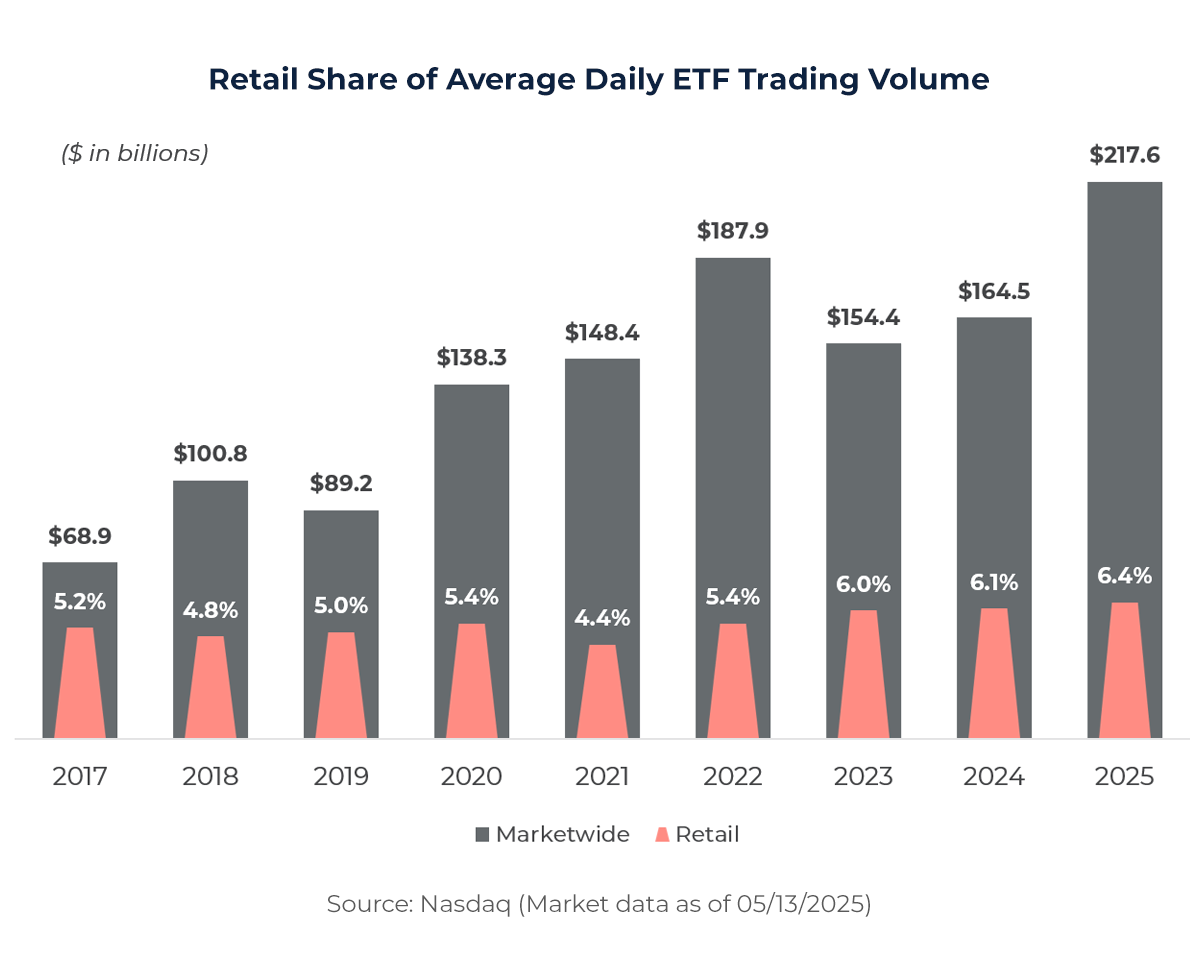

Retail participation in ETFs has shown steady growth, though it remains smaller relative to single-stock trading. Nasdaq data show that the share of ETF trading attributable to retail investors has risen from roughly 5.2% to 6.4% in recent years, highlighting a gradual but consistent increase in household use of diversified investment vehicles[8]. However, trading volume alone does not capture the full extent of retail engagement. Nasdaq’s 2025 ETF Retail Investor Survey shows that daily and weekly trading activity among retail investors increased by 6% and 8% year-over-year, respectively[9]. This trend is being driven by Gen Z, nearly half of whom trade on a weekly basis and 25% on a daily basis, reflecting behavior that increasingly resembles that of institutional investors.

Demographic Trends Among Retail Investors[7]

The retail investor base has become younger, more diverse, and better educated. Approximately 77% of Gen Z investors began investing before the age of 25, establishing a pipeline of long-term market participants. The average income of new investors is $54,000, reflecting growing participation from middle income households. Nearly half of new brokerage accounts were opened by investors from diverse ethnic communities, while women aged 18 to 35 increased market activity by 26% compared to the previous year. While urban investors account for two thirds of new accounts, while rural regions recorded a 19% increase, demonstrating broader financial inclusion. Education levels also support this trend, with 71% of retail investors holding at least a bachelor’s degree. Together these shifts suggest that retail participation is broad based and likely to remain a durable feature of U.S. capital markets.

Flow Behavior and Market Interactions

Retail flows differ from institutional patterns in both timing and drivers. Retail investors are more sensitive to headlines and tend to deploy capital during periods of volatility, often buying when institutions are derisking. These flows are also highly thematic, with significant allocations to technology, artificial intelligence, and other growth sectors in 2025. This behavior has amplified rallies in large capitalization stocks while contributing to heightened volatility in sectors favored by households.

Another clear signal of this evolution is the growing demand for extended hours trading. Investors are increasingly reacting to macroeconomic releases, earnings announcements, and geopolitical developments in real time. NYSE reports that extended hours activity now represents 11% of daily volume, with more than 1.7B shares traded outside of traditional sessions, more than double the level in 2019. Pre-market trading has been the primary driver, growing 15-fold since 2019 and now accounting for over 55% of extended hours volume[10]. This expansion highlights how retail investors, often more flexible in trading times, are shaping liquidity well beyond standard market hours.

Benefits and Risks of Elevated Retail Participation

The rise in retail investors provides clear benefits but also introduces new risks. On the positive side, a larger retail base enhances liquidity and market depth, improving execution for issuers. Persistent inflows have helped sustain the 2025 bull market, particularly during periods when institutional positioning has remained cautious. Broader household participation also diversifies the shareholder base and provides additional sources of demand.

At the same time, elevated retail participation creates challenges. Options-driven activity can amplify short-term price swings around earnings or macro events. Concentrated flows into a narrow set of popular names will also increase the risk of abrupt reversals. Measurement challenges also remain, since different providers use different methodologies to estimate retail share, complicating flow analysis.

Implications for Public Listings

For issuers, the rise of retail investors has direct implications for capital formation and aftermarket performance.

In the IPO market, a stronger retail presence broadens demand beyond institutional channels. For consumer-facing companies, retail appetite can deepen order books and provide more resilient aftermarket trading. A recent example is Gemini Space Station, which disclosed in its S-1 filing that up to 30% of its Class A common stock would be offered to retail investors through platforms like Robinhood, SoFi, Futu, Moomoo, and Webull[11]. The offering was heavily oversubscribed, with demand exceeding available shares by more than 20-fold, yet the company and its underwriters capped the IPO proceeds at $425M[12]. This outcome underscored the strength of retail demand and validated the strategy of reserving a significant portion of an IPO for retail investors.

In de-SPAC transactions, newly listed companies frequently see trading dominated by retail flows. This dynamic can support valuation rerating by broadening the investor base, but it also exposes issuers to sentiment driven volatility. To succeed, companies must adapt their investor relations strategies to engage retail audiences with clear and accessible narratives.

Conclusion

The evidence increasingly indicates that retail participation is a permanent and influential component of U.S. equity markets. Issuers can no longer view individual investors as peripheral. Retail now plays a central role in shaping demand, liquidity, and valuations.

For ARC Group, this structural change reinforces the need for integrated capital markets strategies. Whether advising on IPOs, structuring SPACs, or executing de-SPAC transactions, ARC Group incorporates retail flow dynamics into distribution planning, aftermarket support, and financing solutions. By aligning issuers with both institutional and retail demand, ARC Group ensures that clients are positioned to capture the opportunities and also mitigate the risks created by the rise of the retail investor.

References:

[1] JPMorgan (2025): Who is buying U.S. equities? | J.P. Morgan Asset Management

[2] MarketWatch (2025): Investors traded a record $6.6 trillion worth of stock in the first half of 2025 – MarketWatch

[3] S&P Global (2025): US retail equity investors bounce from heavy selling to buying in April | S&P Global

[4] S&P Global (2025): Institutional investors ramp up US stock selling in May | S&P Global

[5] S&P Global (2025): Retail investors boost US equity buying, institutions slow stock selling in July | S&P Global

[6] Business Insider (2025): Retail Traders Are in the Driver’s Seat of the Latest Rally, Barclays Says – Business Insider

[7] CoinLaw (2025): Retail Investing Statistics 2025: Key Trends Shaping the Market • CoinLaw

[8] Nasdaq (2025): Retail Trading Growth in Perspective | Nasdaq

[9] Traders Magazine (2025): Retail Investors Fuel Push Toward 24-hour U.S. Equity Trading – Traders Magazine

[10] NYSE (2025): The early bird gets the worm

[11] Gemini (2025): S-1 Prospectus 424B4

[12] Crypto News (2025): Gemini Raises $425M In Heavily Oversubscribed IPO