“内卷Neijuan” or “involution”, isn’t a slogan; it’s showing up in P&Ls and market multiples. In autos, the price war has reached the point where BYD posted its first quarterly profit drop in 3½ years, explicitly pinned on price-cut competition; the company also trimmed expansion and slowed production. In solar, China can produce roughly twice the panels the world can buy in 2025; industry leaders are discussing a CN¥50 billion fund to shut ~⅓ of polysilicon capacity, a direct response to losses and overcapacity.

Markets have noticed. A-share valuations by price-to-book sit below long-term averages, with the CSI 300’s P/B sitting at ~1.27 vs ~2.5 in 2020, well below its long-term average of ~1.55. In other words, even with a rebound, Chinese large-cap equities continue to trade at a valuation discount relative to both their historical norms and to regional peers.

Translation for CEOs: staying “China-only” means living with structural margin pressure and multiple compression. That’s the backdrop against which we evaluate M&A.

What the evidence says about M&A and how to use it

The academic record is nuanced (and that’s the point). A difference-in-difference study of 1,616 M&A deals by Chinese listed firms found that, on average, domestic transactions produce stronger short-term market value responses than cross-border ones. At first glance, this might suggest sticking to domestic consolidation. But in reality, much of the weakness in historic outbound performance reflects the nature of the deals that were being done. Many of the large outbound transactions of the mid-2010s – Wanda’s acquisition of AMC Theatres, Anbang’s purchase of the Waldorf Astoria, HNA’s leveraged stakes in Hilton and Deutsche Bank, Fosun’s takeover of Club Med – were seen by investors as headline-driven, misaligned with core businesses, and prone to regulatory pushback.

Other research shows that cross-border deals can generate positive abnormal returns when they are targeted correctly, where there are genuine industry and regional fit, governance discipline, and a manageable deal size. In practice, this could be pursuing mid-market acquisitions in ASEAN or the GCC, where host governments are actively welcoming foreign partners and where integration can be planned with 100-day blueprints. These are the transactions that investors reward, because they deliver international diversification and strategic repositioning that domestic consolidation cannot. For companies squeezed by involution, only disciplined outbound M&A offers a credible path to re-rating and long-term growth.

Outbound M&A as defensive survival (not just ambition)

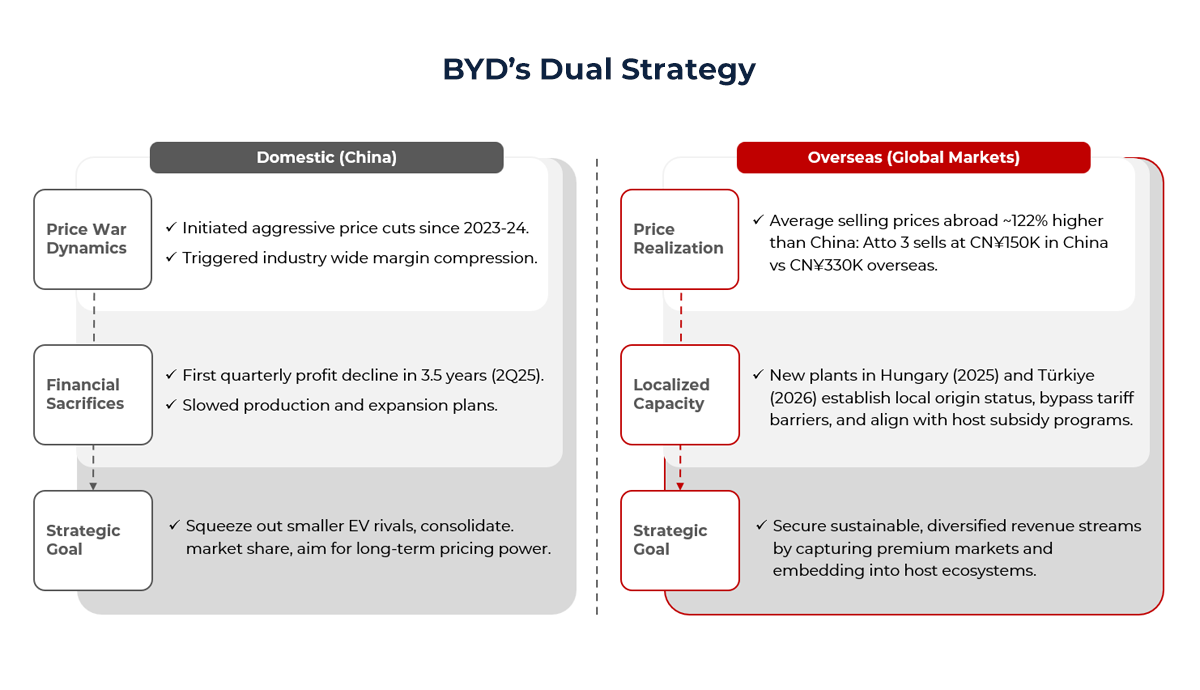

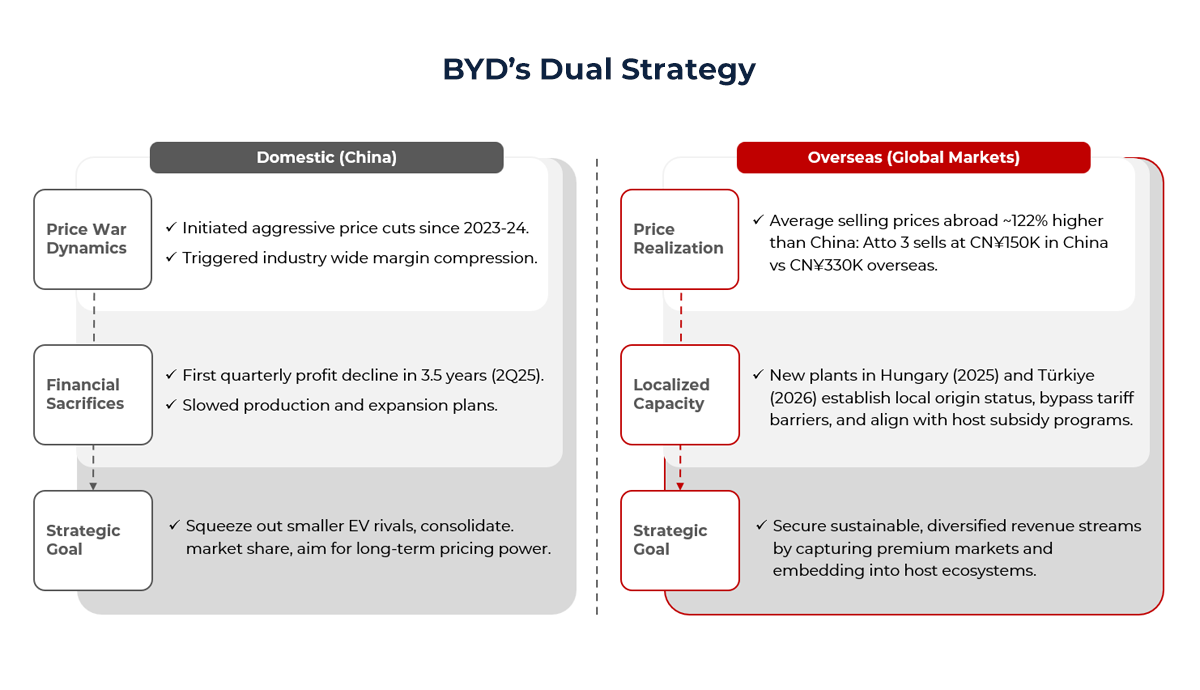

In sectors where involution is acute (EVs, e-commerce, certain consumer tech), purely domestic exposure is an existential risk. Take EVs as an example. In China, BYD has deliberately triggered price war, cutting margins to force smaller competitors out and consolidate market share. That strategy may ultimately give BYD future pricing power, but for the industry overall it is a textbook case of involution: profits collapse long before equilibrium is restored.

Yet the same company demonstrates the logic of going abroad. BYD sells its cars at a 122% premium in overseas markets and has announced plans to double its foreign sales to 800,000 units in 2025. This contrast highlights two dynamics: involution is not just a social catchphrase but a measurable reality shaping China’s EV sector, and international markets offer healthier margins and demand conditions that domestic competition cannot.

Macroeconomic Timing

The macro environment now favours disciplined outbound M&A by Chinese corporates, for three practical reasons:

1) Policy driven supply-chain diversification

The U.S. has held tariffs at 25–50% on batteries, solar inputs, and strategic goods, while the EU has imposed duties and local-content rules across clean-tech supply chains. Exporting directly from China now means margin erosion, but producing through friendly corridors such as ASEAN, GCC, or BRI partner markets can restore competitiveness by meeting rules-of-origin requirements and integrating into subsidy-linked supply chains. Capital flows already reflect this shift: in H1 2025, Chinese ODI into Belt and Road countries rose ~20.7% YoY, and ASEAN drew a record $230bn of FDI in 2023, cementing its role as a global magnet for electronics, renewables, and logistics. For Chinese corporates, outbound M&A into these hubs is the fastest way to gain “local origin” status, bypass tariff walls, and secure policy incentives, without the delays of greenfield projects.

2) Explicit policy incentives from host markets.

- Saudi Arabia’s Regional Headquarters (RHQ) Program: Firms without an RHQ in the Kingdom are barred from government contracts, while RHQ holders enjoy tax exemptions, eased Saudization quotas, and preferential procurement.

- UAE’s Operation 300B: Targeting AED300 billion (US$82B) industrial GDP by 2031, backed by >AED40 billion (US$11B) in Emirates Development Bank financing and local-content (ICV) procurement mandates. These policies mean that buying into local platforms via M&A is the quickest route to market access.

3) Entry valuations abroad remain attractive.

In ASEAN and the Gulf, mid-market assets in sectors such as logistics and industrial services have recently transacted in the ~7–8x EBITDA range, particularly in fragmented subsegments that offer consolidation upside. Non-oil industries in the Gulf also continue to trade at moderate valuation levels relative to global peers, creating accessible entry points. These pockets of valuation discipline, though not universal, are concentrated in companies in the US$400M–US$1B revenue bracket, which are increasingly central to regional growth agendas. For Chinese corporates, this creates a targeted M&A window to acquire accretively across priority sectors.

How ARC Group Can Help

ARC Group doesn’t just advise; it bridges markets and narrows execution gaps. With a presence across Asia, the Middle East, and Western markets, ARC supports clients through the full M&A lifecycle, from target sourcing and due diligence to regulatory navigation and post-merger integration. In past mandates, we have structured cross-border acquisitions to minimize value leakage, align governance across jurisdictions, and ensure integration discipline from day one. Our ability to synchronize strategy, valuation, and execution globally is what differentiates ARC. For Chinese corporates under pressure from domestic involution, ARC delivers access to the right mid-market targets and executes transactions that turn outbound M&A from a defensive necessity into a platform for sustainable global growth.

Author:

Frazer Lee

M&A Intern

References