As Jesus Emilio Hoyos, Partner at ARC Group, states,

“Short selling should not distract issuers. It’s irrelevant. Focus on core business fundamentals, and stock performance and investor confidence will follow.”

What Are the Mechanics of Short Selling?

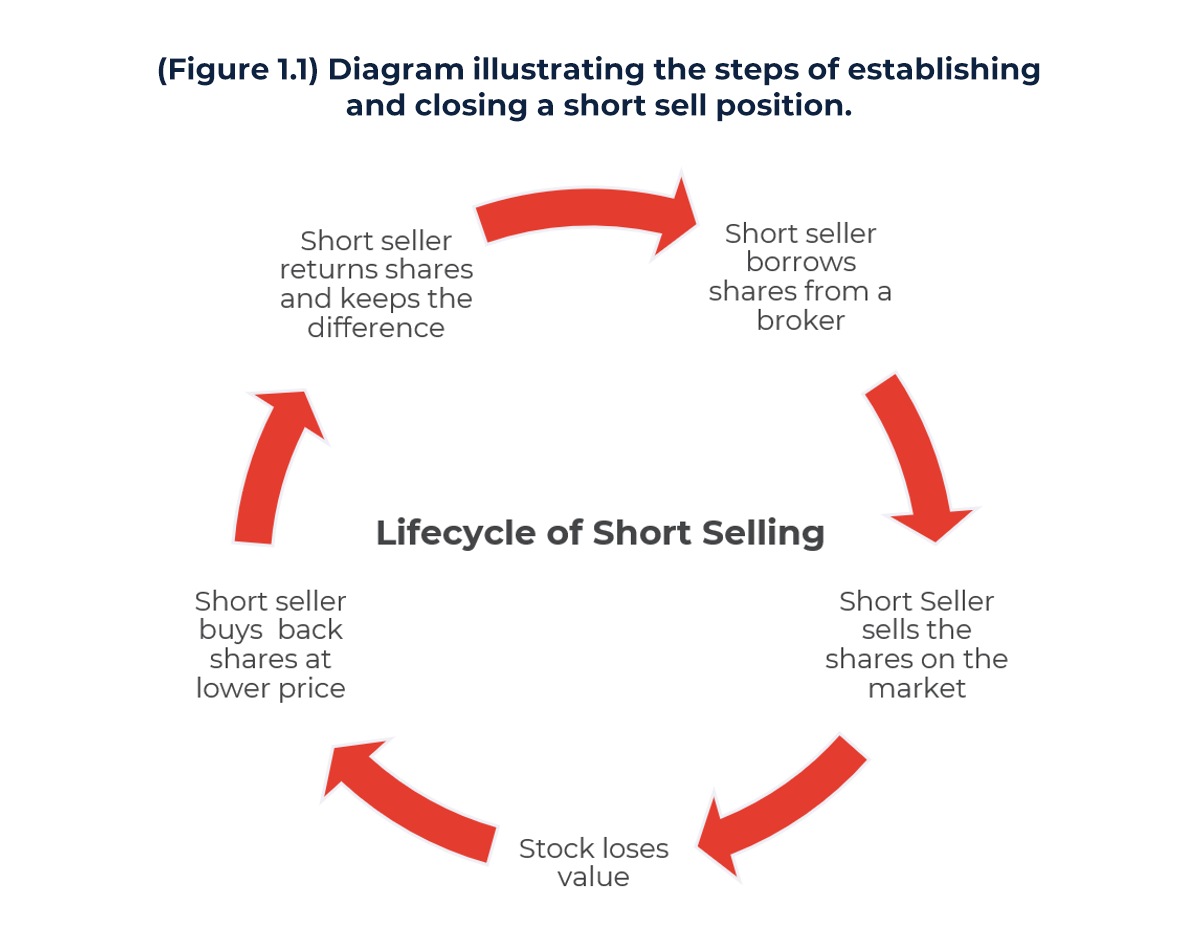

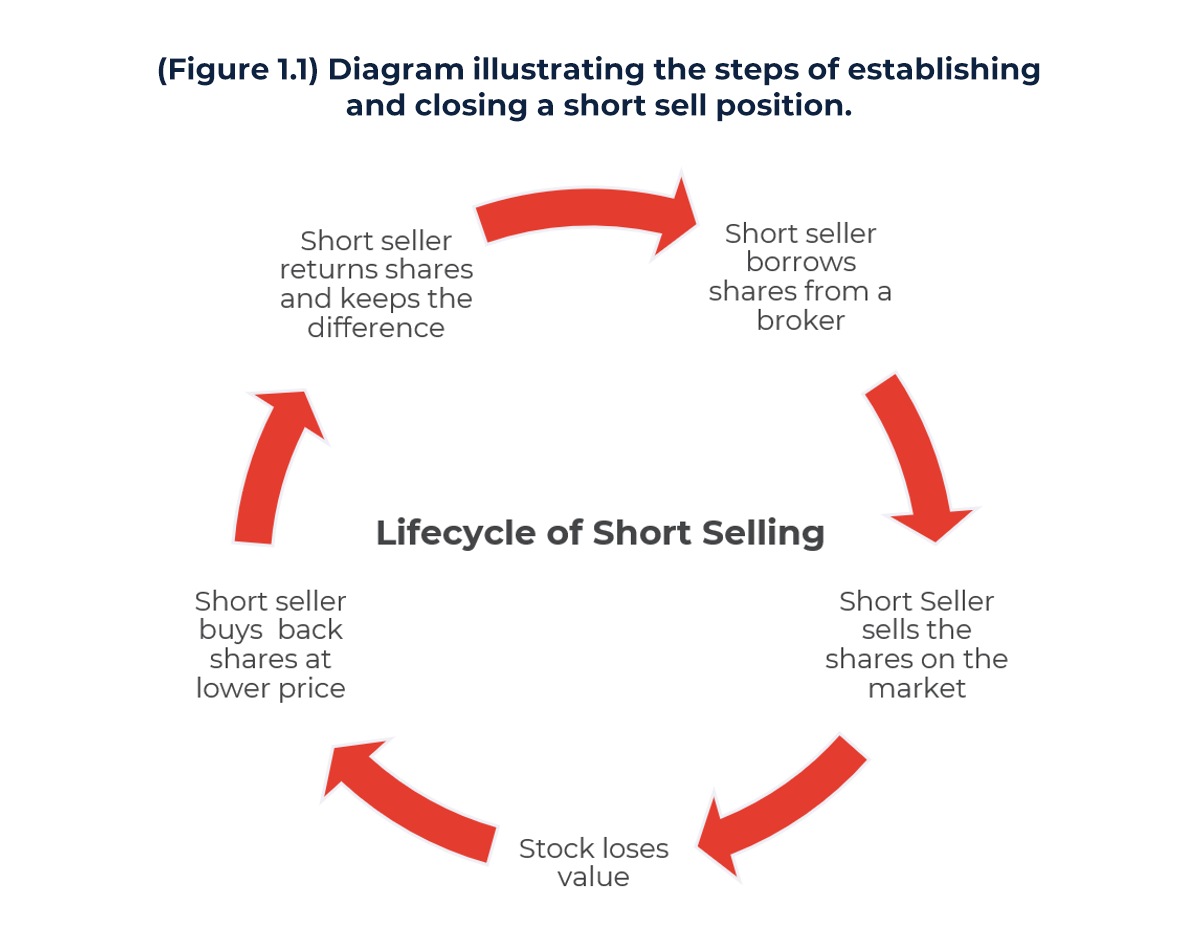

Short selling is a disciplined process governed by the SEC’s Regulation SHO, designed to maintain market integrity while allowing investors to express bearish views. The process involves an investor borrowing shares from a broker or lender, typically paying a borrowing fee based on the stock’s availability and demand. These shares are sold immediately in the open market, creating a “short” position. The investor intends to repurchase the same number of shares at a lower price in order to return them to the lender, thereby realizing a profit from the price difference (excluding fees and interest). For example, if a company’s stock trades at $50 post-IPO, an investor may borrow and sell 10,000 shares, generating $500,000. If the price falls to $40 due to market dynamics, they repurchase the shares for $400,000, earning a $100,000 gross profit.

Correcting the Misconception

Many issuers fear that short selling directly causes stock price declines, viewing it as a predatory tactic that undermines their market debut. This is a misconception rooted in misunderstanding market dynamics. Empirical research demonstrates that short selling does not initiate or amplify price drops; instead, it reflects existing overvaluations or market adjustments, helping prices converge to their fundamental value. For instance, if a stock is overpriced due to IPO hype, short sellers may step in to correct the imbalance, preventing unsustainable bubbles. During market downturns, short sellers often cover their positions and conduct open market purchases, adding buy-side volume and price stability. Issuers should see elevated short interest as a market signal to evaluate fundamentals, not as a cause for alarm. Misinterpreting short selling as harmful can lead to unnecessary distraction, diverting focus from strategic priorities.

Boosting Liquidity Through Short Selling

Short selling significantly enhances stock liquidity, a critical advantage for issuers post-IPO. By providing sell-side volume, short sellers complement buy orders, increasing overall trading activity. This narrows bid-ask spreads, reduces price volatility, and facilitates smoother price discovery, making the stock more appealing to institutional investors who value ease of entry and exit. For example, in IPOs with high short interest, trading volume often doubles compared to low-short-interest peers, improving liquidity metrics and enabling large transactions without significant price swings (Edwards & Hanley, 2010; Franz et al., 2024). This liquidity is particularly valuable in the volatile post-IPO period, as it attracts diverse investors and supports a stable trading environment. Rather than destabilizing the market, short selling ensures a dynamic, liquid stock.

Fundamentals Are Key: Focus on Execution

Issuers must not allow short selling to influence their strategic decisions. The path to public market success lies in prioritizing core fundamentals: delivering high-quality operations, consistently meeting or exceeding financial targets, maintaining regulatory compliance, and executing a proactive public relations strategy. A company that excels at streamlining operations, hitting revenue and earnings forecasts, adhering to SEC and FINRA regulations, and communicating transparently, builds a foundation that renders short interest irrelevant. Additionally, share buyback programs can also send positive signals to the market and effectively further mitigate any perceived short selling risk by reducing the supply of shares available for short sellers to borrow. Short sellers thrive on temporary mispricing, but robust fundamentals and proactive strategies drive long-term value (Managed Funds Association, 2025).

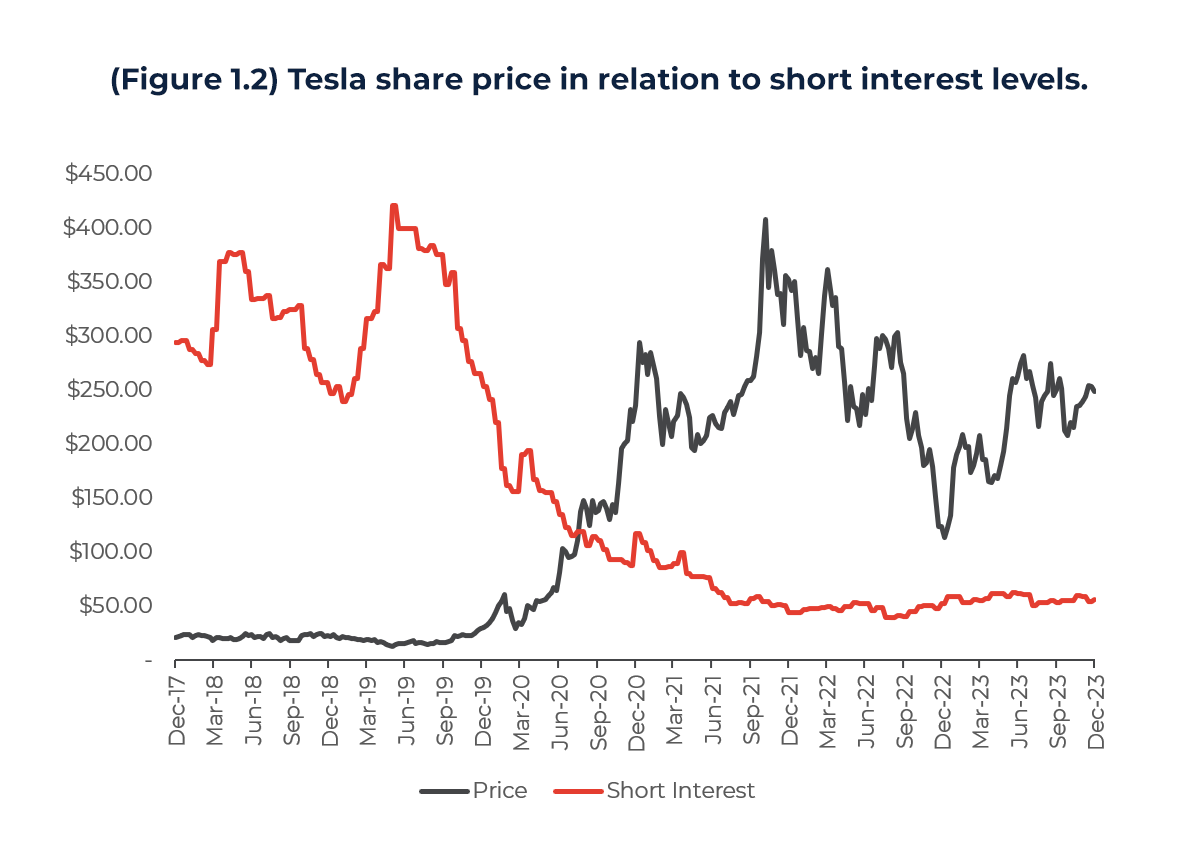

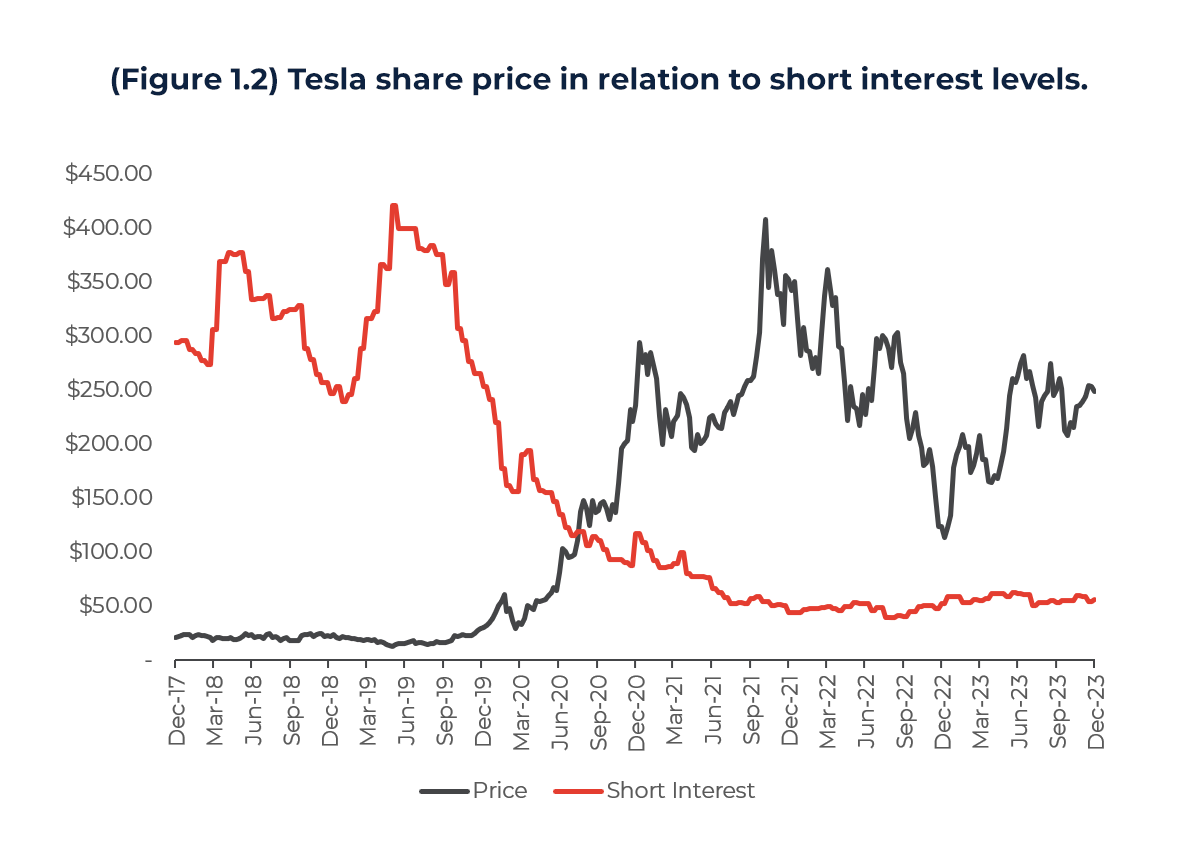

Tesla: A Case Study in Overcoming Short Selling

Tesla’s post-IPO trajectory exemplifies how a focus on fundamentals can eclipse short selling concerns. Following its 2010 IPO at $17 per share, Tesla faced intense short selling, with short positions peaking at over $11 billion by 2017, making it one of the most shorted U.S. stocks. Critics targeted production bottlenecks and ambitious targets, yet Tesla’s relentless focus on innovation, scaling manufacturing, and meeting delivery milestones drove its stock to surge over 2,000% in subsequent years. In 2019, short sellers incurred billions in losses as shares climbed, demonstrating that strong execution trumps short pressure. The high short interest also boosted liquidity, facilitating robust trading and attracting institutional investors, which further supported Tesla’s market resilience. This case underscores that short selling does not dictate a company’s fate; instead, it highlights the market’s efficiency as fundamentals prevail (Fortune, 2020).

Conclusion

ARC Group partners with companies to navigate the complexities of the US capital markets. We provide strategic insights and advisory to help issuers structure and manage their public listings effectively, ensuring access to the right financing solutions. By guiding clients through the listing process and beyond, we allow leadership teams to stay focused on building their businesses and strengthening fundamentals. Our holistic approach, from pre-IPO planning to long-term market positioning, empowers companies to engage investors with confidence and unlock sustainable growth.

Get in touch with our Capital Markets team here to learn how ARC Group can support your U.S. listing journey.

Author:

Callum Cox

Analyst

References:

- SEC (2022) ‘Key Points About Regulation SHO’, 31 May. Available at: https://www.sec.gov/investor/pubs/regsho.htm (Accessed: 2 September 2025).

- Investopedia (2024) ‘Short Selling: How It Works’, 20 November. Available at: https://www.investopedia.com/articles/investing/100913/basics-short-selling.asp (Accessed: 2 September 2025).

- Edwards, A.K. and Hanley, K.W. (2010) ‘Short selling in initial public offerings’, Journal of Financial Economics, vol. 98, no. 1, pp. 21-39. Available at: https://www.sciencedirect.com/science/article/abs/pii/S0304405X1000053X (Accessed: 2 September 2025).

- Franz, A. et al. (2024) ‘Price stabilization, short selling, and IPO secondary market liquidity’, Quarterly Review of Economics and Finance, vol. 91, pp. 122-130. Available at: https://www.sciencedirect.com/science/article/abs/pii/S1062976918303077 (Accessed: 2 September 2025).

- Managed Funds Association (2025) ‘Updated Intro to Short Selling Research Paper’. Available at: https://www.mfaalts.org/wp-content/uploads/2025/04/MFA-Updated-Intro-to-Short-Selling-Research-Paper.pdf (Accessed: 2 September 2025).

- Fortune (2020) ‘Short-Sellers Took on Elon Musk and Tesla in 2019 and Lost’, 10 January. Available at: https://fortune.com/2020/01/10/elon-musk-tesla-stock-short-sellers/ (Accessed: 2 September 2025).