How solution providers can lead the transformation toward safer, smarter industries

Across Southeast Asia, industrial growth is accelerating at a scale not seen since the early 2000s. Thailand, Vietnam, and Indonesia are becoming manufacturing powerhouses, drawing foreign investment and supply-chain shifts from China and beyond. New automotive plants, electronics assembly lines, and logistics hubs are coming online each quarter.

Yet behind this surge lies a fundamental tension: automation and robotics are advancing faster than the systems designed to keep people safe. The very technologies powering growth – high-speed machinery, autonomous vehicles, and advanced manufacturing processes – are also reshaping what “safe operations” mean.

For providers of industrial safety solutions, this transformation opens a new frontier. Factories are under mounting pressure to meet international standards, and their leaders increasingly see safety not as a compliance cost but as a core enabler of competitiveness. Those who can help them get there – with credible, scalable solutions – will shape the next decade of industrial growth in Southeast Asia.

1. A new reality for industrial safety

In the past, factory safety in the region was largely reactive. Barriers were installed after incidents, and audits focused on paperwork rather than prevention. That approach no longer works. Global OEMs now require suppliers to demonstrate world-class safety systems before contracts are even signed. Governments have strengthened enforcement, and sustainability reporting has pushed safety into board-level metrics.

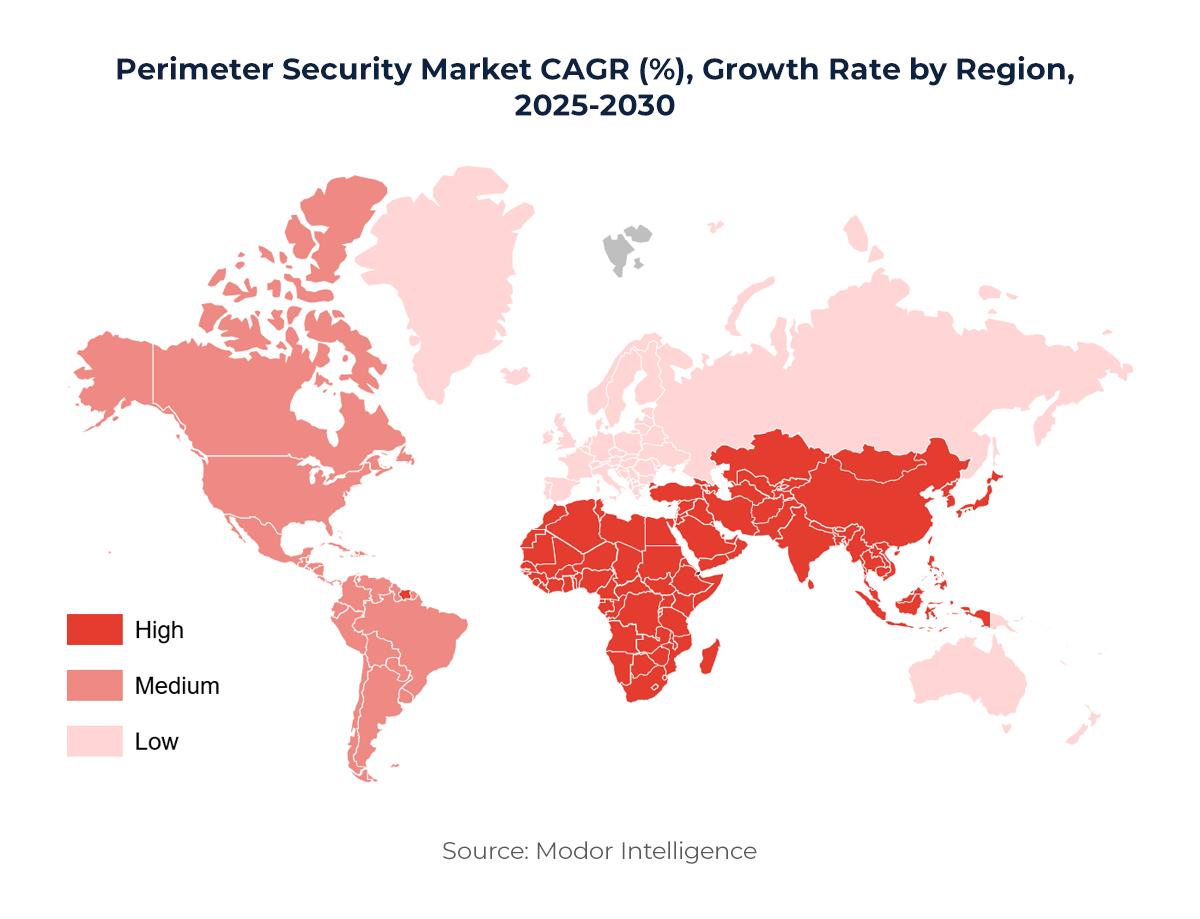

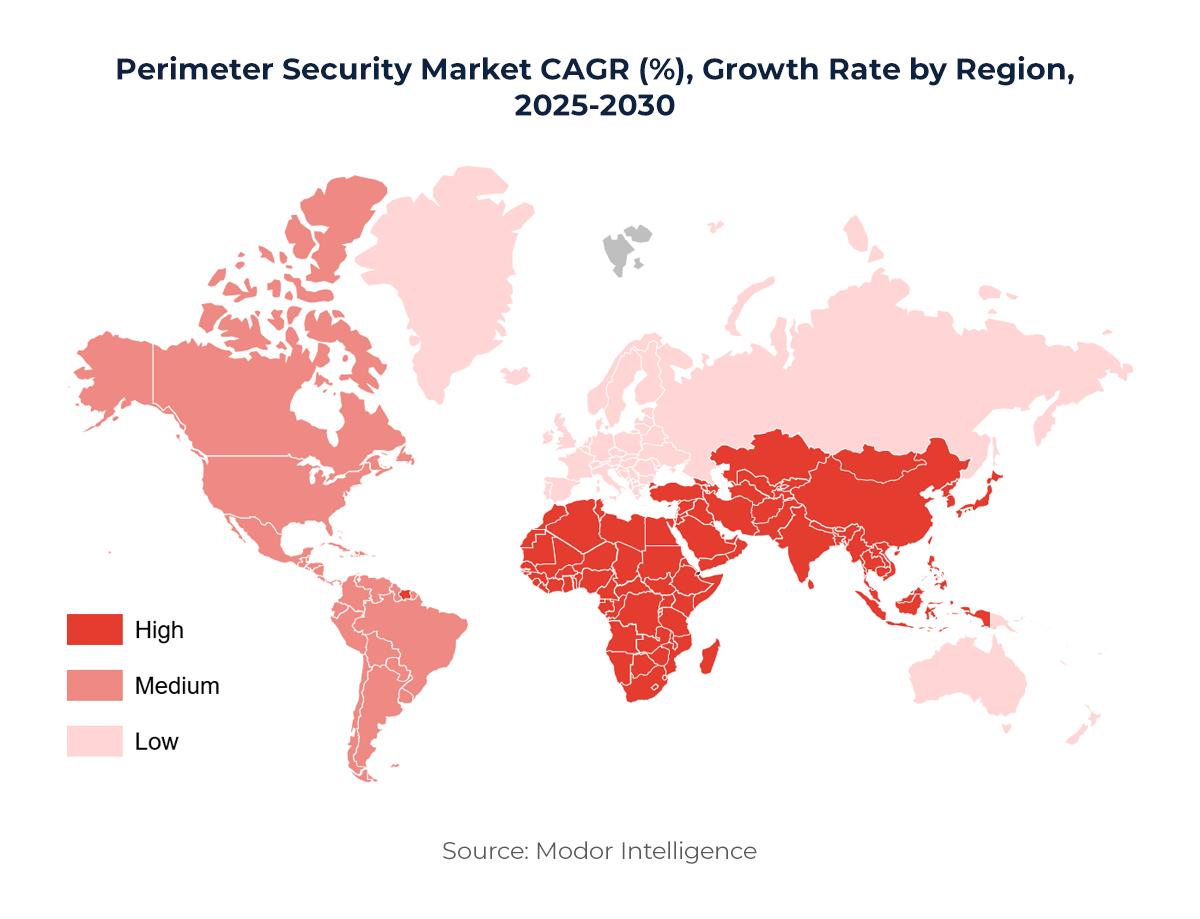

At the same time, the rise of robotics has created an entirely new category of risk. Humans now work alongside machines that move faster, heavier, and more autonomously than ever. Effective perimeter control including fencing, interlocks, and zone management has become essential. The Asia-Pacific perimeter security market is projected to grow at nearly 12 percent annually through 2030, surpassing USD 45 billion, fueled by automation, smart-city programs, and hyperscale industrial investment.

The opportunity is clear: safety systems are no longer optional infrastructure, they are the invisible architecture that makes automation viable. First movers who build this architecture now win preferred-supplier status, secure multi-site rollouts, and lock in recurring service revenue.

2. From compliance to capability

The companies leading this transition are redefining what safety means. They are not merely installing protective equipment; they are embedding safety into design, process, and culture. Factory layouts are being reengineered to separate human and robotic work zones. Air-filtration systems are evolving from environmental afterthoughts into performance assets that improve precision, reduce downtime, and help retain skilled workers. Data from digital sensors and predictive analytics is feeding into integrated control rooms that monitor both machine performance and human exposure in real time.

This movement toward “engineered safety” reflects a deeper mindset shift, moving from checking boxes to building capability. In this environment, a well-guarded, well-ventilated, and well-monitored factory is not only compliant but also more productive, more attractive to global buyers, and better positioned for the next phase of growth.

Customers increasingly expect integrated systems that deliver measurable improvements in uptime, audit readiness, and workforce confidence. Providers that link their solutions directly to operational performance move from being seen as suppliers to being regarded as partners in business excellence. This evolution favors comprehensive, performance-driven offerings: modular guarding aligned with automation strategies, air-filtration technologies connected to energy and maintenance analytics, and digital platforms that make compliance and exposure visible in real time.

3. Southeast Asia’s moment of acceleration

Government programs across Southeast Asia are converting policy into concrete demand for modern safety systems. Thailand’s Smart Factory incentives link automation funding to verified safety standards. Indonesia’s K3 expansion is bringing mid-tier manufacturers into scope. Vietnam’s Safety Culture initiatives are embedding ISO 45001 and CE-aligned practices across industrial zones. The net effect is more buyers required to upgrade, with timelines tied to program milestones rather than discretionary budgets.

This environment creates a larger and more predictable addressable market. Specifications are converging toward international norms, which favors certified solutions and proven reference designs. Because upgrades are often tied to audit readiness and incentive eligibility, purchasing cycles shorten and projects move from optional to required, improving conversion rates and reducing pre-sales friction. Demand is also shifting toward multi-site rollouts and lifecycle agreements. As manufacturers standardize safety architecture across facilities, the winning providers secure network-wide deployments, recurring revenue for inspections and filter changes, and data services that keep compliance visible.

At this stage, market entry and segmentation determine who captures the growth. We help safety providers identify the fastest converting buyer segments, pinpoint countries and corridors where policy-driven budgets are most active and prioritize opportunities where certification alignment and reference ability can accelerate adoption.

4. How safety providers can win

To capture momentum, international providers should align go-to-market models with policy programs, localize certification pathways, and partner with regional integrators to deliver scale. Fast-response service teams help meet program timelines. Demonstration cells and pilot installations that map directly to government or buyer checklists de-risk decisions and shorten time to contract.

Leaders translate safety into business outcomes. They speak in terms of uptime, audit readiness, and brand protection, not only equipment specifications. They understand the dual mandate manufacturers face: comply with international standards while improving operational efficiency. This requires integrated solutions with modular design, lifecycle support, and measurable results, delivered consistently across multiple countries and facility types. Above all, it requires trust, built through transparent performance data and reliable service.

Here, account strategy is decisive. We work with providers to map OEM and tier-supplier ecosystems, understand their audit and safety requirements, and design pursuit plans that address specific pain points and buying criteria. The goal is preferred-partner status that unlocks multi-site rollouts and durable, recurring relationships.

5. Acting on the opportunity

The window to lead in Southeast Asia’s safety transformation is open now but will narrow quickly as regulations mature and local competitors adapt. Early movers that align with policy programs, localize their certification pathways, and establish reference projects will define procurement benchmarks for years to come.

For safety providers, this is not the time for incremental steps. The most effective path forward is targeted investment and rapid engagement—deploying demonstration sites, securing pilot partnerships, and forming regional alliances before mandates and buyer preferences are fully set.

This is where specialized guidance and local insight become essential. Providers entering or expanding in Southeast Asia benefit from support that identifies where demand is strongest, which industries are ready to convert, and how to engage key buyers and regulators with the right positioning. Strategic advice on market segmentation, account targeting, and partnership building ensures that commercial efforts align with policy momentum and deliver faster, more sustainable growth.

In conclusion, safety is not a cost of doing business, it is the foundation that will determine who captures the next wave of industrial opportunity in Southeast Asia. The factories that thrive will be those where workers, machines, and systems operate in harmony. And in a market evolving this rapidly, success will belong to those who act early, build credibility quickly, and scale before the rest of the field catches up.

Author:

Chulisa Nguyen

Associate