Introduction

The global financial and strategic landscape is experiencing a tectonic realignment. Where cross-border investment once concentrated on transatlantic deal flows and transpacific capital movement, we are now witnessing the emergence of a strategic corridor defined not by geography alone, but by the alignment of policy, ambition, and macroeconomic convergence: the corridor between the Middle East and Asia.

While energy trade has long served as the spine of Middle East–Asia engagement, the current wave of M&A activity signals a shift in both intent and depth. What began as resource-for-infrastructure diplomacy has evolved into bilateral strategic investment across high-growth verticals—ranging from renewable energy and digital infrastructure to MedTech, food security, and logistics. Sovereign wealth funds (SWFs), public-private funds, family offices, and conglomerate across the Gulf Cooperation Council (GCC) are rebalancing eastward, both to hedge geopolitical exposure and to harness Asia’s next-decade growth trajectory.

Against this backdrop, ARC Group offers an in-depth analysis of the forces shaping this corridor. Through detailed examination of transaction precedents, sector-specific investment patterns, regulatory complexity, and strategic rationales, we demonstrate why the Middle East to Asia corridor is more than a passing trend—it is becoming one of the defining theatres of global mid-market M&A. In doing so, we aim to contextualize this evolution for corporate stakeholders, institutional investors, and financial sponsors seeking to position themselves in this realignment.

I. Capital Reorientation: From West to East

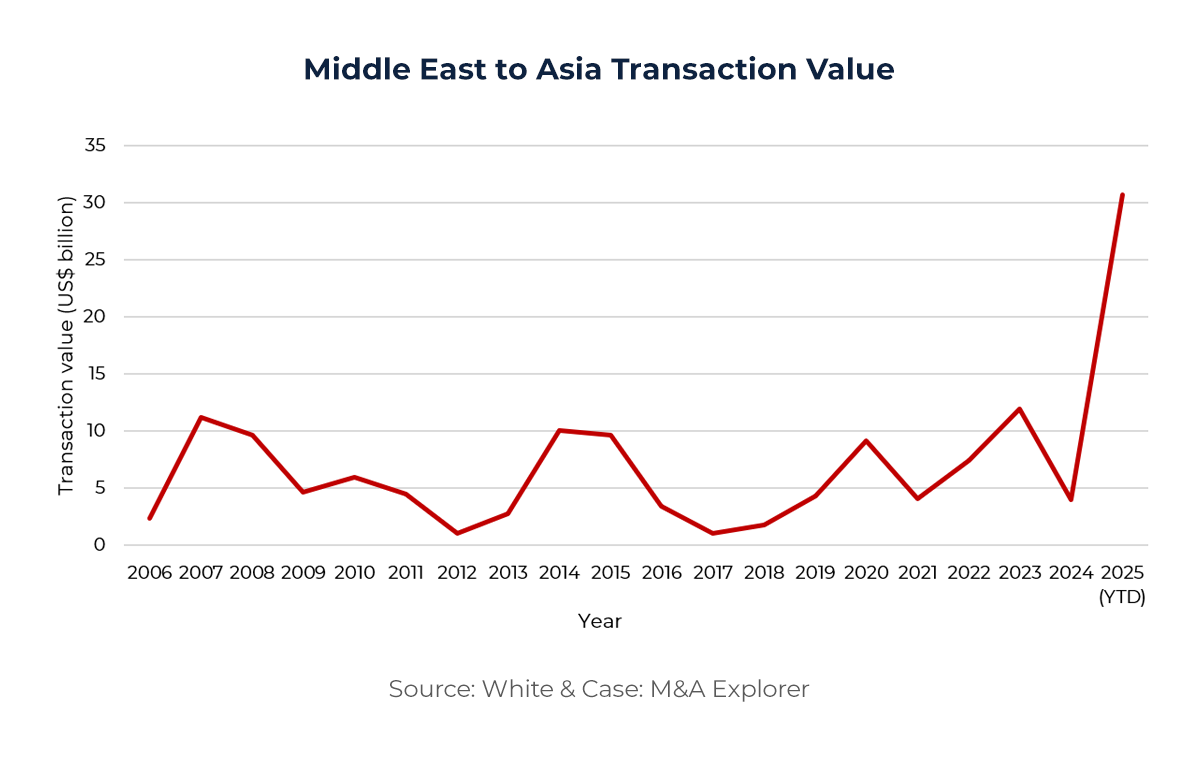

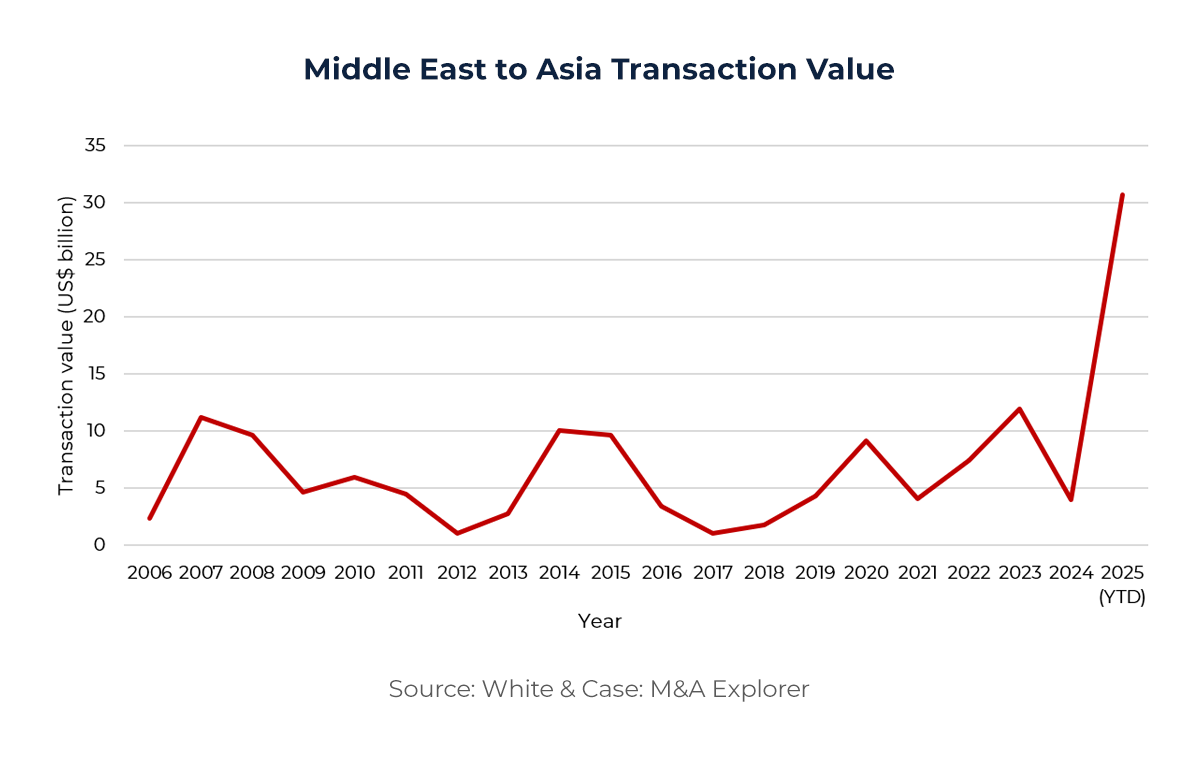

Traditionally, Gulf capital has flowed westward. Between 2005 and 2015, more than 76.5% of all outbound investments from GCC sovereign vehicles targeted developed economies in North America and Europe. This reflected both risk aversion and legacy trade ties. But a combination of factors such as stagnant Western returns, COVID-era fiscal overextension, and the increasing politicization of Western regulatory regimes (including the UK blocking a UAE-backed media acquisition, and EU’s concerns over GCC investments in telecom)—has prompted Gulf allocators to revisit their strategic models. In 2024, MENA SWFs have invested US$34B in Asia, more than doubling the US$16B in 2023.

Specifically on consolidation, MENA SWFs have executed 43 Asia focused transactions in 2024 (rise from only 15 transactions in 2019). This surge is too large to be accounted as volatility, but a broader strategic embrace of Asia’s structural growth story. RHC and financial services represented 46% of deals, indicating the focus on real asset ownership; while consumer and healthcare drew another 26%, signalling the pivot towards middle-class consumption themes within Asia’s demographic. By 2030, India and China is expected to represent ~50% of the global middle-class, therefore justifying the Gulf’s aggressive strategy.

This reallocation is supported by a reciprocated posture towards foreign capital. Since 2020, India has provided 100% income tax exemption for SFWs investing in specified infrastructure and growth assets. Several Southeast Asian markets have also followed suit, offering project-level guarantees and streamlined approvals through sovereign cooperation channels.

II. Who is Buying: From Macro Alignment to Strategic Buyers

Historically, the economic relationship between the Middle East and Asia has been underpinned by hydrocarbon flows, with Gulf crude and gas powering Asia’s industrial ascent. Asia emerged as a primary importer of the region’s energy exports, structuring the corridor around commodity trade rather than corporate integration. This dynamic, while foundational, did not extend into industrial consolidation or operational synergies. Where capital did flow back into Asia, it was often through sovereign wealth fund allocations, focused on passive stakes in infrastructure, digital platforms, and financial markets—investments that mirrored macroeconomic alignment but lacked control or operational influence.

That model is now evolving. While energy trade remains the corridor’s economic backbone, a new layer of Gulf-Asia integration is emerging—defined by strategic acquisitions and operational footprints. Gulf-based conglomerates and sovereign-linked corporates are pursuing control-oriented transactions across Asia, particularly in sectors like logistics and downstream petrochemicals. Rather than simply exporting to Asia, Middle Eastern players are embedding themselves within it. ARC observes several formative current transactions that defines this transition.

Case Study 1: Saudi Agricultural & Livestock Investment Company (SALIC)’s Acquisition of Olam Agri (pending)

SALIC, an investment arm of Saudi Arabia’s Public Investment Fund, is increasing its stake in Olam Agri from 35.4% to 80.01% for US$1.78B. The transaction, valued at an implied enterprise valuation of US$4B, includes a later call/put option for SALIC to acquire the remaining ~20% at the same valuation, plus a 6% IRR, within three years. This valuation represents a 23% premium to Olam’s market cap of US$3.25B, equivalent to 9.3x EV/EBITDA (compared to industry mean of 7.7x) and 11.4x P/E (compared to industry mean of 9.3x).

SALIC, an investment arm of Saudi Arabia’s Public Investment Fund, is increasing its stake in Olam Agri from 35.4% to 80.01% for US$1.78B. The transaction, valued at an implied enterprise valuation of US$4B, includes a later call/put option for SALIC to acquire the remaining ~20% at the same valuation, plus a 6% IRR, within three years. This valuation represents a 23% premium to Olam’s market cap of US$3.25B, equivalent to 9.3x EV/EBITDA (compared to industry mean of 7.7x) and 11.4x P/E (compared to industry mean of 9.3x).

Olam Agri is a Singapore based agribusiness engaged in origination, trading, processing, and logistics of essential soft commodities including grains, oilseeds, rice, and edible oils. The platform spans 30+ countries with strong operating presences across India, China, Southeast Asia, and Sub-Saharan Africa. Its role as a midstream aggregator and trader places it at a critical junction in Asia’s food and feed supply chains. This transaction aligns with the Saudi Vision 2030 food security agenda. With over 80% of domestic food supply imported, Saudi policy is pivoting from reactive purchasing to proactive control across global supply chains, insulating against inbound commodity shocks and mitigating exposure to geopolitical and climate-driven disruptions.

Case Study 2: Alat and Lenovo’s Strategic Collaboration (Jan 2025)

Saudi Arabia’s Alat, another investment vehicle under PIF, has announced a US$2B collaboration with Lenovo Group. The transaction is structured as a zero-coupon convertible bond issuance (3-year maturity), with operational commitments from Lenovo to establish a Middle East & Africa headquarters and a manufacturing facility in Riyadh. Based on Lenovo’s current market cap of US$17.51B, the convertible bond could translate into ~11% equity ownership if fully converted.

Lenovo is the world’s largest PC maker by volume and a growing competitor in enterprise IT infrastructure, smart devices, and edge AI. With key manufacturing hubs in China and India, Lenovo is actively expanding manufacturing footprint outside China to maintain resilience against tariff pressures and supply chain risk.

Deal Rationale for Alat:

- Localize advanced manufacturing: Economic diversification from oil and petrochemicals to build local capabilities in high-value, export-oriented manufacturing through technology transfer partnerships with global players like Lenovo.

- Attract global OEMs and technology players: The launch of Alat and other PIF-backed platforms is a coordinated strategy to incentivize OEMs to establish operational presence in Saudi Arabia for R&D, production, and regional command centres, encouraging knowledge spillover to local SMEs as an agenda within Vision 2030

- Accelerate transition to non-oil GDP growth: Efforts to feed into overarching Vision 2030 objective of increasing the share of non-oil GDP to over 50%.

III. The Middle East’s Strategic Pivot Beyond Oil

For decades, Gulf economies were structurally anchored in hydrocarbon exports. Oil accounted for over 80% of government revenues in countries like Saudi Arabia, Kuwait, and Iran throughout the 1990s and early 2000s. Since 2014, the structural volatility in oil prices has reshaped fiscal planning. Brent crude crashes to under US$35/barrel in 2016 and again in 2020 has exposed the fragility of oil-dependent fiscal models. Combined with the global energy transition, demand plateaus in key importing markets force Gulf governments to no longer view hydrocarbons as a reliable anchor.

Case Study 1: Saudi Arabia’s Race to Diversify

Saudi Arabia’s Vision 2030 marks one of the most ambitious diversification programs in the Gulf, with the Kingdom hoping to raise non-oil exports in GDP from 16% to 50% by 2030. Previous attempts to overhaul this oil-dependent economy was lukewarm, as traction has fizzled out when oil prices recovered in the past. However, many believe that the latest oil price collapse is believed not to be cyclical but structural, caused by the growth in renewable energy and climate change commitments, giving more concrete evidence to signify a successful divergence. These structural shifts are expected to set a stage for strategic outbound consolidation, as Gulf countries transform to become more balanced, multi-sector economies.

Co-investment vehicles

Parallel to this domestic diversification, sovereign investors are establishing co-investment platforms with Asian governments. These investment vehicles act as beachheads for more operationally integrated deals. By anchoring capital, Gulf investors gain early visibility into corporate carve-outs, strategic stake sales, and pre-IPO placements, with pipelines that can evolve into full acquisitions and control transactions. Most notable examples include:

- Hong Kong Monetary Authority (HKMA) and Saudi Arabia’s PIF’s US$1B co-investment fund: Designed to target private equity, infrastructure, and technology opportunities in the Greater Bay Area.

- Goldman Sachs and Abu Dhabi’s Mubadala Investment Company’s US$1B partnership: Long-term capital in pursuit of private credit opportunities in Asia, with a particular focus in India.

- Mubadala’s investment in PAG’s US$550M inaugural Asia renewable energy fund: Paving way for infrastructure-related deal flows and fortifies bilateral ties, specifically targeting solar investments in Japan.

- Abu Dhabi Investment Authority (ADIA) investments in Southeast Asia, expanding UAE’s footprint through infrastructure, logistics, and tech-linked assets. For instance, ADIA plans a USD1.5 billion investment into GLP (Asia logistics platform) and has expressed interest in Malaysian airport and healthcare assets in the region.

Case Study 2: Qatar—China Interdependence

Over the past five years, the Qatar Investment Authority (QIA) has significantly expanded its China presence, moving beyond passive stakes into assets that support Qatar’s domestic diversification ambitions. While QIA retains its global investment spread, China has emerged as a priority market for securing technological expertise and long-term demand anchors for Qatari exports.

Energy: Launchpad for integration

Energy remains the bedrock of Qatar–China relations. Qatar is the world’s third largest LNG exporter, and China became its largest LNG customer in 2023, following a 27-year US$60B LNG supply agreement between QatarEnergy and Sinopec. This establishes deep state-to-state economic alignment—a platform that QIA leverages when pursuing corporate transactions.

Qatar Investment Authority’s (QIA) Transactions in China

- China approves QIA to acquire 10% of its top asset manager (2025)

QIA’s 10% stake in China Asset Management Co (ChinaAMC), a mutual fund manager with over US$418B in AUM, marks Qatar’s first direct foothold in China’s domestic financial infrastructure.

- Anchor investor in McDonald’s China Platform (2024)

QIA acted as the anchor investor in a US$1B continuation fund by Trustar Capital, designed to hold a 52% controlling stake in McDonalds operations across Mainland China and Hong Kong. This highlights strategic interest of Qatar’s vehicle to consumer-facing sectors within China.

Qatar’s outbound strategy mirrors the Gulf’s broader pivot, together, they signal a shift towards active participation in Asia’s corporate and consumer ecosystems.

IV. How ARC Can Help

At ARC Group, we understand that the Middle East–Asia corridor is no longer just a trade route—it’s evolving into a strategic investment gateway shaped by SWFs, co-investment platforms, and sectoral diversification. Navigating this corridor requires both regional insight and global execution capability—two areas in which ARC Group is uniquely positioned to support clients.

- Unmatched Corridor Expertise

ARC Group bridges Asia with Europe and the US, enabling seamless execution of cross-border M&A, IPOs, SPACs, and strategic advisory services. Our transaction teams are currently executing Gulf and Asian cross-border deals, with deep understanding of market mechanics, regulatory landscapes, and cultural nuances.

- Global Reach with Local Footprint

With offices in Abu Dhabi and Dubai, alongside hubs in 12 countries across three continents, ARC ensures physical proximity to investors driving outbound capital. This footprint allows us to operate as a trusted local partner while delivering globally integrated execution.

- Proven M&A Track Record

ARC Group has successfully executed over US$1B in transaction volume over the last three years, specializing in cross-border M&A involving the Middle East and Asia. Our experience includes advising on complex transactions that require meticulous planning and execution, ensuring optimal outcomes for our clients.

- Integrated Strategic and Consulting Support

Beyond transaction execution, we offer comprehensive advisory services, including valuation, due diligence, and post-merger integration support. ARC also specializes in SPAC/de-SPAC and ranked #1 globally in SPAC M&A league table in transactional value, market share, and number of transactions in 2022 and #2 in 2024.

Call to Action

As Gulf investors accelerate their pivot towards Asia, ARC Group stands ready to help stakeholders identify, structure, and close transactions that capture the corridor’s growth potential. Contact us today to explore how we can position you at the forefront of this strategic realignment.

Author:

Frazer Lee

M&A Intern

References

SALIC, an investment arm of Saudi Arabia’s Public Investment Fund, is increasing its stake in Olam Agri from 35.4% to 80.01% for US$1.78B. The transaction, valued at an implied enterprise valuation of US$4B, includes a later call/put option for SALIC to acquire the remaining ~20% at the same valuation, plus a 6% IRR, within three years. This valuation represents a 23% premium to Olam’s market cap of US$3.25B, equivalent to 9.3x EV/EBITDA (compared to industry mean of 7.7x) and 11.4x P/E (compared to industry mean of 9.3x).

SALIC, an investment arm of Saudi Arabia’s Public Investment Fund, is increasing its stake in Olam Agri from 35.4% to 80.01% for US$1.78B. The transaction, valued at an implied enterprise valuation of US$4B, includes a later call/put option for SALIC to acquire the remaining ~20% at the same valuation, plus a 6% IRR, within three years. This valuation represents a 23% premium to Olam’s market cap of US$3.25B, equivalent to 9.3x EV/EBITDA (compared to industry mean of 7.7x) and 11.4x P/E (compared to industry mean of 9.3x).