What Is a Foreign Private Issuer?

A Foreign Private Issuer (FPI) is a non-U.S. company that meets the SEC’s definition of a “foreign issuer” and qualifies under the FPI test[1].

A company qualifies if 50% or less of its outstanding voting securities are held by U.S. residents (the shareholder test). If this threshold is exceeded, a company may still qualify under the business-contacts test, provided that none of the following apply:

- A majority of the company’s executive officers or directors are U.S. citizens or residents.

- More than 50% of the company’s assets are located in the U.S.

- The company’s business is administered principally in the U.S.

For issuers making an initial registration statement, the test is assessed as of a date within 30 days before the filing becomes effective. For ongoing reporting companies, the determination is made annually on the last day of the issuer’s second fiscal quarter.

In practical terms, if a company is incorporated outside the U.S. and either meets the shareholder test or avoids the business-contacts triggers, it may qualify as an FPI. Once established, FPI status provides meaningful regulatory accommodations under U.S. securities law.

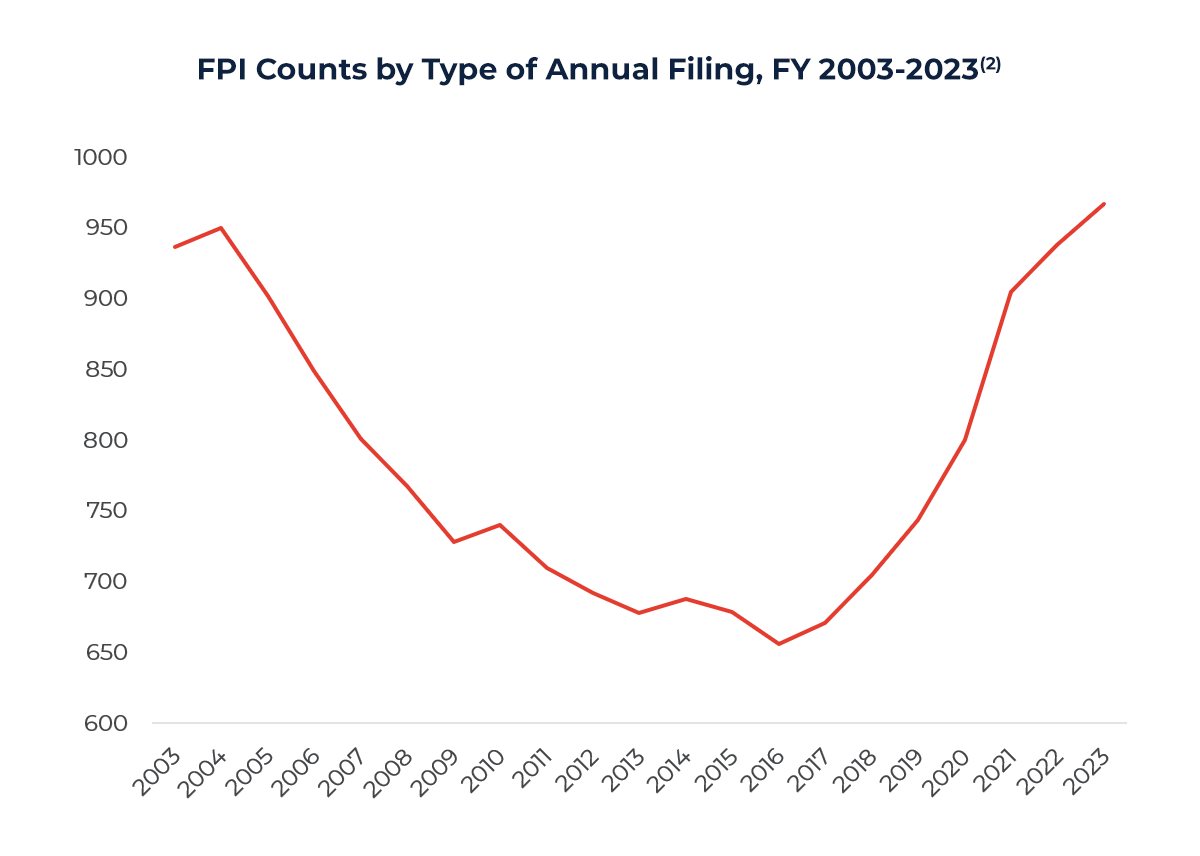

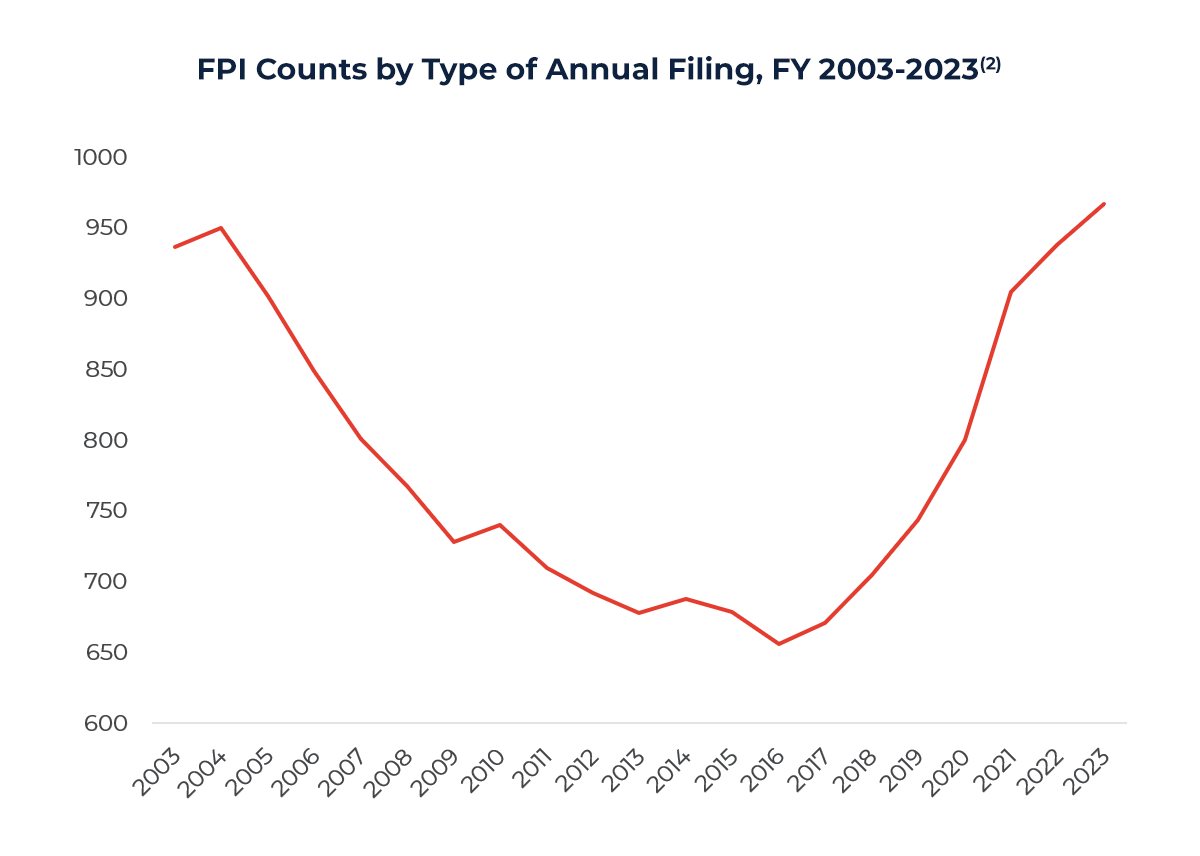

According to a report from the SEC’s Division of Economic and Risk Analysis, there were 967 Form 20-F reporting FPIs in the U.S. markets as of 2023, highlighting the continued globalization of U.S. capital markets[2].

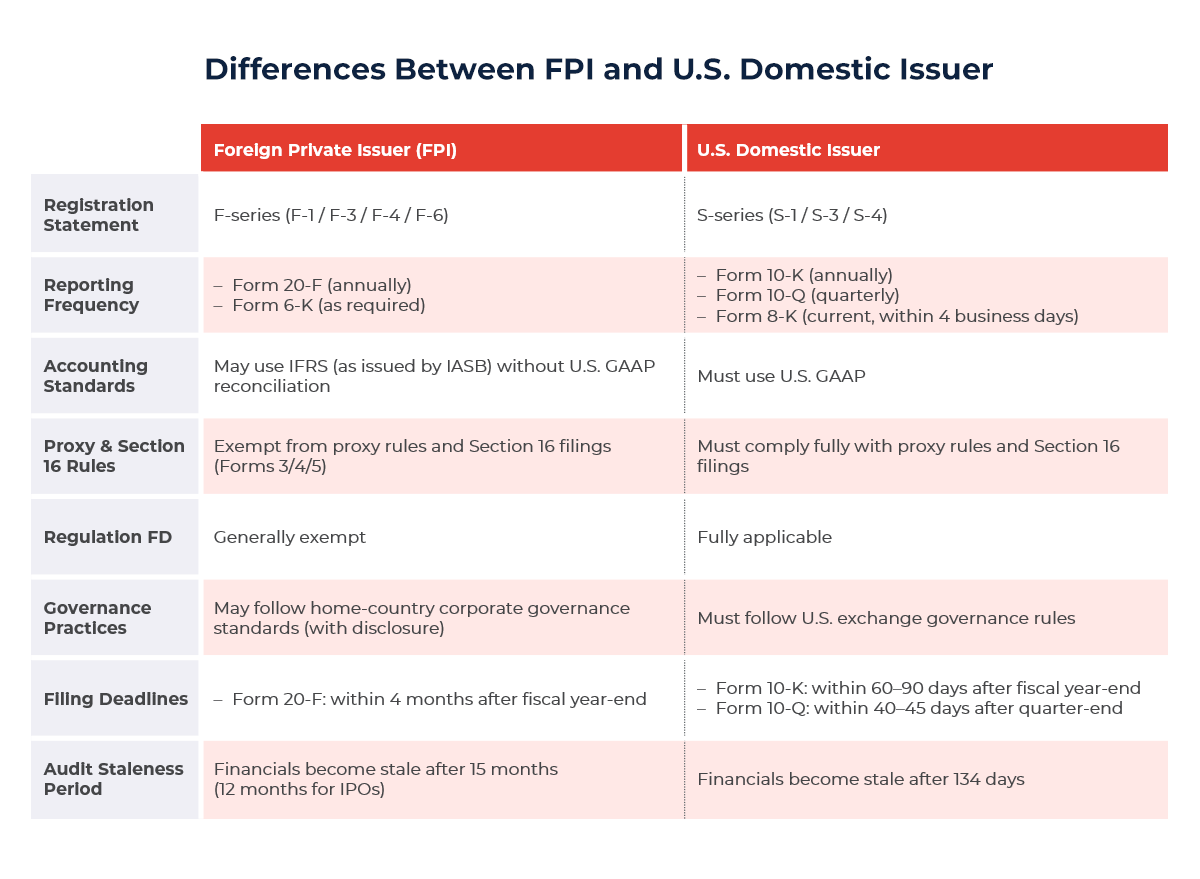

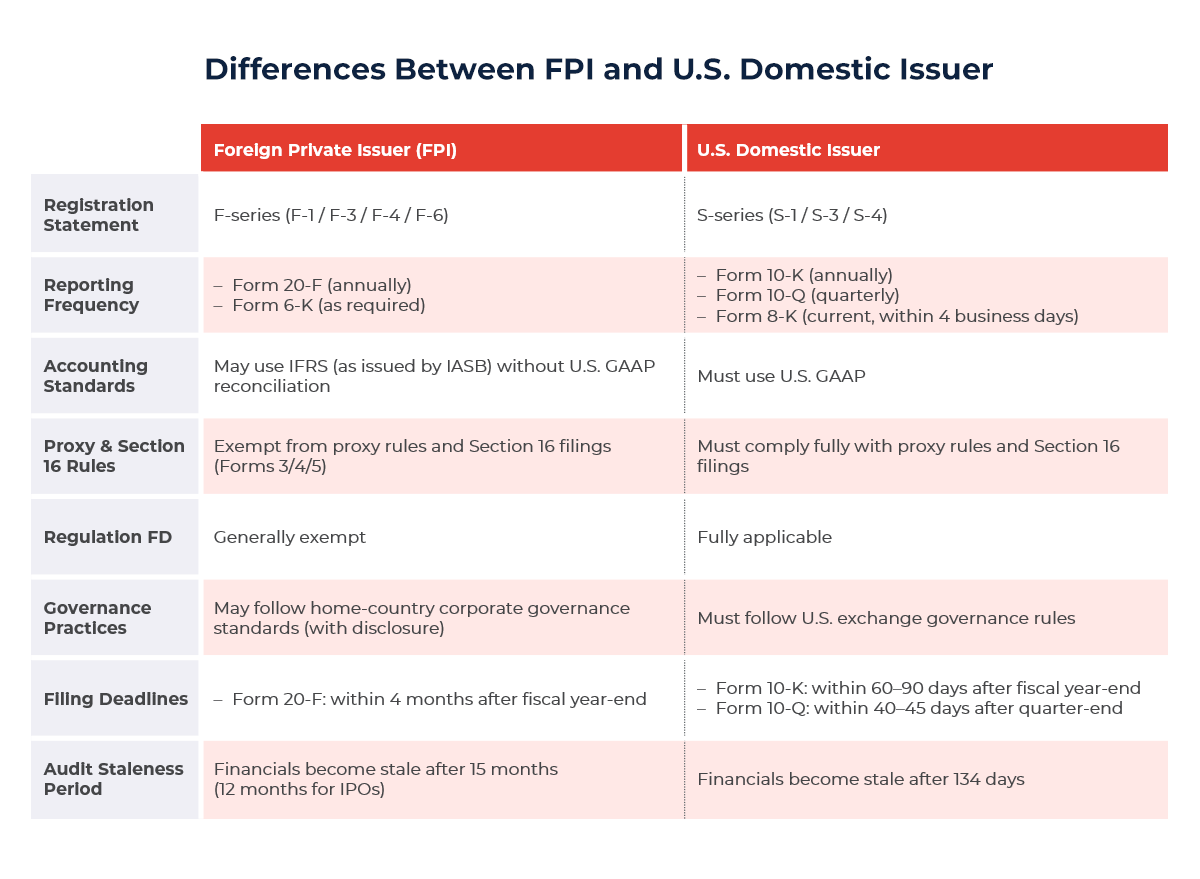

Key Differences Between FPIs and U.S. Domestic Issuers

As non-U.S. entities, FPIs benefit from a distinct regulatory framework under the SEC, which provides several regulatory accommodations compared with U.S. domestic issuers. The table below summarizes the major differences.

Strategic Advantages of FPI Status

For non-U.S. issuers, FPI status offers a strategic balance between global market access and regulatory efficiency:

- Reduced reporting burden: Annual filings only, with no quarterly reporting requirement, reducing compliance costs and administrative workload.

- Reporting flexibility: Form 6-K current reporting is required only “promptly” after material events, without the strict four-day Form 8-K deadline.

- Accounting convenience: Use of IFRS without U.S. GAAP reconciliation simplifies financial statements and audits.

- Governance adaptability: Flexibility to retain home-country governance structures while accessing U.S. investors.

- Regulatory exemptions: Relief from proxy rules, detailed executive compensation disclosure, Section 16 reporting, and Regulation FD obligations.

For many cross-border companies, particularly those headquartered in Asia or offshore jurisdictions, FPI status represents a strategic gateway to U.S. capital markets, combining international investor visibility with streamlined compliance.

Risks & Considerations

Although FPI status allows companies to follow their home-country corporate governance and disclosure practices, those operating in jurisdictions with weaker regulatory oversight may face investor skepticism regarding transparency and accountability, creating reputational and capital markets risk.

While FPI status provides flexibility and cost efficiency, it still demands high standards of disclosure, governance, and investor communication. Companies that fail to prepare adequately may undermine market confidence. Some leading FPIs, such as SEA Limited and Grab Holdings, voluntarily issue quarterly updates through Form 6-K, demonstrating transparency and reinforcing investor trust despite not being required to do so.

At the same time, FPI status must be actively managed to ensure continued compliance. Without proper oversight, companies risk losing eligibility and facing significant regulatory, reporting, and governance consequences.

To maintain qualification, issuers must conduct the shareholder and business-contacts tests annually, as of the end of the second fiscal quarter. If these criteria are not met, the company may lose FPI status and be reclassified as a U.S. domestic issuer.

Loss of FPI status can trigger a series of costly transitions:

- Adoption of U.S. GAAP (if previously reporting under IFRS) or reconciliation to it.

- Quarterly (Form 10-Q) and current (Form 8-K) reporting obligations.

- Compliance with Section 16, proxy solicitation rules, Regulation FD, and full U.S. domestic governance standards.

- A shorter audit-staleness period (134 days vs. 15 months), requiring faster audit turnaround and interim updates.

- Increased audit, disclosure, and internal-control requirements, including enhanced Sarbanes-Oxley compliance and auditor attestation.

In short, FPI status should be viewed as a long-term strategic privilege, not a regulatory shortcut, and must be carefully maintained through disciplined compliance and continuous monitoring.

SEC Concerns Over FPI Status[3]

In June 2025, the SEC issued a Concept Release raising concerns that many FPIs are effectively U.S.-based companies benefiting from lighter regulation. The Commission noted that numerous FPIs are incorporated in offshore jurisdictions such as the Cayman Islands or British Virgin Islands, yet have management, operations, and trading activity centered in the U.S., with many FPIs trading mainly or entirely on U.S. exchanges.

To ensure the framework continues to truly reflect foreign issuers, the SEC is evaluating whether to tighten the FPI definition, including potential revisions to the 50% U.S.-ownership test, the introduction of a foreign trading volume or non-U.S. listing requirement, and an assessment of home-country regulatory robustness. Issuers and investors are encouraged to monitor this development closely, as future changes could directly affect qualification, compliance timelines, and listing strategy.

Conclusion

At ARC Group, we have guided numerous international issuers through the complexities of qualifying, listing, and maintaining FPI status on U.S. exchanges. Our advisory teams assist clients in eligibility analysis, structuring, U.S. GAAP assessment, audit planning, and ongoing SEC reporting compliance.

For companies exploring U.S. market entry, FPI status offers an optimal combination of regulatory flexibility, lower compliance costs, and expanded investor access. ARC Group’s cross-border expertise ensures our clients capture these advantages, while remaining fully aligned with evolving SEC expectations.

References:

[1] SEC (2013): Information about Foreign Issuers – Division of Corporation Finance

[2] SEC (2024): Trends in the Foreign Private Issuer Population 2003-2023: A Descriptive Analysis of Issuers Filing Annual Reports on Form 20-F

[3] SEC (2025): Concept Release on Foreign Private Issuer Eligibility