Abstract: China’s orthopedic device industry is shifting from a manufacturing-driven model toward systematic innovation and global competition. The market continues to grow steadily, with advances in 3D printing, bioresorbable materials, and intelligent surgical systems driving the next upgrade cycle.

Chinese companies are expanding their global footprint—from emerging markets to advanced economies—and transitioning from simply “selling devices” to “delivering surgical solutions.” In the coming decade, localization, digitalization, and ecosystem integration will define the industry’s trajectory, as Chinese enterprises evolve from “Made in China” to “Global Solution Providers.”

I. Definition and Scope: Orthopedics and Orthopedic Implants

Orthopedics is a surgical specialty focused on diagnosing and treating injuries, deformities, and degenerative conditions affecting the bones, joints, spine, and associated soft tissues such as muscles, ligaments, and tendons. Treatment approaches range from conservative therapy (rehabilitation, medication) to minimally invasive surgery (arthroscopy, percutaneous endoscopy) and open surgery (internal fixation, joint replacement). With population aging and sports-related injuries on the rise, demand for orthopedic treatment continues to increase.

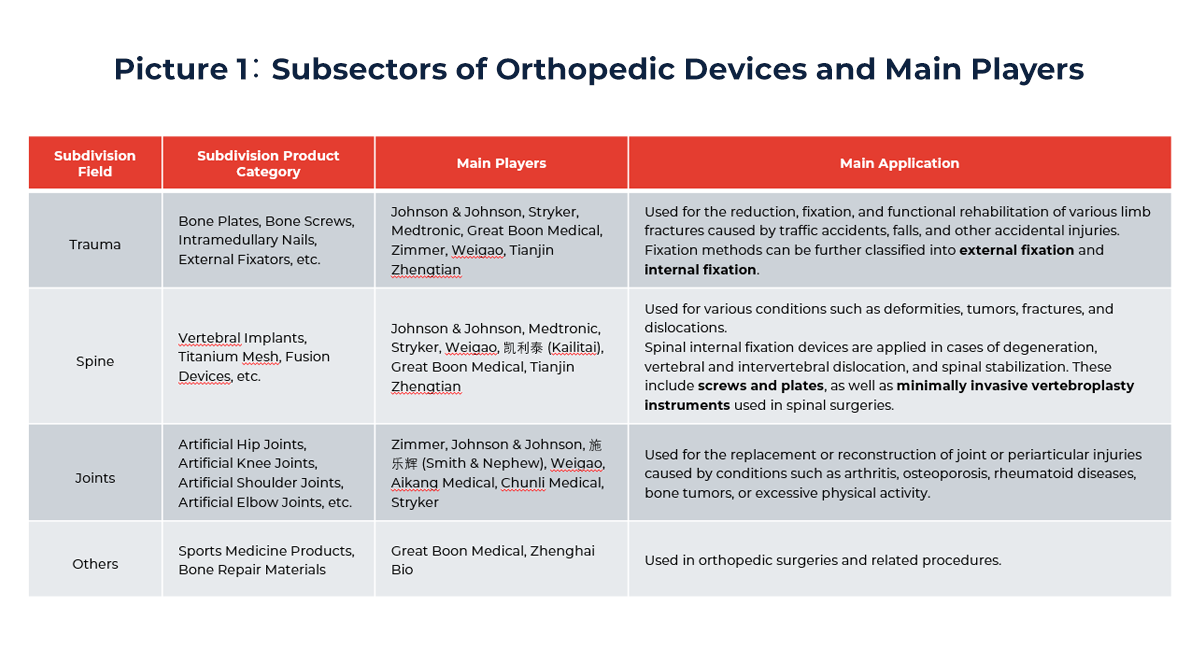

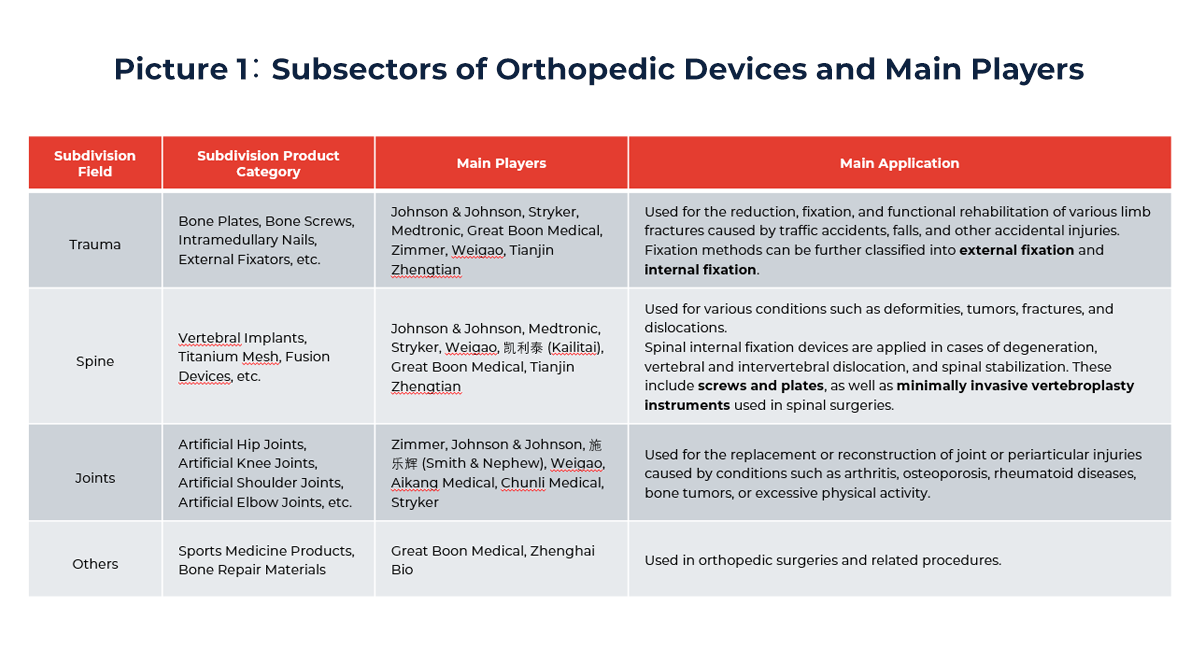

Orthopedic implants are high-risk medical devices surgically placed inside the human body to repair, support, or replace skeletal or joint functions. Representative products include plates, screws, intramedullary nails, spinal fixation systems, and artificial joints. Because these implants are intended for long-term implantation, they must comply with rigorous certification standards such as those of the U.S. Food and Drug Administration (FDA) and the European Medical Device Regulation (MDR). Intraoperative accessories such as irrigation systems, drainage tubes, and dressings complement implants to form a complete therapeutic system.

By application, orthopedic devices are primarily divided into four segments: trauma, spine, joint, and sports medicine—with the first three accounting for roughly 80% of the total market and forming the industry’s core.

II. Market Landscape: Scale and Growth Drivers

II. Market Landscape: Scale and Growth Drivers

China’s orthopedic device market remains in a steady growth phase. According to Grand View Research, the market reached USD 2.86 billion in 2023 and is projected to reach USD 4.58 billion by 2030, representing a compound annual growth rate (CAGR) of 6.9% between 2024 and 2030. Within this, the spinal segment is expected to grow at around 8.5% annually, while joint replacement stands out as the most robust growth driver—benefiting from aging demographics and domestic substitution.

The penetration rate of orthopedic implants in China is still below 10%, far lower than the 40–70% typical in developed countries, indicating significant structural growth potential. Although joint replacement products have long been dominated by imported brands, domestic players are rapidly catching up, leveraging technological progress, cost control, and supportive policies.

Overall, the industry is transitioning from quantitative expansion to qualitative improvement. While foreign companies still dominate the high-end market, Chinese manufacturers are strengthening their R&D and production capabilities, gradually reshaping the competitive landscape around innovation and integrated system solutions.

III. Innovation Trends: From Single Products to Integrated Systems

Innovation in China’s orthopedic sector is evolving from isolated product breakthroughs to systematic, digital, and scenario-driven solutions. The main technological forces driving this transformation are new materials, 3D printing, and smart surgical technologies.

- Manufacturing innovation:

3D printing (additive manufacturing) enables personalized medical solutions. Through precise metal or polymer printing, customized implants can be tailored to each patient, achieving better anatomical fit and functional recovery. Examples include the titanium vertebral scaffold co-developed by Jishuitan Hospital and Huake 3D, and Weigao’s customized knee prosthesis, both now in clinical use—signaling China’s move from standardized manufacturing to high-end customization.

- Material innovation:

Companies are actively exploring materials with enhanced biocompatibility and degradability. Products such as Mindray’s bioresorbable magnesium alloy screws, Double Medical’s micro-structured fusion cages, and Chunli Medical’s wear-resistant ceramic liners have significantly improved implant safety and durability.

- Digital and intelligent surgery:

Firms like TINAVI (Tinavi Medical Technologies), Weigao, and Changmugu are building closed-loop systems that integrate preoperative planning, intraoperative navigation, and postoperative monitoring. By combining AI and robotic assistance, they improve surgical precision and consistency.

In summary, China’s orthopedic innovation is shifting from product manufacturing to clinical integration. Leading companies are developing full-scale solutions that combine “devices + digital platforms + training + service”, laying the foundation for international expansion.

IV. Globalization Pathways

Orthopedic implants belong to one of the most highly regulated and technically demanding medical device categories globally. Products must undergo multi-country registration, clinical validation, and long certification cycles—requiring strong financial, regulatory, and operational capabilities.

Despite these barriers, Chinese orthopedic firms are accelerating globalization. As of the first half of 2025, leading companies derive nearly 20% of revenue from overseas markets, which are becoming a key hedge against domestic price pressures. The mainstream globalization pathway typically follows three stages:

- Entry via emerging markets — initial penetration through OEM/ODM or distributor models in regions such as India, Latin America, the Middle East, and Africa to build sales volume and registration experience;

- Regulatory and brand advancement — after establishing market credibility, entering high-barrier markets such as Europe and the U.S. through direct registration;

- Localized operations — setting up local manufacturing or joint ventures to integrate production, sales, and after-sales services.

Companies like Weigao, Chunli Medical, and TINAVI have achieved early breakthroughs in Southeast Asia and Latin America, marking a shift from “exporting products” to “exporting brands and technologies.” The industry is thus moving from regional exploration toward a globally integrated presence.

V. Advantages and Challenges: Structural Competition and Practical Constraints

Chinese companies possess notable advantages in manufacturing, R&D, and operational integration. A complete metal-processing and tooling supply chain, strong cost efficiency, vast clinical data resources, and policy support for innovation together provide a competitive edge in emerging markets—offering high performance-to-price ratios and rapid response.

However, challenges remain for developed markets. Western regulators place heavy emphasis on long-term clinical follow-ups and real-world evidence (RWE); brand reputation and physician trust are still under development. Registration, distribution, and after-sales service costs elevate the threshold for overseas operations, while differences in IP protection and reimbursement systems create hidden barriers.

To build sustainable global competitiveness, companies must focus on three pillars:

- Compliance and quality systems: proactively plan for international registration and align with MDR/FDA standards.

- Physician networks and brand co-creation: foster trust through academic collaboration, training, and clinical partnerships.

- Localized service ecosystems: enhance after-sales and technical support to strengthen market responsiveness.

Chinese orthopedic firms are transitioning from cost leadership to systemic competitiveness. Their success in compliance and branding will determine the depth and quality of their globalization.

VI. Commercial Strategies for Globalization: From Selling Devices to Delivering Surgeries

The globalization model of Chinese orthopedic companies is evolving from single-product sales to comprehensive solution delivery. Increasingly, firms are co-developing with surgeons through training, intraoperative support, and clinical research partnerships—shifting from “selling products” to “empowering clinical practice.”

Product portfolios are tiered by region:

- In emerging markets, companies emphasize cost-effective mid- to low-end products;

- In advanced markets, they introduce high-end customized and 3D-printed implants to establish multi-level brand hierarchies.

Digitalization is becoming the next competitive frontier. Platforms developed by TINAVI and Weigao already integrate pre-surgical simulation, intra-operative navigation, and post-surgical follow-up. Meanwhile, localized manufacturing and service hubs in Southeast Asia, Latin America, and the Middle East are improving delivery efficiency and tender competitiveness. Some companies are also acquiring or forming joint ventures abroad to accelerate certification and channel access.

Importantly, compliance management is now embedded in strategic planning. Leading firms conduct FTO (Freedom-to-Operate) analyses, risk assessments, and registration system setup before market entry—avoiding the pitfalls of a reactive “sell-then-fix” approach.

Overall, Chinese orthopedic companies are evolving from manufacturers to integrated solution providers. Their systematic product portfolios, digital clinical support, and localized operations are enabling the shift from price competition to value competition.

VII. Outlook: From “Made in China” to “Global Solution Provider”

China’s orthopedic industry is entering a pivotal transformation from manufacturing-driven to innovation-driven growth. Future competition will hinge not on individual device performance but on the ability to provide end-to-end surgical ecosystems spanning preoperative planning, intraoperative precision, and postoperative recovery. Digitalization, robotic assistance, and clinical data integration will define high-end competition.

Leading firms will leverage comprehensive product–solution–service ecosystems to establish reproducible clinical standards and global brand influence. With the market restructuring after centralized procurement, the industry is moving away from low-end competition. Leading players are expected to regain market share and profitability, while overseas markets will become long-term growth engines.

Future globalization will focus less on geographic expansion and more on global operational integration—achieving compliance and efficiency under MDR/FDA frameworks to earn international recognition. As domestic substitution nears completion in trauma and conventional spine segments, complex spine, revision joints, and bioresorbable materials will emerge as new growth frontiers—areas where Chinese innovators could achieve technological leapfrogging.

In sum, the next 5–10 years represent a critical window for China’s orthopedic device industry to transition from manufacturing scale to value creation. Localization, digitalization, and ecosystemization will be the three defining themes. Companies capable of technological integration and global execution will evolve from “Made in China” to “Global Healthcare Solution Providers.”

References:

- Grand View Research. China Orthopedic Devices Market and China Spinal Implants & Devices Market (2023–2033 CAGR forecasts).

- PharmaCube (YaoWu MoFang): 2025H1 Medical Device Mid-Year Report and Orthopedic High-Value Consumables Globalization Trends.

- Additional sources: AAOS, Eastmoney, Medtec China, MDR, FDA, GlobalData, Medical Device Network, Financial Times.

II. Market Landscape: Scale and Growth Drivers

II. Market Landscape: Scale and Growth Drivers