As 2025 draws to a close, global equity markets have shown mixed performance across sectors. Despite a year marked by cautious monetary policy, moderating growth, and geopolitical uncertainty, several areas have continued to demonstrate resilience.

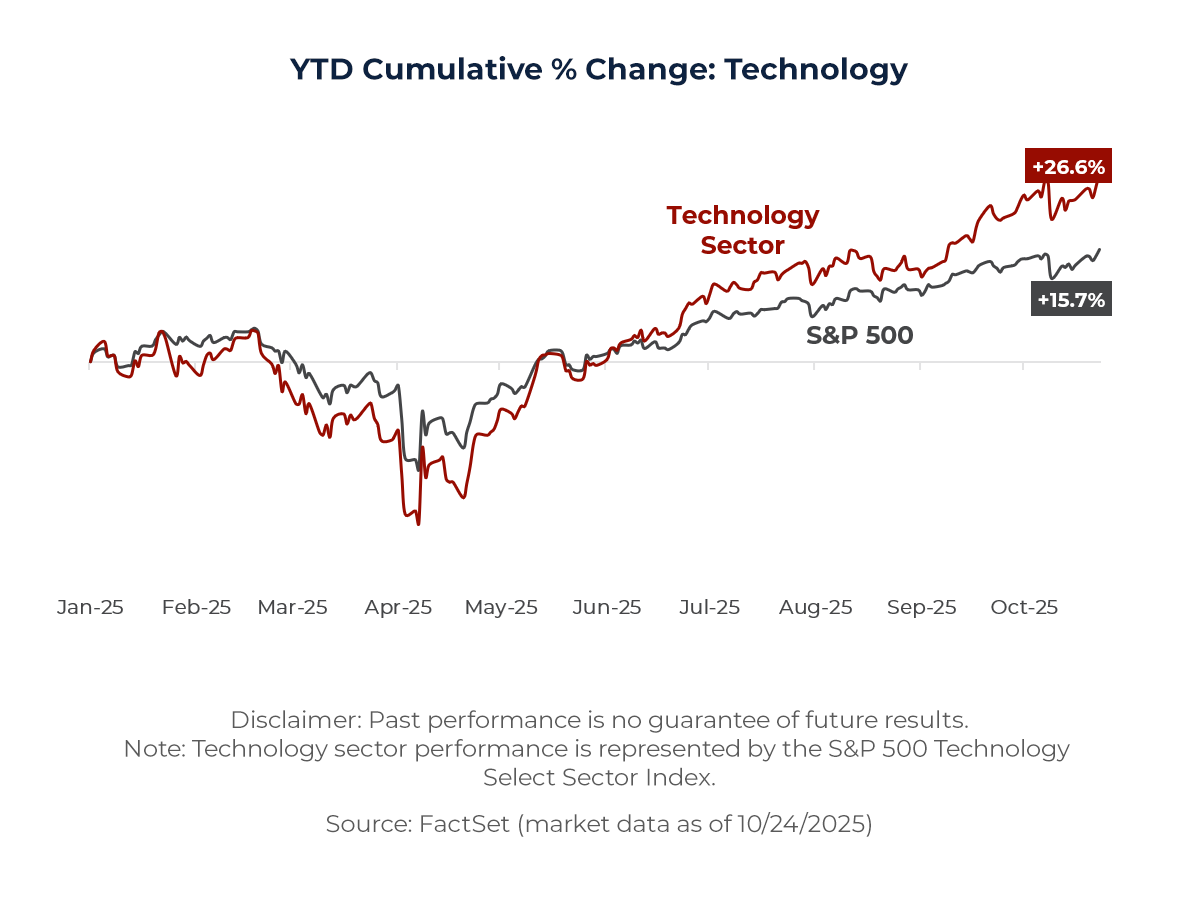

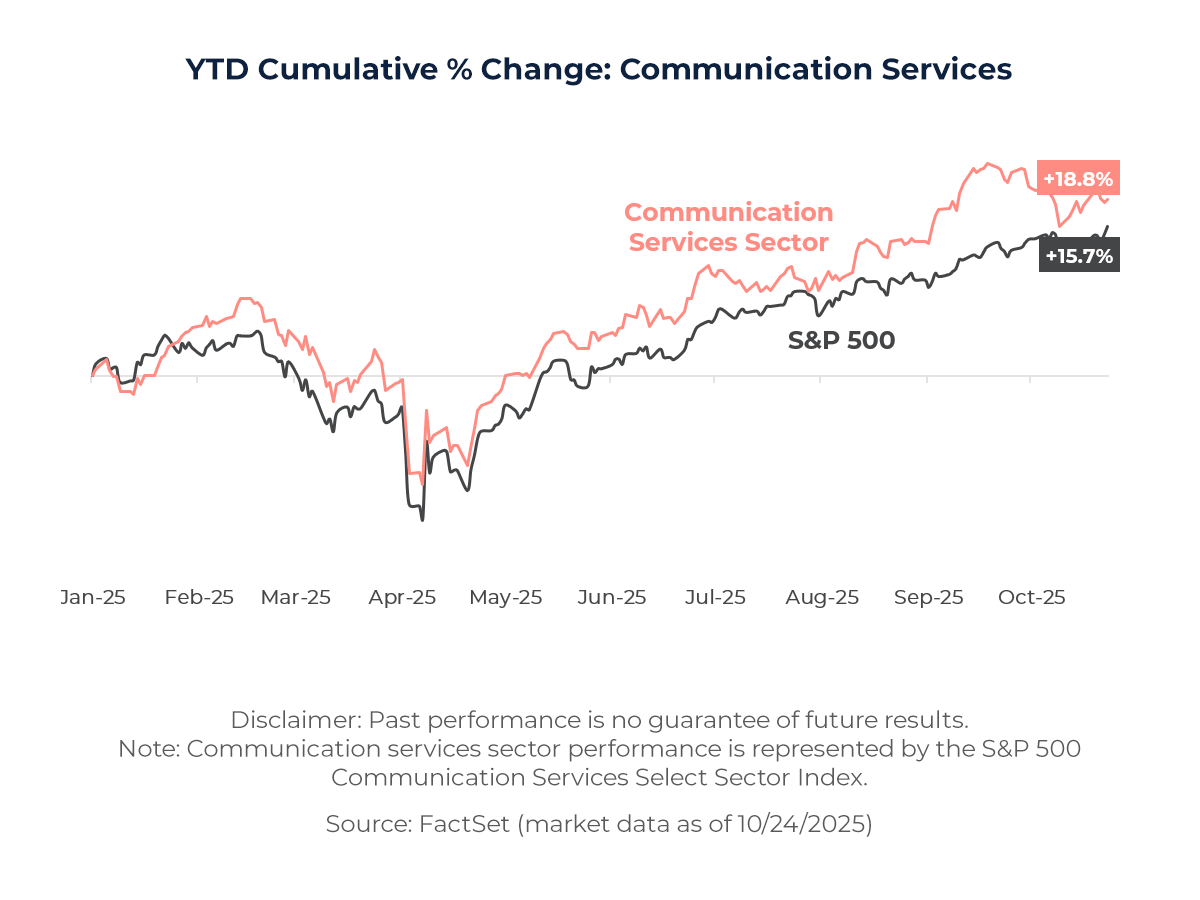

Industrials performed solidly, gaining 18.0% YTD on the back of steady infrastructure investment and manufacturing demand. However, the clear leaders this year have been Technology (+26.6%), Utilities (+19.8%), and Communication Services (+18.8%), according to FactSet data as of October 24, 2025.

These sectors represent the dominant structural forces shaping today’s market: the expansion of AI, the electrification of infrastructure, and the evolution of digital connectivity. Their collective outperformance underscores how investor capital has rotated toward companies positioned at the intersection of innovation, energy, and information.

Technology: AI and Computing Power Define the Year

Technology sector remains the market leader in 2025, extending its multi-year dominance. The sector has benefited from explosive demand for AI, semiconductor capacity, and cloud infrastructure.

According to McKinsey’s 2025 outlooks, AI-related capital expenditure is now the single largest driver of global tech spending, with corporations racing to integrate generative-AI solutions into their products and operations[1].

Key Performance Drivers

- AI Infrastructure Boom: Chipmakers such as Nvidia, AMD, and TSMC have seen record revenues as hyperscalers and enterprises upgrade data-center infrastructure to handle AI workloads. Nvidia’s “AI Factory” model has redefined the modern compute stack.

- Software and Cloud Resilience: Microsoft, Amazon, and Google Cloud continue to post strong double-digit growth as enterprises move toward AI-enhanced cloud tools, offsetting slower consumer electronics demand.

- Productivity and Automation: Demand for AI-enabled productivity tools, edge-computing systems, and robotics integration has expanded margins across the tech value chain.

Representative Leaders

- Nvidia (NVDA)[2]: Maintains its leadership in GPU and data-center computing, reporting Q2 FY2026 revenue growth of 56% YoY. The company continues to benefit from sustained demand for AI infrastructure and the rapid expansion of its data-center business, which remains its main driver of earnings momentum.

- Microsoft (MSFT)[3]: Reinforces its leadership in cloud and AI, recording strong YoY growth in revenue and profitability for FY2025. Microsoft Cloud revenue rose 27% in the fourth quarter, supported by broad enterprise adoption of Azure and the integration of AI capabilities across Microsoft 365, Dynamics 365, and LinkedIn.

Technology’s performance demonstrates how AI has evolved from a conceptual theme into a major source of corporate earnings and capital investment. The sector’s continued strength reflects tangible profit growth, expanding enterprise adoption, and sustained investor confidence in the long-term digital transformation cycle.

Utilities: Powering the AI and Electrification Era

Traditionally viewed as a defensive segment, utilities have become one of 2025’s most dynamic performers. The sector’s resurgence stems from accelerating electricity demand, particularly from AI data centers, renewable projects, and EV infrastructure.

According to Morningstar, utilities have maintained strong momentum as data center expansion, electrification, and renewable energy projects continue to lift long term demand. Although valuations appear elevated, rising power consumption from AI infrastructure and sustained capital investment continue to support earnings growth and sector resilience.

Key Performance Drivers

- AI and Data Centers Power Demand: The rapid buildout of AI infrastructure is driving a sharp rise in electricity consumption, prompting utilities to expand generation and grid capacity. Power demand from data centers is expected to remain a key growth catalyst over the coming years.

- Energy Transition and Grid Monetization: Investment in renewable generation, storage, and transmission upgrades across major markets is reshaping the sector’s growth outlook. Utilities are allocating capital toward cleaner and more efficient systems with stable long-term returns.

- Policy Tailwinds: Incentives under U.S. and European clean-energy frameworks continue to support large-scale infrastructure projects and attract institutional capital. Supportive regulation underpins valuation stability and sustained earnings growth.

Representative Leaders

- NextEra Energy (NEE)[5]: Maintains stable earnings growth, supported by regulated utility operations and a leading renewables portfolio. In Q2 2025, GAAP net income increased 25% YoY to $2.0B, driven by strong performance at Florida Power & Light and continued investment in wind, solar, and battery-storage projects.

- Dominion Energy (D)[6]: Reported a 35% YoY increase in GAAP net income, driven by steady regulated earnings growth. The company remains a key beneficiary of rising data-center power demand in Virginia, supported by continued grid expansion and investment in clean-energy infrastructure to strengthen long-term system reliability.

The utilities sector’s 2025 performance underscores its evolution from a defensive income play into a foundational component of the digital and energy economy. As AI infrastructure, electrification, and renewable investment accelerate, utilities are positioned to deliver steady earnings growth supported by long-term demand visibility and regulatory stability.

Communication Services: Ad Rebound and AI-Driven Engagement

Communication services, which includes digital media, social platforms and telecom operators, recorded another strong year as advertising spending recovered and AI reshaped content monetization.

According to Fidelity’s 2025 outlook, AI remains the sector’s main growth catalyst, particularly for major platforms using it to enhance ad efficiency and personalize user experiences[7]. These innovations have strengthened engagement and created new revenue streams across the sector.

Key Performance Drivers

- AI-Driven Content and Advertising: Major digital platforms are using AI to improve content recommendation, targeting precision and ad performance. Enhanced personalization has lifted engagement rates and monetization efficiency across leading social and video platforms.

- Streaming and Connectivity: The continued convergence of media, telecom and digital services is strengthening recurring revenue streams. Bundled offerings that combine content, subscriptions and connectivity have improved cash flow visibility and customer retention.

- Platform Efficiency: Alphabet, Meta and other large platforms are deploying AI tools to streamline operations and boost advertising yield. Ongoing optimization of search, video and social content ecosystems continues to support margin expansion and revenue growth.

Representative Leaders

- Meta Platforms (META)[8]: Reinforces its media and advertising leadership, reporting 22% YoY revenue growth in Q2 2025 and 36% growth in GAAP net income. The company continues to benefit from expanded advertising demand, increased user engagement across its family of apps, and the growing monetization of AI-driven content recommendation and ad-delivery systems.

- Alphabet (GOOGL)[9]: Solidifies its leadership in search, cloud and AI by reporting 14% YoY revenue growth and 22% growth in diluted EPS in Q2 2025. Google Cloud delivered 32% growth, while Search and YouTube advertising posted double-digit gains, underpinned by strong monetization of AI features and increasing enterprise demand for its cloud-AI infrastructure.

Communication services sector has reemerged as a key engine of market growth, powered by AI-driven advertising efficiency and renewed digital spending. With strong earnings momentum and scalable business models, the sector continues to bridge technology, media and connectivity, positioning itself as a cornerstone of the modern digital economy.

Implications for Private Companies and Capital Markets

The strong performance of the technology, utilities, and communication services sectors in 2025 highlights where investor capital is concentrating and valuation premiums are expanding. For private companies, this momentum creates strategic openings for fundraising and public listing as investor appetite increasingly favors structural growth themes such as AI, electrification, and digital connectivity.

Public market re-rating across these sectors has raised valuation benchmarks for high growth and infrastructure driven firms. Companies in adjacent verticals, including AI software, renewable infrastructure, and digital media, can now leverage stronger peer multiples in pre-IPO and strategic rounds, improving pricing power and deal execution prospects.

At the same time, U.S. and cross border listing markets are regaining depth as sentiment shifts toward growth visibility. Issuers aligned with these outperforming sectors are best positioned to capture renewed institutional demand through IPO, de-SPAC, or dual listing structures, particularly those from Asia seeking international exposure.

ARC Group’s Perspective

At ARC Group, we view these sector trends as clear evidence that structural growth stories continue to command premium valuations in public markets. As investors shift toward companies driving innovation, electrification, and digital connectivity, the window for quality issuers to access public capital is opening once again.

The Technology sector remains a key focus for ARC Group, reflecting its active role in supporting innovative, AI-driven companies in the public markets. In October 2025, ARC committed a $50M investment facility to ScanTech AI (Nasdaq: STAI), accelerating its product development and market expansion while contributing to a significant post-announcement surge in the company’s stock performance. ARC also acted as the financial advisor to BeLive Holdings (Nasdaq: BLIV) on its successful Nasdaq IPO in April 2025, providing strategic structuring and execution support. BLIV, a live commerce software platform, has since traded steadily around its IPO price, underscoring investor confidence in its fundamentals and growth potential.

Through our integrated capital markets platform, which spans SPACs, IPOs, and cross border advisory, ARC Group helps private companies translate sector momentum into successful listings. From Asia to North America and Europe, we guide high growth firms through every stage of the public listing journey, from valuation benchmarking to execution on leading U.S. exchanges.

ARC Group Securities, a FINRA licensed broker dealer and affiliate of ARC Group, can also act as placement agent for capital raising transactions, including follow-on offerings, PIPEs, and other structured financings. The 2025 market cycle is rewarding companies that power the modern economy’s three pillars of data, energy, and connectivity. ARC Group stands at the intersection of all three, bridging private potential with public opportunity.

References:

[1] McKinsey (2025): mckinsey-technology-trends-outlook-2025.pdf

[2] Nvidia (2025): NVIDIA Announces Financial Results for Second Quarter Fiscal 2026 | NVIDIA Newsroom

[3] Microsoft (2025): FY25 Q4 – Press Releases – Investor Relations – Microsoft

[4] MorningStar (2025): Utilities Industry Outlook: Q3 2025 | Morningstar

[5] NextEra Energy (2025): Quarterly Earnings 2025 – NextEra Energy, Inc.

[6] Dominion Energy (2025): Dominion Energy Newsroom – Dominion Energy Announces Second-Quarter Results

[7] Fidelity (2024): Communication services sector outlook 2025 | Communication services stocks | Fidelity

[8] Meta (2025): Meta – Financials

[9] Alphabet (2025): Alphabet Investor Relations – Investors – Earnings