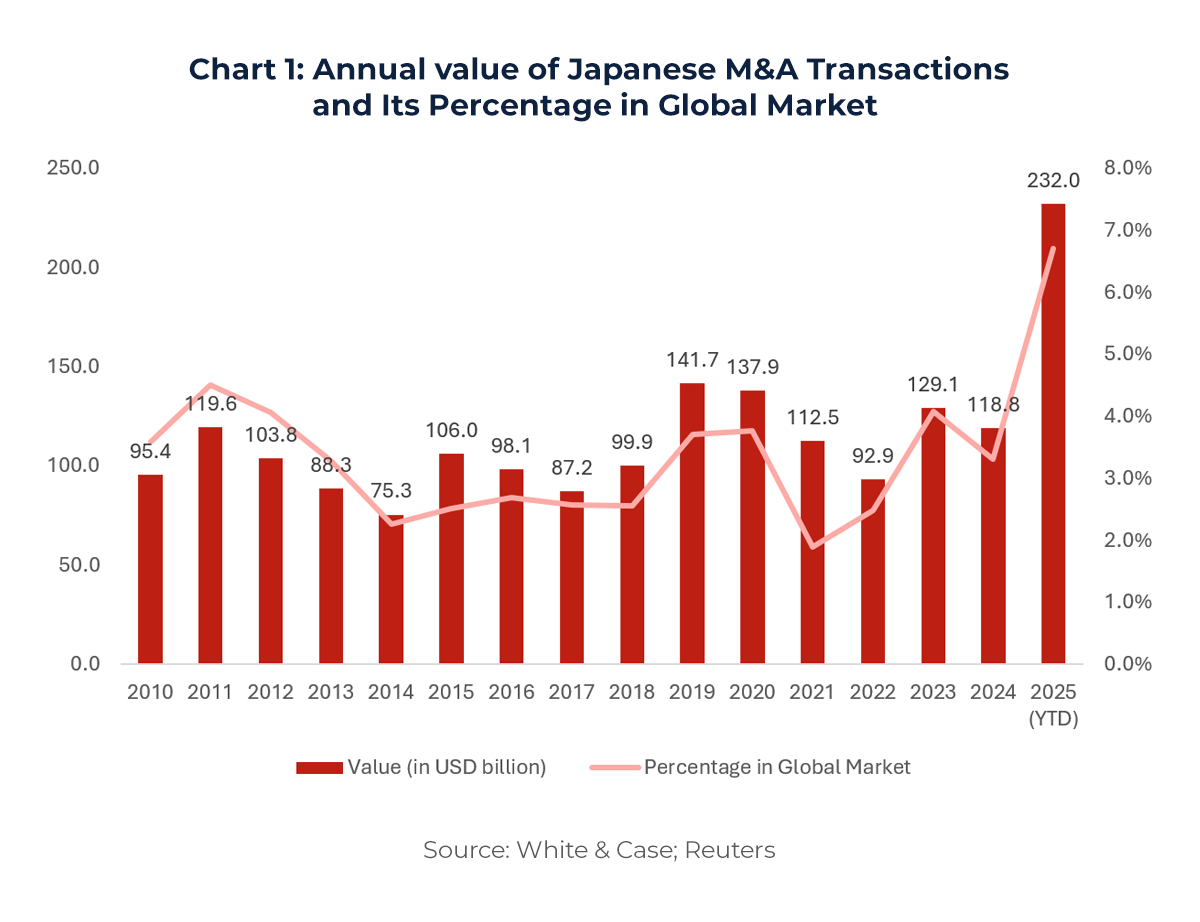

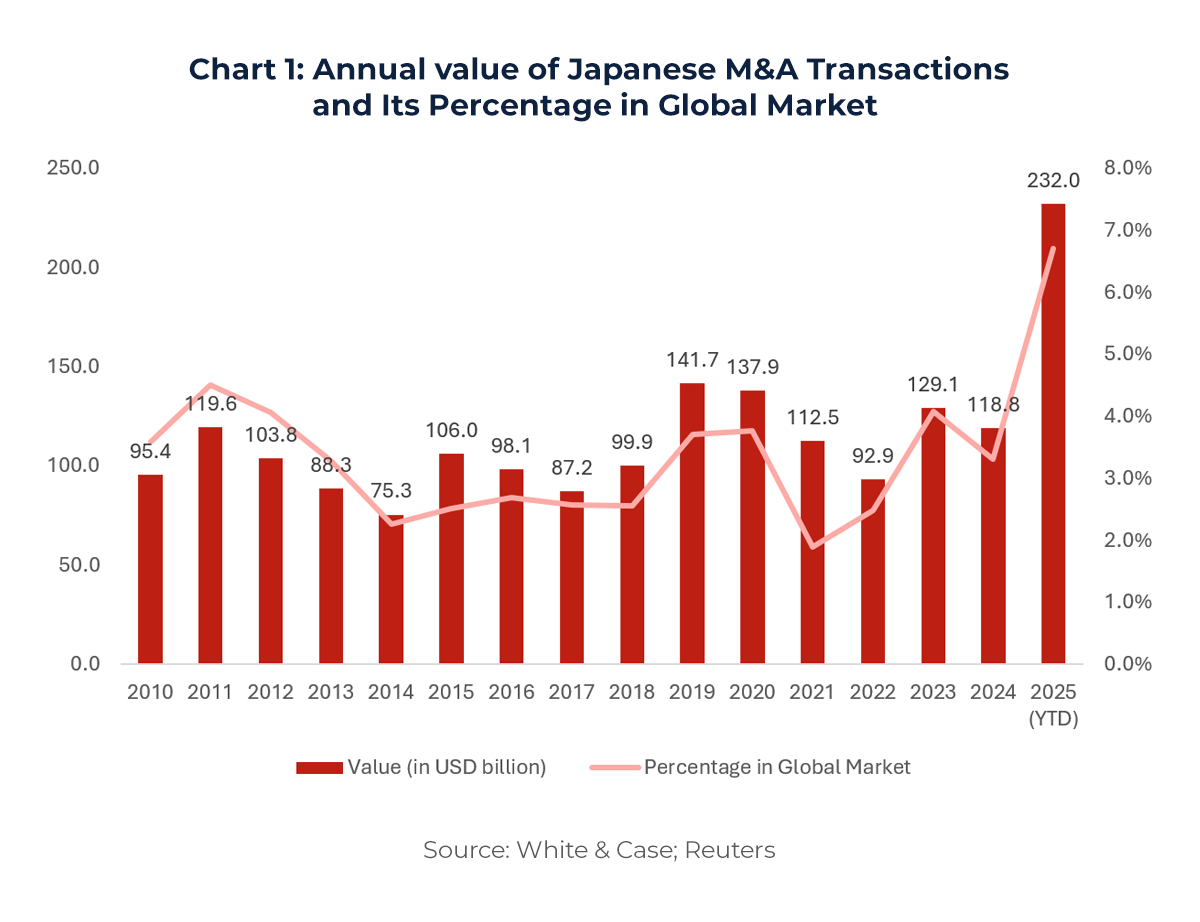

After decades of caution, Japanese corporations are once again asserting themselves on the global mergers and acquisitions stage. In 2025, Japan’s total M&A value surged to an all-time high of US$232 billion (Reuters, 2025), accounting for a significant portion of Asia’s deal-making rebound. The renewed momentum reflects a combination of domestic reforms, corporate governance pressures, and strategic imperatives to secure growth beyond Japan’s mature home market.

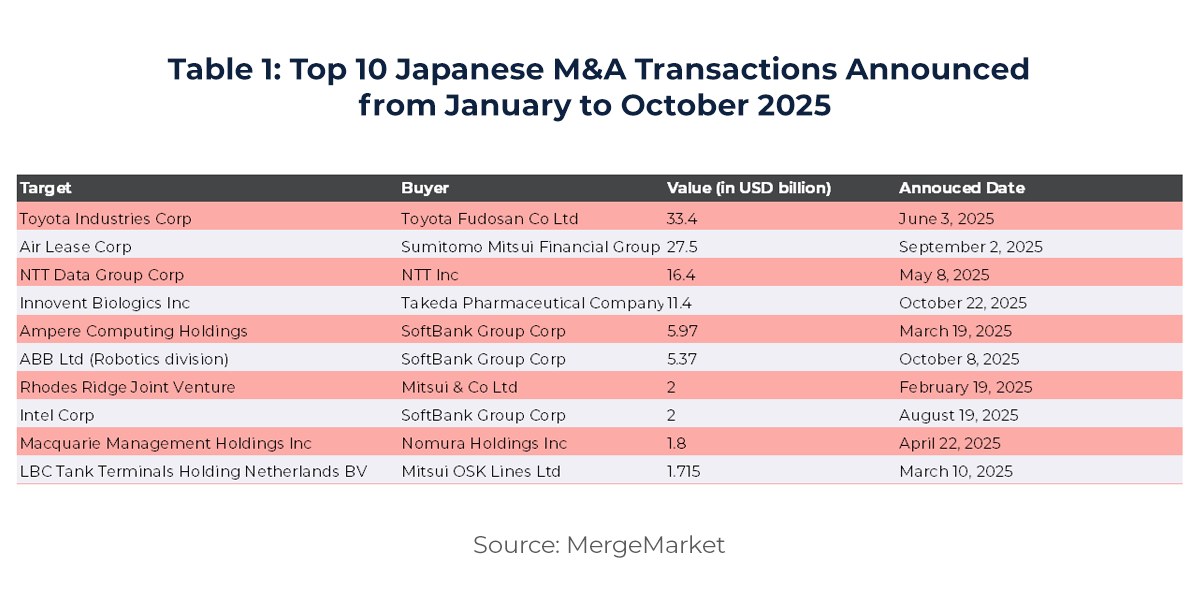

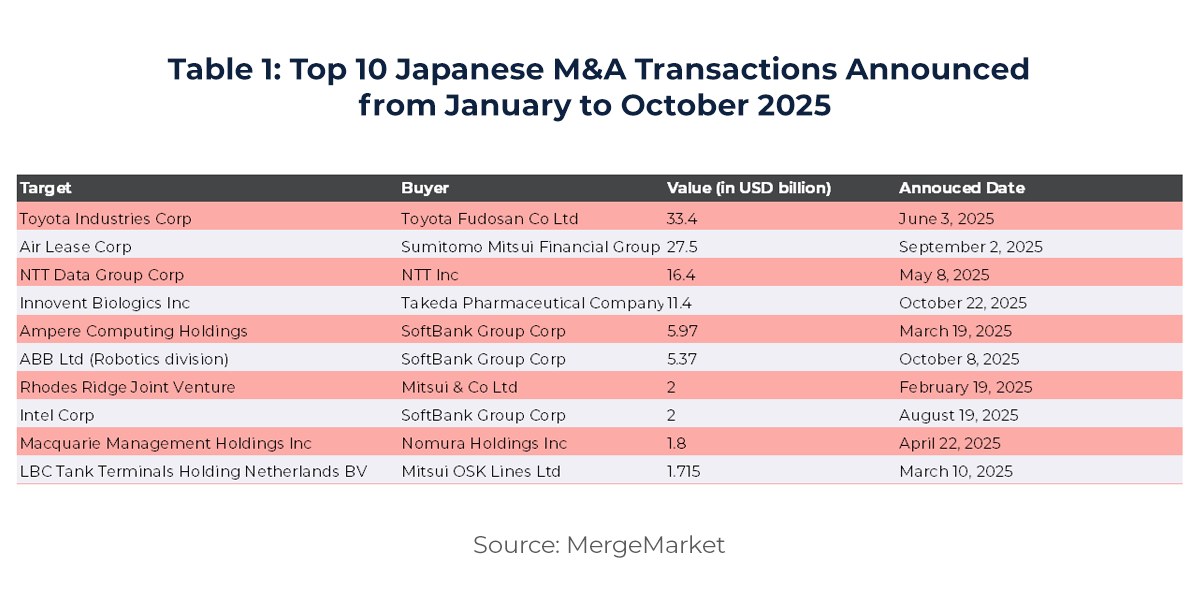

The largest deal was Toyota Fudosan’s USD 33.3bn acquisition of a 69.92% stake in Toyota Industries, a core member of the Toyota Group and the principal shareholder of Toyota Motor. With a deal value exceeding USD 16bn, NTT’s tender offer to acquire full ownership of NTT Data stood as the second-largest transaction of 1H25. Like other deals in 1H25, NTT’s emphasis was on simplifying legacy corporate structures that can be seen as cumbersome in the current environment.

The largest deal was Toyota Fudosan’s USD 33.3bn acquisition of a 69.92% stake in Toyota Industries, a core member of the Toyota Group and the principal shareholder of Toyota Motor. With a deal value exceeding USD 16bn, NTT’s tender offer to acquire full ownership of NTT Data stood as the second-largest transaction of 1H25. Like other deals in 1H25, NTT’s emphasis was on simplifying legacy corporate structures that can be seen as cumbersome in the current environment.

Both the Toyota Industries and NTT Data deals together accounted for more than a third of the total deal volumes in the period. A key catalyst behind this surge lies in Japan’s evolving corporate governance landscape-a transformation that began in 2014 and continues to reshape corporate behavior, driving companies to simplify ownership structures, improve capital efficiency, and enhance shareholder value.

1. Corporate Governance and Capital Efficiency

In 2023, the Tokyo Stock Exchange (TSE) issued a landmark directive requiring listed companies to disclose their cost of capital and present strategies for enhancing capital efficiency, with particular attention to firms trading below 1.0x price-to-book value. The move served as a wake-up call for underperforming corporates, prompting a wave of introspection across Japan Inc. In response, many companies began reassessing their business portfolios, resulting in divestitures of non-core assets and the simplification of sprawling group structures.

At the same time, the evolution of Japan’s Corporate Governance Code and Stewardship Code has fundamentally reshaped how boards approach capital allocation. Shareholder activism, once rare in Japan, is increasingly shaping boardroom agendas. With over US$2 trillion in cash reserves accumulated across listed firms, management teams are facing growing pressure to boost returns through dividends, share buybacks, and strategic investments-including M&A.

Meanwhile, geopolitical and trade uncertainties, notably the renewed tariff threats under U.S. President Donald Trump’s administration, are adding urgency to corporate realignment. This is especially true for manufacturers and wholesalers reliant on Chinese suppliers.

As a result, M&A, both domestic and international, has become a preferred mechanism to deploy this idle capital effectively. As governance reforms reward proactive management, more CEOs are taking calculated risks abroad to secure sustainable growth.

2. Strong push into cross-border and outbound deals

Japanese corporates are increasingly pursuing overseas targets as domestic growth stagnates, wage/price pressures mount, and the weak yen supports external investment.

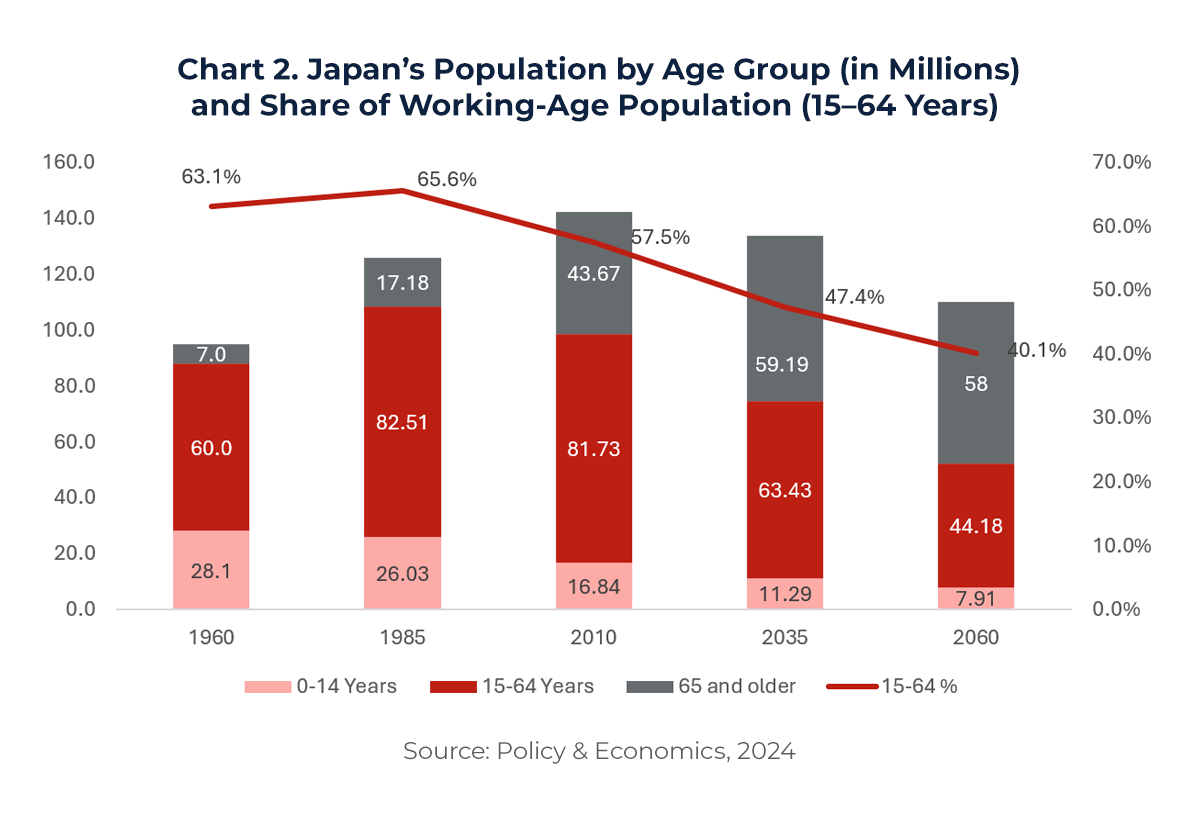

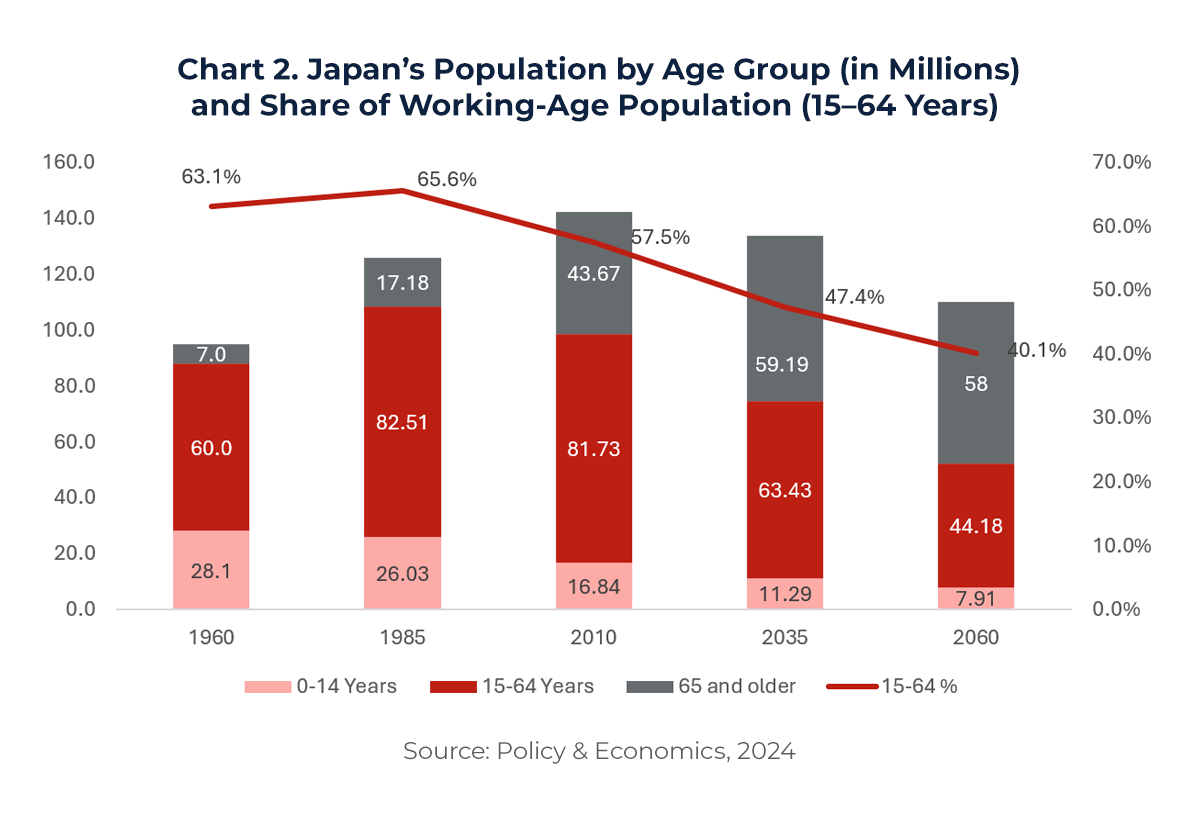

Japan’s demographic decline continues to constrain organic growth. With an aging population, shrinking workforce, and a largely saturated domestic consumer base, opportunities within Japan are limited. Expanding overseas – whether through joint ventures, acquisitions, or technology partnerships – is increasingly viewed as essential for long-term survival.

For many industrial groups, particularly in manufacturing, automotive, materials, and med-tech, global M&A provides access to new customers, innovation ecosystems, and supply-chain resilience.

For many industrial groups, particularly in manufacturing, automotive, materials, and med-tech, global M&A provides access to new customers, innovation ecosystems, and supply-chain resilience.

After decades of deflationary stagnation, wages and consumer prices are finally rising, driven by labor shortages, government pressure for pay hikes, and imported inflation from higher energy and commodity costs. While positive for household spending, these wage and price pressures are compressing corporate margins, particularly for manufacturers operating on thin spreads in a highly competitive domestic market. As a result, many Japanese firms are looking outward for efficiency gains, growth, and diversification.

Compounding this trend, the yen’s persistent weakness, hovering near multi-decade lows against the U.S. dollar, has had a dual impact. On one hand, it raises import costs and squeezes domestic profitability; on the other, it enhances the global competitiveness of Japanese exporters and made outbound investment more appealing. For companies holding substantial yen-denominated cash reserves, deploying capital into foreign assets serves as an effective hedge against further currency depreciation and domestic inflation, making cross-border M&A a strategically attractive avenue for capital deployment.

3. A New Profile of the Japanese Acquirer

The profile of Japanese deal-makers in 2025 looks markedly different from a decade ago. Once characterized by conservative expansion and prolonged negotiation cycles, today’s Japanese buyers are increasingly agile, data-driven, and willing to partner with global investors.

- Trading houses, such as Mitsubishi, Mitsui, and Itochu are diversifying beyond commodities into renewables, digital infrastructure, and consumer sectors.

- Industrial conglomerates are using M&A to acquire technology and R&D capabilities, particularly in Europe and the U.S.

- Financial institutions and PE funds, including Japan Industrial Partners (JIP), SoftBank, and Nomura, are pursuing take-privates and cross-border fund expansions.

- Mid-cap corporates are entering M&A for the first time, supported by domestic lenders offering favorable financing and government incentives for overseas investment.

This new generation of buyers blends traditional Japanese prudence with a more outward-looking mindset, focusing on sustainable value creation rather than headline-driven empire building.

4. Outlook: From Defensive to Strategic Globalization

Japan’s last major outbound M&A wave in the 1980s and early 2000s yielded mixed results. Over-paying for trophy assets and cultural misalignments led to high write-offs and integration failures. Bain & Company estimates that nearly one in four Japanese outbound deals historically underperformed, compared to 5-6% for U.S. peers. (Bain&Co., 2020)

However, today’s environment is markedly different. Governance reforms, globalized management teams, and the professionalization of Japanese corporate M&A units have raised execution standards. Cross-cultural integration, due diligence, and post-merger planning are now taken more seriously. Japanese firms are increasingly partnering with experienced financial advisors and private-equity sponsors to mitigate integration risk and enhance synergy capture.

The current wave of Japanese M&A reflects a deeper transformation — from defensive diversification to strategic globalization. Rather than simply seeking stability outside Japan, buyers are pursuing assets that offer growth, innovation, and sustainability.

As Japan continues to refine its corporate governance landscape and encourage shareholder accountability, outbound M&A will likely remain a key pillar of its global economic strategy. The focus is shifting from large, symbolic deals toward strategically coherent, well-integrated acquisitions that strengthen Japan’s global footprint in technology, energy, and advanced industry.

References:

The largest deal was Toyota Fudosan’s USD 33.3bn acquisition of a 69.92% stake in Toyota Industries, a core member of the Toyota Group and the principal shareholder of Toyota Motor. With a deal value exceeding USD 16bn, NTT’s tender offer to acquire full ownership of NTT Data stood as the second-largest transaction of 1H25. Like other deals in 1H25, NTT’s emphasis was on simplifying legacy corporate structures that can be seen as cumbersome in the current environment.

The largest deal was Toyota Fudosan’s USD 33.3bn acquisition of a 69.92% stake in Toyota Industries, a core member of the Toyota Group and the principal shareholder of Toyota Motor. With a deal value exceeding USD 16bn, NTT’s tender offer to acquire full ownership of NTT Data stood as the second-largest transaction of 1H25. Like other deals in 1H25, NTT’s emphasis was on simplifying legacy corporate structures that can be seen as cumbersome in the current environment.

For many industrial groups, particularly in manufacturing, automotive, materials, and med-tech, global M&A provides access to new customers, innovation ecosystems, and supply-chain resilience.

For many industrial groups, particularly in manufacturing, automotive, materials, and med-tech, global M&A provides access to new customers, innovation ecosystems, and supply-chain resilience.